The climate crisis is one of the largest challenges threatening our planet’s future and the future of mankind. The UNFCCC – the United Nations Framework Convention on Climate Change – designated national goals for reducing greenhouse gas emissions and preventing man-made damage to the atmosphere. To meet these goals, the different countries and the corporate world must adopt different measures that will, in turn, increase the demand for innovative solutions in this field. Technology companies undoubtedly have a role to play in addressing the global climate crisis by developing tools, services and products aimed at contending with greenhouse gas emissions (mitigation) or with the impacts of global warming (adaptation) such as extreme weather events, a change in the precipitation regime etc.

As a small country, Israel does not significantly influence the climate crisis as far as greenhouse gas emissions or its ability to eliminate the global crisis are concerned. But can Israel become a world leader in the development of technological climate-tech solutions and in assisting other countries?

To answer this question, the Innovation Authority conducted a preliminary study in an attempt to characterize the companies active in this field in Israel, 1An extensive mapping of this area is expected to be published by the Innovation Authority towards the end of 2023, that will include tools for measuring different ecosystems in climate-tech fields. the problems to which they offer solution, and the trends of entrepreneurial activity in this area. The study revealed that 516 technology companies were active in Israel in the field of climate-tech as of Mar 2023. Furthermore, during the same period, 26 climate-tech companies were acquired or merged with other companies.2Methodology: fields of activity for technology companies in the field of climate-tech were defined for the purposes of the study presented in this report, including seven sectors that belong to the field of climate-tech and 30 subsectors. The various sectors were determined according to the accepted fields in Israel and around the world. The expanded list of sectors identified key words that describe companies which operate in each of them. The list of key words was checked by the startup databases of SNC and IVC on the list of Israeli technology companies that were active between 2018-2023. Based on this data, a list was created of 615 climate-tech companies that operated in the defined period, of which 516 are active, 64 have closed, 26 were acquired or merged with another company, and 9 companies whose status was unclear. One example is the startup company Breezometer that engaged in the monitoring of environmental hazards and was acquired by Google in September 2022. During the last five years, 64 climate-tech companies operating in Israel closed.

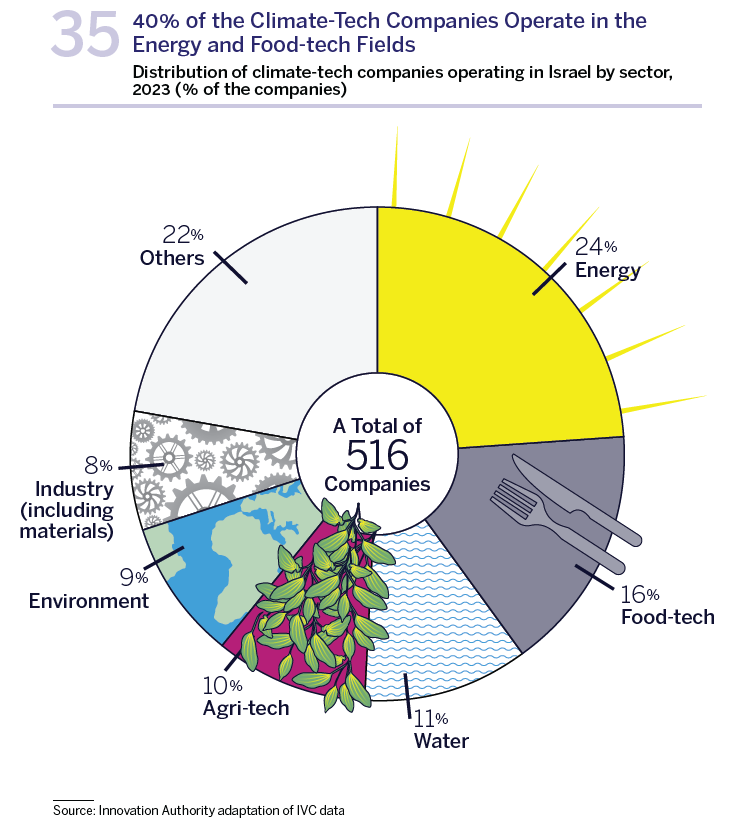

The Israeli climate-tech companies are active in a diverse range of fields. 24% of Israeli climate-tech companies operate in the field of energy, developing solutions for energy storage, renewable energy, energy efficiency and others; 37% of the Israeli climate-tech companies operate in the fields of agriculture, food, and water (approx. 16% in the field of food-tech – alternative proteins, food waste etc.); 11% of the companies operate in the field of water – desalinization, water resource management etc.; and 10% in the field of agri-tech – vertical farming, urban farming, agricultural biotech etc.

