In 2019, the Israeli High-Tech industry continued to flourish and broke new records in several indices. Yet the Israel Innovation Authority is detecting alarming trends that call for the government’s close attention, such as a decline is high-tech exports and a shortage of skilled employees

2019 was another year of growth and prosperity for the Israeli innovation ecosystem. In 2019, the high-tech industry reached new heights in capital raised, export, output and number of employees. These records are reflected in the Israel Innovation Authority High-Tech Index as well as in various international indices, which position Israel in the forefront of global innovation. The data presented in this chapter reviews some of the main markers within the high-tech industry.

Capital raised

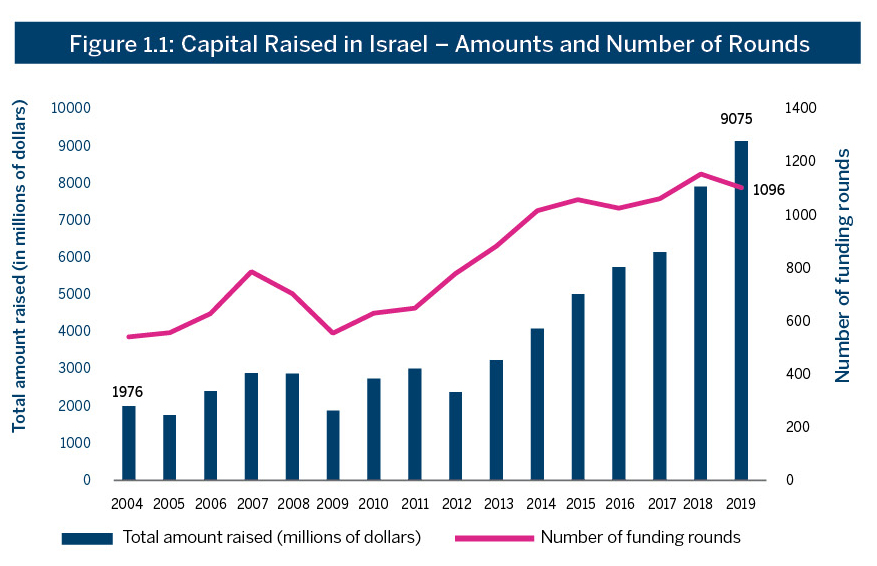

Figure 1.1 shows that the amount of high-tech capital raised in 2019 reached a new peak of 9 billion dollars, a 15% increase compared to 2018. Since 2005, capital raised has multiplied by a factor of 4.5, growing at an average annual rate of around 13%. The number of overall funding rounds in 2019 held steady at 1,100 in 2019, similar to 2018.1IVC Data

Data from 2019 indicates that the increase in capital raised originated mainly from higher amounts raised in each round, rather than more rounds. These higher amounts are a testimony to a wider trend that has been identified in the Israeli high-tech industry over the last decade: the scale-up of existing companies replacing the establishment of new start-up companies as the main driver of growth. This trend suggests that the Israeli high-tech industry is moving towards a new level of maturity.

Source: IVC data processed by the Israel Innovation Authority

Barriers in Local Fundraising

The road to maturation includes an increasing number of growth companies in the Israeli high-tech industry, a development which holds many advantages.2Growth companies are high-tech companies with a mature, saleable product. These companies grow at a rapid pace and allocate significant resources into marketing, sales, support, and possibly production As reported in last year’s report by the Israel Innovation Authority,3Israel Innovation Authority Report, 2018-2019 Israeli innovation must break through its current ceiling and expand its influence on the Israeli economy. An increase in the number of growth companies can help realize this goal.

Fast-developing growth companies have potential to become “complete” companies that employ a large number of employees in a variety of positions other than R&D. Complete companies can significantly increase the number of high productivity employees that characterize the Israeli high-tech sector.

Ensuring that growth companies continue to multiply and flourish is crucial for the Israeli high-tech sector and the Israeli economy. Accordingly, barriers to scale-up must be examined and appropriate solutions offered. One obstacle, notable in the Israeli industry, is the difficulty for growth companies to obtain debt based finance. In chapter 3, “Growth of the Israeli Innovation Ecosystem”, additional data about the increasing number of growth companies in the Israeli high-tech sector is presented, and the challenges of debt financing and the impact of these challenges on Israeli growth companies is analyzed.

