Less Than One Tenth: Women Technology Entrepreneurs in Israel

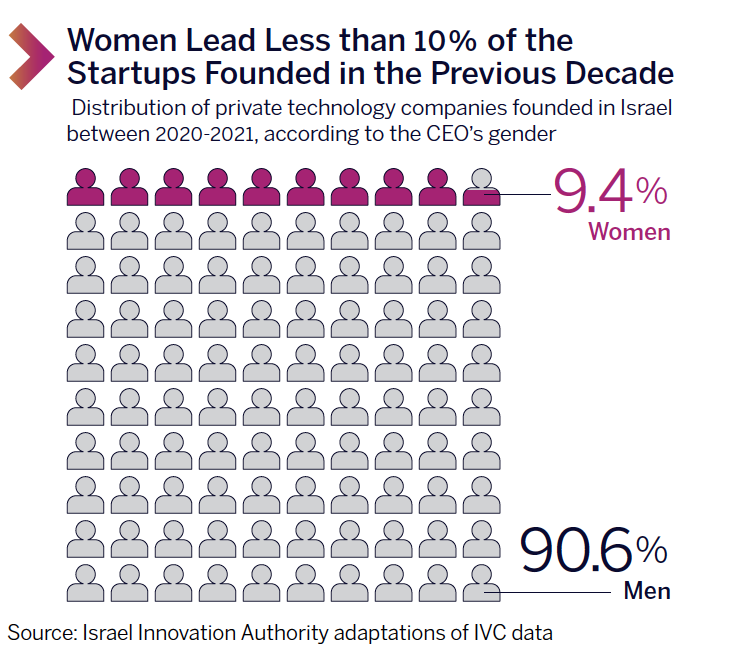

To clarify the gender situation of technology entrepreneurship in Israel, we analyzed data relating to 8,668 startups founded between 2010-2021 in which the CEO’s gender was known. An Israel Innovation Authority adaptation of the data retrieved from the IVC database reveals that the ratio of women founding and managing startups stood at 9.4%, representing 819 female CEOs who founded startups.1 When examining startups founded during this period that are still active, (i.e., have not been closed) where the CEO’s gender is known, the ratio of female CEOs increases to 10% – 626 women CEOs out of 6,269 startups founded during the period under discussion.

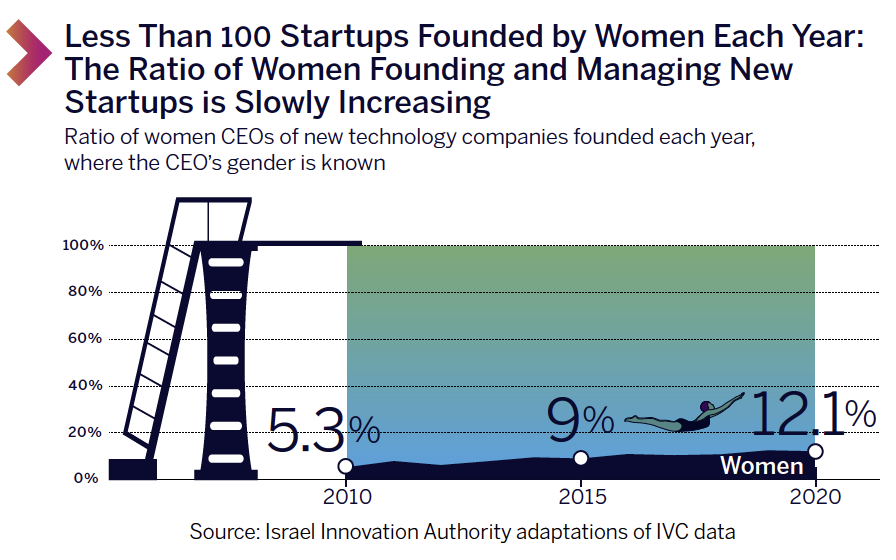

An examination of this trend over the course of a decade reveals a slightly more encouraging picture: the ratio of women who founded and managed new startups increased each year. In 2010, women comprised only 5.3% of all the CEOs of new startups founded that year – a total of only 27. In 2015, this figure had already risen to 9% of the new companies founded that year with 87 women CEOs leading new startups. Analysis of the data available for 2020 reveals that women serve as the CEO of 12.1% of the startups founded that year (of the companies where the CEO’s gender is known).2

