The technology companies established over the past decade operate primarily in three prominent fields: organizational software, fintech, and cyber. These three fields seem to spearhead Israel’s high-tech and are of main interest in terms of entrepreneurship and investments in Israeli high-tech, as detailed further down this chapter.

In short, the findings of studies we’ve conducted revealed that with regard to the sectors of organizational software, fintech and cyber, Israel has a comparative advantage both in entrepreneurship and startups’ funding. Over 40% of the new startups established every year operate in these areas, more than half the investments are in these areas, and most of the specialist venture capital funds that implemented over 10 investments in a specific sector, operate in these fields. International comparisons show that Israel has a global comparative advantage in the cyber sector and attracts more investments than any other innovation hub except San Francisco, New York, and Boston.

The transformation of the organizational software, fintech and cyber sectors into central cornerstones of Israeli high-tech is part of a broader trend of software’s increased dominance within Israeli high-tech. While in the past the high-tech sector was based primarily on companies in the field of hardware (e.g., microchips and communications), most of the companies that raised capital over the past decade were software companies.

It is important to note that a large proportion of the software-oriented companies operating in Israel develop and use infrastructures and tools that are based on Artificial Intelligence which enable them to offer innovative and competitive solutions.[24] In other words, although AI is not defined as a separate area of activity, it is used by many technology companies and constitutes a comparative advantage both for them and for Israeli high-tech in general.

Approximately 65% of the 12,000 companies established between 2012-2022 operate in software-oriented fields while the remainder operate in hardware-oriented fields.[25] This ratio remained stable throughout the decade. When examining the different areas of activity, it is clear that entrepreneurs tended to establish companies in the fields of organizational software, fintech, and cyber. As a result, the relative share of companies in these fields out of all companies established each year increased from 29.4% in 2013 to 42% in 2021 i.e., a relative increase of almost 50%.[26] In contrast, the share of companies in the communications sector, that mainly develop hardware communications infrastructures and microchips, and that belong to the hardware sector, declined from 8% of all new companies in 2013 to only 1.7% of all companies established in 2022. In software categories too, not all the areas of activity grew during the period under discussion. The share of e-commerce, content and media companies declined from 32% of all new companies established in 2013 to less than 20% of new companies in 2022.

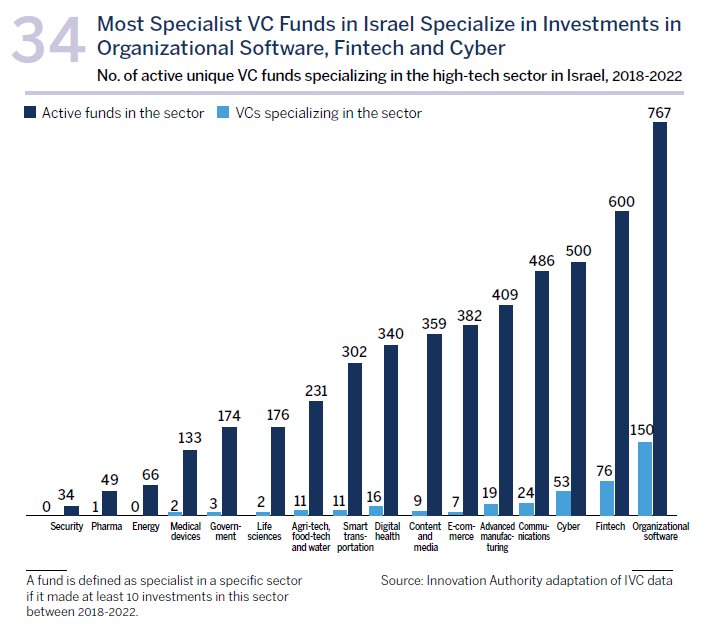

Approximately 57% of the high-tech companies operating in Israel today belong to software fields,[27] with a third of all technology companies in Israel operating in fields of organizational software, fintech, and cyber.[28] It is worth noting that agri-tech, food-tech and water companies already comprise 7.1% of all Israeli high-tech companies. This is in light of the increase in the relative share of these companies out of all new companies established, from 4.6% in 2013 to 9% in 2022. In general, companies that provide solutions for climate challenges are part of a growing category in Israel. For more details see the “Climate-Tech opportunity Chapter“.

