2022 meets high-tech at an interesting intersection: on the one hand, following a decade of record achievements and prosperity, the industry is increasingly strengthening its standing as one of the Israeli economy’s central sectors. On the other hand, the capital market is cooling down, a war is raging in Ukraine, and the sanctions imposed on Russia are impacting the global economy and the movement of workers (including in Israel). This comes on the back of the ramifications of the Covid pandemic that broke out more than two years ago. “The High-Tech Situation Report 2022” reflects all the above and presents high-tech’s successes and the numbers behind the industry, while shining a spotlight on the challenges that must be contended with in order to continue maintaining Israel’s leading position (as local high-tech declines in some global indices).

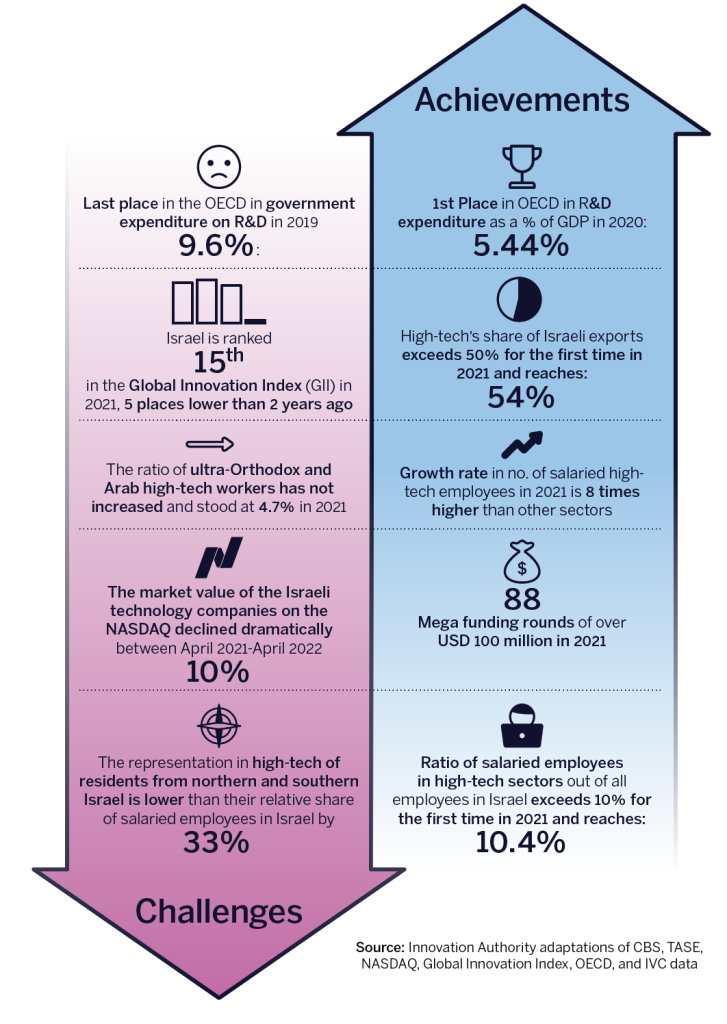

The first section of the report presents an updated situation report of Israeli high-tech, including the challenges it faces. One prominent figure highlighting this gap is that Israel occupies 1st place among the countries of the OECD in expenditure on R&D as a ratio of GDP. In 2019, Israel exceeded the 5% mark for the first time and in 2020 (the last year for which this figure was published), the figure already stood at 5.4%. In contrast, Israel is ranked last in the OECD in the level of government expenditure on R&D out of total expenditure in this field. In 2019, less than 10% of all expenditure on R&D, equal to 0.5% of GDP, was funded by the state. In comparison, in the US this figure stood at 205 and constituted 0.66% of GDP, while in European countries such as Germany and France it climbed to 30% that were 0.69% and 0.88% of GDP, respectively. These disparities may seem insignificant, but they translate into added annual government investment in R&D of 2.4-5.7 billion shekels. This government investment is directed at groundbreaking high-risk R&D that will ensure continued medium- and long-term growth which the private sector has difficulty funding.

Another prominent contrast is related to workers employed in the high-tech industry – an especially critical issue in a period in which many workers are moving in the high-tech direction and when a national program is being formulated to increase the number of employees in the industry to 15% of all salaried employees. The number of high-tech employees grew by 27,000 during 2021 and the industry now employs 362 thousand workers. High-tech demonstrated especially rapid growth in the number of salaried employees: the growth rate in 2021 stood at 8%, compared to growth of only 1% in the economy’s total number of salaried employees during the same period. In other words, workers are joining high-tech at a rate eight times higher than they are joining other sectors of the economy.

At the same time, the unemployment created in the high-tech industry with the outbreak of the Covid pandemic returned to its low pre-Covid level. Those joining the high-tech industry belong primarily to Israel’s younger population, as described in detail in the first section of the report. Further evidence of this trend is the fact that computer science was the most popular academic course of study in Israel during the 2019-2020 academic year with more than 20 thousand studying some form of combination of this course – 10.8% of all undergraduate students. Moreover, in all age groups, including those that typically make less career changes, there is an increase in the level of participation in high-tech employment. Nevertheless, high-tech is preserving is standing as an exclusive industry in which growth is primarily that of the (non-Orthodox) Jewish population in central Israel. An examination of the changes in the composition of salaried high-tech employees reveals that only 200 Arabs joined high-tech in 2021 while the number of ultra-Orthodox high-tech employees dropped by 500 (most of this can be attributed to the 1,200 ultra-Orthodox women who left high-tech).

