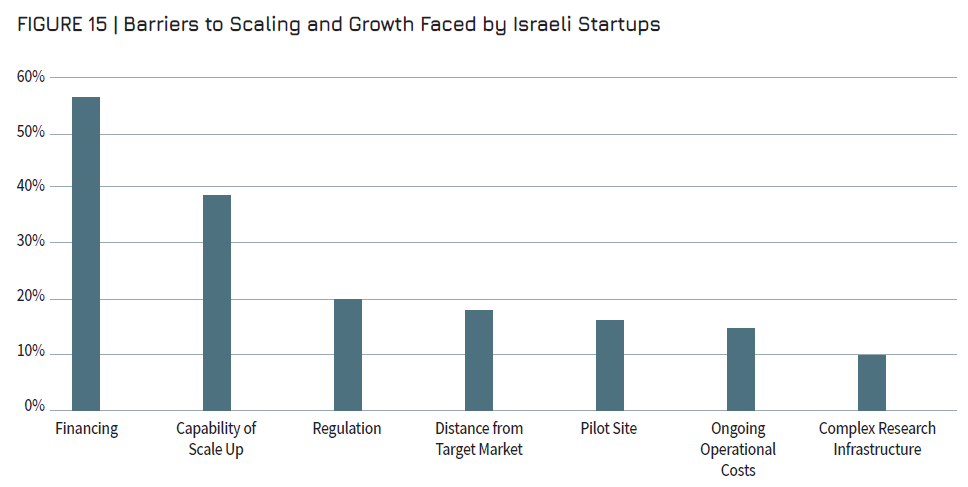

Climate tech startups face unique scaling challenges. They are mostly deep tech, requiring expensive physical assets and equipment, are capital intensive, and have long-term horizons for development from the initial proof of concept stage until commercialization. Until this endpoint, startups need to establish pilot demonstrations and are challenged by the extended period needed to progress from a pilot plant to the sufficient scale and competitive costs required to reach commercial viability. Solutions often address systemic challenges, requiring a collective effort and collaboration between various private and public stakeholders, as well as cross-disciplinary and intersectional thinking. Climate tech solutions can incur both market and technology risks, making the provision of scale-up capital from growth investors a double challenge. A survey conducted among 210 Israeli climate tech companies revealed the main difficulties faced by Israeli companies during their development and growth stages. The distribution of respondents across PLANETech challenge areas was very similar to their distribution among the full data set of climate tech startups, indicating that the respondents were an accurate representation of the broader startup ecosystem. Alternative Proteins was the only sector under-represented in the survey.

The two primary self-reported difficulties (out of the 13 proposed) were Financing and Capability of Scale Up, followed by Regulation, Distance from Target Market, Pilot Site and Ongoing Operational Costs, in that order.

The three most highly cited difficulties are identical to those reported in 2021, although the number of startups affected by each differs. Financing still dominates but was reported as a main challenge by only 57% of the startups compared to 72% in 2021. Capability of Scale Up increased, being cited by near 40% of respondents compared to 28% in 2021, while Regulation was reported by only 20% of the startups, compared to 30% in 2021 (Figure 14).

The startups responding to the survey were from the pre-seed stage through to Round C, as well as public companies. The lack of funding is more prominent for early-stage companies (pre-seed, seed, and Round A) whereas Capability of Scale Up and Regulation are cited more frequently by companies from Round B and onwards. The lack of Pilot Sites is mostly faced by pre-seed and seed companies.

The predominant barriers faced are distributed somewhat similarly across companies of each challenge area.

Interestingly, the only challenge area with a clearly different pattern was Carbon Management, Risk and Finance where the main challenge faced is Distance from Target Market. This is consistent with the fact that startups in this challenge area are generally software-based digital platforms which are easier to fund due to their low capital intensity, are more straightforward to scale due to shorter development duration, and have little need to navigate regulation.

Over 80% of the startups have hardware at the core of their innovation. 29% are developing a hardware-only product, 53% a product that combines both software and hardware, while 18% are solely software. The two challenge areas which are dominantly software are Carbon Management, Risk and Finance and Earth Observations, the former developing digital platforms and the latter, for the most part, utilizing datasets acquired by existing hardware instrumentation run by third parties.

Respondents were asked to detail gaps in local connections and services. Answers were varied and often related very specifically to a startup’s focus and unique experience. Nevertheless, a recurring theme cited was the lack of knowledge and experts in the startup’s domain (industry, scientific and research experts), as well as the limitation of a small market and the lack of pilot sites.

An indicator of the evolvement of Israel’s climate tech ecosystem is the startups’ increased capabilities to quantify the reduction in GHG emissions implementation of their product. 54% answered positively in this regard, compared to only 33% in 2021. Moreover, a further 24% can provide a preliminary assessment. Only 7% reported that they were unable to provide an assessment.1The remainder are either targeting climate adaptation or are enabler technologies for which it is more difficult to attribute the contribution to emission reductions.

Proliferation of Israeli Climate Tech Innovations in Global Markets

Of the survey respondents, 80% already have a product being used, piloted, or have agreements for its future use. The Israeli market is the most prolific, with nearly 80% of the startups operating within its borders, meaning that around 20% do not target the local market at all. This can likely be attributed to the size limitations of the local market, leading to an early global “Go to Market” strategy as well as many of the innovations’ compatibility to specific target markets. The penetration of global markets is impressive and Israeli climate tech innovations can be found worldwide, predominantly in North America, Europe and Asia, followed by South America, Africa, Australasia and Central America (listed by the number of startups active in each region).

Figure 15 displays the geographic markets of the startups participating in the survey by specific countries, and the number of startups active in each country. Around 45% of the startups are active in the USA. The leading European markets are Germany, Italy, and Spain, with approximately 23% of the startups active in each. Canada has a similar representation of Israeli startups (23%). The leading markets in Latin America are Mexico and Brazil (14%), while India (15%) and South Africa (15%) lead in Asia and Africa, respectively. Australia is also a target market for 15% of the respondents.

Over 20% of the startups are active in at least 10 countries, and the median number of countries in which a startup is active is 4.