Another of the entrepreneurial ecosystem’s significant and influential elements is that of venture capital investors. As those controlling the “flow” of investment, these investors decide which startups will receive funding and therefore contribute significantly to shaping the Israeli startup arena. To a large degree, the funding they provide to startups frequently decides which startups will survive and which will be forced to close or change direction. Furthermore, even after making the investment, venture capital investors still have an influence over the companies’ decision-making processes because, following their investment, main investors will receive a place on the startups’ board thereby influencing their future course.

These reasons and others mean that venture capital funds bear significant responsibility for improving the state of gender equality in Israeli high-tech. The makeup of the funds’ human capital and, specifically, the gender of their partners, impact their decisions which, in turn, influence the gender makeup altogether. An examination conducted in the US by Kauffman Fellows Research Center (KFRC) that related to the years 2000-2018,1 revealed that in early-stage investments (seed and A-rounds), women venture capital investors lead twice as many investment rounds in startups that have a gender-diverse team of founders (i.e., that includes a woman entrepreneur) compared to men who lead VC rounds of investment. These investment patterns and the tendency of female investors to invest more in women entrepreneurs are consistent and manifested in all the examined startup sectors. The report’s authors therefore emphasized that it is specifically in the early stages of startups that women investors dramatically increase the chance of women entrepreneurs to raise funding from them and thereby gain an opportunity to build successful market-leading companies. The report’s authors estimate that the women investors’ personal experience helps them identify problems and needs, and to understand the size of their potential market.

An examination conducted by Crunchbase assessed the influence of the gender of the venture capital funds’ founding investors and found that in venture capital funds with a woman founding partner, 28% of the investment rounds between 2016-October 2021 were in startups with at least one female entrepreneur.2 In contrast, in venture capital funds where the founding team consisted solely of men, the ratio of investment in startups with at least one female entrepreneur dropped to 22%.

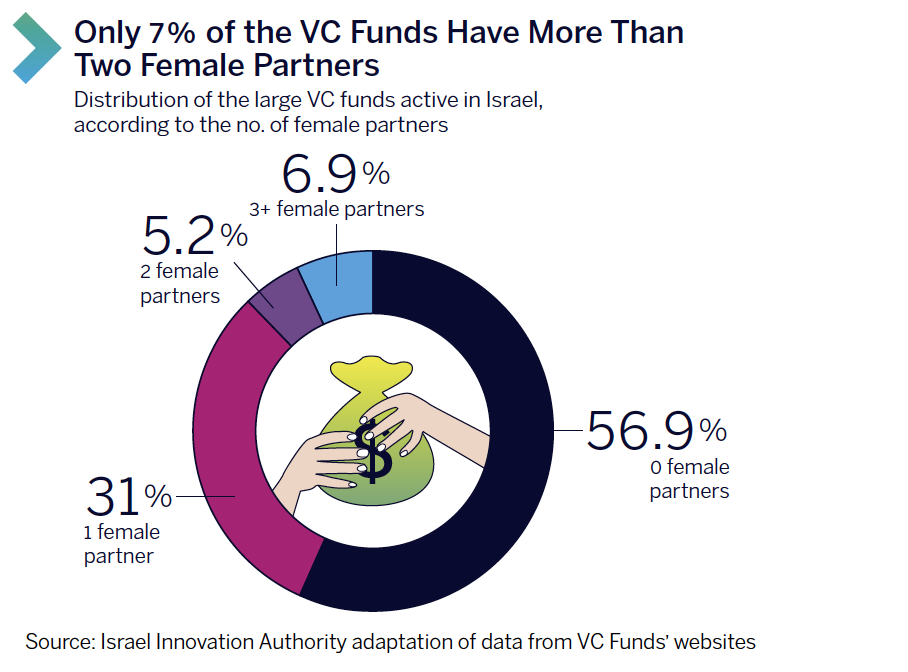

57% of the large large venture capital funds active in Israel have no female partner

The Israeli venture capital industry is predominantly controlled by male investors who occupy most of the partner roles – making the decisions about new investments. According to an Innovation Authority assessment conducted with the report’s publication, approximately 57% of the large large venture capital funds active in Israel in recent years failed to appoint a single woman partner. In 31% of the funds, there is at least one female partner.