Despite the growth in the ratio of women entrepreneurs serving as CEOs of new startups, the number remains extremely low – less than 100 women CEOs of new companies per year. For example, an examination of the 2019 data reveals that 696 men served as CEOs of new startups founded that year compared to only 99 women CEOs. The partial figures for 2020 indicate 67 women CEOs of new startups founded that year compared to 485 male CEOs.

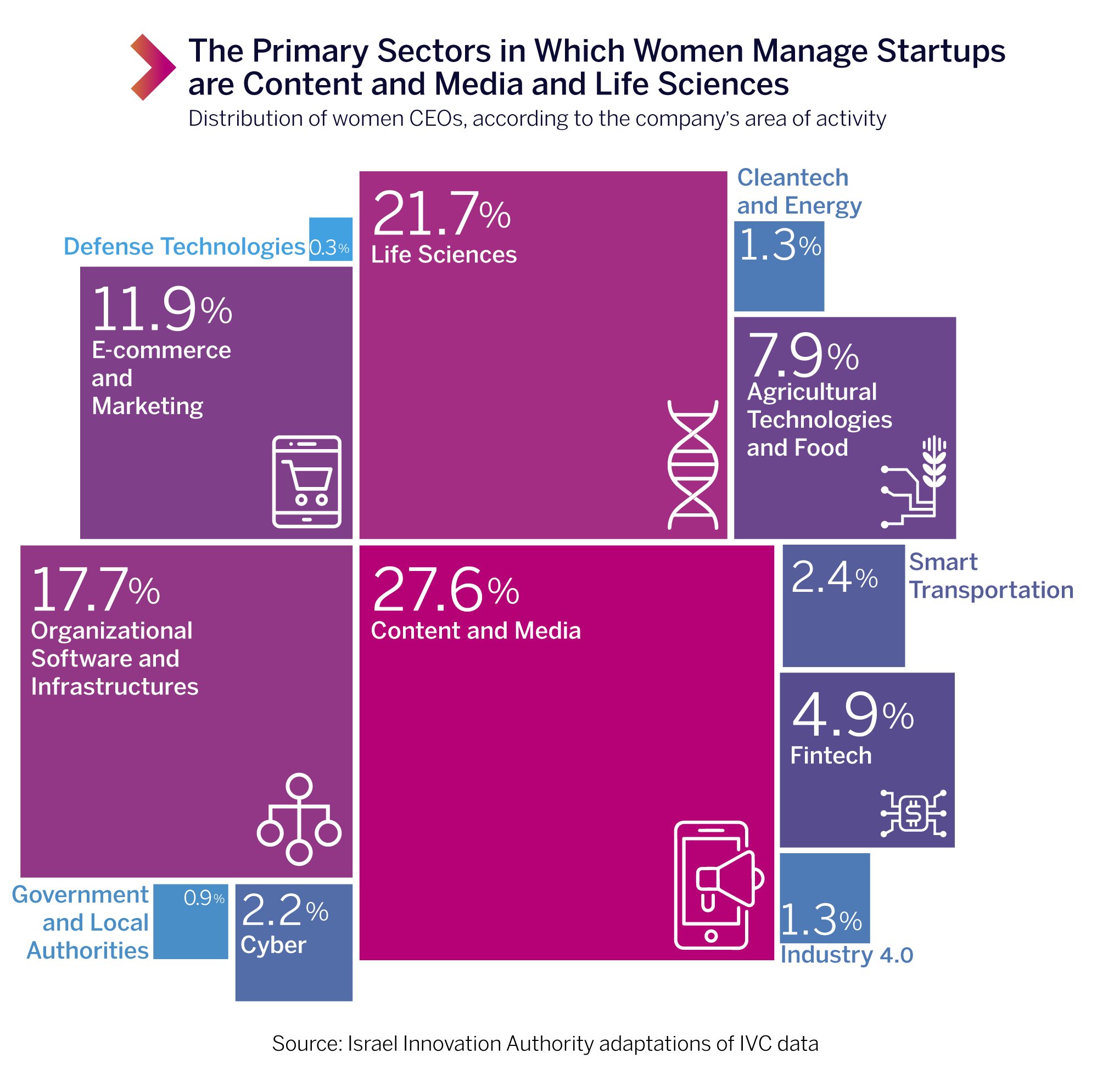

In which sectors do women found and manage startups?

The main sector in which Israeli women founded startups during the previous decade was the content and media sector. Of more than 800 startups founded and managed by women in the years 2010-2021, 186 (comprising 27.6% of all the female founders) where in the content and media sector.3 The next most prominent field in which women founded startups is life sciences sector which attracted 146 women (21.7% of the women CEOs who founded and managed startups during this period). The next most popular sector is organizational software and infrastructures (119 women – representing 17.7% of the CEOs). Two thirds of all women who founded and managed startups, manage companies in one of these three sectors (compared to 45% of the male CEOs who manage startups in one of these sectors). Female-led entrepreneurship is therefore focused in a narrow range of sectors compared to startups founded and managed by men, which is characterized by a more extensive sectorial distribution.

The ratio and number of women choosing to found startups in popular sectors in Israeli high-tech such as cyber and fintech is relatively negligible compared to men. For example, between 2010-2021 women founded and managed less than 50 technology companies in the cyber and fintech sectors, compared to more than 800 companies founded and managed by men.

