A Global Comparison: High-tech in Israel Relies Almost Entirely on the Private Sector, and Primarily on Foreign Investors

The Israeli innovation ecosystem is in direct competition with other hubs around the world for human resources, investments, and innovation infrastructures. It is important therefore to examine high-tech’s contribution to the Israeli economy not just in comparison to other sectors of the local economy but also in relation to other hubs of innovation that Israel compares itself to. The importance stems from the need to prevent the erosion of Israel’s comparative advantage and of its leading position in this field that has solidified in recent decades, and out of an understanding for high-tech’s critical role in the growth of the Israeli economy.

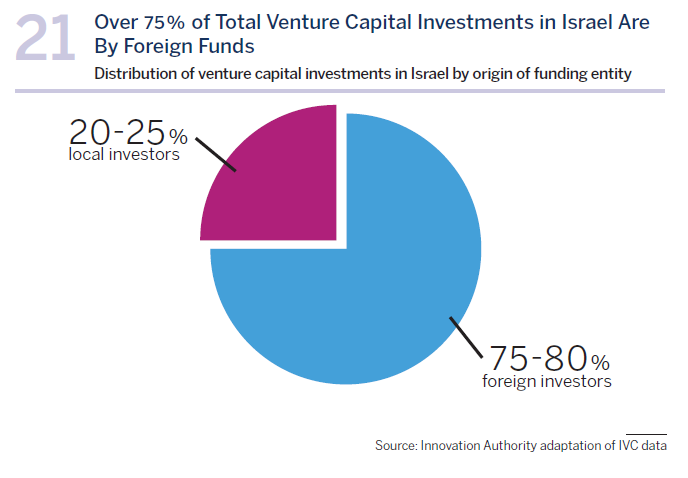

The importance of the high-tech sector and the innovation ecosystem to the Israeli economy stands out on a global level. In 2021, the level of national expenditure on R&D as a percentage of GDP stood at 5.6% – a total of 88 billion shekels – the highest level of national expenditure on R&D in the OECD. 91% of R&D in Israel is conducted by the private sector – the highest such ratio of all OECD countries. Furthermore, as we presented in the 2022 Annual Report, Israel recorded the lowest level of state funding of R&D among the OECD countries – only 9% of the national expenditure is funded by the state, including R&D conducted in academic institutions or with funding from the Innovation Authority, the various security bodies, and other government entities. State funding of R&D is particularly intended to provide a solution for high-risk R&D investments that constitute the basis for disruptive innovation and in which the private sector underinvests.

On the one hand, these figures testify to the maturity of the local market and the high level of trust it enjoys from investors, however it also means that Israel is especially dependent on the private sector to fund and conduct R&D. The result is that during periods of global crises and declines in private sector investments, Israeli startups that have less access to alternative funding channels and are thus more exposed to upheavals.

The situation in Israel is unique compared to the rest of the world with regard to the distribution of investments in innovation development between foreign and local entities. According to OECD data, Israel is the only country among the organization’s members in which foreign entities fund more than 50% of the R&D conducted by the private sector. At the same time, the local private sector is responsible for funding 40% of the R&D – the lowest level of all OECD countries, and a unique characteristic of Israeli high-tech. In the other OECD countries, local private investors primarily fund R&D in their local market and in some of the countries, mainly in Europe, state funding also plays a significant role.

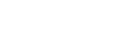

When examining the situation of venture capital investments in startups that constitute a significant part of the Israeli business sector’s R&D activity, Some of the R&D activity in the business sector is funded directly from the companies’ income the foreign investors’ share is even greater. According to an Innovation Authority evaluation based on IVC data, foreign investors’ share of Israeli venture capital in 2021-2022 was at least 75%-80%. In light of this, it is impossible to arrive at a precise evaluation as to the level of foreign capital funding Israeli R&D activity, but this figure nevertheless stands at more than half of all R&D activity.

It is important to note that even among the local entities responsible for investments in startups, primarily Israeli venture capital funds, most of the capital is raised overseas. In practice therefore, a higher ratio of R&D in Israel is funded by foreign investors than is reflected in the global comparison.