The findings further indicate that only 16.5% of the partners in the funds active in Israel are women – 38 women out of a total of 230 partners in 58 funds examined. It is important to note that these women are partners in all kinds of roles in the fund and do not serve solely as investor partners (i.e., the number includes female partners responsible for managing human resources, legal consultation etc.).3

The assessment was conducted in January 2022 and included a sample of 58 funds. Details of the partners’ gender were retrieved from the funds’ websites. The funds included in the sample were graded in the IVC lists of active funds from 2018-2020 as the funds with the largest investment portfolios as of December 2021 – out of an understanding that these funds have the widest influence on Israeli entrepreneurship. The list includes both Israeli and foreign funds that have local offices in Israel or that have partners responsible for investments in Israel, out of an understanding that the gender of these partners impacts the status of gender equality in the Israeli startup industry.

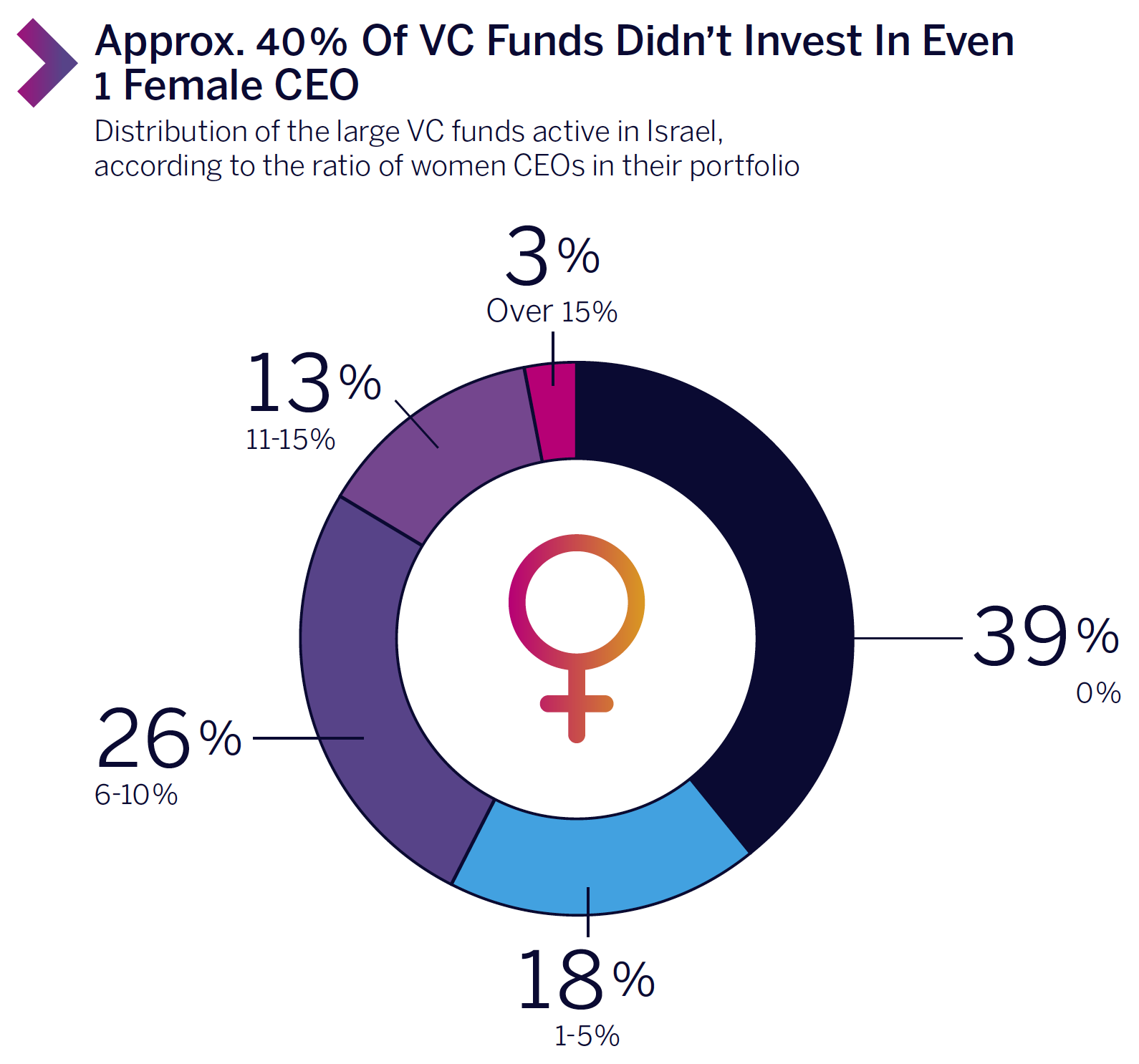

The influence of the funds’ lack of gender diversity is also evident in the portfolio of companies in which they invested. In 39.5% of the funds examined,4 the investment portfolio lacks even a single startup company with a woman CEO. In another 13.2% of the funds, the investment portfolio contains one startup led by a woman. In other words, more than half the large active venture capital funds in Israel have investment portfolios that contain either no startups led by women or only a single such company. Moreover, 97.4% of the funds have an investment portfolio in which the ratio of women CEOs is less than 15% of the portfolio’s CEOs.

An examination conducted by ‘Power in Diversity’ that was published in January 2022 revealed similar results according to which 14.8% of the venture capital fund partners in Israel are women – 29 women out of 195 partners examined, following an increase of 3% in the number of women partners in 2021.5 When analyzing the data further, the organization found that only 9% of the partners in investment roles in the sample (that included 70 funds in Israel) are women – a ratio that has remained almost unchanged despite the growth in investment activity.

