Government Approves Transformative Stimulus Package to Boost Israeli High-Tech Industry

Israel Innovation Authority to launch a set of programs to accelerate and strengthen Israeli high-tech

The Israeli government, in collaboration with the Ministry of Finance and the Israeli Innovation Authority, announced today that it has approved a transformative stimulus package aimed at elevating Israel’s standing as a global high-tech hub. A result of exhaustive deliberations by the Budget Division in the Ministry of Finance and the Israel Innovation Authority, the multifaceted stimulus plan will include several key initiatives aimed at bolstering Israel’s high-tech ecosystem

- Revolutionary Startup Fund: A new startup fund will be launched that will collaborate with private investors to inject over half a billion shekels annually into seed, pre-seed, and Series A rounds for startups with limited access to capital. This fund will strategically focus on startups exhibiting technological depth and breakthrough innovation.

- New YOZMA Fund (Institutional Investment Catalyst): An investment fund will be established to encourage Israeli institutional entities to invest in Israeli venture capital funds, utilizing a Fund of Funds model. Over 4 billion shekels will be invested jointly over a 5-year period, bolstering the high-tech ecosystem.

- New Venture Creation Incubators’ Fund: An innovation fund will be set up with an advanced investment model, featuring a tender process that allows international companies to participate. This includes the establishment of innovation incubator hubs in a venture creation model providing financial backing, enhancing global collaboration in deep-tech technological vectors.

The stimulus package is builds on recent initiatives such as the Fast Track investment program, angel investor clubs, regional-technological innovation hubs, and the doubling of grants for the Ideation program (Tnufa Fund), and more.

Minister of Finance, Betzalel Smotrich: “”Israel’s security challenges demand a budgetary focus from us, but we are determined to invest in growth engines. The Israeli high-tech sector is the engine leading the economy, and we are giving it exactly the boost it needs at this time. The program we are launching today will enable direct funding for young tech companies with a short runway and will provide a significantly larger injection of around a billion dollars to Israeli venture capital funds by offering incentives to institutional entities. All of these measures will facilitate the expansion of capital availability to the sector and strengthen its stability by increasing the weight of local capital. Additionally, we are working to diversify the tech sector by providing direct support to disruptive startups. Alongside these initiatives, we are launching a program to counter “brain drain” by offering research grants to outstanding Israeli researchers. This program will allow us to turn the current crisis into an opportunity during these challenging times. I believe in Israeli high-tech, in the people of the Israeli high-tech, and I am confident that the Israeli startup nation will continue to be a global leader.”

Minister of Innovation, Science and Technology, Ofir Akunis: “This decision is a monumental milestone for the Israeli high-tech sector. At the beginning of our term, we promised that new investments with government support would grow to fuel the engine of Israeli economic growth. We made a promise, and we are keeping it. The decision to increase the budget of the Innovation Authority, aimed at encouraging investments in Israeli high-tech, is crucial beyond measure. It sends a message to the Israeli industry and foreign investors worldwide that we are committed to fostering the Israeli tech sector.”

Dror Bin, CEO of the Innovation Authority: “This is the plan that the Israeli economy needs! The high-tech sector is our natural resource, and we are determined to do whatever is necessary to ensure its strength. The ability of the Israeli economy to emerge from the crisis largely depends on the establishment of more startups, the continuous growth and sales of tech companies, ongoing investment attraction, and the solid foundation of the Israeli economy continuing to provide support and a leap forward in the future. Over the years, the Israeli economy has dramatically relied on this growth engine, which is both an advantage and a disadvantage for it: If the high-tech sector flourishes, the country thrives, and if it contracts, the entire Israeli economy will follow suit. The decision made this morning to embark on this ‘boost program’ is a strategic decision that will bear fruit for the next decade. We have identified two key challenges for the high-tech sector today: first, a consistent decline in the number of new startups opening each year in Israel and a decrease in their diversity (focusing on software domains); and second, a sharp decline in investments in the last quarters and a high dependence on foreign capital. The program we are launching today will provide a meaningful response to these challenges and assist the Israeli high-tech sector in emerging stronger from the current crisis, as has happened in previous downturns.”

Meeting Global and Local Challenges

Building on recent initiatives, the Israel Innovation Authority has committed to a series of new integrated measures. These will specifically address challenges within the Israeli high-tech industry, ensuring empowerment and bolstering global competitiveness with other innovation hubs. The newly launched programs will replace some of the Innovation Authority’s existing programs, providing response to various challenges faced by the Israeli high-tech industry.

Against the backdrop of the current period’s challenges, the Israel Innovation Authority together with the Finance Ministry’s Budget Division is launching a range of tailored programs, focusing on meeting challenges faced by the Israeli tech ecosystem, creating conditions that foster establishment of larger number of startups in more diverse subsectors, reversing declining private investments, and reducing dependence on foreign investors. This strategic approach aims to ensure the continued growth of the sector, vital for the Israeli economy, and strengthen its competitive position against other global innovation hubs.

