Israeli High-Tech 2023 – A Situation Report

The past decade has witnessed an increase in the importance of the high-tech sector to the Israeli economy. Even prior to that, high-tech was regarded as “the growth engine” of the Israeli economy, however an analysis of data from the last decade reveals that the sector has grown at an accelerated rate, especially during the past five years. This accelerated growth has transformed high-tech into the sector with the economy’s largest output and growth, responsible for the largest ratio of Israeli exports, and with the most rapid growth in the number of employees and salaries.

As high-tech grows, so too has the Israeli economy’s dependence on it. Furthermore, more than other countries, in Israel this sector is based almost entirely on the private market and is therefore exposed to global fluctuations that impact investors and multinational technology companies. The resultant ramifications of this situation threaten the continued growth of Israeli high-tech, especially in periods such as the present, that are characterized by declining levels of startups’ funding rounds.

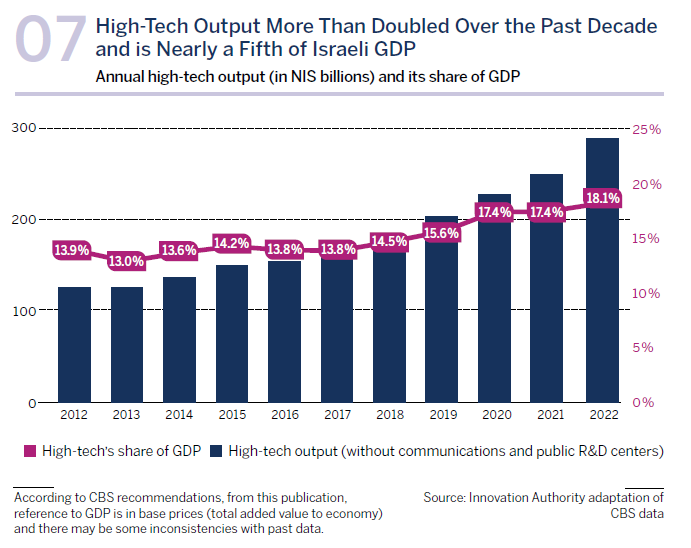

High-tech constituted 18.1% of Israel’s GDP in 2022 – a figure that positions it as the sector with the largest output in the economy.1According to CBS recommendations, from this publication, reference to GDP is in base prices (total added value to economy) and there may be some inconsistencies with past data. From 2012, high-tech’s share of GDP increased by more than four percent (from 13.9%). In comparison, in the US, which has a large and developed high-tech sector alongside a more diverse economy, high-tech’s share of GDP in 2021 stood at 9.3%.2Source: Tech GDP as a percent of total U.S. GDP 2021 | Statista. In other words, high-tech’s relative share of Israeli GPD is almost double that in the US, a figure that dramatically illustrates Israel’s high dependency on this sector.

Output of the high-tech sector has doubled nominally within a decade. In 2012, high-tech output stood at 126 billion shekels, a figure that increased to 290 billion shekels in 2022. If this trend of growth continues at the rate typical of recent years, in just a few short years, high-tech will account for a fifth of the State of Israel’s GDP. This will only further heighten Israel’s dependence on high-tech and, accordingly, the sensitivity of the entire Israeli economy to upheavals in this sector.

