In this report, we analyze high-tech taxation’s share of total state revenues. The object of the analysis is to understand how the high-tech sector and its employees contribute to the Israeli economy.

The need to examine the sector’s contribution to state revenues arose against the background of high-tech’s significant contribution to Israel’s exports and GDP. The high-tech sector’s share of GDP has increased markedly in recent years, among other reasons, because of the rapid growth rate in the number of employees in the sector combined with their high salaries.

State Revenues from Individual Income Tax and Corporate Tax

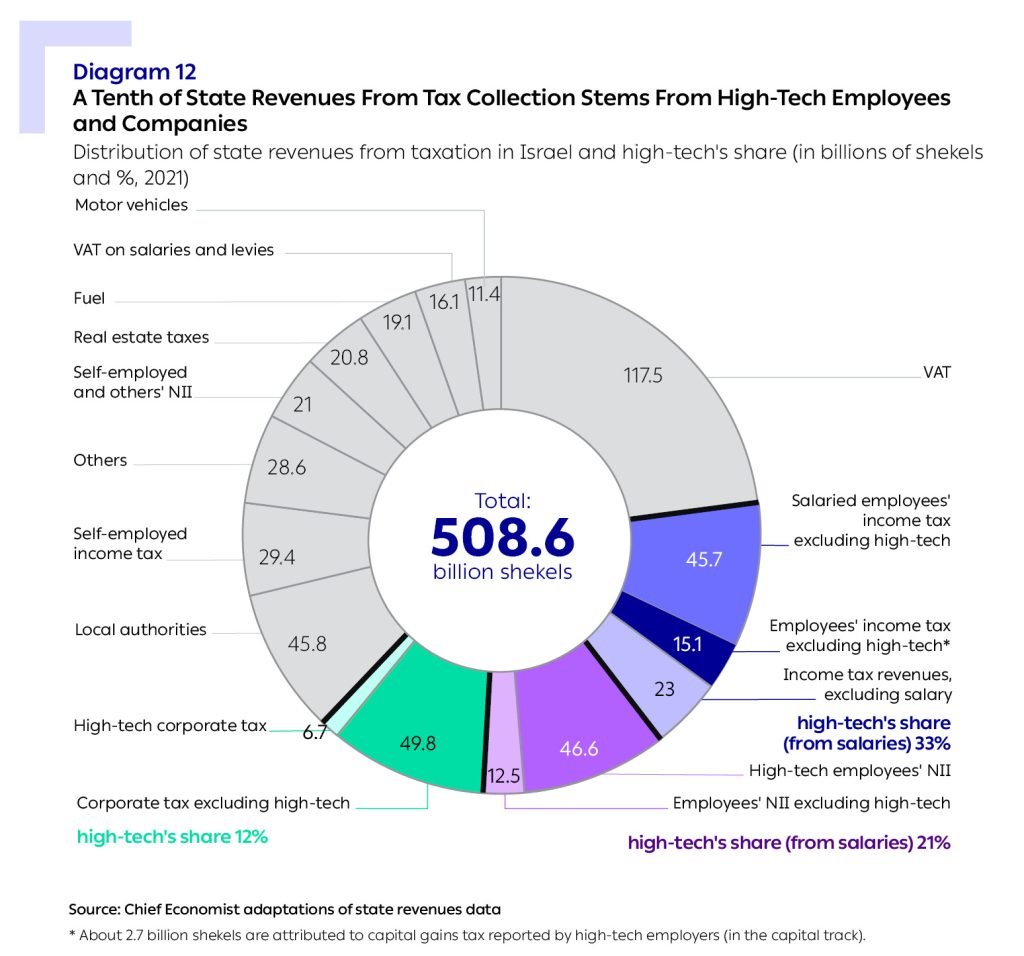

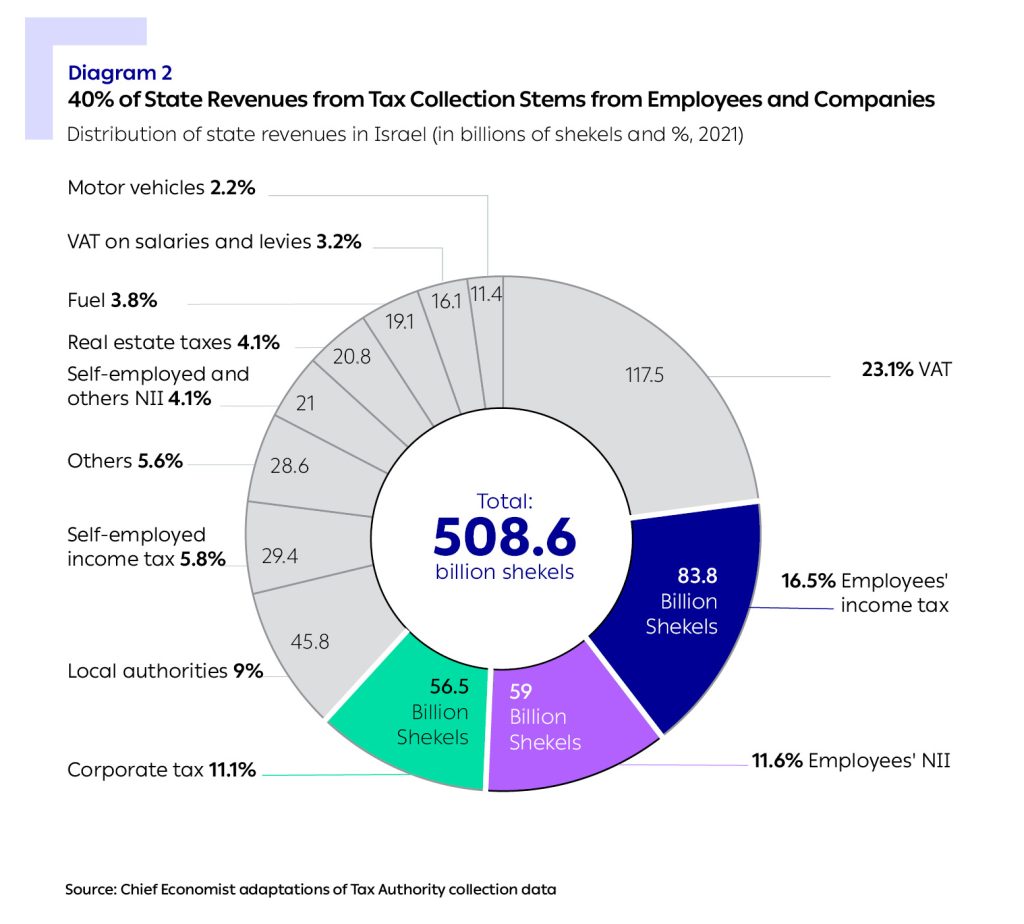

The total state revenues stemming from salaried employees’ income tax in the general economy was estimated at 83.8 billion shekels in 2021. Moreover, a total of 59 billion shekels was collected during this year by the National Insurance Institute (NII – Bituach Leumi) from salaried employees1NII payments for salaried employees include deductions of both employees and employers.. The total corporate taxes collected stood at 56.5 billion shekels during the same year. Consequently, the total state revenues from work (individual income tax and NII payments) and from companies (corporate tax) stood at 200 billion shekels in 2021. This sum constitutes approximately 40% of all state revenues (508.6 billion shekels)2Throughout this report, “all state revenues” refers to broad state revenues that include the central state revenues of 383 billion shekels and revenues from NII and local authorities that totaled 126 billion shekels.. In this report, we will examine the high-tech sector’s share in these revenues.

State Revenues from Individual Income Tax and Corporate Tax in the High-Tech Sector

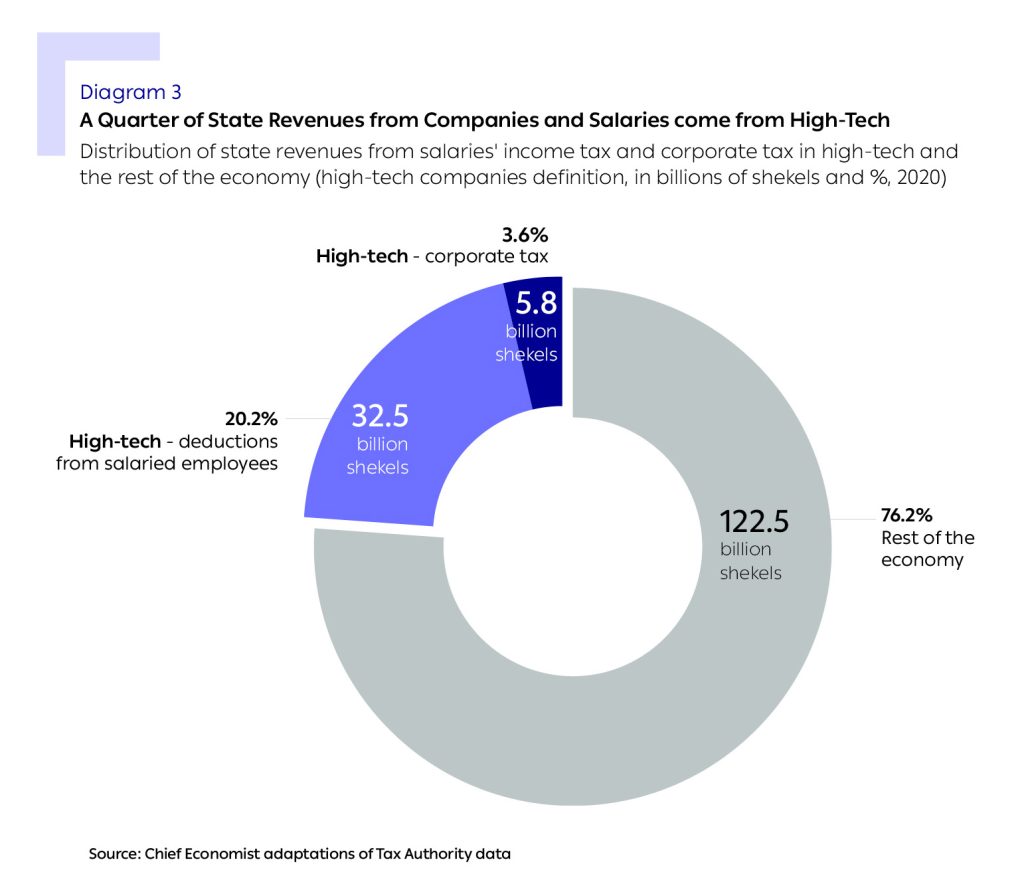