High-Tech Export

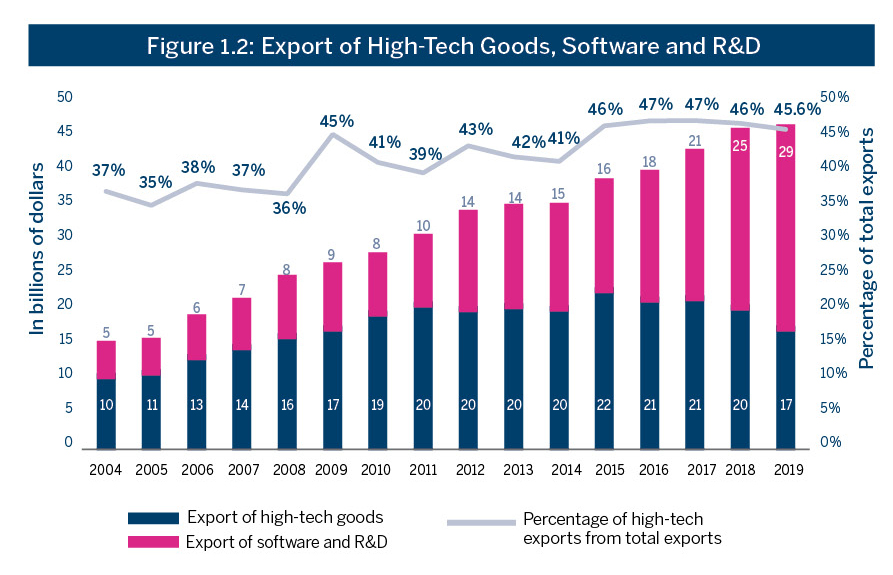

Data on high-tech export in 2019 reflects the growth of the industry. In 2019, Israeli high-tech export continued to grow, and reached an all-time record of 45.8 billion dollars, about 46% of all Israeli exports, an increase of 1.2% compared to 2018.4Based on data provided by the Ministry of Finance and the CBS, processed by the Israel Innovation Authority. Total export data for 2019 represent an annual evaluation based on data from the first half of 2019

Source: Ministry of Finance. 2019 data refer to January through October, calculated for the whole year

The Central Bureau of Statistics (CBS) divides the high-tech industry into two sub-sectors: software and R&D, and commodities.5Software and R&D include knowledge-intensive service branches, such as computation and R&D, while goods refer to high-tech industrial branches such as medicine, electronic components, communication equipment, industrial and machine equipment and aircrafts. Source: CBS, Subcommittee for Official Classification of High-Tech Industries Figure 1.2 presents Israel’s high-tech export split by sub-sector. As shown, most of the growth in high-tech export stems from software and R&D export, which together make up 63% of high-tech export, and which grew by around 14% since 2018, up to 28.8 billion dollars.

Changes in High-Tech Export

Figure 1.2 demonstrates that despite accelerated growth in software and R&D export, the export of high-tech goods (medicine, electronic and optical equipment, etc.) decreased by around 15%, continuing 2018’s trend. Figure 1.2 also shows that in 2019, the share of high-tech export from total export decreased slightly to 45.6%, following six years of over 46%.

It can be concluded from these figures, that due to the drop in the export of high-tech goods, high-tech is no longer the driving force of Israeli export. Today, Israeli high- tech export is growing at a rate similar to the rest of the economy’s export, which is reflected in its unchanging share of overall export.

The relative slowdown is also evident in data pertaining to high-tech output, as shown here. These figures suggest that the high-tech “engine” has become a “railcar”, growing at a similar pace to that of the entire economy instead of pushing it forward, and consisting mainly of software and R&D, and less on products and goods.