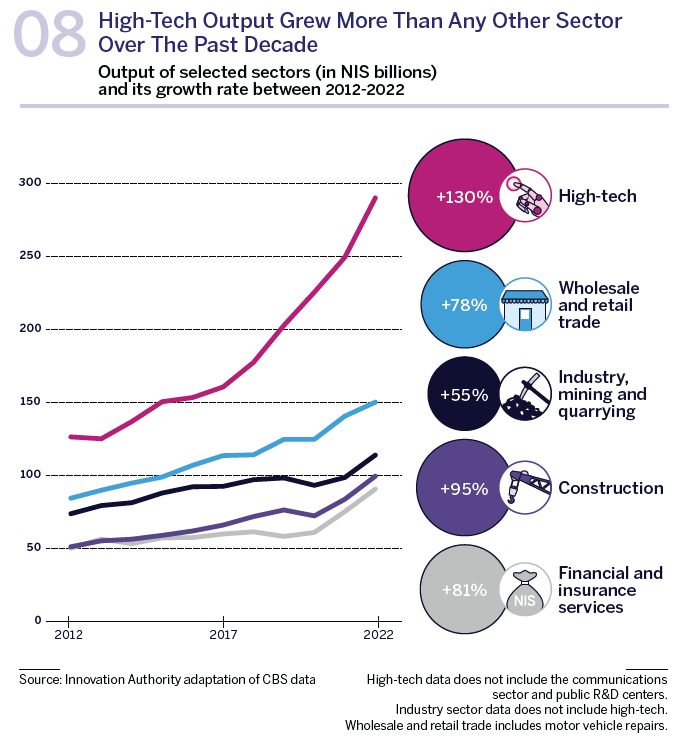

The growth in high-tech output is especially marked when compared to the growth in outputs of other sectors in the Israeli economy over the past decade. For example, the output of the high-tech sector in 2012 was 50% higher than that of the trade and retail sector – the next sector in size after high-tech. A decade later in 2022, the gap between the two sectors stood at more than 90%, i.e., high-tech output is becoming increasingly dominant in comparison to the other sectors in the private market. Of the economy’s main sectors, high-tech output is the only one to have doubled, or more, over the past decade.

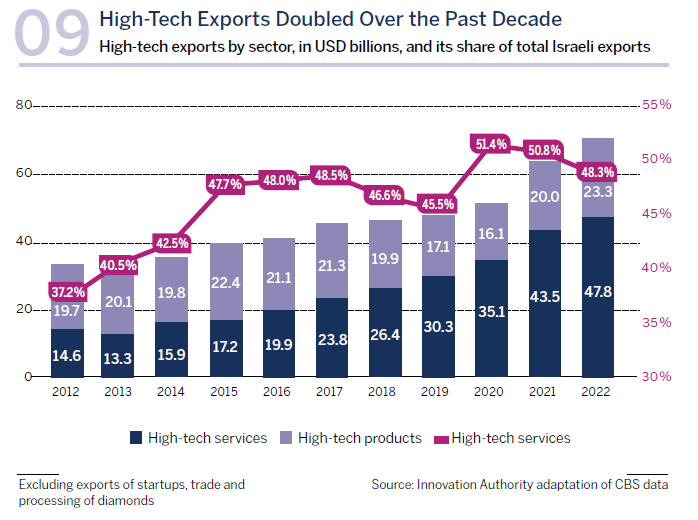

The Israeli high-tech sector was responsible for 48.3% of all Israeli exports in 2022, totaling 71 billion dollars, more than doubling over the last decade and growing by 107%. This growth stemmed almost entirely from the increase in exports of high-tech services that include, among others, software services. This export more than tripled from the 2012 level of 14.6 billion dollars to 47.8 billion dollars in 2022. During the same period, exports of high-tech commodities that include the microchips sector, grew by only 18%. Between 2016-2020, exports of high-tech commodities declined but increased again over the last two years. After the ratio of high-tech exports out of total Israeli exports crossed the 50% threshold during the Covid crisis, its relative share declined in 2022 due to the general recovery of the economy and the increase in other sectors such as tourism that were negatively impacted during the pandemic.

High-tech has established itself over the past decade as the fastest growing sector in Israel in terms of employees.