After having presented the general distribution of state revenues from individual income tax and corporate tax, we will now examine high-tech’s share in these revenues. In 2020, out of total tax payments from employee salary deductions and companies in the general economy during that year, which totaled 161 billion shekels3It should be noted that high-tech’s share of state revenues in 2020 is slightly high due to the Covid crisis that had relative impact on businesses that are not high-tech companies. In an examination of 2019 (that appears in Appendix 2), high-tech makes a significant contribution to the state and shows similar trends. Therefore, despite the deviation that exists in the 2020 data, this publication relates to this year because high-tech activity was not significantly affected by the Covid crisis, and continued to grow markedly, in the number of employees, the number of companies, and state revenues payments., the total tax liability from high-tech activity in Israel – both corporate and individual income tax – stood at 38 billion shekels. This sum relates to tax collection stemming from all components of employees’ salaries (including income tax, capital gains tax from options and stocks awarded to employees deducted by employers, NII payments, and health insurance payments for salaried employees) and from corporate tax payments.

The overall tax liability from high-tech activity in Israel has a direct and significant contribution to state revenues from individual income and corporate taxation: approximately 24% of the tax payments stemming from companies and salaries4In 2020, the state’s tax revenues from corporate tax, salaried employees’ individual income tax, and NII totaled 161 billion shekels. The parallel figure for 2021 stood at 185 billion shekels.. In total, state revenues stemming directly from high-tech activity in Israel equate to 9.2% of the state budget for 2020. This sum does not include state revenues that do not stem directly from work in high-tech companies5In 2020, the state budget stood at 410.8 billion shekels without the dedicated budget increment for Covid “Covid boxes” (84.8 billion shekels). https://main.knesset.gov.il/about/pages/budget/budgetinfo8.aspx, such as VAT payments on private consumption of high-tech employees.