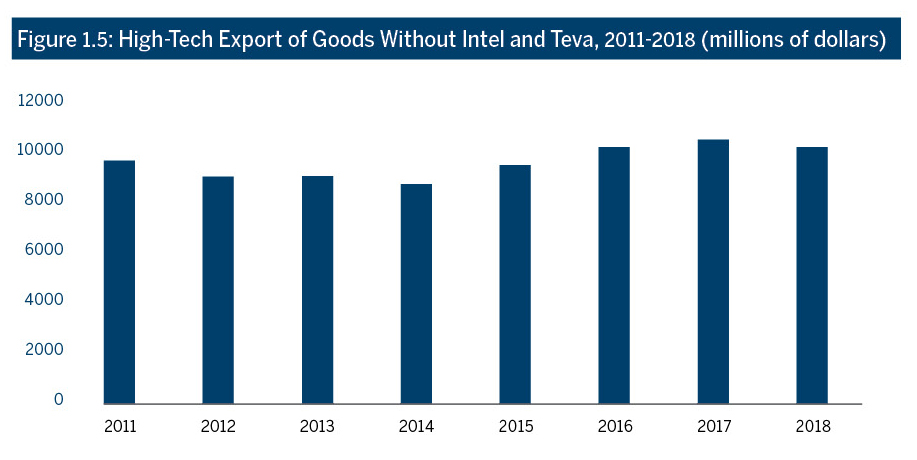

Some argue that the decline in export of Israeli high-tech goods has been caused primarily by downward business cycles in Teva and Intel, which are collectively responsible for about 50% of high-tech’s goods output. Yet, even when the impact of these two companies on high-tech export of goods is controlled for, the evidence shows that the export of goods is slowing moderately.

Figure 1.5 presents the export of high-tech goods without Intel and Teva. In 2017, the export of high-tech goods grew by about 2.9%, and in 2018 it shrank by almost 2.7%, indicating the decline is not a result of changes to these two specific companies.

Source: CBS data processed by the Israel Innovation Authority6Data on 2019 was not yet published in full at the time of the publication of this report

The Israel Innovation Authority believes that the decline in the output and export of high- tech goods is cause for concern. The contribution of high-tech commodities to the Israeli economy is crucial. Beyond their significant contribution to the GDP and export, many high-tech manufacturing companies are complete companies and offer a wide range of jobs beyond R&D. Manufacturing firms are also spread across the country, with production plants in various locations in Israel, and are not clustered in the center of the country. These companies play a significant role in creating and preserving innovation assets and infrastructure in Israel.

The reduction in the export of high-tech commodities and the growing reliance on software, including the provision of services for international R&D centers (an issue that was extensively reviewed in the previous Innovation Report), negatively affect the versatility of the Israeli innovation ecosystem. This trend can hinder Israel’s ability to compete globally and maintain its lead in identifying and developing the next wave of technology.

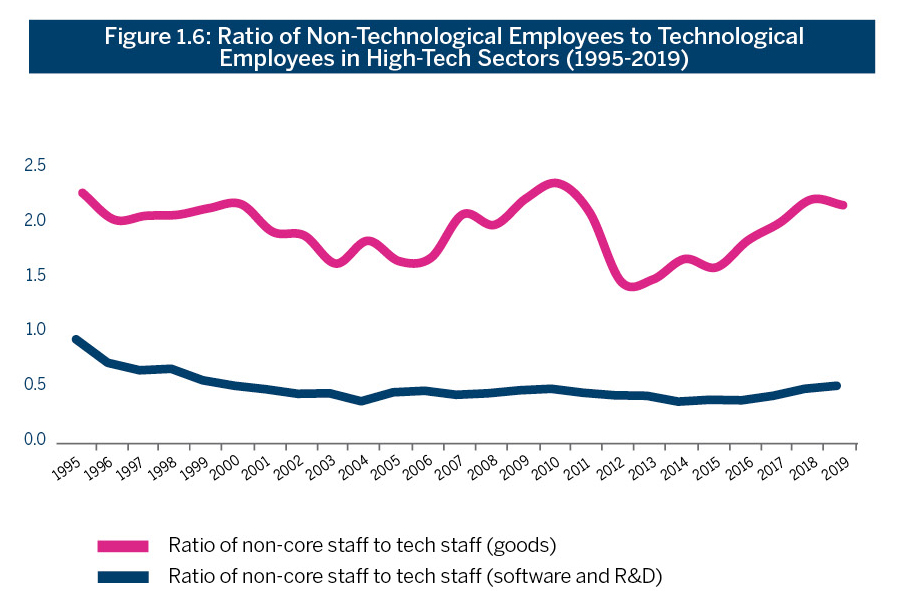

The contribution of the high-tech goods sector to broad employment – employment of more than just R&D employees – is evident in Figure 1.6, which depicts a 2:1 ratio of non-technological employees (finance, marketing, manufacturing, etc.) to technological employees in high-tech manufacturing companies, compared to a 1:2 ratio in software and R&D companies.