Israeli high-tech’s dependence on investors from the private market, especially on foreign investors, poses a significant risk factor for Israel. The more foreign investors are deterred by the political instability in Israel, or by other possible changes in the country, the greater the danger that investments in Israeli high-tech may be suspended or slowed. This could lead to the establishment of less new technology companies and, consequently, to the creation of less high-paying jobs and lower demand for services in Israel (e.g., office space, restaurants, service providers such as lawyers or accountants etc.). A decline in foreign investments in high-tech may therefore have a negative impact on broader circles outside high-tech, leading to a wider impact on the medium and long-term growth of the entire Israeli economy.

Israel continues to decline in the Global Innovation Index

Israel’s ranking dropped a further notch in the 2022 Global Innovation Index to number 16. Global Innovation Index 2022 – ISRAEL Since 2015, Israel climbed up the ranking until 2019 when, for the first time since the index was published over a decade ago, it was included in the world’s ten leading countries. Since 2019 however, Israel’s ranking is on the decline.

Another prominent worrisome feature in the Global Innovation Index decline is in the international ranking of Israeli universities. This metric may impact the international prestige of Israeli researchers, the quality of research produced in Israel, and the quality of university graduates’ training. Today, Israel’s three leading universities rank 32nd in the global rankings, compared to the 22nd place achieved in 2015.

Israel stands out among the group of countries with the highest income in four central areas: human capital and research, market sophistication, maturity of the business sector, and output of knowledge and technology. While human capital is one of the primary resources attracting global technology companies, Israel is only ranked 24th (the composers of the index note that Israel produces relatively higher innovation outputs in relation to the level of investment in innovation). In contrast, areas that constitute weak points for Israel, and in which it has a relatively low ranking, are creative outputs, institutions, and infrastructures.

Startups in Israel have raised significant sums in the past decade but should not be complacent

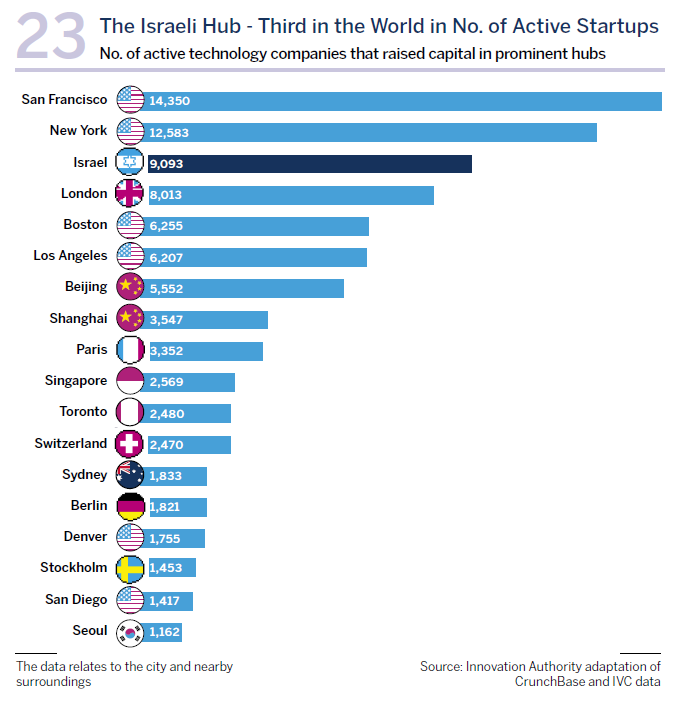

Israel has stood out in relation to other hubs worldwide in its number of active startups which raised funding from investors. As of April 2023, there were 9,093 technology companies that had, at some stage of their operation, raised funding from investors. This figure ranks the Israeli hub as third in the world in this metric and positions Israel as a prominent startup hub on a global level. San Francisco is the largest hub in the world according to this metric with 14,300 technology companies that raised funding, followed by New York with 12,600. The next largest hubs in the ranking are London, Boston, and Los Angeles.

