Recent years have shown an increase in the number of Israeli high-tech companies that are in sales and growth stages. The Israel Innovation Authority recognizes that these companies struggle to raise debt financing in Israel. This obstacle could damage their competitive advantage and encourage them to divert their operations overseas

High-tech companies undergo significant changes throughout their life-cycle, especially between preliminary start-up stages and more mature start-up stages, such as scaling. In preliminary stages, most of the company’s resources are allocated to R&D and the product has generally not yet reached the market. In later stages, such as scale-up, companies have successfully developed an in-demand product and have fast-growing sales, and accordingly allocate much of their resources to marketing, sales, support, and sometimes manufacturing.

There has been a recent trend of maturation in Israeli high-tech. This is evident in the significant uptick in the number of companies in more mature stages, which have grown both in sales and in the number of workers they employ. This growth has led to a relatively higher proportion of mature companies in the high-tech industry, which is reflected in various indices that analyze the state of Israeli high-tech.

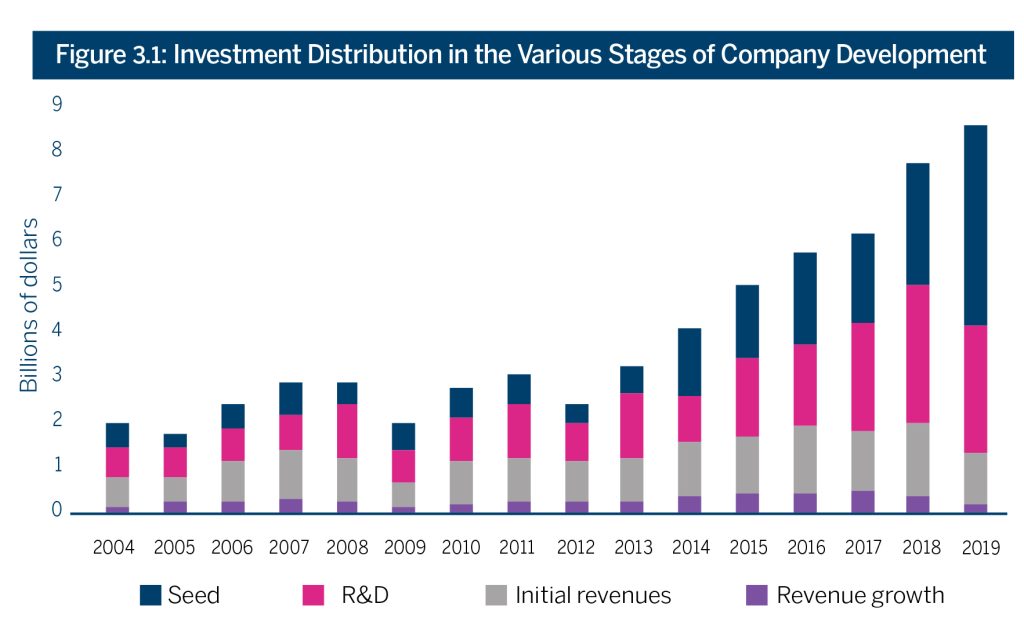

Figure 3.1 illustrates the size of investments in Israeli companies by stages in their life- cycle.1The stages of high-tech companies as defined by the IVC: Seed stages – a start-up company in its infancy, in the stage of product development and capital raising R&D stages – a start-up company discovering new knowledge about products, processes and services, and implementing this new knowledge to meet market demands Initial revenue stages – a company whose revenue does not exceed 10 million dollars a year Growth stages – a company whose revenue exceeds 10 million dollars a year Particularly noticeable is the continuous growth in total investment in start-up companies that have matured to initial revenue and growth stages. The past decade has seen a dramatic surge in investments in companies offering a mature product, with sales climbing from 1.6 billion dollars in 2010 to 7.2 billion dollars in 2019.2For additional information on developments in start-up companies at seed stages, see chapter four of this report