Source: CBS data processed by the Israel Innovation Authority

Chapters 2 and 7 of this report present various tools offered by the Israel Innovation Authority, aimed, among other things, at encouraging the growth of innovative complete companies, including goods and commodities companies. The creation of new technological ecosystems, as described in Chapter 6 “Bio-Convergence: The Future of Medicine”, could also potentially facilitate the regrowth of these segments.

Employment in High-Tech

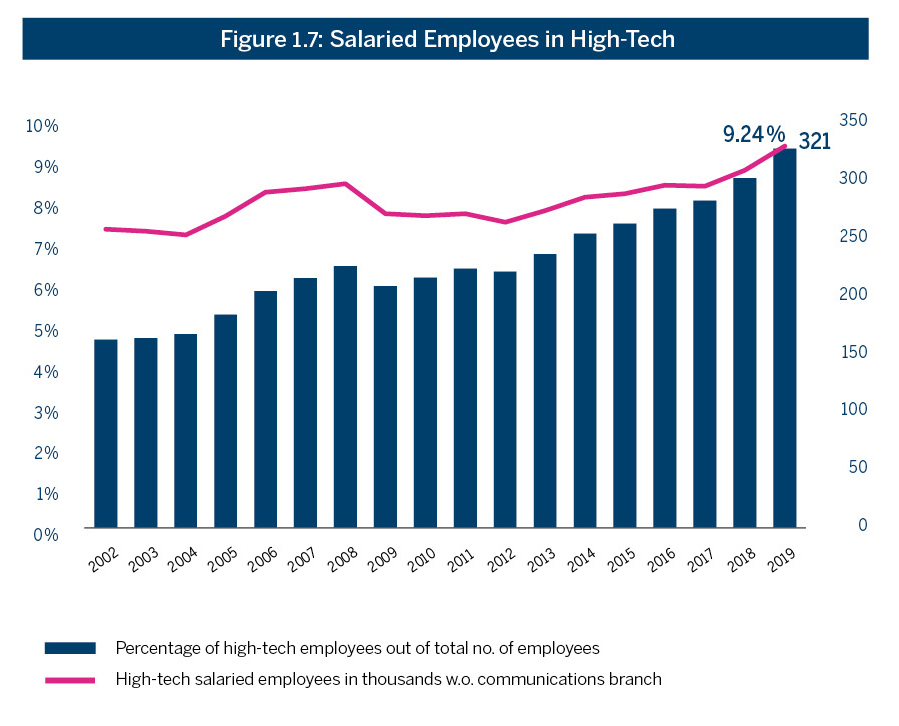

Figure 1.7 indicates that in 2019, the number of high-tech employees grew at a growth rate of 8.4%, to 321,000, up from 295,000 in 2018, and for the first time crossed the 300,000 threshold.7Data on 2019 was not yet published in full at the time of the publication of this report Also for the first time, the ratio of high-tech employees in the workforce exceeded 9%, and today stands at 9.2%.

Source: CBS data processed by the Israel Innovation Authority

The increase in high-tech employment reflects the growth of high-tech companies and the success of government action in expanding the pool of skilled high-tech professionals (which was extensively covered in the Authority’s previous report). Collaborations between all the stakeholders in the Israeli high-tech ecosystem are beginning to bear fruit, and the rate of employees joining the high-tech professions is growing.

A Shortage of Skilled Employees

Despite the increase in the number of skilled high-tech professionals, there is still a significant shortage of skilled employees required by high-tech companies in Israel.

According to a survey conducted by the Central Bureau of Statistics, Israeli high-tech is in need of an additional 12,500 thousand tech professionals.8CBS, Employed persons, job vacancies and supply – demand ratio, by selected occupations, 9.33 A survey conducted by the Startup Nation Central (SNC) and the Israel Innovation Authority estimates this number to be even higher, reaching approximately 18,500. The shortage of human capital is driving a rapid increase in high-tech salaries compared to the general average salary (annual growth rates of 4.3% and 3.1%, respectively),9CBS, statistical yearbook with Israel having the fifth highest wages for software developers in the world.