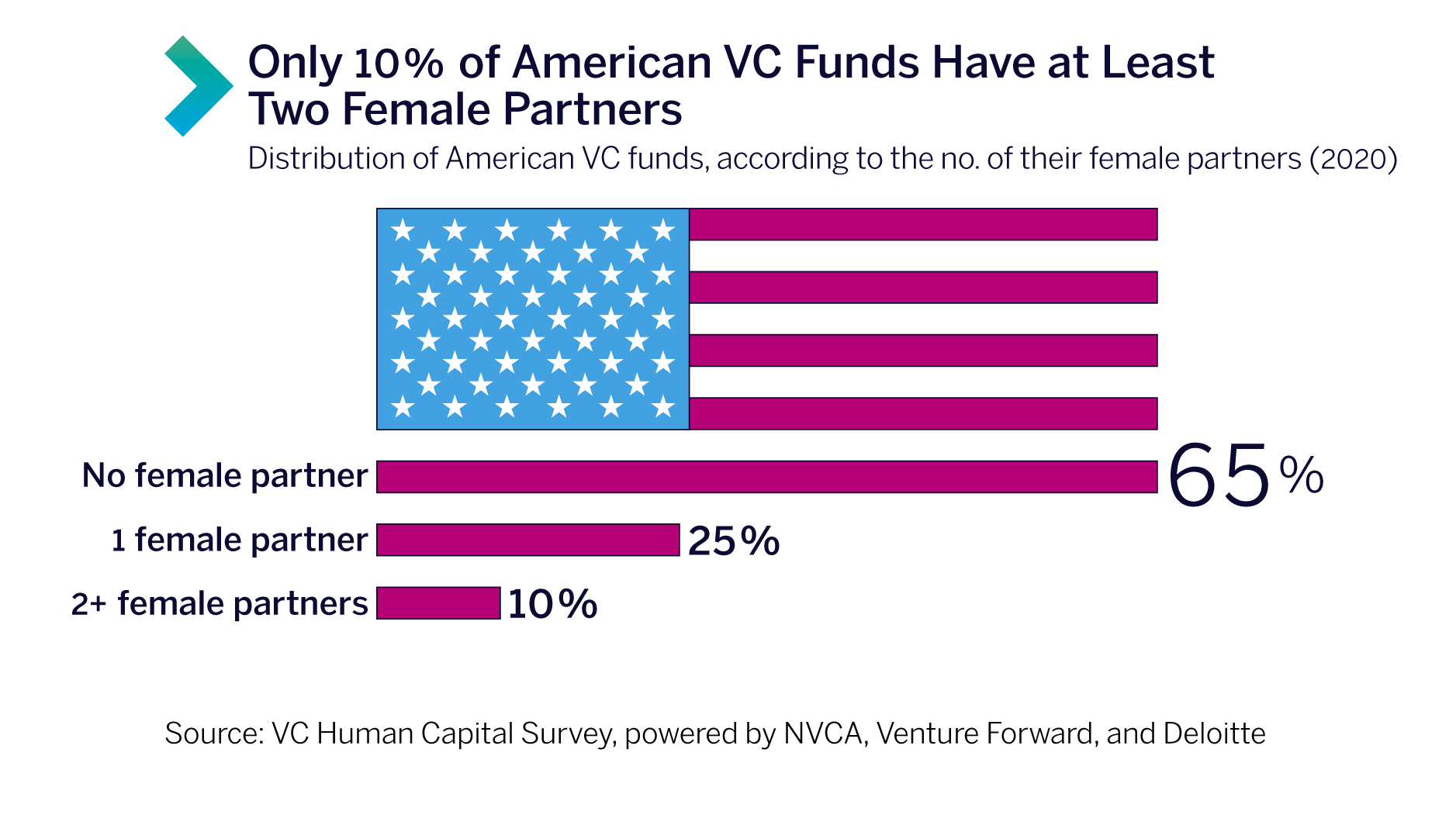

65% of American VC Funds Have No Female Investor Partner

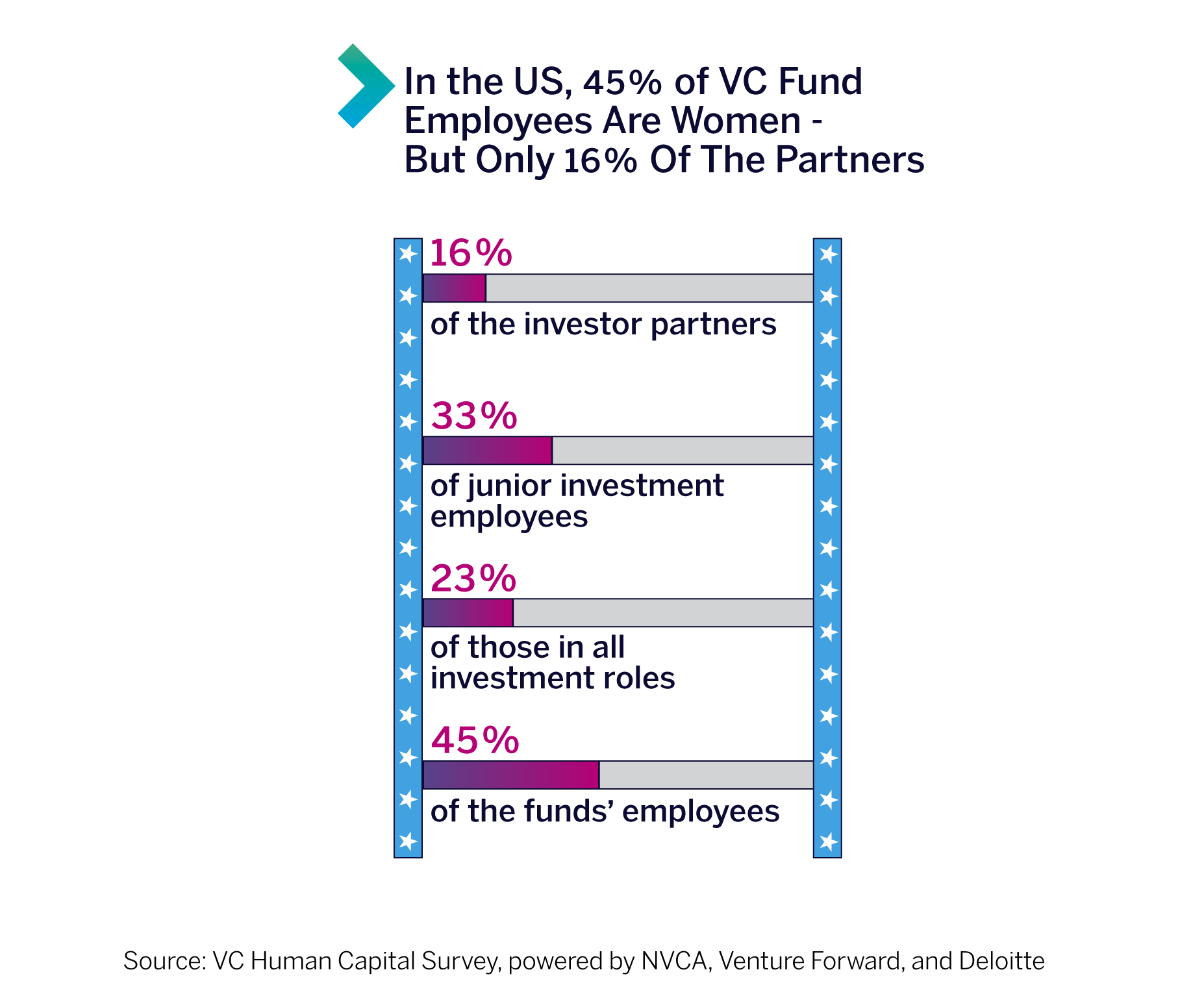

According to the VC Human Capital Survey conducted by Deloitte, the National Venture Capital Association (NVCA), and ‘Venture Forward’, 16% of the investor partners in the US in 2020 were women.6 The ratio of female investor partners in the US has slowly increased in recent years: from 11% in 2016, to 14% in 2018, and 16% in the last survey. The 2021 ‘All In’ Report showed similar results.7 Nevertheless, alongside the slow improvement, according to VC Human Capital Survey, 65% of American VC funds still have no female investor partner. In 2018, this figure stood at 68%. In 75% of the investment entities that reported having female investor partners, there is only one such partner. It is important to note that women comprise 45% of the VC funds’ human capital however most of these serve in administrative roles (965 of the employees in these roles are women) and in auxiliary investment roles such as investor relations and public relations. Among all those in investment roles (not just partners), 23% were women. In funds specializing in investment in startups in growth stages, the ratio of women in investment roles is especially low.

An encouraging sign noted by the report’s authors was that women comprised 33% of those in junior investment roles, a ratio that is gradually increasing. This would suggest that, in the future, more women with relevant experience will be able to progress to partner positions. Another encouraging process over the past decade is related to the increase in activity of private female angels investing in early-stage startups. According to the 2021 ‘All In’ Report, the number of female angels in the US rose from less than 100 in 2010 to nearly 1,000 today (895 according to 2021 data). The report’s authors attribute the growth in the number of female angels since 2018 to the #MeToo Movement which they claim also increased the female angels’ tendency to invest in women entrepreneurs. In 2021, nearly 30% of the female angels’ investments were designated for startups founded by women – a continuation of an upward trend that began in 2017 (when this figure stood at 20%). There is no official information in Israel about female angels’ investments in startups, among others because these are private investments by individuals under no obligation to reveal information about their investment activity, but their number is estimated to be relatively small.