Source: IVC data processed by the Israel Innovation Authority

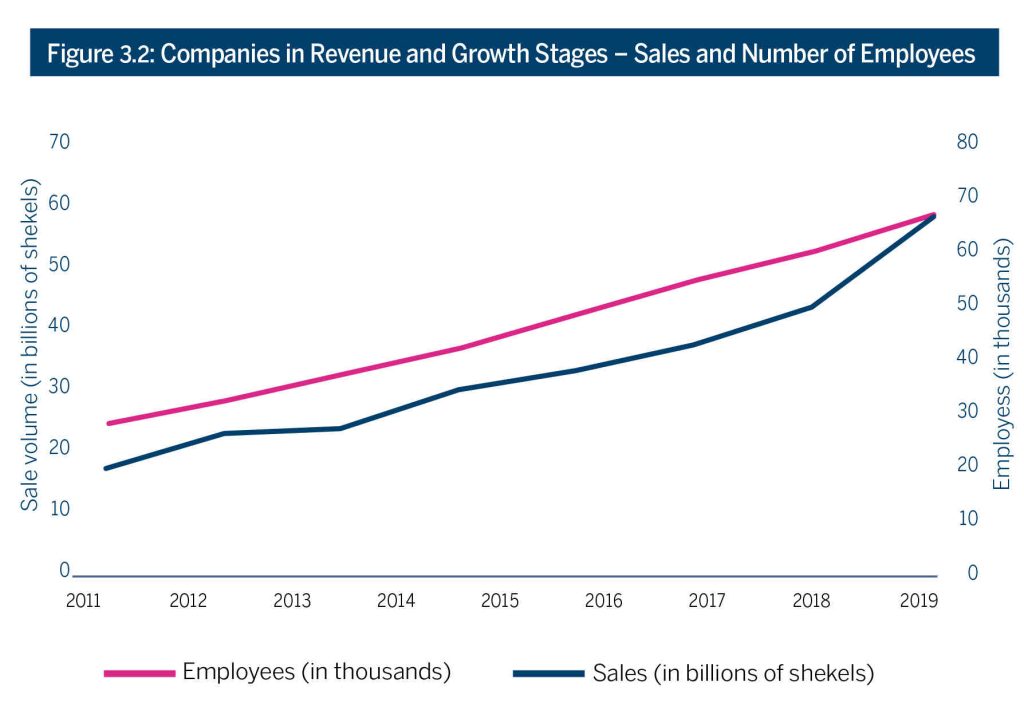

Figure 3.2 provides further evidence for the growth of mature companies, and shows the change in sales and in the number of people in Israel employed by companies in revenue and growth stages. The diagram demonstrates that from 2011 to 2019, the number of workers employed by these companies increased from 23,000 to 70,000, and sales rose from 12 billion shekels to 61 billion shekels.

Source: Central Bureau of Statistics data processed by the Israel Innovation Authority

The number of companies that successfully reached the revenue and growth stage has risen accordingly. In 2011, there were 2,400 companies in Israel in these stages. By 2019, the number had increased twofold to around 4,500 operational companies.

There are also over 30 Israeli unicorns – private companies valued at over one billion dollars – in the revenue and growth stage. Twelve of them became unicorns in the past year.3Based on data from TechCrunch.com and NoCamels.com

