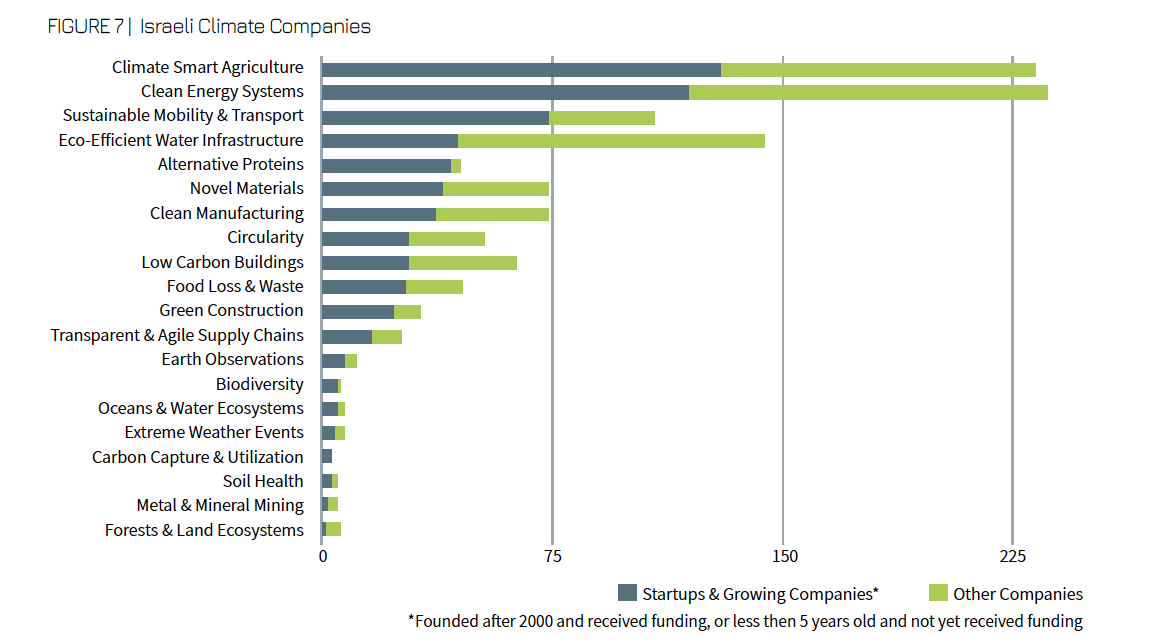

The mapping procedure, described above, revealed nearly 1,200 Israeli companies that provide solutions to climate challenges. A distinction was made between 637 startup & growth companies and other types of companies. The former category included all the companies founded after the year 2000 and which have raised investments, as well as young companies – founded less than 5 years ago – that are yet to raise funding. We presume that there are many more young startups under the radar which are not represented in the databases.

The discussions below will clearly state whether the analysis relates to all climate companies or to this latter group of startup and growth stage companies (henceforth referred to as “startups”).

The distribution of the companies between the different climate challenges is depicted in Figure 7, according to a company’s main challenge. The challenges are presented in descending order, according to the number of startup that address any given challenge. The three most prolific challenges are Climate Smart Agriculture, Clean Energy Systems, and Sustainable Mobility & Transport, with 130, 119 and 74 startups respectively. The Israeli climate ecosystem is characterized by a mix of veteran, wellestablished fields with a majority share of mature companies, for example Eco-Efficient Water Infrastructure, and young and growing fields such as Alternative Proteins, which predominantly consist of startups.

