Israeli high-tech has enjoyed phenomenal growth in startups’ funding over the past decade. Looking at the entire decade, the investments in Israeli startups grew five-fold between 2013-2023, totaling 95 billion dollars. These investments enabled the startups to remain independent over time without the need to perform a quick exit, to establish and develop sustainable businesses, and to employ large numbers of employees in roles that are not exclusively technological (in nature) and which facilitated the companies’ growth. Furthermore, the startups became a significant economic cornerstone when they purchased services from peripheral businesses: restaurants that provide meals for employees, real-estate rental space, and service providers such as lawyers, accountants etc.

According to a Tech Aviv estimation, https://www.techaviv.com/unicorns as of May 2023, there were 98 unicorns operating in Israel i.e., private technology companies that reflected an estimated value of at least 1 billion dollars in their last funding round. According to Tech Aviv, these companies alone raised a total of more than 44 billion dollars – at least part of which is still in the companies’ coffers and allows them to continue to develop and hire employees.

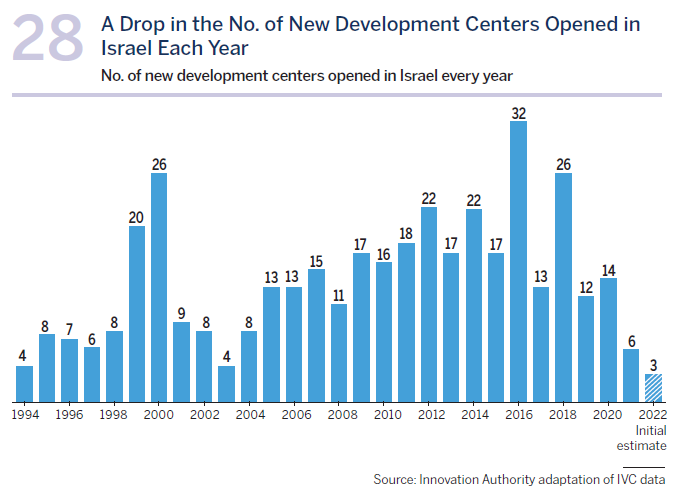

The emergence of the Israeli unicorns is a significant part of the Israeli high-tech story over the last decade. Previously, Israeli companies were generally oriented towards technology development and were sold at a relatively early stage before investing significant resources in marketing, sales, and global expansion. These acquisitions led multinational companies to rapidly open hundreds of development centers in Israel, primarily between 2005-2018.

As the unicorns established themselves as complete companies, the pace of opening development centers slowed from 2019, declining to a pace similar to that of the early 2000s. As noted, over the years, most of the development centers were opened as the result of a M&A transaction and the startup becoming a development center of the purchasing corporation. Between 2010-2015, an average of 14 new development centers were opened each year.

At the height of the acquisitions period between 2016-2018, the rate rose to 24 new development centers on average every year, while between 2019-2022, this declined to a low point of 8 new development centers on average each year. Recently, against the backdrop of the global economic crisis, we have witnessed a phenomenon of closure of development centers operating in Israel. Among the centers closed were those of EA, Dropbox, and others. Considering the importance of multinational companies’ development centers for the stability of the high-tech sector, it is important to monitor the development of this trend.

Together with the decline in development centers in recent years, the number of IPOs during this period increased dramatically: according to IVC data, 117 Israeli technology companies issued stock between 2019-2022 – an average of 29 a year. Furthermore, over this period, there were 595 M&A (merger and acquisition) transactions – an average of 149 per year. Some of the acquisitions over the past decade were by Israeli entities – a development that testifies to a maturation of the local industry that is also enjoying non-organic growth.

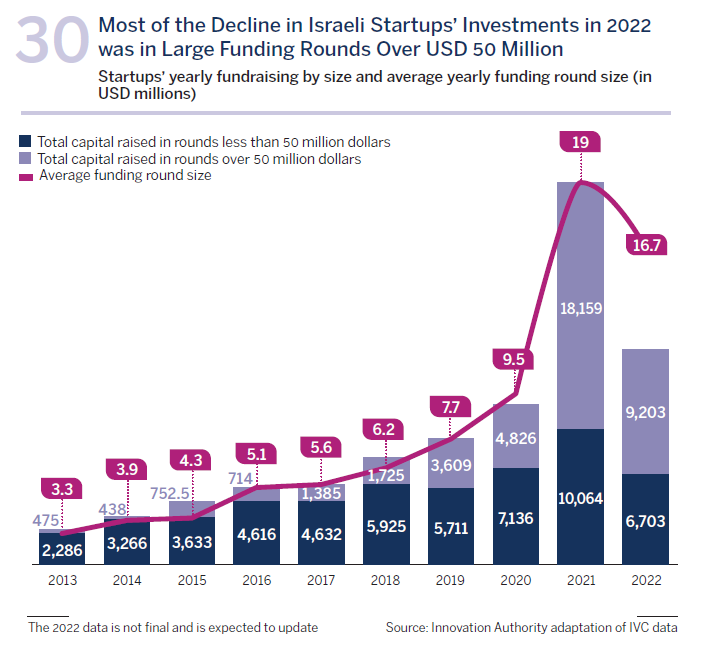

The increase in the number of large-scale funding rounds of the mature technology companies bolstered the total funding raised by startups in Israel in recent years during which there has been an acceleration in the rate of funding raised by startups. However, recently this rate has slowed, with growth companies and unicorns are seemingly most adversely affected from the slowed rate of investments during this period.