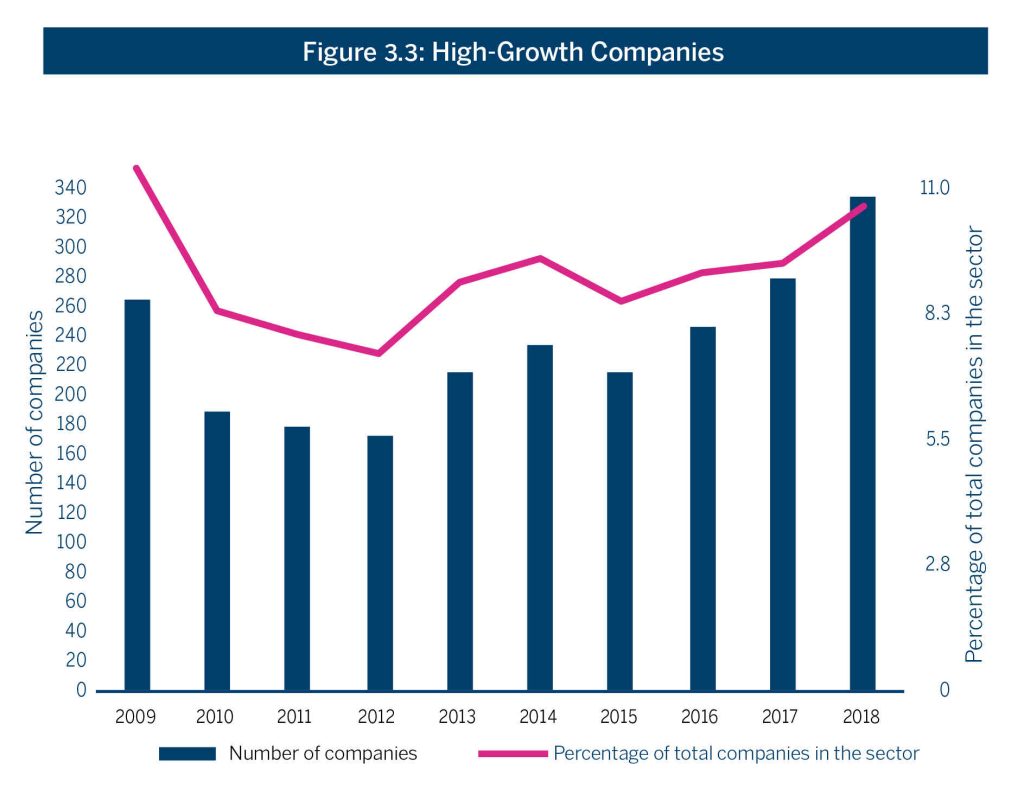

Another interesting group of companies in revenue and growth stages is high-growth companies – companies whose number of employees has increased for three consecutive years and whose annual growth rate exceeds 20%.4High-growth companies, as defined by the OECD and EuroStat. High-growth businesses have at least ten employees in the start-year and an average annual employment growth exceeding 20% for 3 consecutive years. High-growth companies had an average of 83 employees in 2018,5Data from Central Bureau of Statistics, Business Demography 2016-2018, processed by the Israel Innovation Authority Figure 3.3 shows that the number of high-growth companies has almost doubled in size over the past decade. In 2010, 172 of these companies operated in Israel; in the past decade, this number increased by roughly 78%, reaching 322 companies in 2018.

Source: Central Bureau of Statistics data

The increased focus on mature companies is not exclusive to the Israeli high-tech industry. Investments in start-up companies at more mature stages have grown worldwide, alongside a decrease in investments in companies at earlier stages. Another expression of higher investments in start-up companies at more mature stages is evident in the increase in funding raised via external financing rounds by high-tech companies in Israel and worldwide.6KPMG, Venture Pulse, Q3 2019

As outlined in the first chapter of this report, the increasing number of companies in revenue and growth stages is part of the welcome trend of the maturation of Israeli high- tech. The significant number of later stage companies in Israeli high-tech calls for closer study of the obstacles potentially impeding their growth in Israel. The remainder of this chapter explores one of the primary obstacles – Israeli companies’ difficulty in raising debt.

Appropriate Financing for High-Tech Companies in Growth Stages

High-tech companies in growth stages require substantial capital to finance their engines of growth, such as marketing existing products, business development, increasing sales, geographic expansion, technical support, manufacturing, and the acquisition of synergetic companies that facilitate their expansion to additional geographic markets and sectors.

