The Israel Innovation Authority’s vision is to establish Israel as a world leader in innovation and entrepreneurship that frequently grows innovation-driven companies, in order to provide extensive, highly productive employment for all population groups and all regions of the country

2019 was a productive, colorful, momentous year marked by the continued growth and development of programs and measures designed to advance the Innovation Authority’s vision, and to enact the strategic plan outlined by the Authority’s Council.

Key measures taken by the Innovation Authority in 2019 include:

- Developing an array of new tools and measures to advance the ecosystem of innovation in Israel’s periphery. These measures include launching a program to aid in the establishment of large companies’ R&D centers in the periphery, establishing three entrepreneurship incubators in Karmiel, Yeruham and Bnei Shimon, a foodtech incubator in Kiryat Shemona, two innovation labs in Haifa and Beer Sheva, an innovation center in Haifa, and a collaboration with the Ministry of Economy to advance the establishment of a foodtech center in Kiryat Shemona and a center for advanced manufacturing in Karmiel.

- Developing an array of new tools and measures to increase the volume and diversity of skilled human capital. These measures include promoting the Coding Bootcamp program, launching a program to encourage women’s entrepreneurship, and establishing two new training programs:

- High-tech specialization program – helping companies hire and train inexperienced graduates (juniors) in high-tech professions.

- The Workshop program – an association for advanced technology studies to help high-tech companies train workers in advanced development professions, particularly in AI.

- Developing an array of new tools and measures to advance growth companies. These include a significant expansion of the pilot program, which helps growth companies perform semi-commercial demonstrations in beta sites. A series of actions was taken to expand the capital market and the availability of debt financing for growth companies: a program to encourage institutional investments, to advance collaborations with the European Bank, and to help growth companies apply for EU funding. Efforts were also made to remove regulatory obstacles and to create regulation that is supportive for innovations, such as the establishment of a dedicated center – an Israeli branch of the World Economic Forum’s Center for the 4th Industrial Revolution (C4IR) for the regulation of innovative technologies.

- Advancing Israeli leadership in future technologies. As a member of the TELEM Forum (the forum for national R&D infrastructures),1The TELEM Forum also includes the Ministry of Science, the Ministry of Finance, the Planning and Budgeting Committee of the Higher Education System, and the Administration for the Development of Weapons and Technological Infrastructure in the Ministry of Defense the Innovation Authority participates in the national program for the promotion of quantum science and technological applications. The Authority advances a national program for AI as well as a national program for bio-convergence (for further details see Chapter 6).

- Advancing efforts to improve customer service, such as simplifying and eliminating procedures and bureaucracy, upgrading the website and computer systems, establishing a service center, and cutting response time (providing a response within 11 weeks of submission).

- Relocating the Innovation Authority to Jerusalem: in 2019, in adherence with R&D Law, the Authority moved from central Israel to Jerusalem. This complicated relocation had no impact on its ongoing operations.Israel Innovation Authority’s workplan for 2020 includes several measures aimed at advancing Israel’s innovation ecosystem in adherence with the Council’s five-year strategic plan. However, political unrest in Israel hinders the Authority’s ability to quickly formalize and implement a stable, long-term government policy.Israel’s provisional government in 2019 decelerated governmental budgetary mechanisms and forced the Authority to defer its payments to companies. This provisional government also limits the ability to advance the new policy and legislation processes required for the long-term elevation of Israel’s innovation ecosystem. The 2020 budget will primarily be a continuous budget,2By this method, the budget allocated to each issue is identical to last year’s budget with mild changes which could further decelerate governmental mechanisms and could jeopardize the Authority’s budgets and its capacity to advance its programs.The Innovation Authority believes that substantially slashing its budget and hindering its ability to advance its programs could deal a heavy blow to Israel’s high-tech industry. The first to be hit will be start-ups, but the damage is expected to eventually affect the entire high-tech industry.

Israel Innovation Authority – 2018-2022 Strategic Plan

In 2018, the Authority’s Council devised a strategic plan for 2018-2022. The plan is comprised of four strategic goals and highlights ten strategic objectives.

The Israel Innovation Authority employs various programs and measures to realize these ten strategic goals. Further details on the Authority’s operations can be found in Chapter 7: The Israel Innovation Authority in Action.

In preparing the workplan for 2020, the Authority defined four strategic goals as its main focus this year (assuming it will be feasible with the continuous budget of 2020). Macro measures and quantitative goals were defined for each of these goals, and a quantitative objective to facilitate progress to reach the goal by the end of the five-year period (2022).

The Israel Innovation Authority’s Structure and 2019 Budget

The Structure of the Israel Innovation Authority

According to the R&D Law,3The Law for the Encouragement of Research, Development and Technological Innovation in Industry Law of 1984 the Innovation Authority is led by a council headed by the Chief Scientist at the Ministry of Economy and Industry. The council appoints the CEO who is supervised by the Council.

