Following more than a decade of growth and prosperity in Israeli high-tech, this year’s annual Innovation Authority report is being published during a challenging period, one characterized by uncertainty for the Israeli high-tech industry. During the previous quarters, the positive trend that typified the industry over recent years was replaced by a decline in important metrics, including a downturn in startups’ fundraising and increased dismissals in high-tech companies that led to a decline in the number of employees in the industry. The central question currently facing the industry is whether it will fall in line with the signs of recovery that can already be seen in the US or whether there is cause for concern of a deep ongoing crisis with uniquely Israeli characteristics.

After a record year for global high-tech in 2021, the subsequent year signaled a cooling-off of the economy. Funding of startups declined in 2022 in innovation hubs around the world compared to the previous year. The record quarter for Israeli high-tech fundraising was the fourth quarter of 2021 when local technology companies – primarily the growth companies – raised more than 9 billion dollars. The positive trend continued into 2022, and the level of investments during the first two quarters of that year were similar to the corresponding quarters of 2021. This trend changed during the second half of 2022 however, and total quarterly investments were cut by more than half. In total, investments in startups in Israel shrunk during 2022 by almost 50% compared to the previous year, totaling 16 billion dollars. Nevertheless, this sum is still more than 30% higher than startups’ fundraising in 2020 that was then considered a record year for capital raised by startups.

According to initial figures published regarding startups’ fundraising in 2023, it seems that the negative trend has continued during the first two quarters of the year (the data is still expected to update). If this trend is not significantly reversed, we can expect a continuation of the decline in investments in startups in Israel compared to the growth trend that characterized recent years. If this scenario materializes, it would be a warning light for Israeli high-tech, one that would require an appropriate response.

As will be presented below, most of the decline in fundraising during 2022 stemmed from the drop in large funding rounds (over 50 million dollars) that are intended to support the continued growth of mature startups in Israel. It is important to pay attention to the decline in funding of companies that belong to this group, and which facilitate a diversity of jobs in high-tech. An Innovation Authority analysis reveals that complete software companies employ an average of 2.55 employees in non-technology jobs for every employee in a technology job such as engineering or development. In other words, these companies make an important contribution to high salary employment and productivity levels in non-technology jobs. These companies constitute a significant cornerstone of Israeli high-tech and contribute significantly to the economy. It is important therefore to continue monitoring the way they contend with the present situation and to consider proposing relevant solutions.

At the same time, it is worthwhile continuing the monitoring of trends related to young companies in their early stages that constitute the next generation of Israeli high-tech, and the difficulties with which they are currently contending. This is especially true against the backdrop of the ongoing multiyear declining trend of new startups. In the “Decline in Establishment of Startups” Chapter in this report, we analyze this phenomenon – not unique to Israel but which definitely impacts the sector’s future.

It is important to note in this context that crises are a good period for growing startups, and that there are successful companies which were established specifically in such periods – for example, JFrog and IronSource that were established in 2009 and 2008 respectively. Furthermore, the long-term effects of the 2008 global crisis were positive for Israeli high-tech and were among the factors that caused the sector’s maturation we have witnessed in recent years with the growth of unicorns and complete companies in Israel.

It is important to note in this context that crises are a good period for growing startups, and that there are successful companies which were established specifically in such periods – for example, JFrog and IronSource that were established in 2009 and 2008 respectively. Furthermore, the long-term effects of the 2008 global crisis were positive for Israeli high-tech and were among the factors that caused the sector’s maturation we have witnessed in recent years with the growth of unicorns and complete companies in Israel.

Is Israeli High-tech Detaching from the Global Trend?

The state of Israeli high-tech is primarily a result of global and local macro-economic factors that influence the sector. Among these are the ongoing war in Ukraine, the instability on financial markets and the surge in inflation. Furthermore, increased interest rates have contributed to a reality whereby after long years of negligible interest rates, investors can now enjoy a return on their deposits without risking their capital in high-risk startup investments. The result is a lower incentive to invest in startups compared to previous years when there were fewer investment alternatives.