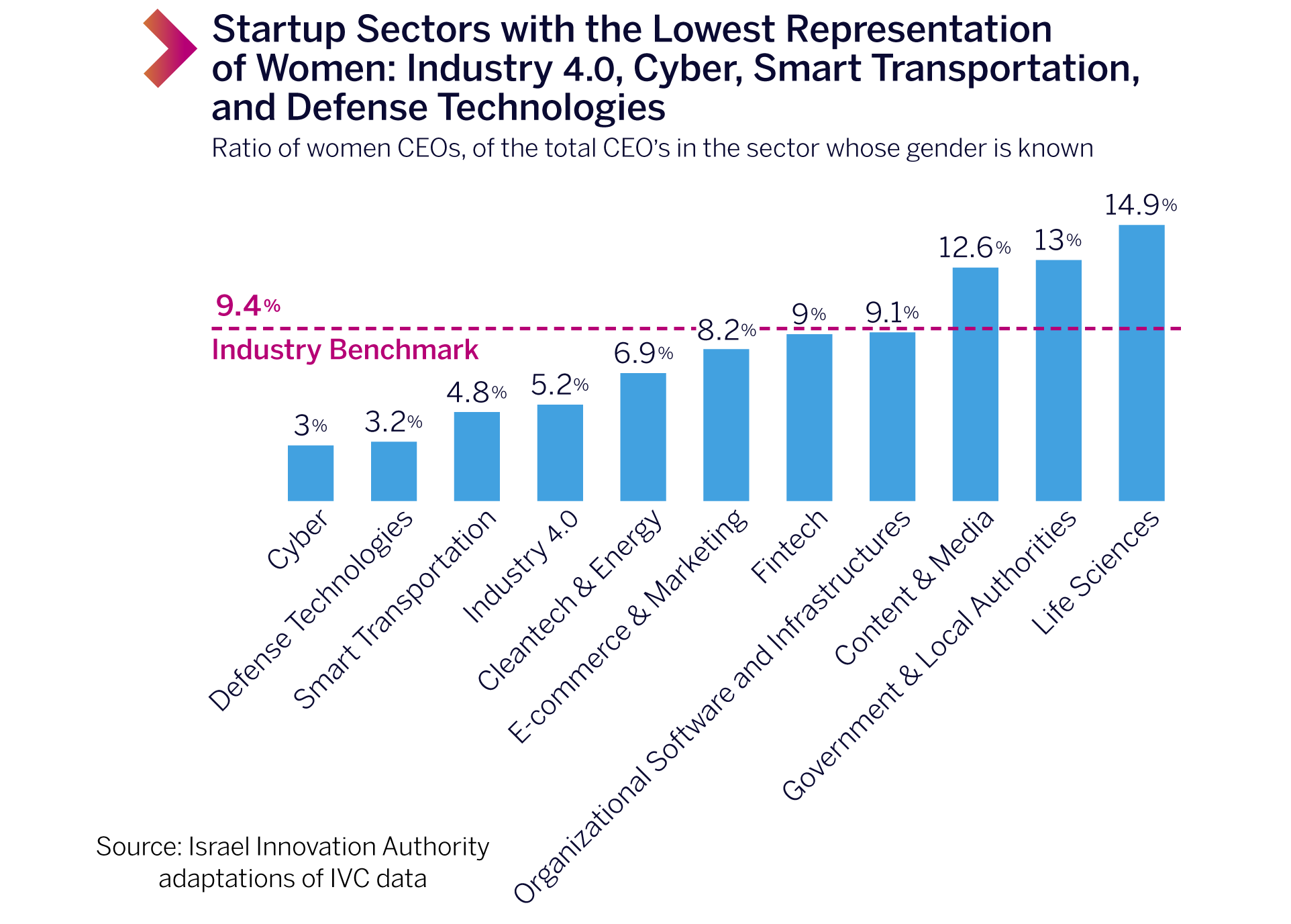

We also examined the gender distribution of the different technology sectors, checking which sectors had a higher or lower ratio than the industry average of women founders and CEOs which stood, as mentioned above, at 9.4%. The sectors in which the ratio of women managing companies that they founded was higher than the industry average and include life sciences (14.9% of the companies), companies developing technologies for government and local authorities (13%), and content and media companies (12.6% of the companies). In the Agritech and food sector, the ratio of women CEOs is 10.2%. In the remaining sectors, the ratio of women CEOs is less than the industry average: organizational software and infrastructures (9.1% of the companies), fintech (9%), E-commerce and marketing (8.2%), cleantech (6.9%), industry 4.0 (5.2%), smart transportation (4.8%), defense technology (3.2%), and cyber (3%).

Less than 5%: Women Raise Less Money – Primarily During Early Stages

Raising capital enables startups to make their next quantum leaps – to recruit employees, develop new technologies and products, enter new markets, and to acquire other companies as part of their growth process. The relative share of the “industry’s fuel” that reaches startups led by women is therefore very important and enables their continued development.