The Authority is divided into different divisions that specialize in professional challenges, target audiences, and tools to achieve their goals. Figure 2.4 describes the structure of the Innovation Authority.

The Israel Innovation Authority’s Budget

The Israel Innovation Authority’s budget is divided into three sections:

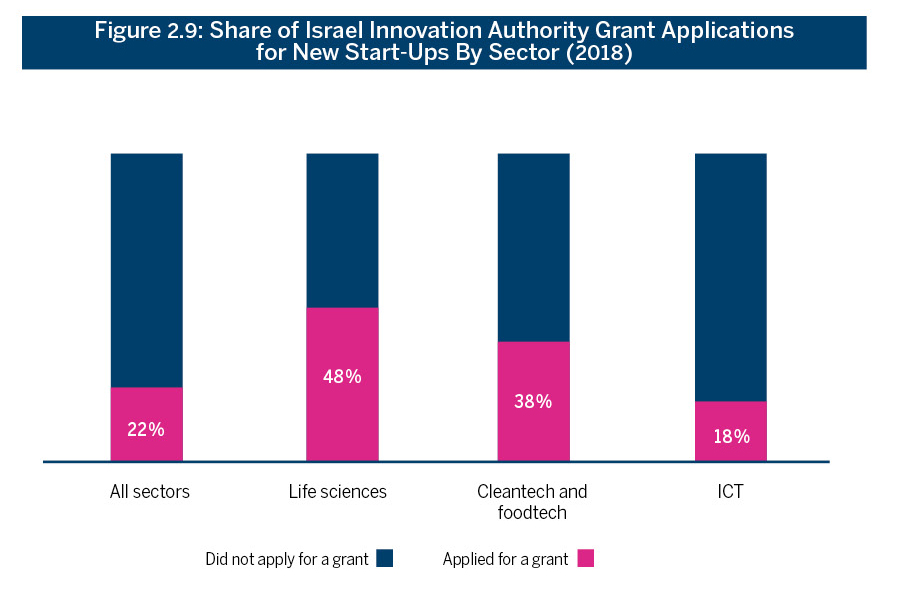

- In 2019, the Innovation Authority’s budget for grants (allowance budget) was 1.73 billion shekels. Out of this amount, 175 million shekels were provided by other government entities for shared projects.

- The European R&D Horizon 2020 program – in 2019, the Innovation Authority’s share of participation in the program amounted to about 334 million shekels.

- The operational budget of the Innovation Authority in 2019 amounted to about 172 million shekels.

Figure 2.5: Specifications of the Israel Innovation Authority grants’ budget in 2019:

Revenue from royalties and knowledge transfer

The Israel Innovation Authority charges royalties for sponsored projects that were able to generate sales (3%-5% of sales until the grant is covered).4Plus LIBOR interest The Authority also charges for knowledge transfer, when knowledge acquired from a particular project is sold to another company (1 to 6 times the grant amount calculated according to a fixed formula).

According to the R&D Law, revenue from royalties and knowledge transfer are paid to the State Treasury and are used as a funding source for Innovation Authority’s grants.

Roughly 459 million shekels were charged in 2019, including 299 million shekels in royalties and 160 million shekels from knowledge transfers.

The Israel Innovation Authority’s grants focus on addressing “market failures” in the Israeli innovation ecosystem

The overall 2019 grant budget amounted to 1.7 billion shekels. This budget comes to around 5.5% of the total capital raised by the Israeli high-tech industry (in 2019 it amounted to 9 billion dollars–30.8 billion shekels),5IVC data. For further details, see Chapter 1 of this report and 2.5% of the total expenditures on civilian R&D in Israel (which amounted to roughly 65 billion shekels in 2018).6CBS data, August 2019, national spending on civilian R&D, 2018

In accordance with the R&D Law7The Law for the Encouragement of Research, Development and Technological Innovation in Industry, 1984 and the Innovation Authority’s vision, the Authority grants are designed to encourage technological and industrial R&D and innovation. However, some question the validity of governmental R&D support in a sector where numerous venture capitals operate and there is ample private funding. Others question the impact of a budget that is 2.5% of the total R&D civil expenditure on the ecosystem of Israeli innovation.

The justification for governmental investments in R&D is in cases of market failures – i.e.: where capital investment is expected to yield significant gains, but the private market does not invest the required capital or that its investments are very minimal. This occurs when the private sector disregards market gains (that do not translate to revenues), and when the private sector tends to stick with familiar sectors that are relatively low risk and offer short-term gains.

New data suggest that unlike the private capital market, Israel Innovation Authority’s grants focus on sectors that experience market failures – innovative, less familiar sectors that are high-risk and that offer long-term gains. In these sectors, the Innovation Authority’s grants make up a significant share of the total investment and can significantly impact developments.

Figure 2.6 presents the distribution of Israel Innovation Authority’s grants by technological sectors in comparison to the distribution of private capital raising in the same sectors.