Nevertheless, there are also local factors unique to Israel that may impact the entire Israeli economy. Senior figures in the Israeli high-tech industry have warned in recent months against the ramifications on the industry of the legal reform that the government is attempting to lead, among others, expressing foreign investors’ concerns about continued investment in Israel.1See for example: Amnon Shashua – News – TheMarker: chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.gov.il/BlobFolder/dynamiccollectorresultitem/weekly_economic_review_301219/he/weekly_economic_review_weekly_economic_review_30122019.pdf (Hebrew).

A position paper published in April by the Innovation Authority highlighted two main phenomena identified in Israeli high-tech since the beginning of the year. First, a decline in the listing of new startups in Israel that can already be observed – the ratio of new startups registered overseas increased from 50% to 80%, compared to 20% the previous year. This phenomenon signifies a decline in the trust in the Israeli business environment’s stability on the part of entrepreneurs who prefer to register companies overseas despite the tax advantages enjoyed by companies registered in Israel.2For example, corporate tax in Israel for a R&D-oriented company is 12% (under the definition of “a preferred technological enterprise”) and dividend taxation stands at 20%, whereas the corresponding tax rates in the US are 21% and 30% respectively. The second phenomenon is the concern of Israel’s imminent detachment from global capital movements and of a decline in Israeli high-tech’s share in international venture capital investments. This concern stems from the ongoing decline in investments in Israel whereas other locations have already witnessed the reversal of this trend.

These and other phenomena reinforce even further the need to minimize the prevailing legal uncertainty in Israel, alongside the expansion of supportive tools for startups currently being established in order to register them in Israel. It is important that the state act in the short-term to reduce the phenomenon of new Israeli startups being registered overseas. This is because the Israeli high-tech sector is responsible for 30% of the growth in Israeli GDP over the past five years (2018-2022).3Based on an Innovation Authority adaptation of CBS data. This growth stems from the success of startups established during the previous decade to become growth companies operating in Israel, to maintain their intellectual property here, to record their sales in Israel, and to employ a wide range of employees – technological and non-technological – at high salary levels.

It is still too early to determine that internal Israeli issues are those which lead to the different results of the Israeli high-tech sector compared to those observed in other innovation hubs around the world. However, regardless of the reason for this difference, there are several worrying metrics that indicate discrepancies in recent months between the situation in Israel and that in other hubs.

The first of these discrepancies relates to the underperformance of the technology companies traded on the Tel Aviv Stock Exchange: in the first quarter of the year (January 1-March 30), the index of the 100 largest technology companies traded on the NASDAQ rose by 24%. In contrast, the Tel Aviv Technology Index declined during the same period by 1%.4The yields of the TA Technology and NASDAQ 100 Technology indices did not change significantly before final preparation of the report during Q2 2023. In other words, while the NASDAQ had already begun its recovery with technology shares on the rise, no such similar trend was recorded in Tel Aviv.

A further analysis conducted for the report assessed the performance of the Israeli technology companies traded on the NASDAQ.5The Innovation Authority monitors changes in the value of more than 100 Israeli technology companies traded on the NASDAQ to create a synthetic index. This analysis revealed that these companies’ shares yielded a return of 10.8% during the first quarter, a higher return than that recorded by the technology companies traded on the TASE but lower than that of the NASDAQ 100 Technology Index. This would seem to indicate that Israeli companies have underperformed since the beginning of the year, with Israeli companies traded in Israel being “punished” by the market with especially low yields. By comparison, from the beginning of 2019 to the end of 2022, the index of Israeli technology companies traded on the NASDAQ rose more than the NASDAQ 100 Index.