When these companies begin to raise capital, they need to decide which financial instrument to employ. Financial instruments used by companies are generally equity based, debt based, or a combination of the two. Equity financing includes stock, options, and convertible loans (loans that can be converted to stock). Debt financing generally comes in the form of loans, bonds and more. There are also hybrid financial instruments that combine equity and debt (quasi-equity), such as mezzanine credit (from the Italian word mezzano, meaning ‘go-between’).7Ìnvestopedia.com’s definition for mezzanine debt.

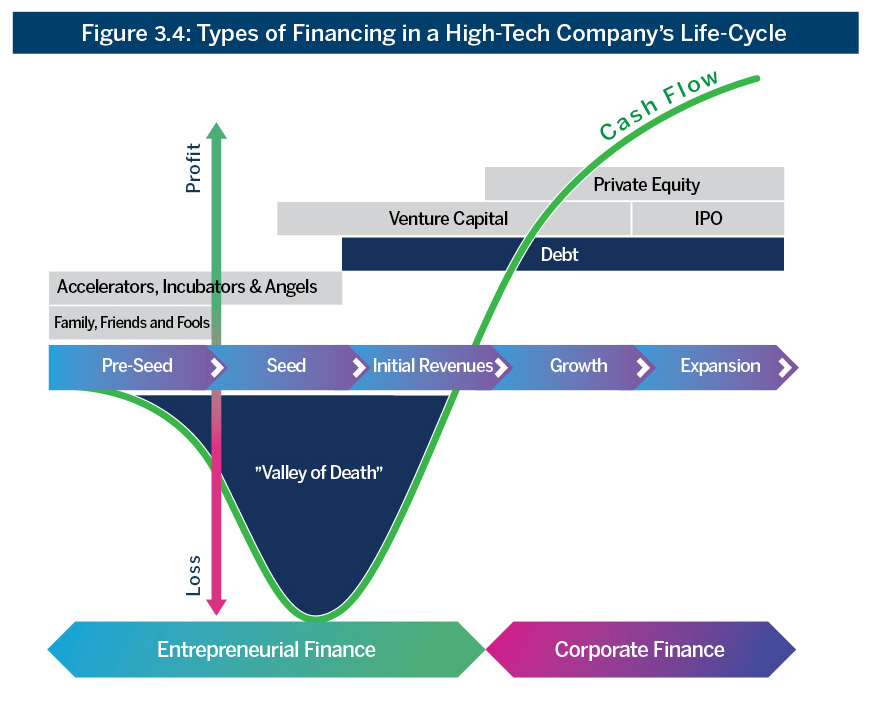

Figure 3.4 displays the appropriate type of financing in the various life-stages of a high-tech company. The change in financial instruments throughout the life of the company reflects the diminishing level of investment risk in accordance with the maturity of the company and the cost of capital, respectively.

Source: StartExplore and TechCrunch diagrams processed by the 8Israel Innovation AuthorityIsrael Innovation Authority, based on startupxplore.com and crunchbase.com

Debt financing has two main advantages over equity:

- The price of debt in high-growth stages is usually lower than the price of equity.

- Debt does not dilute the current ownership share. Equity financing changes the company’s ownership structure and diminishes the relative holdings of existing owners, especially those of the company’s founders.

It is important to note that changes to a company’s ownership structure could grant foreign investors significant influence over the company’s development. Foreign investors may appreciate Israel only for its R&D capabilities, and can look to divert the company’s business operations overseas.

Yet despite the benefits of debt financing, Israeli companies in growth stages face a variety of obstacles in raising debt in comparison to corresponding companies in the US. This leads them to rely primarily on equity financing, which could damage their competitive advantage and encourage them to move significant operations overseas.