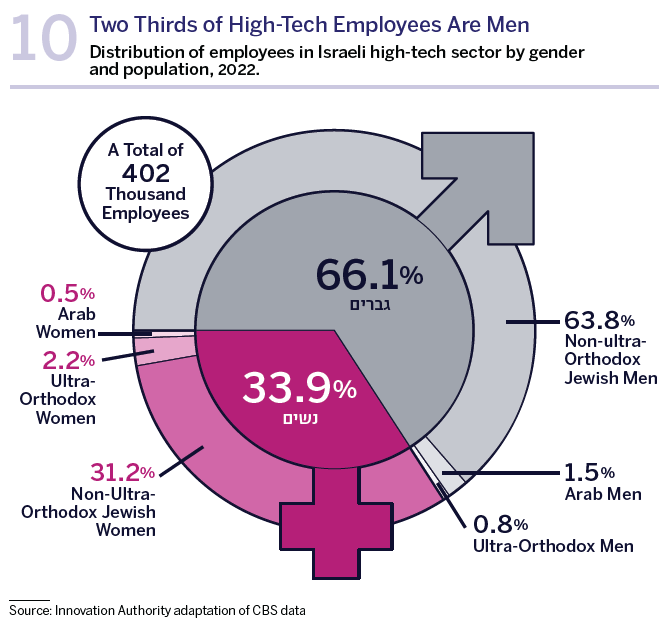

Human capital is the primary resource of Israeli high-tech and the one which attracts technology companies and investors from around the world to Israel. In total, 401,900 salaried employees worked in the Israeli high-tech sector in 2022.3The recommendations of the National High-Tech Human Capital Committee (the Perlmutter Committee) include a new definition of “tech jobs” – people employed in high-tech and in technology jobs in other sectors. See: The Committee’s Recommendations (in Hebrew). In this section, we examine the high-tech sector according to its previous definition which refers exclusively to employees in this sector. A “tech jobs” based analysis is presented in a separate text box. Although significant resources were invested in diversification and inclusion, and despite an increase in the rate of diverse population groups integrating into a variety of roles in the sector (see details below), Israeli high-tech still largely consists of (non-ultra-Orthodox) Jewish men. 66% of salaried high-tech employees are men and 34% are women.

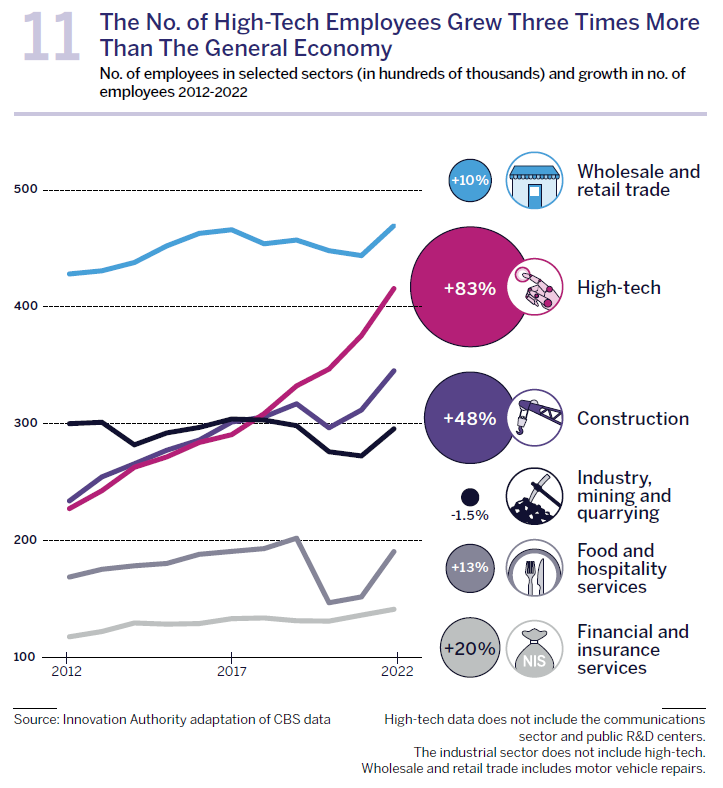

One of the prominent trends over the past decade is the rapid rate of growth in the number of salaried high-tech employees, especially in comparison to other sectors of the economy. Within a decade, high-tech has established itself as the fastest growing sector in terms of salaried employees out of all Israel’s private market sectors and as one of its largest. A more in-depth analysis of the types of population and roles responsible for most of this growth is presented below. The average yearly growth rate in the number of salaried high-tech employees between 2012-2022 was 6.3%, compared to a yearly rate of 2.2% in the economy’s overall number of salaried employees. In other words, the growth in high-tech employees was three times that of the overall number of the economy’s employees, with the growth rate in high-tech increasing even further in recent years (an average yearly growth rate of 7.5% between 2017-2022).