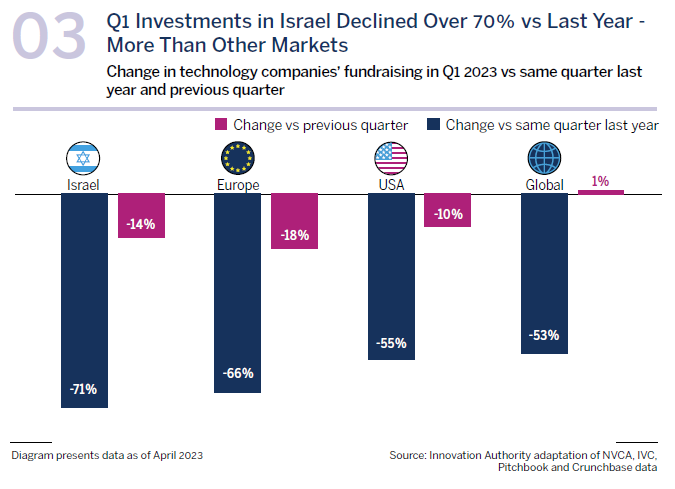

Another worrying metric is that of fundraising by Israeli startups during the first quarter. While some global markets had begun a slow recovery, even reversing the negative trend, investments in Israel declined by more than 70% compared to the corresponding quarter the previous year.6This assessment is based on data published in the middle of April 2023. This is a sharper decline than that recorded in other markets assessed with which Israel compares itself. In comparison to the previous quarter, the decline in investments in Israel was more moderate – a decline of 14%. However, this figure is still enough to indicate a sharper decline than that recorded in the US during the same period.

As far as hiring employees in high-tech companies in Israel is concerned, a change in this trend – expressed by employee dismissals – has been observed since the beginning of the year, one that may impact the entire Israeli economy after years of growth. An analysis of the changes in the number of employees in subsectors of high-tech services (primarily including the software companies in Israel which are the main and growing part section of Israeli high-tech) in recent years reveals a significant growth in high-tech employment. For most of 2017-2018 there was a quarterly increase of 1,000-8,000 employees in the high-tech services subsectors. In 2019, the largest increase in hiring employees reached a peak of 9,700 employees in the fourth quarter of that year. During the first half of 2020, with the uncertainty that accompanied the outbreak of the Covid pandemic, a wave of dismissals was observed in high-tech companies and the number of employees in high-tech services sectors shrunk by more than 10,000. Furthermore, the companies slowed the pace of their recruitments and in the first quarter of the year the number of available jobs declined sharply. However, during the second half of the year, with a higher degree of certainty, the high-tech companies began hiring and growing again.

The increase in hiring employees and the growth of the industry peaked with the number of employees joining high-tech each quarter growing significantly until, in the second quarter of 2022 alone, the number of high-tech employees grew by 15,000. A turning point occurred shortly afterwards: during the second half of the year, the companies slowed their recruitment, and the number of available jobs declined every quarter. The crisis deepened with the onset of 2023. Data reveals that not only were fewer job opportunities made available by the companies compared to the second half of 2022 – but that the increasing wave of dismissals led to a decline in the number of high-tech employees. In other words, the industry stopped hiring and subsequently began to reduce the number of their employees. In the first quarter of 2023, the number of employees in the high-tech services sectors declined by 2,500 and, in April, subsequently declined by another 3,400.

Looking ahead, Israel must monitor developments in high-tech employment that have implications for the entire local economy. A drop in the number of the industry’s employees is expected to lead to a decline in income tax collected in Israel and a resultant lowering of the technology companies’ expenditure on purchasing auxiliary services such as real estate, restaurants, and service providers like lawyers and others. Combined with the figure presented in this report relating to the decline in high-tech companies’ fundraising, it can be assumed that startups will hire fewer employees and that they will also be compelled to dismiss some of the existing employees as a significant part of the fundraising is directed at hiring employees and payment of salaries.