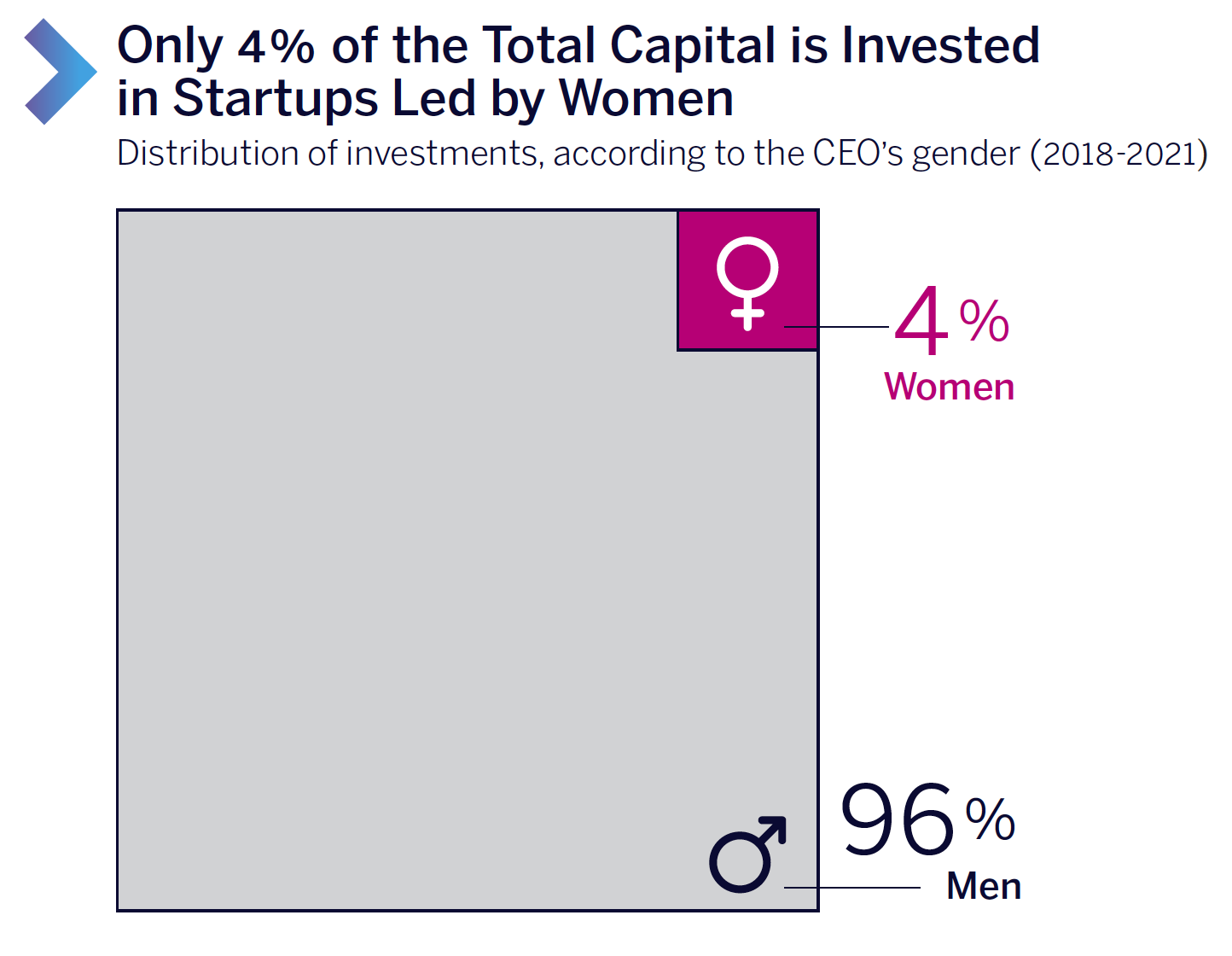

Examination of funding trends reveals a grim reality: out of 3,636 rounds of investment in Israeli startups between 2018-2021 where the gender of the company CEO was known, only 281 investment rounds (7.7% of the total number) were in startups led by women CEOs,4 according to Innovation Authority adaptations of IVC data. In other words, the ratio of investment in startups led by women (7.7%) is lower than the total ratio of startups founded between 2020-2021 that are led by a woman CEO (9.4%).