Entrepreneurial activity in Israel has been especially prominent over the past decade during which 11,865 companies that raised funding from investors were established in Israel. Some of these companies have since closed or become inactive. The fields in which the Israeli ecosystem’s comparative global advantage in concentrating fund raising came to the fore were privacy and information security (cyber), agricultural technology (agri-tech), content and media, and information technologies. In relative terms, Israeli cyber companies’ share of the total capital raised locally is 2.85 times higher than the global average.

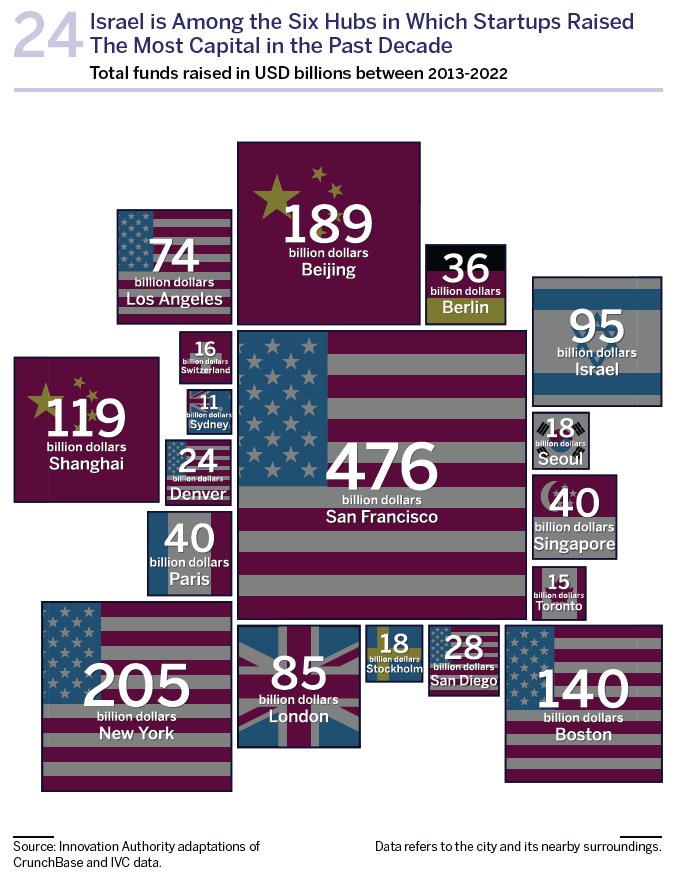

Israel has enjoyed phenomenal growth in startups’ fundraising over the past decade. An unprecedented sum of 95 billion dollars was raised by Israeli technology companies between 2013-2022, a figure which positions the Israeli innovation hub in 6th place in the world in terms of startups’ fundraising during this period. This is an especially impressive achievement considering the largest hubs that are ranked ahead of Israel and which are located in economic superpowers – the US and China.