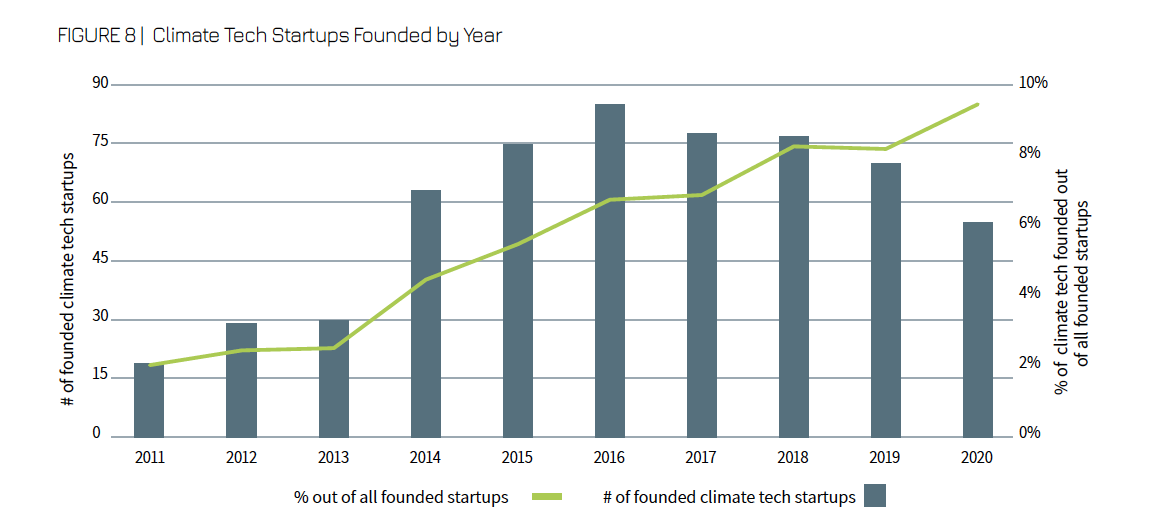

The local ecosystem witnessed a surge of newly established climate tech companies back in 2014, and since then, a relatively constant number of startups have been established each year. Climate tech startups occupy a growing proportion of all newly founded Israeli startups across all sectors each year (Figure 8). This trend is striking considering the general decrease of newly established startups in the Israeli ecosystem, especially during the COVID-19 crisis.

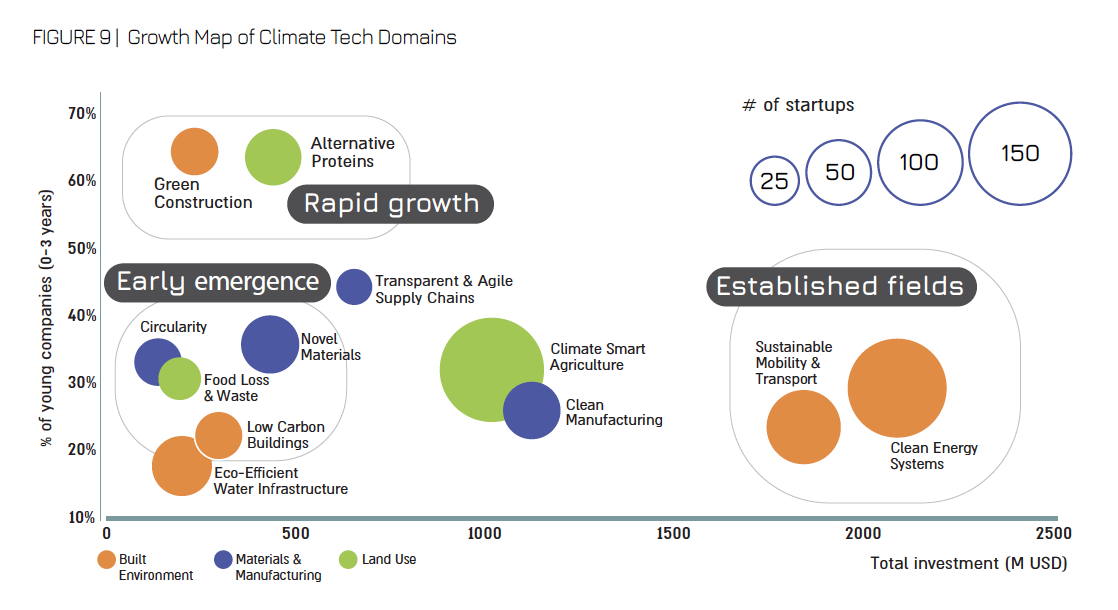

An analysis of the growth rate of startup companies for any given challenge is shown in Figure 9. The graph depicts the percentage increase in the number of startup companies over the last 3 years (2018-2020), and the total number of startups and total known investments11 per challenge area.