Figure 2.7 suggests that while software leads in private capital raising with 32% of the total amount of funds raised, Israel Innovation Authority’s grants focus on healthcare and medicine. Grants for healthcare and medicine, which are high-risk and offer long-term gains, comprise 32% of the total Innovation Authority grants. Figure 2.7 also suggests that Innovation Authority grants tend to focus on less familiar sectors such as agriculture and food, energy, and environment. These segments are less popular in the private sector, despite their potential to significantly contribute to the market and for becoming the next technology trend.

Source: IVC and Israel Innovation Authority data processed by the Israel Innovation Authority for total investments in the Israeli market

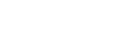

Figure 2.88Distribution of market investments is based on IVC data processed by the Israel Innovation Authority completes the picture. It shows that by focusing Israel Innovation Authority grants on industries experiencing market failures and a shortage of human capital, the Authority becomes a key player, thus having a substantial impact on the total capital raised for R&D in this field.

Figure 2.8 shows that while the total amount of the Innovation Authority grants in 2018 was only 5.5% of the total capital raised, the Authority’s preference for providing grants to high-risk, less popular segments significantly increased its share of grants in these specific sector – 12% in healthcare and medicine, 15% in communication, 40% in energy, water and environment, and over 200% of private capital raised for agriculture and food (in many fields, the Israel Innovation Authority invests in collaboration with relevant ministries.

Source: IVC and Israel Innovation Authority data processed by the Israel Innovation authority for total investments in the Israeli market

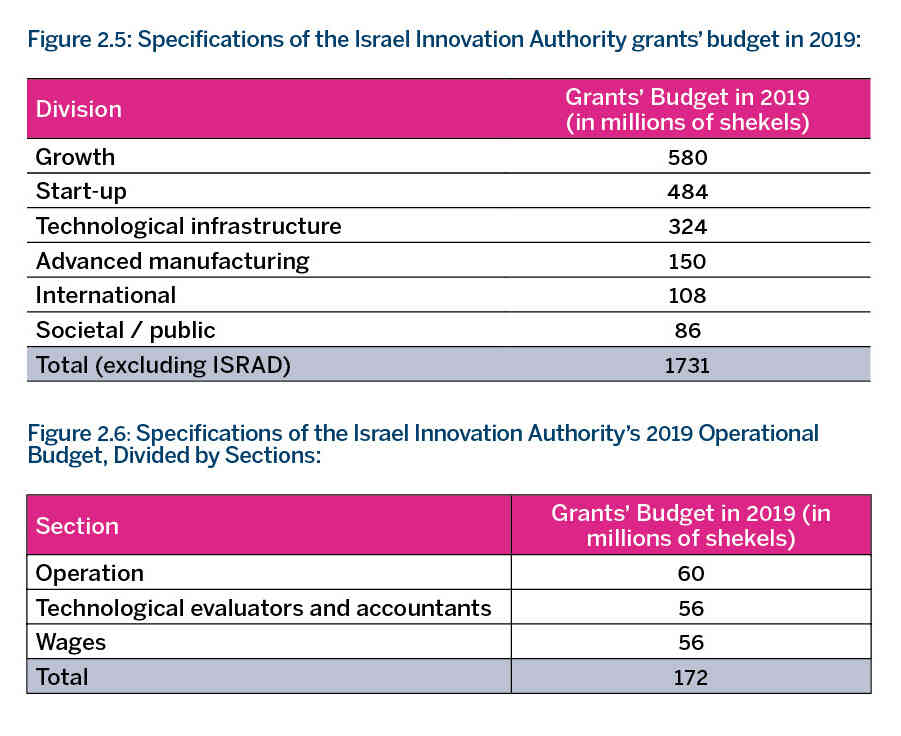

Another approach to understanding the importance of the Authority’s grants’ focus on market failures is to analyze the scope of the support the Authority offers for the establishment of new start-ups. As will be further detailed in Chapter 4, in recent years, private capital investments in early stage start-ups (seed stage) have been in decline. The Authority believes that this decline reflects insufficient private investments in seed-stage companies, investments that are crucial for Israel’s high-tech industry. This indicates yet another market failure, which calls for governmental support.

Figure 2.9 examines the number of start-ups that were established in 2014-15 and that applied for Innovation Authority grants (by 2018). The diagram indicates that a relatively high share (22%) of new start-ups that requested support and applied for grants. It also shows that in industries with an inherent market failure, such as life sciences, cleantech and foodtech, this share is even higher, reaching 48% and 38%, respectively.

The data show that the Innovation Authority plays a key role in funding new start-ups, particularly in segments that have inherent high risk with long-term gains like medicine and life sciences. The Authority is an important, meaningful player. Support by the Authority has a significant impact on the establishment of new start-ups, which ultimately offer long- term contribution to Israel’s market and economy.