More Than Half the Investments in Israeli startups are in Organizational Software, Fintech and Cyber Companies

The popularity of entrepreneurial activity, expressed in the establishment of companies in the field of software, was also accompanied by an increase in capital raised in these areas. The share of venture capital investments in companies in the fields of software in Israel reached 70% in 2022 while the parallel figure for 2013 was less than half of all investments (48%) i.e., the rate of increase in entrepreneurial activity in these fields grew at a similar pace to the growth in investments in them. It is important to note that because the investments in Israel grew on a significant scale, the growth in the various fields is expressed not only in their relative share of the investments in Israeli startups, but also in the total capital they attracted in absolute terms.

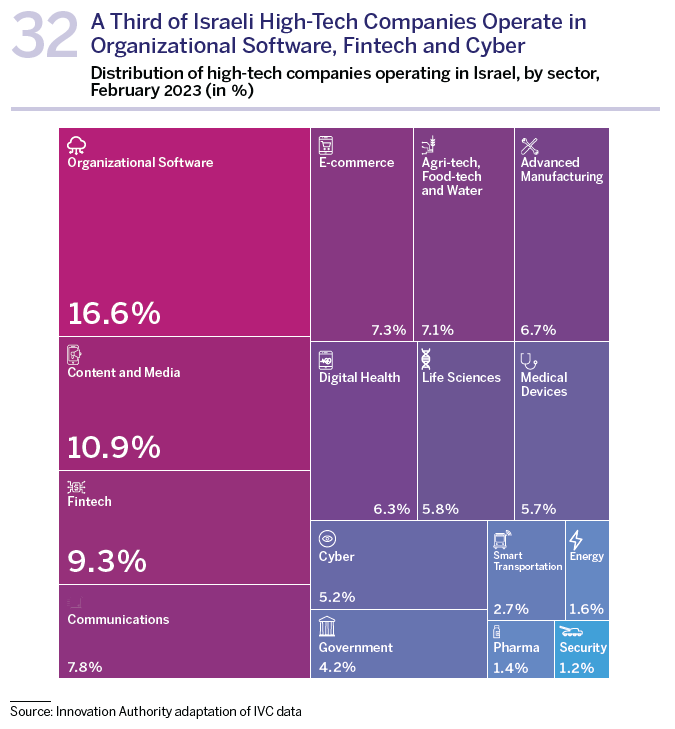

Parallel to the increase in entrepreneurial activity in organizational software, fintech and cyber, there was also a significant increase in the flow of capital to these areas that is indicative of a change in the distribution of investments in the high-tech sector over the past decade. In 2013, each of these three fields concentrated a similar share of the total investments in Israel to those in fields such as communications (11.8% of total investments in 2013), medical devices (10.6%), and e-commerce (9.5%). In total in 2013, the three fields – organizational software, fintech and cyber – were responsible for only a quarter of all investments (26.4%). The growing popularity of organizational software, fintech and cyber led to a situation whereby in 2021 and 2022 these three fields already attracted more than half the investments in Israel, with their share reaching 53.4% of total investments in 2022.

Alongside the increased popularity of organizational software, fintech and cyber, there was also a sharp decline in the share of investments in the field of medical devices, from 10.6% of total investments in 2013 to 1.7% in 2022. Other fields to suffer a significant decline in their share of the investments pie are e-commerce, communications, and smart transportation.