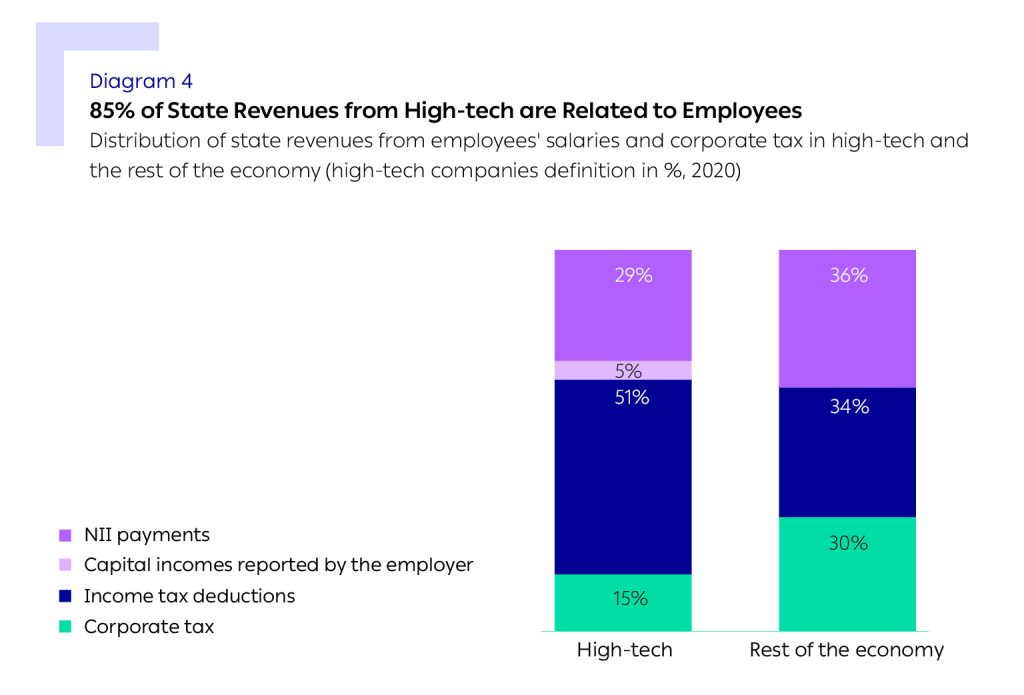

The direct contribution of the high-tech companies to state revenues relies to a large degree on taxation derived from the sector’s workforce. About 85% of state revenues stemming from high-tech in 2020 (32.5 billion shekels) were related to employees. In other words, the main revenues section impacting the state treasury which is related to high-tech will be influenced – either positively or negatively – by the number of people the companies employ in Israel and by the levels of their salaries. This sum also includes employees’ NII payments, most of which are paid for by the employers.

Only 15% of state revenues from high-tech companies stem from taxation directly related to the hightech companies (corporate tax).

Because most of the state revenues stemming from high-tech are related to the number of jobs in the sector, and because the number of jobs in high-tech and the sector’s average salary have increased in recent years, it can be assumed that tax collection related to high-tech in Israel increased between 2021- 2023. Moreover, in light of the rapid growth rate in the number of jobs and in salaries in high-tech, it can be assumed that the sector’s relative share of state revenues from taxation will continue to increase during the next tax years for which data will be published (2022-2023).

The distribution of state revenues from high-tech companies differs from that of the rest of the economy: in short, the revenues stemming from high-tech employees are significantly higher than the rest of the economy, unlike the low share of taxes stemming from the sector’s companies6In this context, we refer to tax collected directly from employees ior employers for employees’ salaries, such as NII payments. In contrast, indirect taxes (such as VAT, vehicle licensing fees etc.) collected as the result of high-tech employees’ consumption or service providers who earn money from the consumption of high-tech employees are not included in the calculation..

About 85% of the state revenues from high-tech companies in 2020 were related to their employees. Over half these revenues came from employees’ income tax deductions, 5% from capital gains tax (deducted by employers from profits on options or sale of shares), and 29% from NII payments (paid by the employee and the employer). The total state revenues from taxes related to high-tech companies’ employees stood at 32.5 billion shekels in 2020.

51% of the state revenues from tax collection in the high-tech companies stems from salaried employees’ income tax, compared to 34% in the rest of the economy, a difference that naturally stems from the high salaries in high-tech which incur high income tax payments.

In contrast, 15% of high-tech’s contribution to the state treasury stems from corporate tax, compared to 30% in the other sectors of the economy. This disparity stems from the fact that startups do not generally have profits on which tax is paid and, furthermore, since many high-tech companies benefit from reduced levels of taxation as part of the Encouragement of Capital Investment Law. The revenues from high-tech companies’ corporate tax totaled 5.8 billion shekels in 2020.

Another unique characteristic of the high-tech sector is the remuneration of employees via allocation of options or shares. In this report, due to a lack of available data, we refer only to state revenues from taxation on capital incomes reported by the employer i.e., incomes reported on employees’ pay slips. These incomes constitute 5% of state revenues from high-tech related to employees. Furthermore, there are additional state revenues not surveyed in this report, that stem from payments for capital gains when a liquidity event occurs (an “exit” or IPO) or upon sale of shares.

Israeli high-tech consists not only of Israeli companies but also of multinational technology companies. Despite their small number, the tax liability ascribed to foreign high-tech companies and their employees totaled 13 billion shekels in 2020, approximately 36% of the total tax liability of high-tech companies. Later in this report, we will refer in detail to the share of foreign high-tech companies and their employees in the pie of state revenues from taxes.