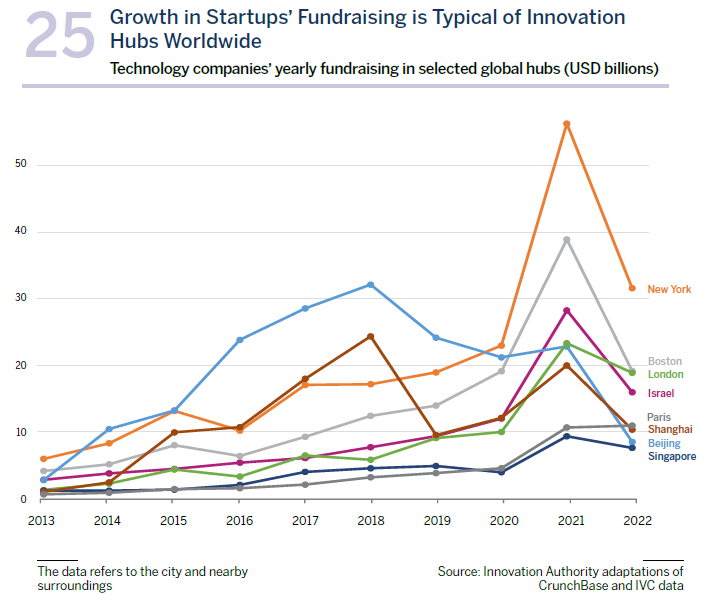

Nevertheless, Israel must not be complacent, and it is important to be aware of global trends and other factors that exert a long-term influence on innovation, as noted above. Firstly, the accelerated growth in startups’ fundraising is not unique to Israel. In most of the hubs examined there was a significant growth in startups’ fundraising during this period, including a record in total investments in 2021 followed by a decline in 2022. Some of the hubs enjoyed growth similar to that of Israel, including Singapore, Switzerland, Berlin, New York, and Los Angeles. In other places, it was double, and even higher, that of Israel.

It is important to mention London and Paris – two hubs with the most noteworthy growth in funds raised by startups. At the beginning of the period under examination in 2013, startups’ fundraising in Israel (2.8 billion dollars) was five times higher than in Paris and double that in London. Thanks to the rapid development of the innovation ecosystems in both cities, by the end of the relevant period in 2022, London had overtaken Israel in the sum raised by startups in the city: almost 19 billion dollars were raised in London in 2022 compared to almost 16 billion dollars in Israel. The sum raised in Israel was still higher than that raised in Paris (10.9 billion dollars), however if the rapid growth typifying Paris in recent years is sustained, this situation may change within a few years.

The significance for the startups and innovation hubs in Israel is that its competition is increasing, and not just with the major hubs with which it regularly competes for funding and personnel, primarily San Francisco – the largest ecosystem in terms of the number of companies and funding. The fiercest competition today is with smaller and rapidly growing ecosystems, mainly in Europe.

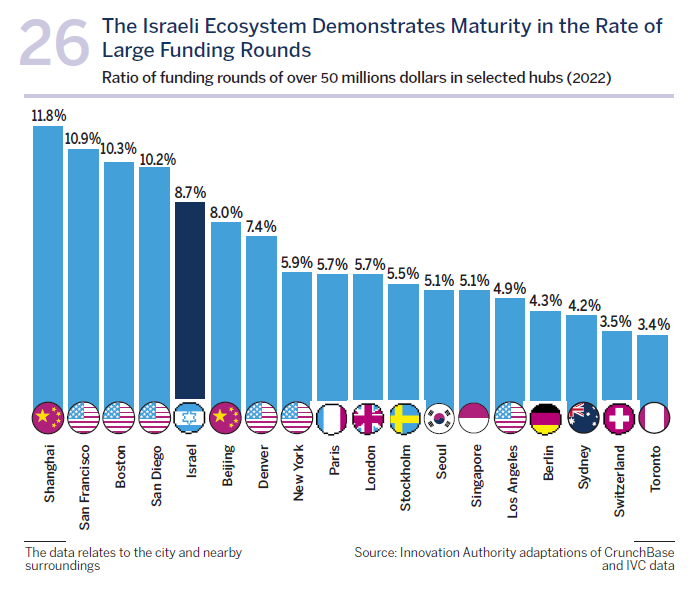

In relative terms, Israeli startups’ funding rounds of more than 50 million dollars constitute a high ratio of all funding rounds. The areas with larger shares of the funding rounds of this scope are large mature hubs: Shanghai, San Francisco, Boston, and San Diego. This figure testifies to the maturity level achieved by the Israeli innovation ecosystem in recent years that position it among the world’s leading ecosystems that are located in significantly larger countries than Israel – the US and China. Furthermore, in the period under examination (2013-2022), Israel witnessed the sharpest increase in its share of funding rounds of this scope (at least 50 million dollars) compared to the other large hubs and has thus almost closed the gap with these hubs within just a decade.

At the same time, it is important to note that this phenomenon is not unique to Israel. As of 2022, in most of the hubs examined and to which Israel compares itself, the majority of funding raised by startups was in funding rounds larger than 50 million dollars. Funding raised in the large-scale funding rounds also increased significantly in London, New York, and Switzerland.