Capital Structures Differ Between Israeli and Foreign High-Tech Companies in Growth Stages

Currently, there is no single source of comprehensive information in Israel on the capital structure of high-tech companies in growth stages. In order to tackle this challenge, the Israel Innovation Authority performed a comparative analysis of public Israeli high-tech companies in growth stages and US companies comparable both in size and in the sector in which they operate.9Based on a sample of 26 Israeli companies and 26 US companies

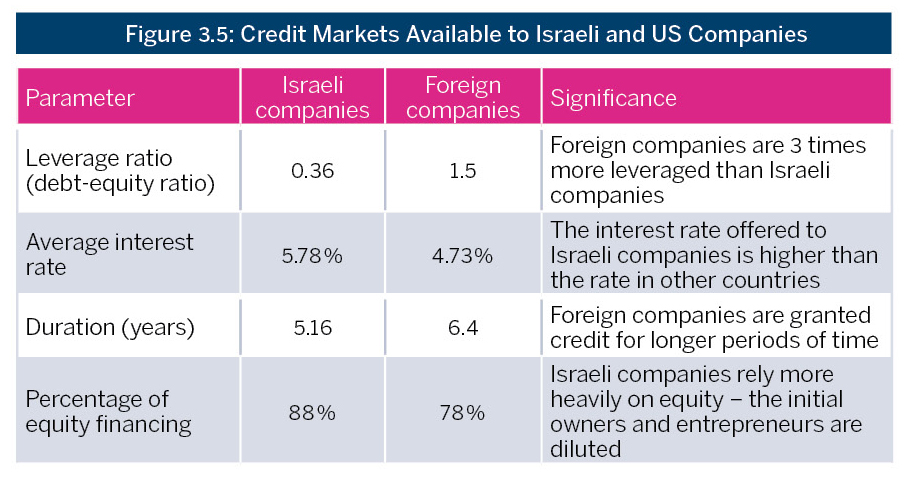

The results of the comparison are demonstrated in Figure 3.5, which depicts the difference in credit markets available to Israeli and US firms.

Figure 3.5 shows that credit terms made available to Israeli high-tech companies are inferior to those available to US companies, and that Israeli companies use less debt to finance their operations. The Israel Innovation Authority believes that it is more difficult for Israeli companies to raise debt capital, which hurts their competitive advantage and their ability to grow in Israel.

It is important to note that the data in Figure 3.5 reflects a sample of public companies. While information on conditions in private companies is not available, expert estimations and several roundtable sessions that the Israel Innovation Authority held with growth companies and high-tech capital industry leaders indicate that for private companies, the discrepancies between loan size, interest rates on debt, and the duration are even greater.

Barriers to Debt Financing in Israel: A Small Local Market and Taxation of Foreign Loans

Market research and roundtable sessions conducted by the Israel Innovation Authority revealed two primary difficulties in obtaining debt financing for Israeli growth-stage high-tech companies:

- There is a narrow supply of available local debt and a lack of financial expertise. Growth-stage high-tech companies can require loans with unique structures, valued at hundreds of millions of shekels, which are tailored to meet the specific needs of their operations. Local credit providers have more difficultly offering loans on this scale, and they have less relevant experience in providing appropriately designed loans and in assessing the intrinsic risk of loans for growth-stage high-tech companies (companies that are inherently new and operate in innovative fields).

- Foreign credit is significantly taxed. The Income Tax Ordinance and tax treaties state that an Israeli company borrowing foreign debt is subject to taxation deducted at source, unlike interest on a loan granted by an Israeli entity. Deduction at the source is an additional tax payment submitted on the date of the interest payment, which in turn raises interest on the debt owed by the company. The Israel Innovation Authority estimates that this tax increases interest on the debt by an average of 1-3%.