The challenges are grouped into a number of clusters with similar characteristics. Cluster 1 consists of the established fields of Sustainable Mobility & Transport and Clean Energy Systems that have received the largest total funding sums over time. The relative growth of startups over the last 3 years in this cluster is moderate (between 20-30%) and is based on well-established and mature companies in these domains (see Figure 7). Cluster 2 – rapid growth – includes challenges that have grown in terms of the number of companies, and that are expected to raise increased capital in the coming years. Israel is renowned as a leader in Alternative Proteins (as described later in the report), and the emergence of startups in Green Construction, where material choices and site management can reduce resource use and waste, has high potential for meaningful decarbonization. Cluster 3 – early emergence – includes a group of challenges, each with 30-40 startups and a growth of 30%-40%. These challenges are highly interrelated i.e., novel materials can support circularity, and circularity and consumption patterns can support reduction in food loss and waste. These are domains with emerging innovations, and reflect the increased global interest in and commitments to advancing decarbonization via innovations in these areas. Outside these clusters, Climate Smart Agriculture (CSA) comprises a large number of companies, and a consistent and high creation rate of new startups. Clean Manufacturing plots in proximity to CSA, and encompasses an array of platforms, both software and hardware, for improvements and optimization of industrial production processes that minimize energy and resource use and reduce waste. The relatively high investments in this challenge domain result from large investments in a few companies. Startups addressing the supply chain showed a marked growth of 44%. Supply chain traceability is a crucial component of decarbonization and enables energy efficiency, waste minimization, and visibility with regard to emissions and climate risk along the value chain and is another domain worthy of attention.

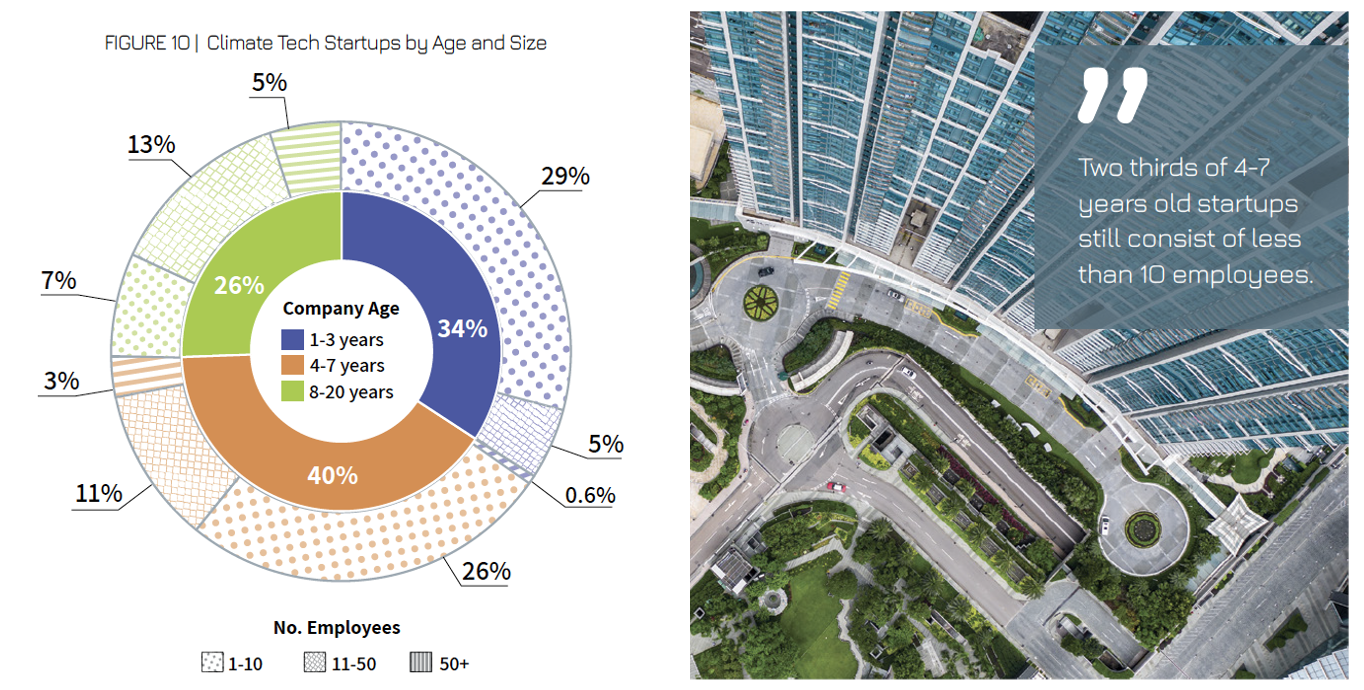

While the Israeli climate tech domains are at different stages of growth, the majority of the startups (74%) are less than 7 years old and are evenly distributed between subgroups of 1-3 years and 4-7 years old (Figure 10). As most companies (62%) are small in size, having less than 10 employees, it is interesting to note that twothirds of 4-7 years old startups still consist of less than 10 employees. This emphasizes the uniqueness of the ecosystem and, perhaps, its main challenges – a long development period, high risk, and late onset of growth.

- 11.See the “Capital Investments” section for information on limitations of investment data.