The coming months will be critical for Israeli high-tech. Experience teaches that, in general, two quarters after the beginning of a recovery on Wall Street, expressed by a rise in the NASDAQ Index, there is also an increase in recruitment of capital and employees in Israeli high-tech.7In 2019, the Chief Economist in the Ministry of Finance pointed out that “there is an almost perfect correlation between the growth of the NASDAQ and the total scope of investments in Israel”. See: “The Synergy between the Private and Public Sectors in Funding Innovation in Israel”, Chief Economist’s Division, Ministry of Finance, December 2019 (Hebrew): chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.gov.il/BlobFolder/dynamiccollectorresultitem/weekly_economic_review_301219/he/weekly_economic_review_weekly_economic_review_30122019.pdf In light of the increase in the NASDAQ since the beginning of the year, the normal expectation would have been for an increase in fundraising and employee recruitment in Israel already during the summer months of 2023. However, according to indicators presented so far, and which are reinforced by data for April and May, there is a genuine concern that Israeli high-tech will become detached from global trends.

These trends are worrying, especially considering data presented in this report that indicates the significant dependence created on the high-tech sector in Israel as a central and growing industry that contributes to the economy, and in light of this sector’s substantial dependence on foreign investors – more than other innovation hubs. A combination of the phenomena explains the possible negative impact on the Israeli economy should the declining trend of investment in Israeli high-tech and of personnel recruitment indeed continue. In other words, a situation whereby unique local circumstances lead to the continued decline of fundraising by Israeli high-tech companies, in contrast to the global trend of recovery, would be a genuine cause for concern.

Israeli high-tech was responsible for 18% of Israeli GDP in 2022 and for 48% of the country’s exports. High-tech output more than doubled in size within a decade. In relative terms, high-tech’s share of Israeli GDP more than doubled compared to the corresponding figure in the US. These figures indicate the importance of high-tech to the Israeli economy – an importance that has grown increasingly over the past decade.

At the same time, the data we present in this report illustrates the unique and high degree of dependency of Israeli high-tech on foreign investors. First, 91% of Research and Development (R&D) in Israel is conducted by the private sector – the highest ratio of all OECD countries. On the other hand, as shown in last year’s “2022 High-Tech Situation Report”, the level of state funding for R&D in Israel is the lowest in the OECD and stands at just 9%.

A further characteristic unique to Israel is the high level of R&D funding by foreign entities compared to that of the local private market. On the one hand, this testifies to the significant attractiveness of Israeli high-tech for foreign investors and technology companies and to the quality of the human capital and technological excellence. On the other hand, this also means a high level of dependence on external factors and the Israeli market’s exposure to the fluctuations that stem from a change in the preferences of these external entities.

Annual Report 2023 – Main Points

In addition to the challenges related to the current period in Israeli high-tech against the backdrop of the economic downturn, this year’s report also presents new analyses and highlights important trends impacting the high-tech sector. Among others, this year we present a new analysis of high-tech employees in Israel that, for the first time, also includes a reference to employees in technology jobs outside the high-tech sector, e.g., a programmer in a supermarket or a software engineer in a bank. The number of salaried employees in the high-tech sector and in technology jobs in other sectors stood at 508,400 in 2022. This figure comprises 14% of all salaried employees in Israel – an increase of 10.6% since 2014. For more on this subject, see “How many Israelis really work in high-tech”.

Against the background of the accelerated growth in the number of employees in the high-tech sector, it is impossible to ignore the fact that despite the significant resources and efforts invested in diversification, the disparities between the various groups in high-tech have endured over time. Over a period of almost a decade, there have been only minimal changes in the composition of the high-tech population. Women – the largest group underrepresented in high-tech – have maintained their relative share of one third of the salaried employees in the high-tech sector and in technology jobs in other sectors. Progress in integrating Arabs and ultra-Orthodox into high-tech has also been very slow. In 2022, only 2% of high-tech employees belonged to the Arab society and 3% to ultra-Orthodox society.

A further significant social disparity relates to the salaries in high-tech. In 2022, the average monthly salary in high-tech – that stood at 28,385 shekels – was 2.7 times higher than the average salary in the rest of the economy (10,452 shekels). Over the past decade, with the major investments in and the growing global demand for technological solutions, high-tech salaries rose as did the disparity between them and the average salary in Israel. High-tech employees’ salaries increased by 9,465 shekels between 2012-2022, compared to an employee in the other sectors of the economy where salaries rose over the same period by 2,290 shekels.