Tel Aviv is the undisputed high-tech capital of Israel as far as the number of workers employed in companies there and the number of companies opening their offices there are concerned. The city is home to over one-third of the high-tech companies operating in Israel and to a quarter of the industry’s employees. The figures also reveal that Jerusalem is characterized by mainly small high-tech companies unlike Haifa which has mainly large companies. Beersheba is the fastest growing city as far as the number of new startups is concerned, although these are still small (an increase from 70 startups in 2015 to 100 in 2020).

The industry’s centralization was expressed not only in the location of its employers, that is sometimes at a distance from residential areas but also in the places where high-tech employees live. 60.3% of hightech salaried employees live in cities in central Israel, whereas the general proportion of the employees from all sectors of the economy in these cities is 45.5%. In other words, as CBS data for 2020 reveals, the representation of residents from central Israel in high-tech is 35% larger than their relative share of all Israel’s salaried employees.2020 is the latest year for which this data is available. The communications sector is included in this analysis of the high-tech industry. In contrast, the representation of residents from northern and southern Israel in hightech is 33% lower than their share of all salaried employees. In Jerusalem this figure stands at 50%. Only in the Haifa District does the ratio of salaried high-tech employees match its share of the general population. It should be stressed that these disparities between the periphery and central Israel stem in part from the low high-tech representation of the Arab and ultra-Orthodox sectors of the population which generally live in other areas with a significant concentration of ultra-Orthodox in Jerusalem and of the Arab sector in northern and southern Israel. There are also disparities within the Jewish population between residents of central Israel and the periphery which begin already in the education system. Proportionally more school students from central Israel are eligible for a matriculation certificate, a higher ratio of residents from central Israel with a matriculation certificate are accepted to higher education, and these students demonstrate a greater propensity to turn to studies in high-tech subjects.These findings are based on an analysis conducted by the Ministry of Finance and the CBS on people born between 1993-1996 and was presented as part of the work of the High-Tech Human Capital Committee.

An analysis of the distribution of workers between the different types of Israeli high-tech employers reveals that despite Israel’s image as a “startup nation”, only 8% of the workers are employed in companies defined as startups, with most being employed in more mature companies. In practice, the greatest concentration of workers is in high-tech industry companies that employ 30% of its workers. This sector primarily includes the defense industries that are among the sector’s largest employers.

Additional metrics testifying to the resilience of high-tech and its importance to the Israeli economy achieved significant milestones last year: high-tech exports exceeded 50% of total Israeli exports for the first time and reached 54% in 2021. Furthermore, the ratio of salaried high-tech employees of all salaried employees in Israel passed 10% for the first time this year and stood at 10.4%. At the same time, Israel slid to 15th place in the Global Innovation Index (GII) in 2021, having been ranked 13th in 2020 and 10th in 2019. Israel is ranked first in the Global Innovation Index in several sub-metrics that testify to the breadth and depth of the country’s high-tech industry, such as public expenditure on R&D, the scope of venture capital investment rounds, exports of ICT products, and cross-sectoral collaborations in innovation fields. In contrast, Israel is ranked below the global average in other metrics related to infrastructures that are critical for achieving technological progress, such as regulatory climate, participation in public sector digitization processes, the percentage of expenditure on software out of GDP etc.

Another record broken by high-tech companies in 2021 was the total capital raised by startups – approx. 72 billion dollars in a year,According to IVC data as of 24.4.2022, and without funding raised via cryptographic IPOs and loans. It should be emphasized that this figure is expected to be updated during the coming months. more than double the previous year. About 56% of the capital was raised by companies that deal in enterprise software, cyber or fintech. Companies in higher-risk fields, with longer development and sales processes that are also generally exposed more to regulatory ramifications, attracted less venture capital investor attention. The large-scale fundraising rounds are becoming more common: 88 of these fundraising rounds in 2021 were defined as mega rounds of at least 100 million dollars. Since 2018, the annual number of mega rounds has increased more than tenfold.

In contrast, the recent period has been a more moderate one for the mature technology companies in Israel and dampened the euphoria and excitement that accompanied the wave of IPOs of Israeli companies on Wall Street in 2021. As part of preparing this report, the Innovation Authority examined the data of 125 technology companies with a connection to Israel traded on the NASDAQ and found that their aggregate value declined by 9.4% between April 2021-April 2022, from 252 billion dollars to 228 billion dollars. During the same period, the NASDAQ Index itself rose 9.3%. The value of the Israeli technology companies traded in the TA-35 Index also declined by 9.5%, while the TA-35 Index rose by 22% during the same period. This trend was expressed in the first signs of decreased private market fundraising for startups in Israel and the US during the first quarter of 2022, compared to parallel periods in the previous year. Nevertheless, it is still too early to point to a trend and the fluctuations in startup fundraising should continue to be monitored in the near future.