High-Tech’s Share of State Revenues by Categories

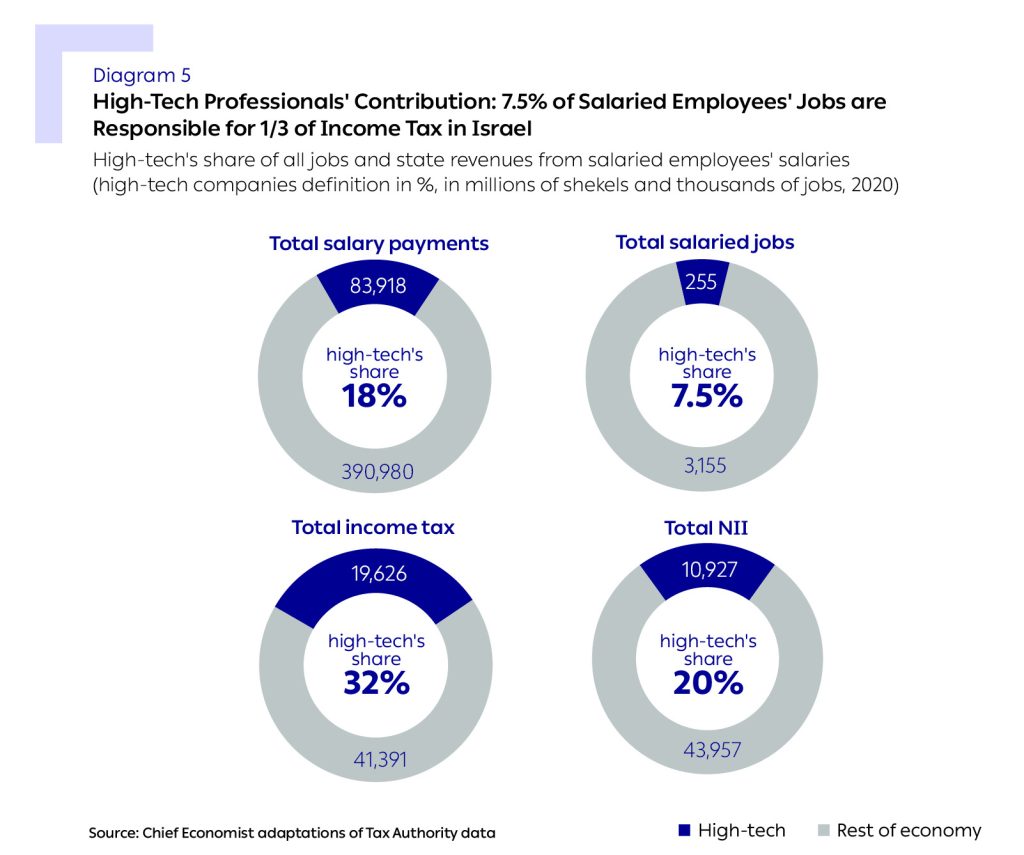

The progressive tax system applied to income tax in Israel means that high-tech employees are responsible for a larger share of income tax payments in Israel than their relative share of the labor market and of salary payments. 7.5% of the salaried employee jobs in Israel were in high-tech companies – and their employees were responsible for 32% of the country’s income tax payments in 2020. In other words, the share of high-tech employees’ income tax payments – that amounted to 19.7 billion shekels in 2020 – is four times larger than their share in the workforce (255,000 in 2020)7For explanations on the differences in calculating high-tech’s share of all jobs and salaried employees, see the Methodology Chapter..

High-tech employees’ share of income tax payments in Israel is higher than their share of salary payments (18% of all salary payments), as the result of the sector’s high salaries being taxed in the upper tax brackets. Nevertheless, high-tech employees pay 20% of NII payments (10.9 billion shekels in 2020, including employers’ contributions for health insurance and NII), because NII is a less progressive tax.