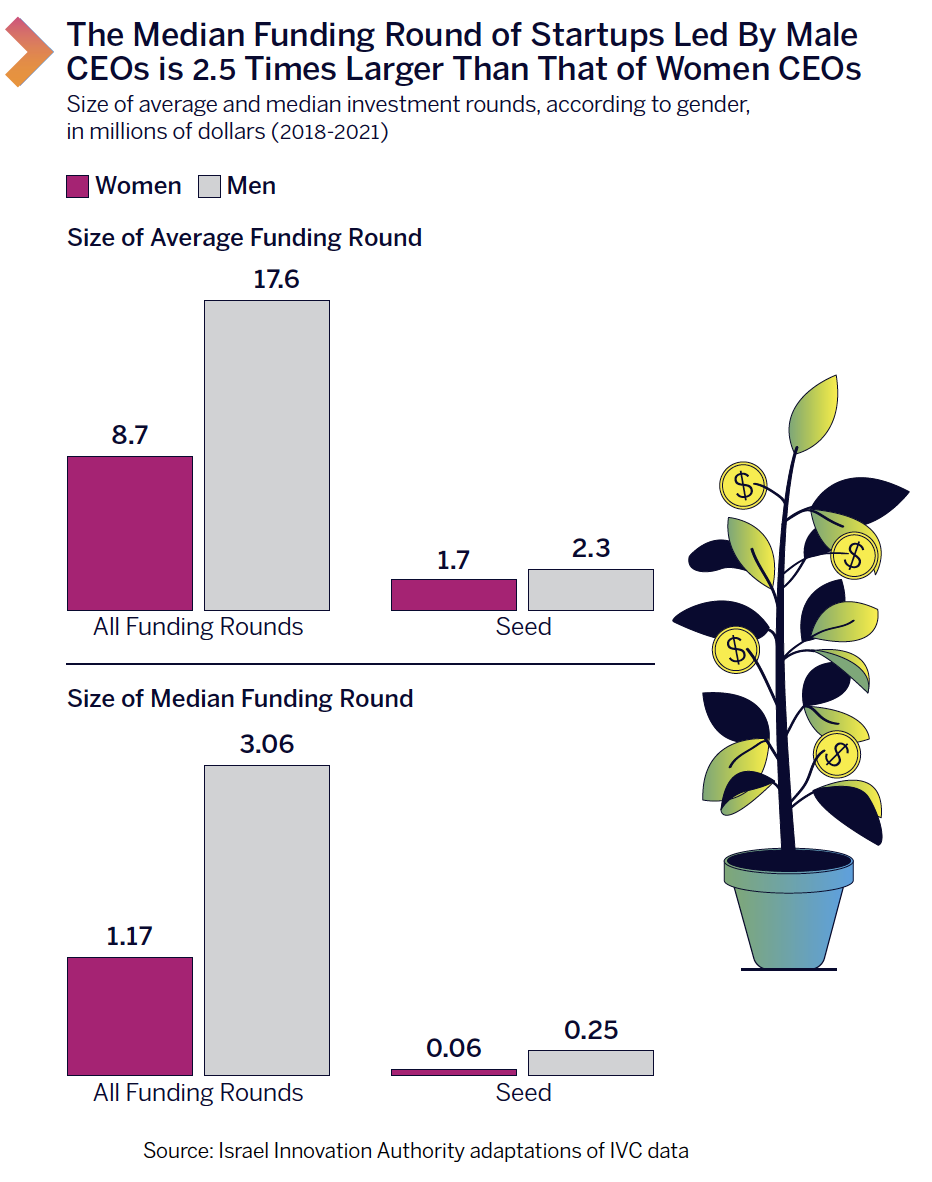

An examination of the total capital raised by women reveals a worrisome picture: of the funding rounds where the CEO’s gender and the sum raised are known,5 startups led by women raised 4% of the total investments while those led by men raised 96%. A further expression of the disparity in funding between men and women can be seen in the average and median size of a woman-led startup’s funding round compared to those led by men. The average size of funding rounds conducted by startups led by women between 2018-2021 was 8.7 million dollars compared to an average size of 17.6 million dollars for startups led by male CEOs. The median size of the funding rounds drops dramatically: The average median funding round between 2018-2021 for a startup led by a woman CEO was 1.17 million dollars compared to 3 million dollars for a startup led by a male CEO – a difference of more than 250%.