We also compared high-tech with other sectors of the economy while analyzing different trends and evaluating their contribution to the economy: the accelerated growth transformed high-tech into the sector with the economy’s largest and fastest growing output, responsible for the largest share of Israeli exports, with the fastest growth in the number of employees, and with the fastest growth in the rate of salary increase. Further details about the other sectors can be found in the chapter “A Macro Look at Israeli High-Tech”.

An analysis of productivity shows that the output per work hour of high-tech employees stood at 337 shekels per hour in 2022 – almost double the output per work hour in the economy at large (178 shekels). Although high-tech productivity is 90% higher than that of the general economy, it still trails the sector of electricity and water supply and sewage services, and the finance and insurance sector.

Alongside the challenges faced by Israeli high-tech, this period witnessed the emergence of a wave of technology that may influence the sector and the economy in general and constitute a seminal development. Use of generative AI technology has recently become widespread, and the assimilation of tools launched for public use is progressing rapidly. The significant breakthrough in tools in this field is expected, already in the near future, to influence the activity and efficiency of Israeli companies introducing these technologies via a variety of processes. Furthermore, the demand for solutions in this field also constitutes a commercial opportunity for Israeli startups developing relevant technologies.

Another opportunity we identified is the development and assimilation of Israeli technologies aimed at contending with the climate crisis. According to an analysis presented in detail in this chapter, in the section addressing climate-tech in Israel, Israel is in a promising position as a player developing revolutionary solutions in the field of climate-tech. Israel’s long history of contending with challenges in the fields of water and agriculture, and the extensive knowledge accumulated in its research institutions contribute to the Israeli reputation and experience and constitute a comparative advantage of the Israeli ecosystem in this field. According to an analysis presented in this report, there are over 500 companies operating in Israel in the field of climate-tech, with the prominent areas of activity being energy, food-tech, and water.

In addition to the growing opportunity in the field of climate-tech, we show how three central fields have become the spearhead of Israeli high-tech: organizational software, fintech and cyber. According to the analysis presented in the report, over 40% of the new startups established each year operate in these fields, more than half of all investments are directed to these fields, and most of the specialist funds that made more than ten investments in a specific field, operate in these areas.

An examination of the composition of investments in Israel and in the US reveals several differences between the two markets. As will be detailed below, it is clear that investments in Israel in technology companies in the fields of health and biotechnology are relatively lower than those in the US, especially private market investments. It is interesting to check why Israel does not fully utilize its entrepreneurial and technological potential in this important field. Especially prominent in relation to the US market are the investments in the fields of software and cyber in which Israel has a comparative advantage that is based, among others, on the knowledge produced in the IDF. The Innovation Authority closely monitors global investment trends in sectors of the high-tech industry to identify trend changes and reinforce Israel’s readiness to contend with them.

At the same time, Israel must not descend into complacency. In comparisons to other global innovation hubs, Israel stands out as the third largest ecosystem in terms of the number of startups – over 9,000 – and in terms of startups’ fundraising that totaled 95 billion dollars between 2013-2022, positioning Israel in 6th place among the large hubs in terms of fundraising. Additional data is presented in detail in the chapter addressing global comparisons. Although Israel currently stands out on a global level, it is important to note that many countries and regions around the world invest in developing innovation and entrepreneurship and attain significant achievements (London and Paris are prominent examples of this) so that Israel’s competition is only growing.

It is therefore important to continue investing in high-quality education from a young age that will enable young people to join the global high-tech industry. Furthermore, the Innovation Authority will continue to closely monitor trends in the high-tech industry and will propose relevant solutions as needed. As a growing and extremely important economic sector, Israel must continue to cultivate this national resource for the benefit of the entire Israeli economy and society.