Average Tax Payment of the Employees in Israel

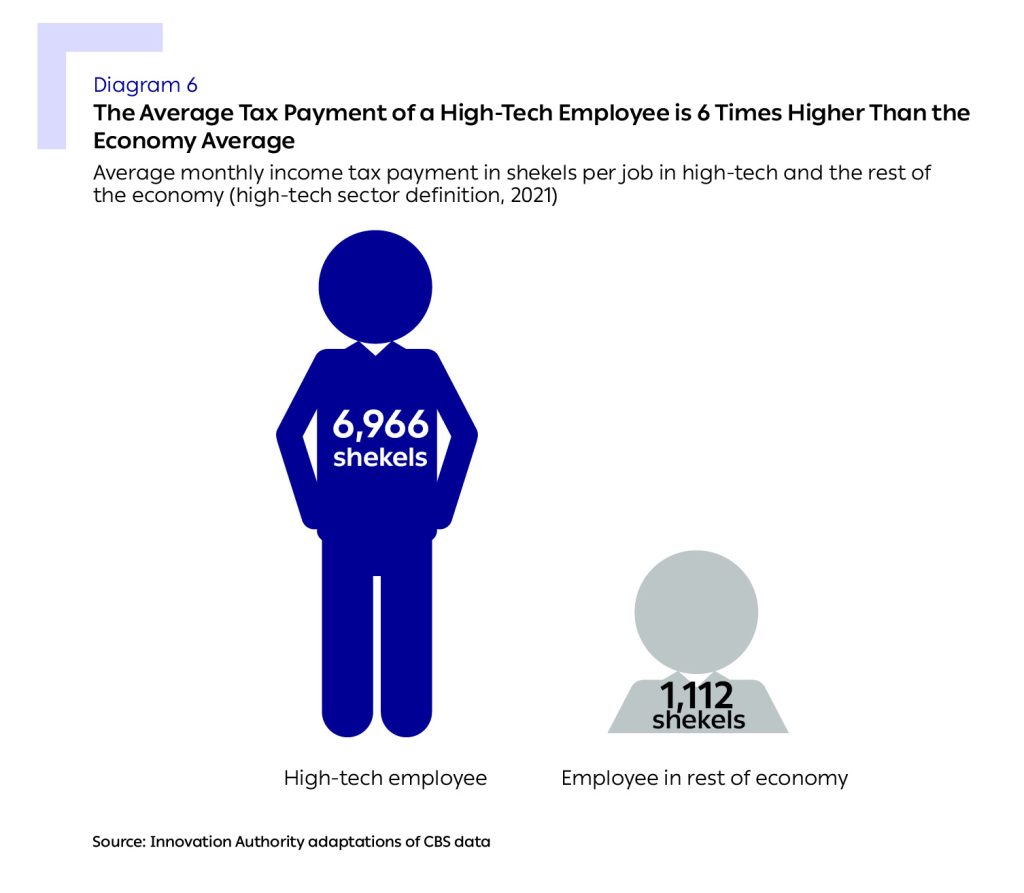

Beyond the high-tech sector’s contribution to collecting national taxes, we also examined its employees’ income tax payments individually according to various profiles. In 2021, the high-tech employee’s average tax payment was six times higher than the average of the rest of the economy: 6,966 shekels a month on average for a high-tech employee compared to 1,112 shekels in the rest of the economy. This sum refers to income tax collected and to capital gains tax and does not include other direct and indirect taxes paid by high-tech employees, such as NII, VAT, and others. The discrepancy in the average tax payment naturally results from the progressive taxation model employed in Israel and from salary disparities. The average high-tech salary in 2021 was almost 3 times higher than that in the rest of the economy, a ratio that is still valid today8According to CBS data, the average salary in a high-tech job in 2023 was 2.7 times higher than the salary for a job in the rest of the economy..

The High-Tech Companies’ Share and Contribution out of all Commercial Companies

As presented (on page 15), high-tech companies’ share of tax payments is low compared to companies in the other sectors of the economy. In this section, we present a more in-depth analysis of the high-tech companies’ tax payments to better understand the reason for this disparity.

According to the Tax Authority data, approximately 29% of the high-tech companies in Israel reported profits in 2020, compared to 47% of the economy’s other commercial companies. This difference stems, among other things, from the fact that a relatively large ratio of high-tech companies are in development and early growth stages, compared to the economy’s other companies, leading to these companies having expenses and development investments that are higher than their revenues (that sometimes do not yet exist). Nevertheless, the high-tech companies that did report a profit, reported relatively high profitability of 21% on turnover, compared to 14% on turnover in the other commercial companies.

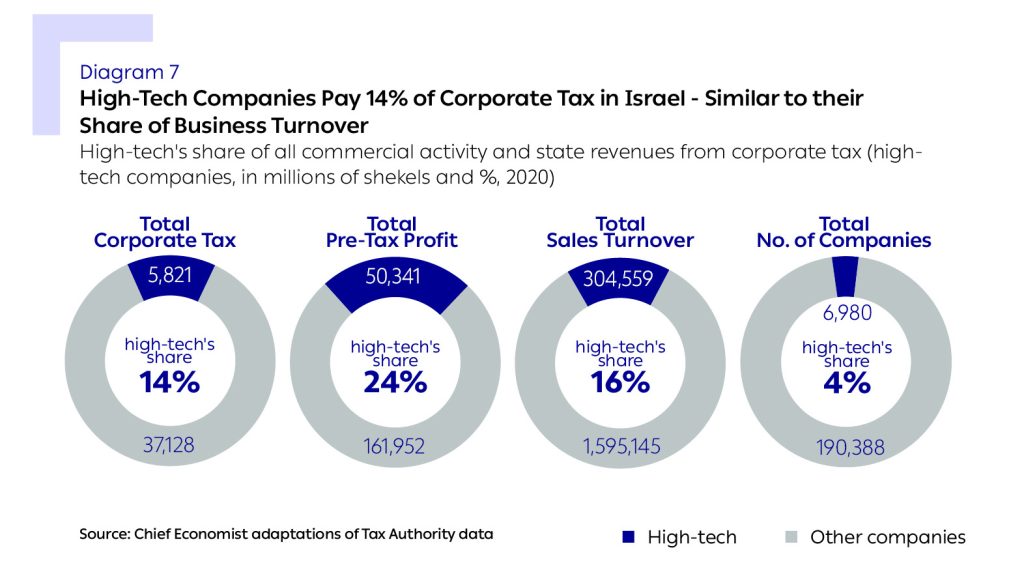

About 7,000 companies meet the definition of high-tech companies. In 2020, these high-tech companies constituted only 4% of all commercial companies in Israel but were responsible for 16% of commercial companies’ sales turnover (approx. 300 billion shekels) – 4 times higher than their relative share of the number of companies. Examination of the high-tech companies’ pre-tax profits (50.3 billion shekels) reveals that they constitute more than one fifth (24%) of all commercial companies’ profits, a significantly higher ratio than the numerical share of these companies. Nevertheless, the bottom line was that these companies pay 14% of all corporate tax in Israel – close to their relative share of the commercial companies’ turnover.

The contribution of high-tech companies to state revenues from corporate tax is relatively lower than their revenues and pre-tax profits. This is caused by the fact that the average tax rate paid by the high-tech companies on their profits is relatively low and stood at 12% in 2020. This compares to an average tax rate of 20% paid by all other companies. The low tax rate stems from the fact that many high-tech companies benefit from reduced tax rates as part of the Encouragement of Capital Investment Law. Consequently, high-tech companies’ tax liability is relatively smaller than their share of profits and totaled 5.8 billion shekels in 2020 (14% of the total tax liability of all commercial companies).