The second section of the report presents an in-depth discussion of the changing role of the government and the Innovation Authority in the wake of the Israeli high-tech industry’s maturation and the evolving competition between innovation centers in many countries, all competing for capital, workers, and entrepreneurs. Among others, Israel’s relative share of the global venture capital pie is in decline (despite the increase in the absolute total sum of investments reaching startups). Furthermore, Israel has dropped in rankings related to academia and readiness for future technologies. Action is therefore required to enable the next quantum leap of Israeli high-tech.

During recent decades, government support has focused on laying then infrastructures necessary to establish and strengthen the industry, such as the “Yozma” Program that lay the foundation for the Israeli venture capital industry and the Incubators Program that supported high-risk startups in early stages. The central support tool used was direct support of companies via financial grants. The Innovation Authority’s new generation of support and investment tools, that are now being introduced and are detailed in this report, expresses the change in role of the government and Innovation Authority in the innovation ecosystem. This change will encourage the transition of Israeli technologies to the public sector and the lives of Israeli citizens who currently frequently fail to benefit from the fruits of innovation created by Israeli companies. To a large degree, the State of Israel and its citizens are the “barefoot cobbler” with regard to assimilation of the technologies and innovation they enjoy. As part of the Authority’s new strategic program, sections of which are presented in this report, it will become a mediating and facilitating factor striving to strengthen the connection between the public sector and the Israeli high-tech industry, in the context of the public services received by Israeli citizens and the public infrastructures for assimilating innovation.

The report details the programs for regulatory sandboxes and opening the public sector as a playing ground for testing new technologies such as autonomous vehicles. Furthermore, collaborations between the public and private sectors are being promoted to develop groundbreaking solutions that will benefit Israeli citizens in fields such as autonomous public transportation or modular construction aimed at increasing the supply of available housing in Israel. The new generation government support tools for innovation will enhance the service provided to the public and daily life and will enable Israel to continue preserving a leading position versus other global innovation hubs.

Israeli technology companies will also be required to adapt themselves to a changing reality and to their new status as mature companies with evolving needs in order to sustain their global growth. To continue being innovative, these companies will need to continue investing in R&D and to diversify the areas of activity and the markets in which they operate. In this context, the report addresses one of the factors that will contribute to the building of complete technology companies in Israel: collaborations between technology companies in Israel and universities and research institutes. Today, most of the collaborations between industry and academia in Israel is undertaken by foreign companies, chiefly Microsoft and IBM which are together responsible for half of the joint research publications conducted in academia and funded by high-tech industry companies. The growing Israeli technology companies generally refrain from utilizing this avenue to support their own continued innovation development despite its availability of high-quality personnel.

In summary, the success stories of Israeli high-tech – including mega funding rounds of growing startups and noteworthy exits – occupy most of the high-tech headlines. However, these stories sometimes hide the challenges latent in the future of high-tech, especially those of young startups in the early stages of operation that are yet to prove themselves. In a broad perspective, the number of new startups in Israel has been declining for several years,See the publication: “A decline in the number of new startups” by the Innovation Authority and Start-up Nation Policy Institute. and the number of early funding rounds is growing at a significantly slower rate than that of later rounds. The number of early funding rounds grew by 20% compared to 2019 and stood at nearly 1,000 in 2021, while the number of later rounds doubled itself and reached over 400. As a result of these trends, only 4% of all funding rounds in 2021 (approx. 1.1 billion dollars) were directed to seed stages. Moreover, as mentioned above, more than half of the total capital raised by private technology companies in Israel in 2021 reached just three sectors, all software based. This finding may indicate the development of a diversity and risk distribution problem in the Israeli high-tech industry. The Innovation Authority is constantly monitoring these figures and conducting relevant research.

Another central challenge in which Israeli high-tech must improve is more diverse inclusiveness of different population sectors that, as of 2022, are under-represented, including in terms of its employees’ geographical dispersion. Preserving the homogeneity that characterizes high-tech together with its rapid growth and the high demand to work in this field may lead to damage in the Israeli social fabric and increase socio-economic disparities. The rapid transition of high-tech companies to working from home during the Covid crisis and subsequently to a hybrid work model that combines work from home and the office, has opened new employment opportunities. Consequently, companies interested in contending with the chronic shortage of high-tech workers find themselves needing to create attractive opportunities for those living outside central Israel and the country’s main centers of high-tech employment. The government must ensure the creation of infrastructures to meet this need, for example, by laying broadband communications infrastructures and creating suitable transportation solutions to reduce commuting times on those days when employees are still required to travel to the office.

In conclusion, Israel must avoid complacency and false expectations that without long-term investments the economy’s central export sector will continue leading the global arena. The country’s slide down the Global Innovation Index and metrics evaluating the resilience of Israeli academia are evidence of this. Past investments on a national level enabled Israel to occupy leading positions in the field of innovation, and considering the country’s significant reliance on this industry, it is vital to safeguard it in today’s changing reality.