Together, these four fields represent over 60% of the technological activity in the field of climate-tch in Israel. The main fields in which the other companies operate are: 9% in environmental fields, 3Environmental fields – anything related to measurement of the current situation of the planet such as the weather, atmosphere etc. and 8% in industrial fields, including the segment of materials.4Industry and materials – anything related to recycling, energy efficiency, manufacturing of new materials for construction etc. In addition to the fields detailed above, climate-tech companies in Israel also operate in areas such as carbon trade, circular economy, smart transportation, and others.

Although climate-tech is generally regarded as a new category that grows as the climate crisis increasingly becomes the focus of international discussion, in some of the subsectors of this category, Israel is an established, veteran player. These include, among others, the fields of water, farming, agriculture, and energy. Because of the weather and geographical conditions that characterize Israel, technologies that solve problems in these areas have been at the center of local development for decades. The success stories exported from Israel in these subsectors include Netafim that developed drip-irrigation solutions, the solar energy company SolarEdge, and the veteran Ormat Technologies in the field of geothermal energy.

Furthermore, Israel is home to leading global research institutes in this field, including the Volcani Institute, the Soreq Nuclear Research Center, and the Weizmann Institute. These institutes and their researchers are responsible, among other things, for the development of innovative climate-tech solutions. A significant proportion of the climate-tech companies operating in Israel today, many of which have been established in recent years, is concentrated in fields to which government resources and efforts have been dedicated and where incentives have been given, including in the fields of energy (fuel substitutes), agriculture, and water.

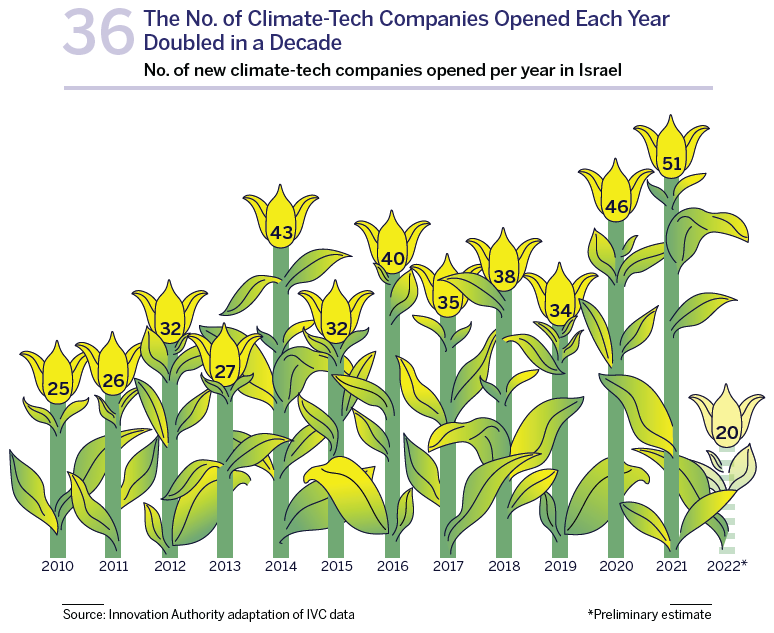

Several metrics related to fluctuations in the entrepreneurial activity in this field were examined to assess whether the Israeli innovation ecosystem is responding to the growing global interest in the climate issue. As far as entrepreneurial activity evident in the establishment of new technology companies in this field is concerned, we can discern a growth trend in the number of new companies: from 2010, the number of new companies in the field increased from 25 a year to 51 new climate-tech companies in 2021. In other words, the number of new companies opened each year in the field of climate-tech more than doubled within a decade. The figures for 2022 are still a preliminary estimate and it is therefore too early to understand from them whether we are witnessing a change in this trend and whether they indicate a decline in entrepreneurial activity in this field.