Development of Tax Payments from High-Tech Companies

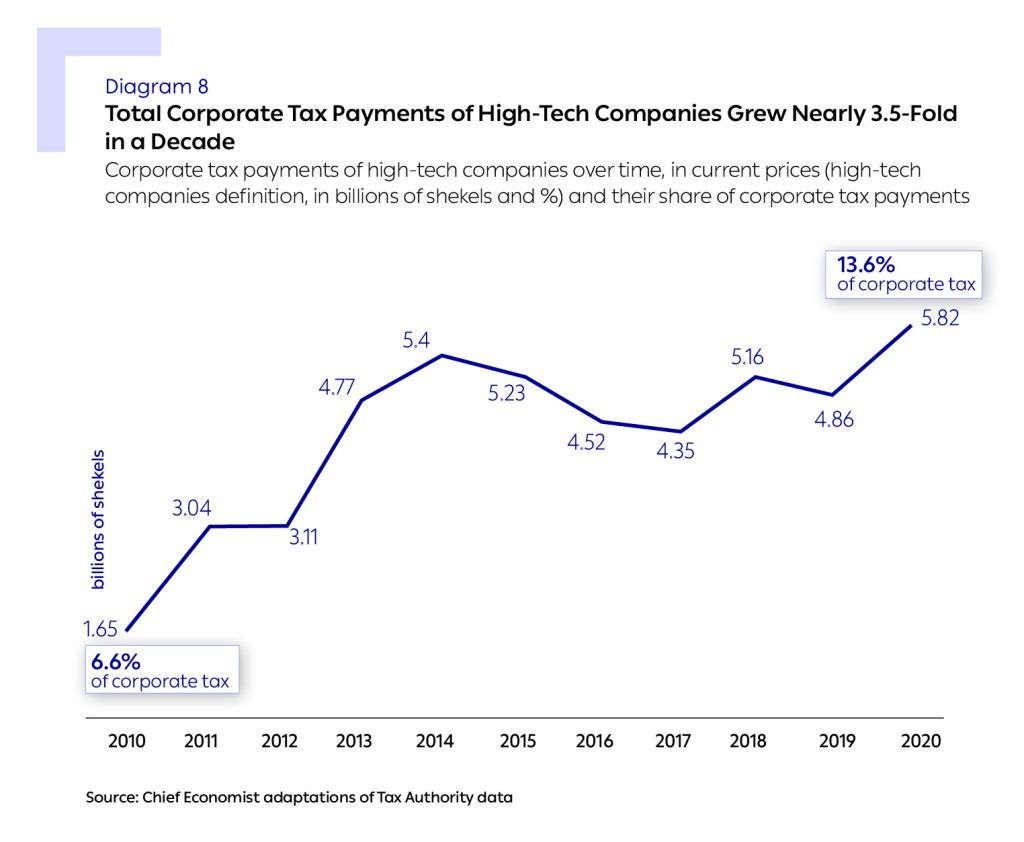

Within a decade, the total tax payments paid by high-tech companies has increased 3.3-fold from the total tax payments of 1.7 billion shekels paid in 2010. In relative terms, the rate of growth in corporate tax payments paid by high-tech companies was higher than that of commercial companies in the rest of the economy. Accordingly, the share of high-tech companies’ share of all corporate tax payments increased from 6.6% in 2010 to 13.6% in 2020. This increase stems from a growth in the high-tech companies’ business activity and cannot be explained as the result of changes in Israeli corporate tax policy during this period.

These figures illustrate the growing importance of high-tech employees’ share of income tax, NII and health insurance payments. In 2020, the total deductions from the high-tech employees stood at 32 billion shekels – 5.5 times higher than the tax collected from the high-tech companies in the same year.

The Impact of Growth in High-Tech Employment and Salaries on State Revenues

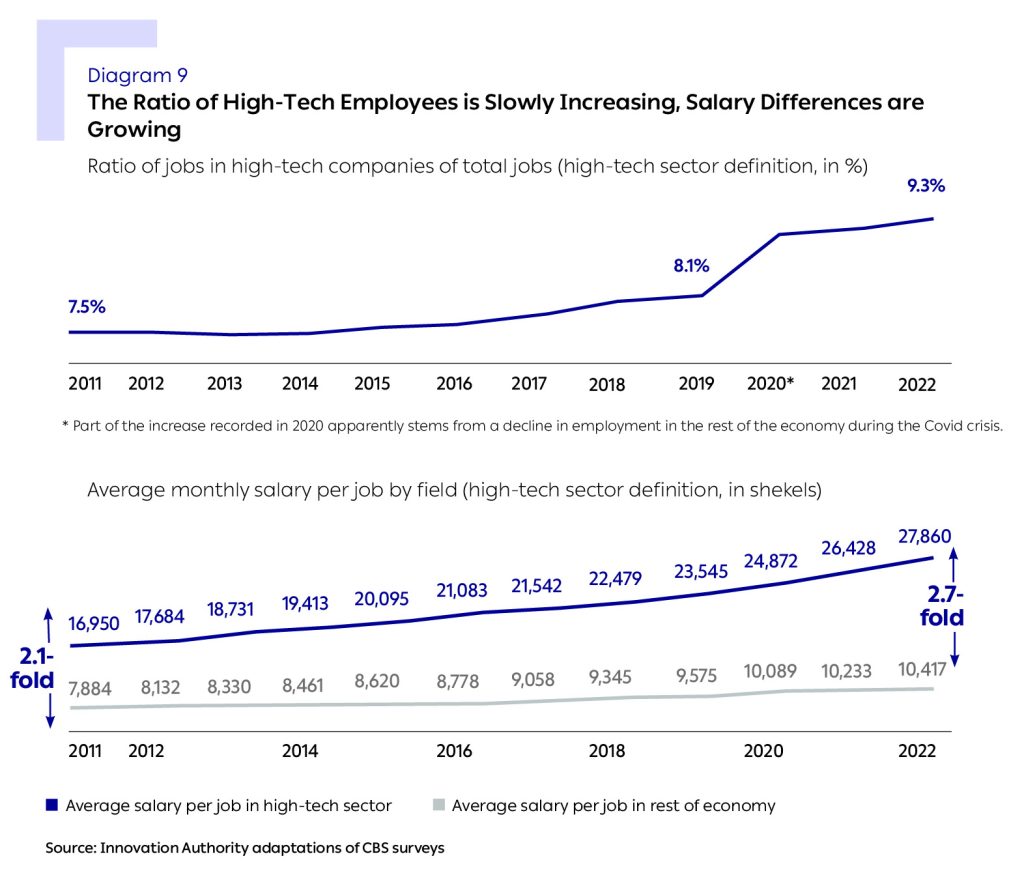

As presented in the Innovation Authority’s annual report “The State of High-Tech 2024“, high-tech was the fastest growing sector in the Israeli economy in terms of personnel over the past decade and grew 3 times faster than the other sectors. In total, there were 350,000 jobs in the high-tech sector in Israel – an increase of 28% since 2010. As a result, there was a growth in the relative share of jobs in the high-tech sector compared to those in the general economy.