Moreover, high-tech is almost the only industry in the private sector in which the growth in employees was not impacted by the Covid pandemic, in contrast to most of the private sector industries that witnessed a downturn and a decline in the number of employees.

It is interesting to examine the trends associated with the integration of new employees into high-tech when compared to other private market sectors. The sector employing the highest number of employees in the Israeli private market is trade and retail that includes stores and shopping malls, 4The wholesale and retail trade and motor vehicle repairs sector. and which employed 469 thousand people in 2022. This sector is however growing relatively slowly – only 9.64% throughout the entire decade. Another major private market sector in which the number of employees is stagnating is the industrial sector. In 2012, the number of employees in this sector was higher than that of high-tech: 299 thousand compared to 227 thousand in high-tech. A decade later, the number of employees in the industrial sector declined by 4,000 and was overtaken by the high-tech sector that employed more than 400 thousand workers. In other words, almost 190 thousand people joined high-tech during this period. Part of the growth in high-tech stemmed from the transition of workers in non-technology roles from other sectors such as bookkeepers, marketing personnel, lawyers, and others.

A further significant sector in the Israeli economy is construction, 5This sector includes the construction of buildings and civil engineering as detailed in the economic sectors categorization. which had 233 thousand employees in 2012. This figure is slightly higher than the number of high-tech employees in the same year (227 thousand). Both sectors grew significantly over the past decade but the momentum of growth in high-tech was greater. As of 2022, the number of high-tech employees stood at 415 thousand, a total increase of 83% over the past decade. 6For a distinction between the definition of “employed” and “salaried employee”, see the “labor market” tab in the CBS glossary of terms. In contrast, the number of employees in the construction sector stood at 344 thousand, representing a growth of 48%. Both sectors demonstrated a similar growth rate until 2017, however from this year onwards high-tech growth constantly outstripped that of the construction sector.

Two other central sectors in the Israeli economy that demonstrated relatively low growth over the past decade are the hospitality and food sector that were severely affected during the pandemic but recovered in 2022, growing by a total of 13% over the decade; and the financial and insurance services sector that grew by 20% over the same period (from 117 thousand employees in 2012 to 141 thousand in 2022).

The disparities are growing: high-tech salaries are almost three times higher than the general economy’s average

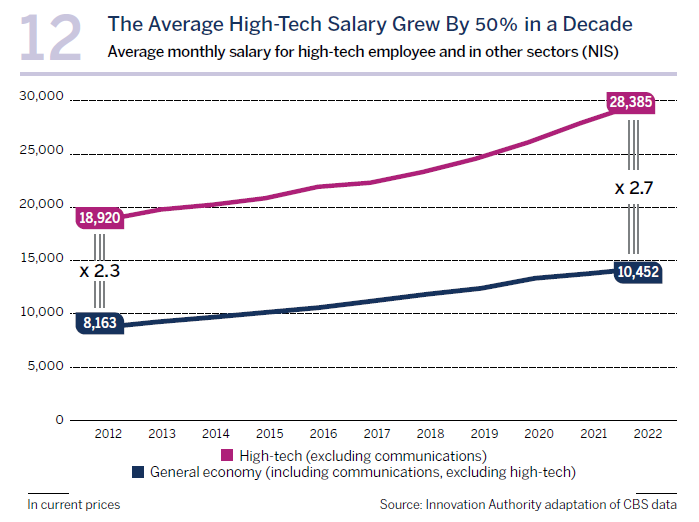

For several decades, the average salary in high-tech has been (at least) double that of the economy’s average salary. In 2012, high-tech salaries were 2.3 times higher than the general economy’s average salary. Together with sector’s accelerated growth described above during the past decade, and the fierce competition between the companies over human capital – the primary factor in attracting the world’s leading technology companies to Israel – salaries in this sector also surged. The average yearly growth rate of high-tech salaries between 2012-2022 stood at 4.14% compared to 2.5% in the rest of the economy. In recent years, the yearly salary growth rate accelerated and stood at an average of 5% a year between 2018-2022.