It is important to note that during this period, the average size of funding rounds conducted by startups led by women CEOs increased nearly four-fold from 4.8 million dollars in 2018 to 18.85 million dollars in 2021.6 When examining the change between 2018-2020, women were in a relatively worse situation as the increase in the size of the average funding round stood at only 40% for women compared to 80% for men. There was a similar increase (of approx. 420%) in the scope of the average funding round in startups led by male CEOs, from an average funding round of 8.7 million dollars in 2018 to 36.4 million dollars in 2021. The median size of funding rounds revealed a similar picture. In other words, there is an increase in the funding rounds of startups led by women CEOs but not one that is closing the disparity in relation to the average and median size of funding rounds in male-led companies.

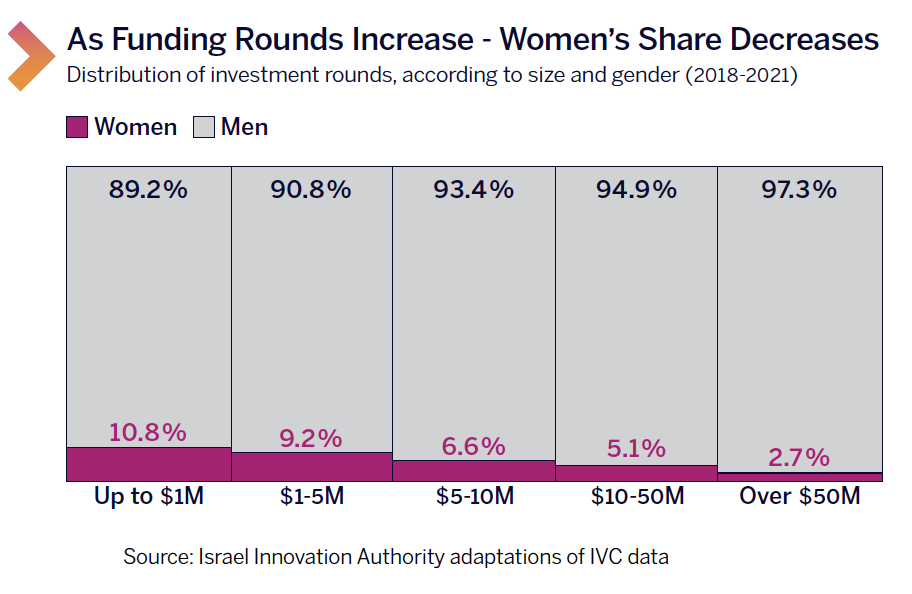

One of the explanations for the significant disparity is that most of the funding rounds conducted by startups led by women are in early-stage companies – seed investment and Round A funding – and that the ratio of startups led by women decreases as the funding rounds progress. Nevertheless, even in the early funding rounds, the size of the average and median funding in startups managed by women is lower than that in companies managed by men. For example, in the seed round, the size of the average funding round in startups led by women CEOs is 1.7 million dollars compared to 2.3 million dollars in those led by male CEOs.

Out of the total seed funding rounds in companies where the CEO’s gender was known between 2018-2020, an average of 8.2% of the investment transactions each year were in startups led by a woman CEO. However, already in the next funding stage (Round A), this ratio declined to approximately 7%. From Round B onwards, the average yearly ratio of investment transactions in companies managed by women was 6.2% of the total transactions at this stage. In advanced funding rounds (Round D onwards), only a few companies managed by women successfully completed investment rounds.