According to other accepted definitions in the high-tech field (including the CBS definition of the high-tech sector which is based on personnel surveys and the tech jobs definition determined by the Perlmutter Committee for Increasing Human Capital in High-Tech), the number of employees is slightly different and their ratio is higher, but the trends of growth are common to the different definitions.

High-tech salaries also rose more rapidly than the increase in salaries in the rest of the economy. The average high-tech salary in 2022 was 27,900 shekels per job – 2.7 times higher than the economy’s average for that year. Salaries in the high-tech companies have risen by approximately 50% since 2010, compared to 20% in the rest of the economy during the same period.

The high-tech sector’s contribution to state revenues has grown in recent years against the background of two trends characterizing the past decade: a rapid growth in the number of the sector’s employees and increased salaries.

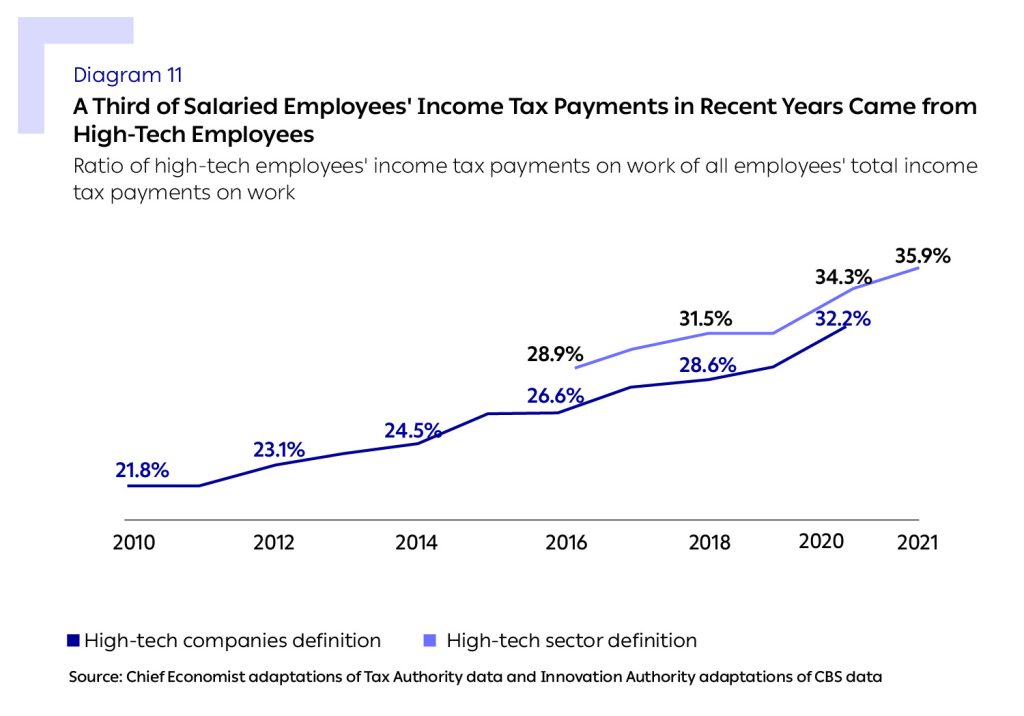

The growth in high-tech salaries and the number of the sector’s employees in recent years has increased the sector’s share in state revenues. The result is that changes in high-tech salaries or employment have a more significant impact than other sectors on tax collection in Israel. High-tech employees’ share of income tax payments in Israel has grown markedly within a decade and stands in recent years at one third or more of Israeli income tax payments9This finding is valid under both definitions examined in this report for analyzing the high-tech sector..