This situation led to increased salary disparities in Israel and in 2022, the average high-tech salary – that stood at 28,385 shekels – was 2.7 times higher than the average salary in the rest of the economy (10,452 shekels). Another perspective of this is the nominal growth in high-tech employees’ salaries that have increased by 9,465 shekels since 2012, compared to the salary of an employee in the economy’s other sectors which increased by 2,290 shekels over the same period. The figures relate to the salary of all employees in the high-tech sector, both in technology and non-technological jobs. In other words, high-tech employees’ salary increased by 50% over a period in which the average salary of employees in all the other sectors increased by just 28%.

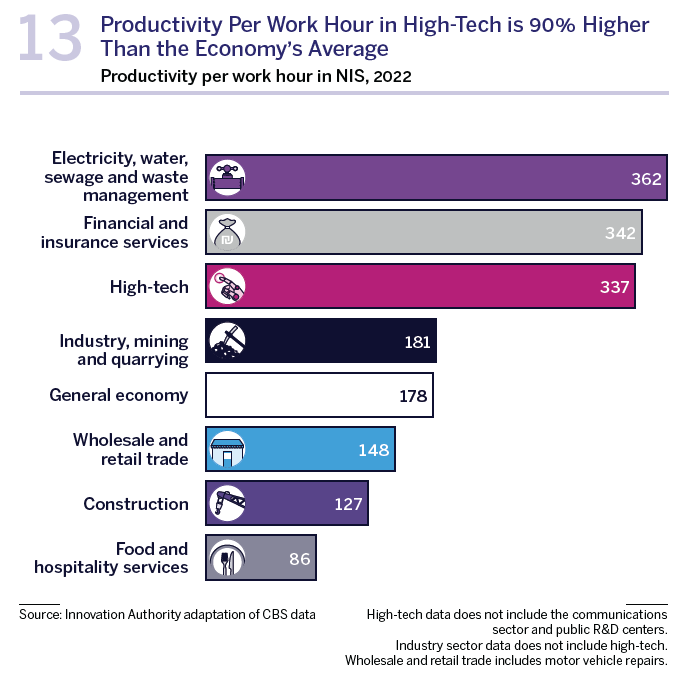

Bank employees’ productivity overtook high-tech productivity for the first time in 2022

Another comparison we conducted was that between the productivity of high-tech employees and that of employees in the other sectors, with the aim of assessing the disparities between the contribution of high-tech and that of other sectors. Work productivity in high-tech, that was calculated as the hourly output per employee in the sector, stood at 337 shekels per hour in 2022 – almost double that of an employee in the general economy (178 shekels). During the past decade – from 2012 to 2022 – high-tech employees’ productivity increased by 29%, while the parallel growth in the general economy was more rapid and stood at 42%. As a result, the disparity between the hourly productivity in high-tech and that in the general economy also slightly narrowed. It should be noted that the rapid rate of salary growth in high-tech, alongside a more moderate increase in this sector’s productivity, indicates that the high-tech sector represents a more competitive employment market than the rest of the economy. In other words, employees in this sector possess greater negotiation power than those in other sectors.

Although high-tech productivity is 90% higher than the economy in general, it is not the sector with the highest productivity in Israel. Two other sectors are characterized by productivity higher than that of high-tech. The first of these is the electricity and water supply and sewage services sector where hourly productivity stood at 362 shekels in 2022. This is a relatively small sector where most of the operational tariffs are supervised by various regulators, and which employs about 40 thousand people – less than a tenth the number of high-tech employees. Although productivity in this sector suffered from a high level of volatility over the past decade, it still ranked in first place in this metric throughout the entire period. At its peak in 2019, the productivity of electricity and water supply services reached 434 shekels per hour.

The second largest sector in terms of hourly work productivity is financial and insurance services which, for the first time, overtook high-tech productivity in 2022, reaching 343 shekels last year. This figure stems primarily from the banks’ profits, the sector’s high degree of centralization, and a lack of competition. Nevertheless, in recent years, as part of economization processes in the financial sector, there has been a marked growth in the number of technology workers hired in this sector who also have contributed to the increased productivity. Over the past decade, the productivity of financial services employees increased by more than 50%, compared to 29% in high-tech. If the growth rate of the financial services sector over the last three years is maintained, we may see this gap in productivity increase even further.