As described above, the climate tech domain encompasses a broad variety of solutions which directly or indirectly address global climate challenges, that are based on varied technological platforms, and which are associated with many industry sectors. The resultant added complexity in attributing capital investments to climate tech from available data sources enables only partial retrieval of information. As such, private capital data provided in this section is preliminary and should be taken with caution.

Climate Tech Investments

- Investments in climate ventures totaled 2.97 billion USD during 2018-2020, demonstrating a compound annual growth of 14%. Initial data suggests that the total capital invested in climate tech startups during the first half of 2021 was nearly 40% more than the total amount invested during the previous 3 years.

- The two climate challenges which attracted the most funding over these years were Clean Energy Systems and Sustainable Mobility & Transport. Alternative Proteins displayed promising growth in raising capital.

- 2020 saw a surge in Initial Public Offerings (IPOs) conducted by climate tech startups on the Tel Aviv Stock Exchange. Five startups, primarily from the energy sector, conducted a public offering (25% of total IPOs in 2020), while 11 have already filed IPOs during the first 3 quarters of 2021.

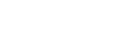

Climate Tech Investors

- Israeli climate tech attracted almost 570 investment groups and a significant number of additional private investors (not included in the following analysis).

- Of the 20 investment groups that have invested the highest total amounts in Israeli climate tech startups – none are dedicated climate funds. Moreover, in Israel, to date, there is no dedicated climate tech investment group.

- Of the 10 most active investment groups in Israeli climate tech, 4 are operating a government-supported incubator, thereby highlighting the importance of such government support in the climate domain.

- Four of the most active investors in the global climate tech space (both in the number of deals and the amounts invested),[12] have invested in Israeli climate ventures (SOSV, Sequoia, Khosla Ventures, and Techstars).

- Less than 20% of the 570 investor groups are attributed to corporate venture capitals (CVCs). Late-stage dedicated funds conducted less than 1% of the active investments, thus demonstrating the low level of capital diversity available for climate ventures.

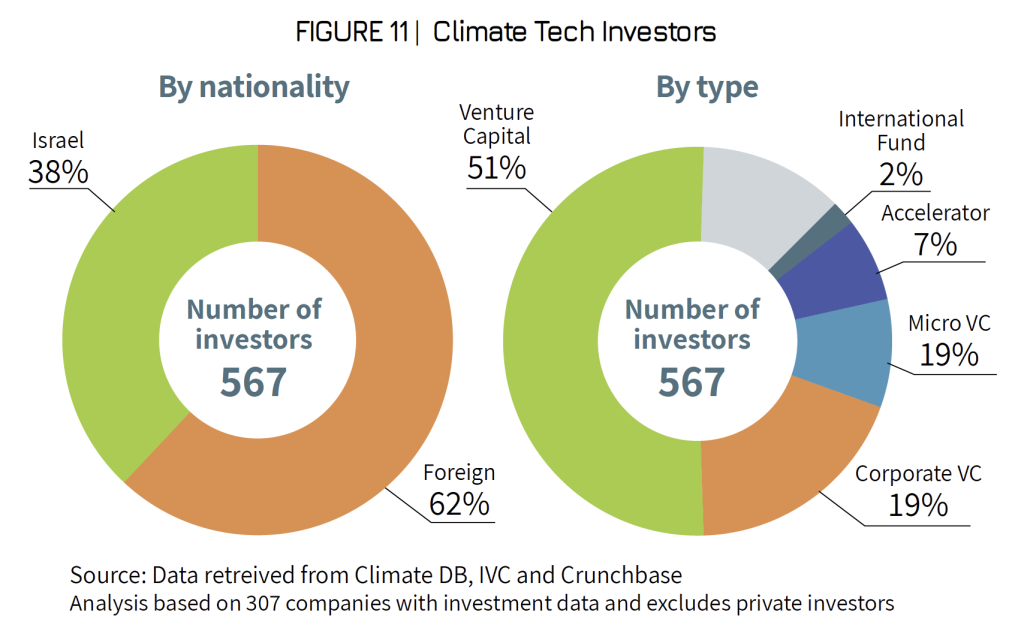

Government Support

- The Israeli government invested more than 280 million USD during 2018-20 in promoting R&D in climate tech startups (all the data below pertains to this timeframe) (Figure 12).

- Israel Innovation Authority (IIA) supported 290 ventures with a total budget of 250 million USD during 2018-20 (16% of its annual budget). The average approval rate of climaterelated applications was higher than the IIA’s general approval rate, indicating the high quality of projects applying for support.

- The IIA supported ideation and early-stage ventures via 7 incubators and innovation labs and promoted generic research via 4 “MAGNET” consortia.[13]

- Pilot program – The IIA invested 60 million USD together with 7 government ministries and entities to climate tech startups for support ventures in their later-phase R&D pilot testing and implementation.

- The IIA has also provided support to climate companies for implementation of their R&D project within commercial manufacturing facilities.

Additional Support from Government Ministries

- In addition to collaborating with the IIA in the Pilot Program, the Ministry of Environmental Protection has collaborated with the IIA and the Ministry of Economy and Industry in supporting early-stage ventures in joint public-private innovation labs.

- The Ministry of Economy and Industry is focusing efforts on circularity domains via the “Industrial Symbiosis” Program and the Israel Resource Efficiency Center.

- The Ministry of Energy, in addition to collaborating in the IIA Pilot Program, is also promoting climate innovation in dedicated support programs across the innovation value chain from academic research to pilot projects (total of 30 million USD).

- Other government ministries operate climate support projects via their Chief Scientist departments.

- [12].PwC, The State of Climate Tech 2020: The next frontier for venture capital

- [13].MAGNET – An IIA incentive program that provides grants for R&D collaboration between industrial companies and research institutions developing technologies together.

Additional articles in the magazine that may interest you

Methodology

Opportunities & Barriers to Climate Tech in Israel

Israel’s Climate Tech Ecosystem

Introduction

Executive Summary

Looking Ahead

Israel as a Global Climate Tech Player

Foreword