In 2022, Israeli startups raised 15.9 billion dollars in 953 funding rounds. This represents a decline of almost 45% in total investments compared to 2021. At the same time, 2021 was an unusual year in the scope of investments in startups: 28 billion dollars – more than double the previous year. Excluding the jump in investments in 2021, the following year (2022) actually continued the trend of growth in investments typical of recent years.

Considering the global economic downturn expressed, among other things, by interest rate hikes and a global deceleration in the rate of funding rounds, and given the ongoing political instability in Israel, it would seem that we can expect a continued decline in investments this year compared to the growth trend of recent years.

The industry’s maturation and the consolidation of the complete companies in Israel over the past decade was expressed in an important metric that improved significantly during this period: the size of the average funding round. In 2013, this metric stood at 3.3 million dollars for a startup in Israel and had, by 2022, grown five-fold to reach 16.7 million dollars. Between 2013-2018, the size of the average funding round doubled and three years later, almost tripled.

The primary factor contributing to the significant growth in the total capital raised was especially large funding rounds of 50 million and, even, of more than 100 million dollars. Until recent years, technology companies raised such sums on the capital market. In comparison, just a decade ago in 2013, the Israeli company WIX raised 127 million dollars in an IPO, reflecting a market value of 765 million dollars. At the time, this was one of the largest stock issues in the history of Israeli high-tech. In other words, the accepted scales of private sector investments in high-tech changed within just a decade. In 2013, only 0.6% of startups’ funding rounds were of 50 million dollars or more – five of all the funding rounds conducted that year. In 2022, their relative share grew more than 14-fold to nearly 9% of the funding rounds. These rounds raised 58% of all total capital raised i.e., 6.7 times their relative share of the number of rounds. In 2013, only 17% of the total capital was raised in funding rounds larger than 50 million dollars whereas since 2019, 55% of the capital raised by Israeli startups was in funding rounds larger than 50 million dollars.

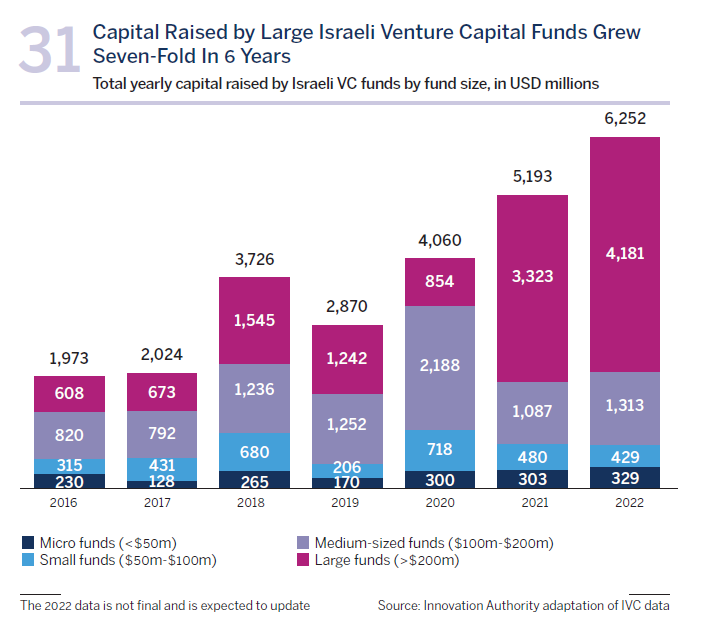

The growth and flourishing of Israeli startups were also expressed in the growth in capital raised by Israeli venture capital funds, especially in sums intended for relatively large funds that can generally write larger checks and invest in companies at advanced stages. Between 2016-2022, Israeli venture capital funds raised a total of 24 billion dollars. The total capital raised in 2022 tripled compared to the level of 2016 and reached 6.2 billion dollars. As noted above, most of the investments in Israeli startups are by foreign investment entities such that the capital raised by Israeli investment funds represents only part of the investment potential for Israeli startups in the visible future.

The sum raised by Israeli venture capital funds that manage over 200 million dollars grew seven-fold during this period – from 608 million dollars in 2016 to 4.2 billion dollars in 2022. In total, the funds which manage over 200 million dollars raised 12.5 billion dollars throughout this period – approximately half the total capital raised. In relative terms, the large funds have the highest growth out of all the funds that raised capital in Israel during this period.