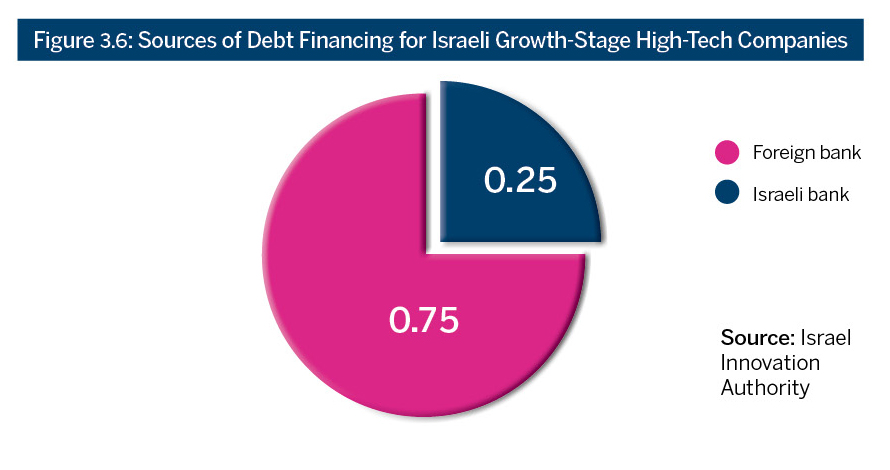

The difficulty in raising debt in Israel is also seen in data provided by the sample of Israeli companies. Data from the sample presented in Figure 3.6 indicates that 75% of the debt raised by Israeli companies was obtained from foreign sources, while only 25% of it was obtained from the Israeli banking system.

The Significance of Raising Debt Outside of Israel: Company Expansion Overseas and Ultimate Departure from Israel

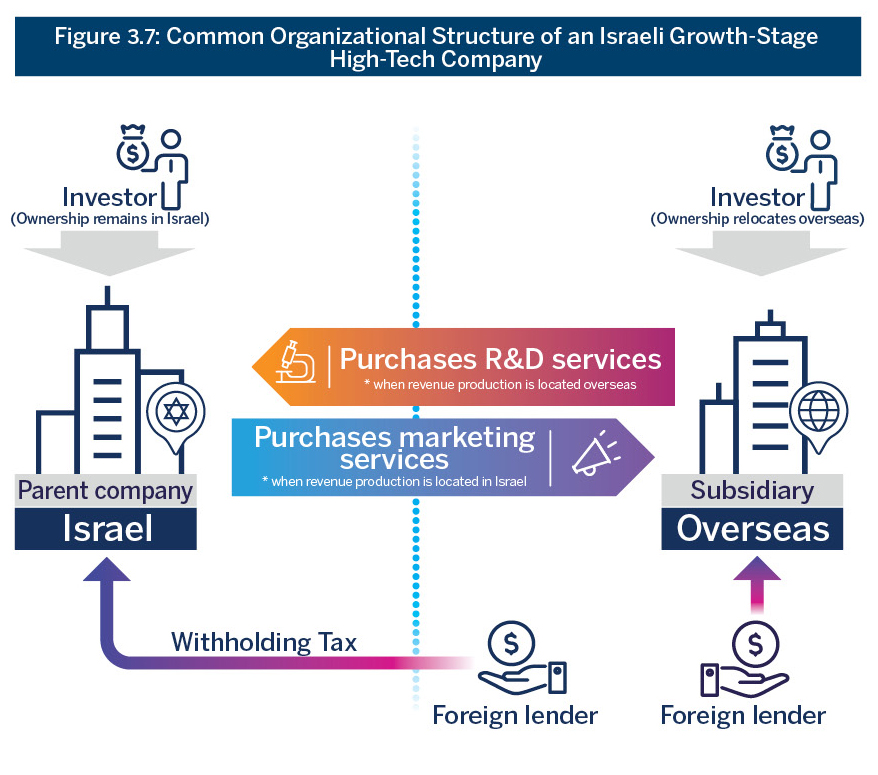

As shown, there are significant difficulties in obtaining debt financing for Israeli companies. Another option for raising debt is through a foreign subsidiary. Most Israeli growth-stage high-tech companies already have subsidiaries abroad as part of their business network (marketing, sales and technical support), making financing through a subsidiary accessible.

Figure 3.7 depicts the standard structure of a high-tech company in growth stages, including an overseas subsidiary. The right side of the diagram shows the tax obstacle it faces when obtaining a loan from a foreign lender; the left side shows the company’s opportunity for debt financing with no tax deduction through the subsidiary located overseas.