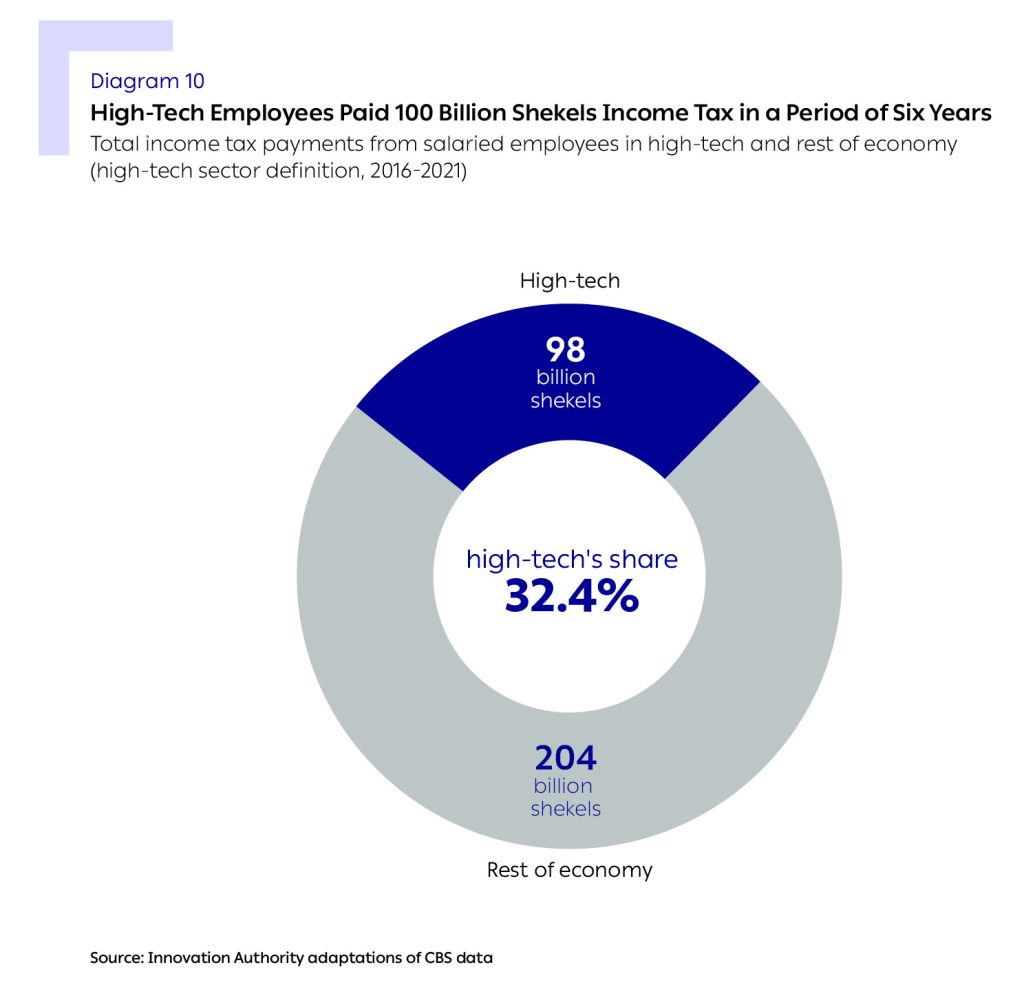

The high-tech employees’ share in the tax pie increased from 29% of all income tax payments in 2016 to 36% in 2021 – an increase of nearly 25% in five years. Regarding the sums collected from high-tech employees, they increased from 12.6 billion shekels in 2016 according to the high-tech sector definition10According to the 2021 “State of High-Tech” Report, high-tech employees paid 25% of all income tax payments in Israel in 2018. This figure is lower than that presented here, with the difference stemming from a change in the basis of counting that also included the holders of controlling interest in closely held companies., to 21.8 billion shekels in 2021 i.e., an increase of over 66% during this period. The tax payments of the employees in the other sectors of the economy increased by only about 21% during the same period, from 31 billion shekels to 39 billion shekels11A similar trend is reflected when using the high-tech companies’ definition. The income tax payments of the sector’s employees rose from 7.5 billion shekels in 2010 to 19.7 billion shekels in 2020 – an increase of 147% within a decade. The income tax payments of employees in the other sectors of the economy rose by only 45% during the same period, from 26 billion shekels to 41 billion shekels..

Between 2022-2023, the share of the high-tech sector’s employees in income tax payments has apparently continued to increase, because the growth in the number of high-tech employees continued at a faster rate than that of the rest of the economy, and their salary rose at a sharper rate compared to the economy’s average salary.

Capital Gains Tax Payments Related to Work in High-Tech

High-tech employers customarily award employees on all levels options and shares as part of their remuneration, in addition to their monthly salary. In liquidation events in private companies (mergers and acquisitions, initial or secondary stock offerings), the options are monetized for the company’s employees. Furthermore, some public technology companies – Israeli and foreign – also award employees shares. On liquidation events in private companies and when exercising shares in public companies, employees pay tax on capital gains stemming from work, in addition to income tax on their salary and payments to NII.12The capital gains tax figures refer to capital gains stemming from sales of securities by employees in a capital/benefit value track and do not include data connected to capital markets investments and other investment tracks not related to work.

In general, state revenues from capital gains of high-tech sector employees vary and are directly influenced by M&A activity and by prices of the public companies’ shares, more than the fluctuations in the income tax payments of the sector’s employees. This is because salaries tend to increase moderately and without sharp changes over time. Considering the fact that the years 2021-2022 were record years in terms of liquidation events of Israeli high-tech companies, it can be assumed that the sum paid for capital gains tax of salaried high-tech employees during that period was relatively higher than in previous years.

Most of the options and shares allocated to Israeli high-tech employees are awarded in a capital track.13According to Section 102 of the Tax Order. This means that the employees pay capital gains tax of 25% for this benefit, a level that is generally lower than the rate of marginal tax that they pay on their salary income.14The Tax Order stipulates tax directives in relation to allocation of securities to employees (shares or options) that include two main tracks: the benefit value track whereby the employee is taxed on the benefit with a marginal tax rate of up to 47%; and a capital track where the tax rate is 25% (excluding surtax). It should be noted that in the capital track, in the event of allocation of a public company’s securities, part of the benefit component will be taxed with benefit value tax.

Due to the limited data, it is impossible to precisely estimate the state revenues stemming from high-tech employees’ capital gains tax payments. The Ministry of Finance will publish a future clarification on this matter. Nevertheless, it should be noted that part of the taxation on options and shares of high-tech companies’ employees is deducted by their employer via their pay slip (in the capital track). These deductions totaled 1.7 billion shekels in 2020.15The estimation is based on data from the large trustee portfolios. This chapter only surveys the capital gains for salaried high-tech employees, not including the entrepreneurs. This tax payment reflects high-tech employees’ income from options and shares from which tax was deducted by employers of 7.4 billion shekels in 2020.

Furthermore, some of the high-tech employees’ options and shares are held by trustees. As noted, it is impossible to precisely estimate the state revenues stemming from high-tech employees’ capital gains tax payments on options and shares held by trustees. Details on this subject will be published in a separate report.

Summary: State Revenues from Work and Companies in High-Tech

To summarize this section, high-tech’s significant contribution to the national economy stems primarily from payments related to the sector’s employees. Thanks to the progressive tax structure in Israel, the tax payments stemming from high-tech employees’ income tax and NII payments are larger than their relative share of the population of salaried employees in Israel.

As noted, 40% of the tax collected in Israel stems from payments related to employees and companies and totaled 200 billion shekels in 2021. Of this sum, the portion examined in this report stood at 185 billion shekels.16Approx. 15 billion shekels collected to the state coffers in 2021 were income tax revenues not stemming from salaries (e.g., for pension payments). High-tech’s share of this sum is estimated at 24%. High-tech employees’ share of income tax payments is 33% while their share of NII payments stands at 21%. Moreover, 12% of corporate tax payments stem from high-tech.