The Investment Funds Accumulated Expertise in Fields in which Israel has a Comparative Advantage

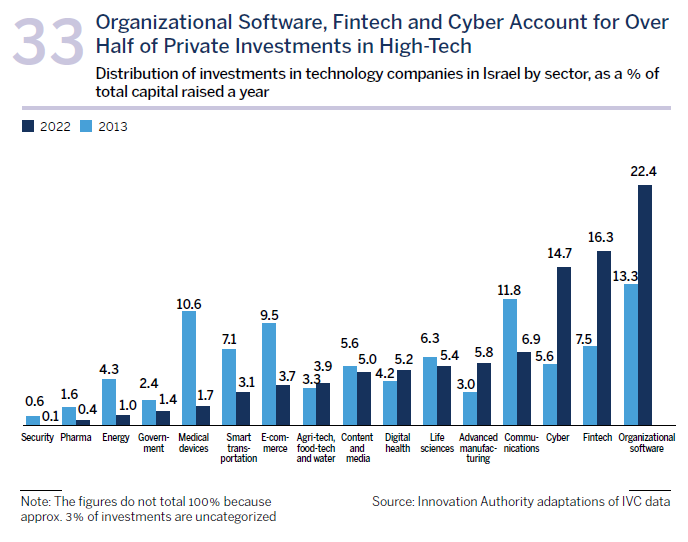

Thus far, we have examined the distribution of the investments as expressed in the flow of capital to the companies. In this section, we aim to examine the number and characteristics of the funds investing in the various fields and especially, any disparities between the areas of activity pertaining to the existence of “specialist funds”. This refers to venture capital funds with in-depth knowledge of a specific area of activity and which have added value – both professional and business – when investing in a company, beyond the funding itself. Accordingly, when a specific field has a larger number of “specialist funds”, it could be expected that companies with high success potential would receive funding whereas companies with lower success potential will not receive funding.[29] This is because the funds’ specialist expertise is expected to lead to better sorting of investment opportunities they encounter. For the study we conducted, a fund (VC or CVC) was defined as a “specialist investor” in a specific field if it implemented at least 10 investments in this field for five years, between 2018-2022. We identified 384 such specialist funds operating in Israel.[30]

Diagram 34 shows that the fields of organizational software, fintech, and cyber lead not only in the total investments and the number of new companies, but also in the number of funds operating in their fields, both specialist and general funds. 767 venture capital funds in Israel implemented at least one investment in the field of organizational software during the period examined (2018-2022), 600 funds implemented an investment in the fintech field and 500 companies in the field of cyber. About 15% of the funds which invested in one of these fields, made at least 10 investments over the past five years, while in the other fields the average stands at only 3%. In other words, the funds’ ratio of specialist expertise in these fields is relatively very high. As a result, the specialist funds’ share of these fields out of all the specialist investments operating in Israel is very high and constitutes 73% of all the specialist funds operating in Israel.

A broader look at all software fields reveals that 62% of all the funds examined and 82% of the specialist funds invest in these fields. Furthermore, another 6% of the specialist funds operate in the field of communications such that all the communications and information (ICT) sectors in Israel comprise almost 90% of the specialist funds’ activity.

An examination of the funds’ areas of specialty in other fields shows that the funds’ specialty does not conform to trends in the field of investments. In other words, the fields that have attracted most of the investments do not necessarily concentrate the specialty of the funds and vice versa – some fields are no longer popular for establishing a company or for investments but have a large number of specialist funds. This is apparently because it takes time for funds to acquire expertise in certain fields. On the one hand, the fields of advanced manufacturing, agri-tech, food-tech, and water displayed relatively high growth in terms of fundraising for startups and are fields in which a significant number of venture capital funds operate. Nevertheless, the number of specialist funds is still relatively low. In contrast, the e-commerce, smart transportation, and communications sectors displayed lower than average growth of startups’ fundraising however, considering their significant and central past role in the Israeli high-tech sector, it seems there is still a large number of specialist funds operating in these fields.