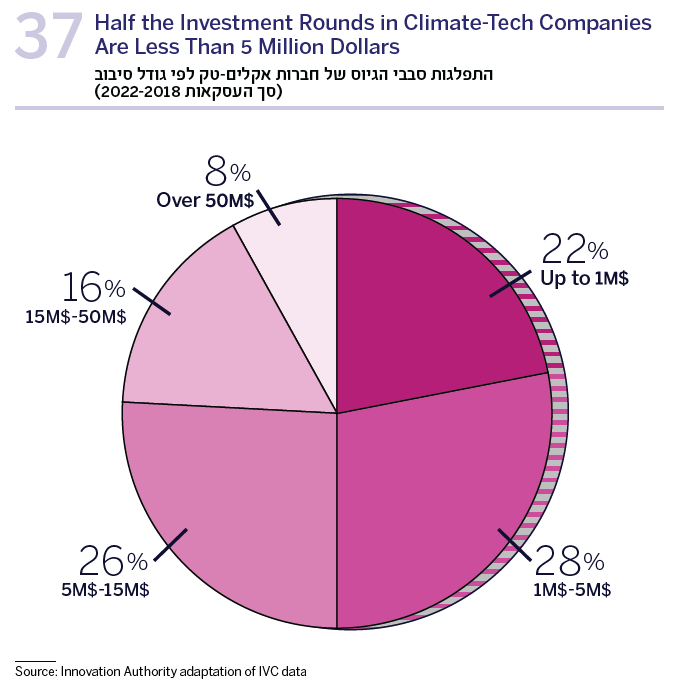

Alongside the increased rate of new climate-tech companies, the capital raised by climate-tech companies also increased significantly. According to the study, in the five years between 2018-2022, a total of 7.2 billion dollars was raised by 344 companies in the fields of climate-tech, 24% of which was by food-tech companies that raised 1.7 billion dollars. Of all the funding rounds in the various fields of climate-tech, half were by companies in early stages, with less than 5 million dollars raised in each round.

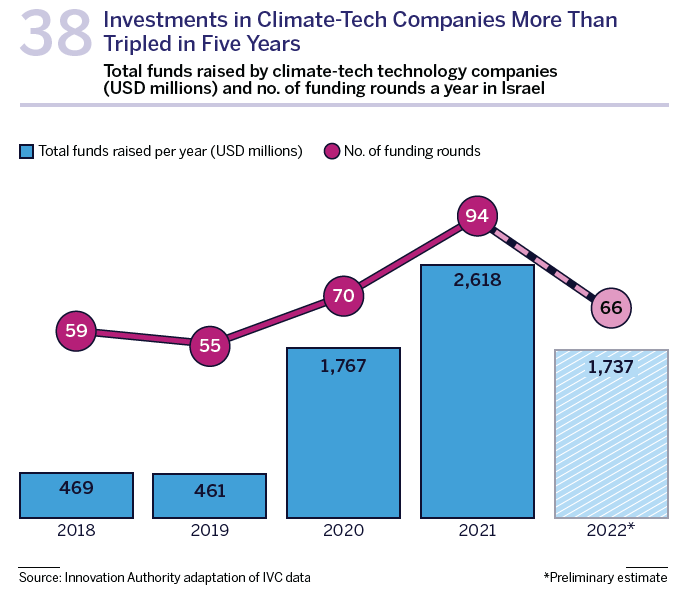

Furthermore, the scope of fundraising tripled during this period: from less than half a billion dollars in 2018-2019, to more than 2.5 billion dollars in 2021. The combination of these two metrics indicates an increase in interest in this field and the attractiveness of Israeli companies engaged in climate-tech. The average size of each funding round also more than tripled – from 8 million dollars in 2018 to 26 million dollars in 2022. This metric indicates a maturation of the Israeli climate-tech companies.

Among the prominent recent funding rounds in the Israeli climate-tech field were H2Pro that develops a green hydrogen technology and raised 75 million dollars in 2022; Beewise which raised 80 million dollars in 2022; and Remilk that raised 120 million dollars in 2022, a figure which, according to reports, reflected a total company value of 325 million dollars.

The rise in climate-tech investments in Israel is consistent with the increasing global interest among venture capital investors. Moreover, it is clear that international funds are starting to formulate investment strategies in this field. The increased interest is also reflected in investors’ desire to collaborate with organizations that will be recognized as climate-tech investors. In Israel for example, over 40 investors joined the Investor Alliance list created by PLANETech that promotes climate-related innovations.

The increased interest in investments in the field of climate-tech is not unique. Evidence of this can be found in a Pitchbook survey conducted among 58 venture capital funds in April 2023. The survey reveals that investors regard climate-tech as a field characterized by high innovation and one that is expected to continue to prosper as clients adopt new technologies. The field of climate-tech is ranked second only to Artificial Intelligence in these two metrics.5EMERGING TECH RESEARCH H1 2023 VC Tech Survey, see here.

The bottom line is that Israel enjoys a promising position as a key player in the development of revolutionary climate-tech solutions. This is, in part, thanks to the decades during which the young state was required to develop solutions in areas related to water, agriculture, and solar energy. Israel enjoys a positive worldwide reputation as one of the countries contributing to the global effort to develop technological solutions for the climate crisis. Today, Israel’s rich store of research knowledge and experience in this field constitutes a comparative advantage of the Israeli ecosystem in the climate-tech field over other countries. The rate of new companies being opened in Israel and of their fundraising has also grown significantly in recent years.

To preserve its relative advantage in climate-tech, Israel must continue developing high-quality training of skilled personnel with relevant expertise and to continue investing in research to stand at the forefront of global knowledge in this field. On the national level, effort must be made to develop infrastructures for research and its application in the local market so that it too can benefit from the fruits of the technology. Furthermore, as a field that requires relatively long years of development, in contrast to software solutions for example, there is a need to examine the demand for unique funding solutions to advance climate-tech.