The Authority sees this shortage as one of the main barriers for the future growth of the high-tech sector. As will be explained later in the report, the Authority continues to operate in different ways to overcome this obstacle and increase the number of skilled professionals in the high-tech workforce.10Global Developers Salaries, Daxx.com

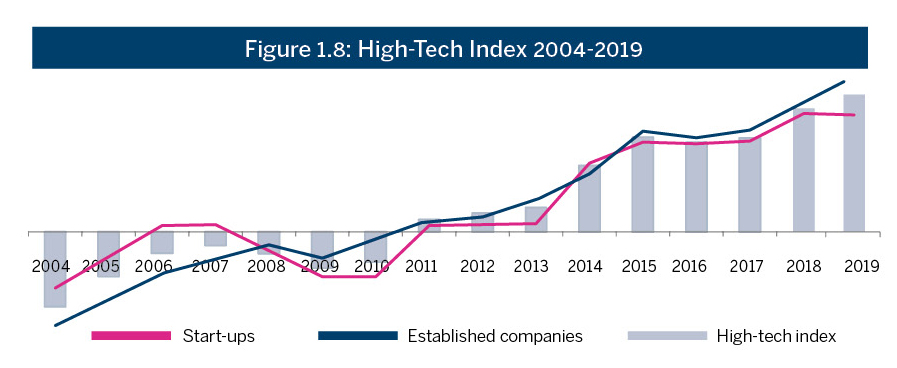

The High-Tech Index

The growth of the Israeli high-tech sector is also reflected in the Israel Innovation Authority’s High-Tech Index, presented in Figure 1.8. This index is based on a number of indicators defined by the Authority, which together show an overall picture of the Israeli high-tech industry.11As detailed in Appendix A of this report period The index is divided into two groups: start-ups and established companies.12The complete methodology of the high-tech index is described on the Israel Innovation Authority website

An analysis of the high-tech index suggests that the overall performance of Israeli high- tech is excellent, and that the index of established companies continued its upward trend during 2019. In the start-up group, the index remained steady following a decline in the scale of capital raised by the funds (for further details on the index indicators and measures, see Appendix A).

International Comparison

The Israeli innovation ecosystem maintained its leading position in 2019, and is highly ranked in different international indices.

As seen in Figure 1.9, Israel is ranked 6th in Bloomberg’s Innovation Index,13The Annual Bloomberg Innovation Index, 2019 out of 95 countries went up from 10th to 11th place in the Global Innovation Index14Global Innovation Index 2019, out of 129 countries, and maintained its 6th place position in the Global Start-Up Ecosystem Ranking.15Start-up Genome report 2019, out of 150 ecosystems

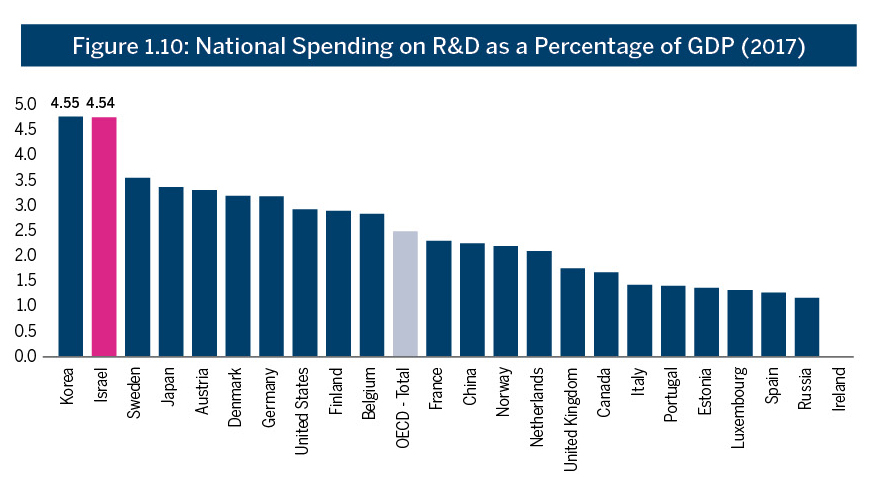

In the OECD R&D Intensity Index (R&D investment as a ratio of GDP), presented in Figure 1.10, Israel continues to hold a leading position, sharing first place with Korea, with its national spending on R&D being 4.5% of the GDP.

Changes to the Israeli High-Tech Mac

Israel has been dubbed the Start-Up Nation for a reason. Over the last decade, the fertile ground of Israeli entrepreneurship has yielded over 750 startup companies every year. Israeli entrepreneurs continuously manage to position themselves as global leaders in a variety of fields, repeatedly being able to identify the emergence of new trends and segments early on, maintaining its position at the forefront of global innovation.