A scenario where most of the company’s available capital is in the account of the subsidiary located overseas could result in the transfer of increasing segments of the Israeli company’s operations to the foreign subsidiary, due to convenience or through pressure from the creditor. Foreign credit suppliers, who work opposite the overseas subsidiary, may grant credit on the condition that management and business operations are moved to the funding location. This process could gradually deplete the Israeli company’s operations in Israel, transforming the Israeli firm into a de-facto R&D site of a foreign company, with the majority of its non R&D operations (marketing, sales, production, technical support, etc.) located outside of Israel.

Source: Israel Innovation Authority

Costs to the Israeli Market

The current situation, in which Israeli high-tech companies struggle to raise debt in Israel, damages the Israeli innovation ecosystem struggle to raise debt companies face difficulties in employing the financial instruments that are best suited for their growth. In turn, this could impede their development and their global competitive advantage.

Second, the inability to raise finances locally forces companies to transfer operations overseas, which reduces the companies’ contribution to the Israeli economy, both in terms of tax revenue and in their potential of becoming “complete companies” in Israel. Complete companies employ a wide range of high-productivity personnel beyond R&D, including marketing, business development, technical support, and management.

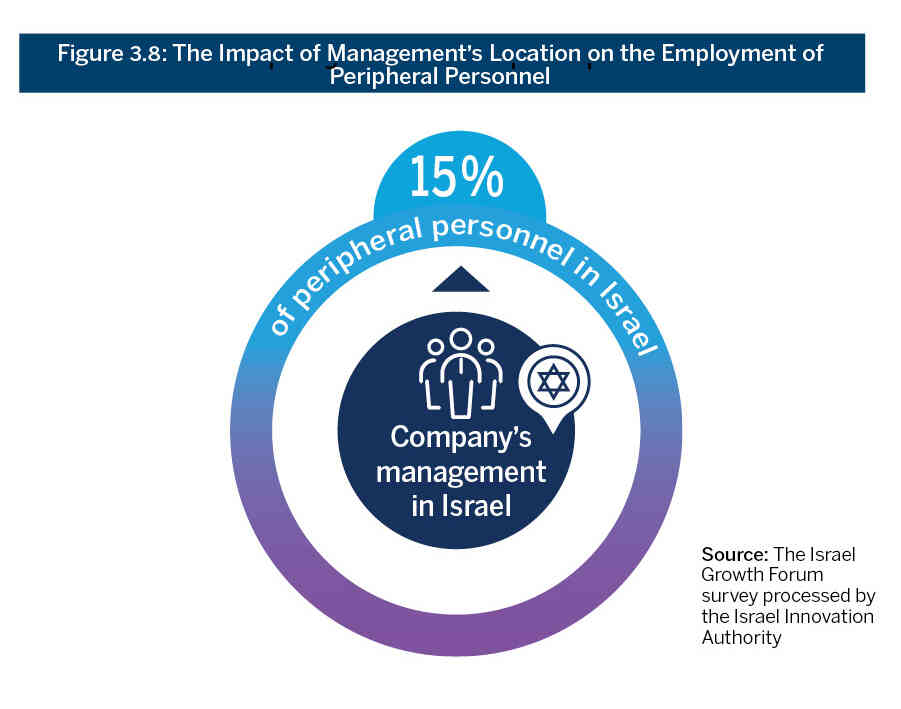

Figure 3.8 shows the result of a survey conducted by the Israel Growth Forum in 2019, which found that the location of companies’ management has a significant impact on their contribution to the Israeli economy.1 According to the survey, an average of 85% of these companies’ R&D staff are employed in Israel, while less than 30% of peripheral staff (working in administration, marketing, manufacturing and sales) work in Israel. Conversely, the survey determined that if management is situated in Israel, the average number of peripheral employees jumps to roughly 45%.