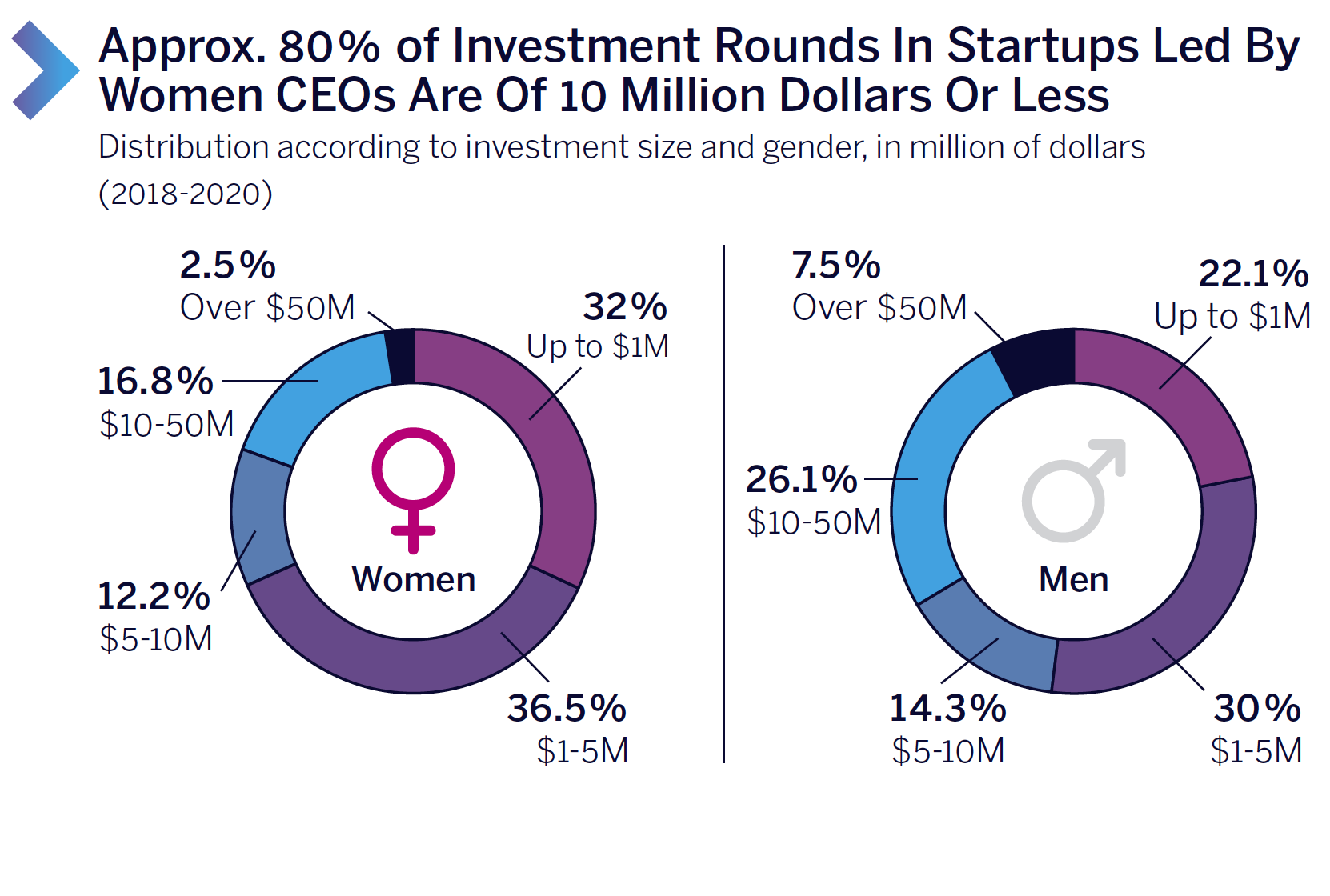

An examination of the distribution of all investment rounds in startups led by women CEOs reveals that 80% of the transactions between 2018-2021 were of 10 million dollars or less. Among male CEOs, 66% of the transactions were of this size. The investment transactions in male-led startups are therefore distributed over a wider range of transaction sizes while the transactions in which investment was made in women-led startups are concentrated primarily in the lower range of investment round sums. For example, during this period, five investment transactions over 50 million dollars were identified in startups managed by women compared to 180 such transactions in startups led by men.