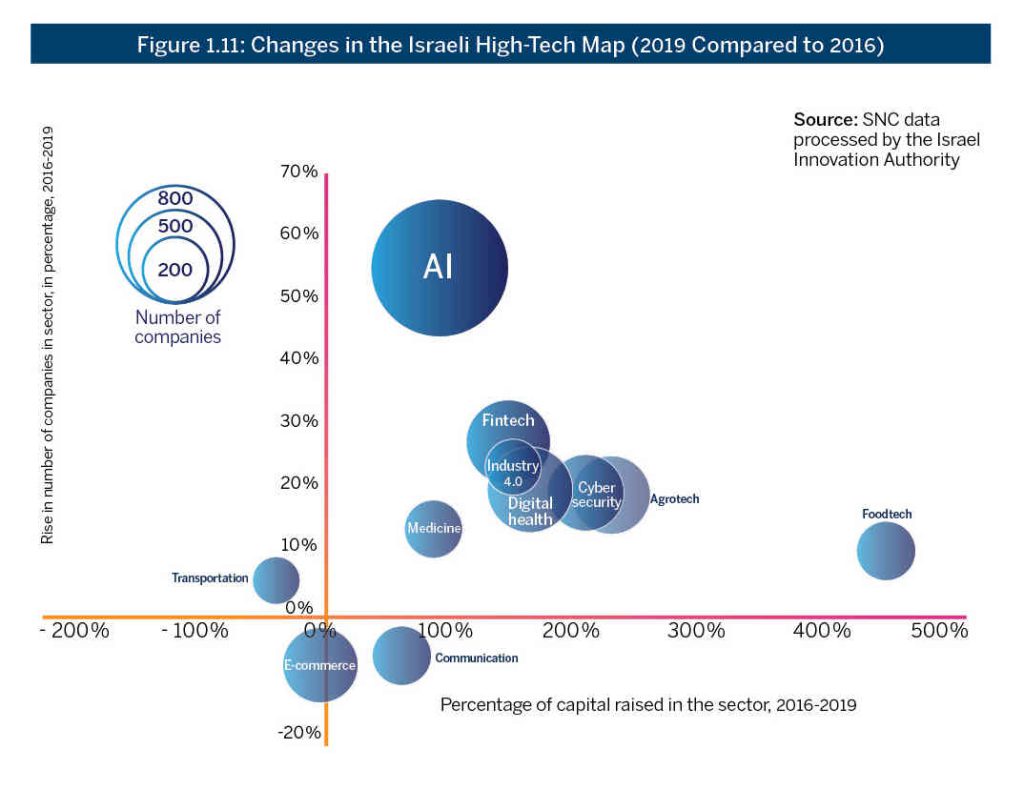

Figure 1.11 presents recent years’ changes to the Israeli high-tech map (2019 compared to 2016).

Figure 1.11 shows that AI has the most companies of any high-tech sector, and will be extensively covered in Chapter 5: ”Bolstering Artificial Intelligence – What Can Be Done for Israel to Maintain its Leading Position in the Field of AI?”. Israeli entrepreneurs’ ability to identify the potential in this field at an early stage and enter it quickly has made Israel a world leader in AI.

Beyond AI, there is a significant increase in the number of fintech, cyber and digital health companies, and in capital raised by foodtech companies. These sectors are at the cutting edge of global innovation, and have been promoted by the Israeli government through various government initiatives.16Government decision – Cyber,17Government decision – Digital Health as a Growth Engine,18Government decision – Sandbox FintechThe increase in the number of companies and capital raised in these segments highlight both the importance of government support, and the government’s ability to be a driving, motivating engine of new technological sectors in the Israeli innovation ecosystem.

Alongside the development of new technological sectors, the dynamic nature of the Israeli innovation ecosystem is also reflected in its ability to quickly reduce activity in fields that are more mature. Figure 1.11 indicates a significant decrease in the amount of capital raised and the number of active companies in communication technologies, as well as a decrease in the volume of capital raised for e-commerce. These declines may suggest that the aforementioned sectors have matured and face more vigorous competition in the global innovation arena and are less attractive for private capital investments.

In conclusion, this chapter reveals a complex picture of growth and prosperity alongside challenges and barriers. The Israeli innovation ecosystem faces some difficult, complex challenges, which can hinder it from realizing its full potential and might even hamper its future prosperity. The Israel Innovation Authority believes that government support is required in order to overcome these challenges, and is employing every measure available to address these challenges in the best possible way.