Guidelines for The New Israel Innovation Authority Investment Programs

The plans have been carefully crafted in response to both global and local factors that characterized 2023. Influential global events, such as the ongoing wars, both at home and abroad, and resulting impacts on energy prices and inflation, alongside local challenges related to political and security instability, have shaped the guiding principles of the new investment plans.

These innovative and far-reaching measures are set to replace existing investment programs, addressing the evolving challenges faced by the Israeli high-tech industry. The comprehensive approach comes after a detailed examination revealed a concentration of investments in specific areas and a minority of investors specializing in non-ICT (software, cyber, fintech etc.) fields in recent years.

Global and local events, alongside long-standing trends, have led the Israeli high-tech sector to face several key challenges today:

Current State of the Quantity and Diversity of Israeli Companies

- Persistent decline in the number of new startups established each year.

- Increasing concentration of investments in software companies, with a reduction of investments in deep technology fields.

- Rise in the registration rate of Israeli companies abroad.

Investment Challenges

- Decline in venture capital investments in Israel.

- Significant dependence on foreign capital, constituting approximately 80% of the total venture capital in Israel.

This list of challenges is not isolated and essentially characterizes venture capital investments globally. In short, the situation is a result of significant market failures in the venture capital investment sector in non-developed capital markets, based on knowledge gaps regarding the quality of companies between entrepreneurs and investors. In Israel, the situation is exacerbated by two factors: high reliance on foreign capital for startup investments, mainly American capital, and the lack of a systematic risk management policy. Heavy reliance on foreign capital makes leaves Israel more vulnerable to a rapid and higher reduction in investments in the event of a global crisis compared to what may occur in the United States[1].

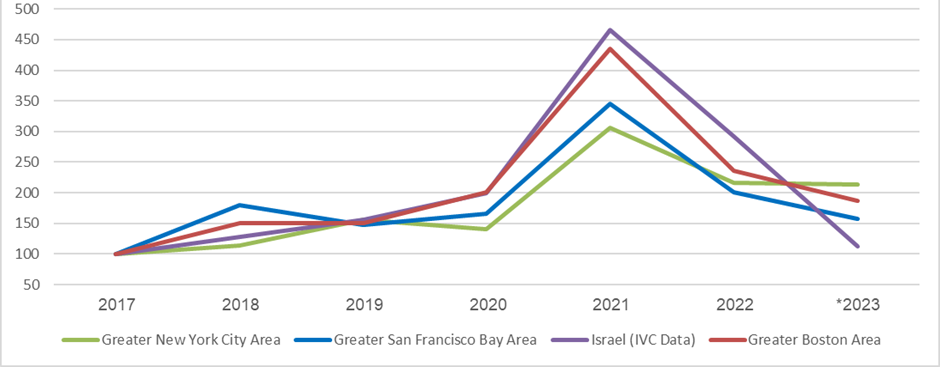

Changes in the amount of venture capital investments in Israel and innovation hubs in the U.S over time (2017 as the base year):

As can be seen, the fluctuations in startup investments in Israel, compared to major hubs in the United States, such as San Francisco, New York, and Boston, are higher[2]. This volatility is explained, among other factors, by the fact that the majority of investments in Israel come from foreign investors, whose crisis concerns narrow investment, and also because the size of the market makes it more sensitive to fluctuations in investments. Thus, the total known investments in Israel in 2023 stand at around $7 billion. This figure represents only about 10-15% of the total investments in the major hubs in the United States; San Francisco and New York, and less than a third of the total investments in Boston.

Within the framework of the initiative, the following funds will be launched:

Funds meeting the challenges of quantity and diversification of companies:

- Establishment of a Startup Fund valued at NIS 500 million a year

This fund aims to assist in the establishment and funding of early-stage deep-tech companies at various development stages, from ideation to growth, in sync with the market. The fund will focus on early-stage development in areas with extensive R&D, presenting a high level of risk with challenges related to private capital availability. The new fund will involve the Innovation Authority in all investment rounds, from pre-seed through seed to Series A, with joint investment alongside venture capital firms or private investors, aiming to reduce risk for investors and encourage investment realization. Companies can apply for funding to the Startup Fund with or without a signed investment agreement. Companies approved without an investment agreement will have a limited time frame after the Innovation Authority’s funding approval to raise the additional required funding in the private market.

The goal is to provide robust funding suitable for the company’s development stages, enabling companies to reach the next funding milestone (in contrast to smaller rounds that do not sufficiently advance the company).

The Fund includes three main investment programs:

- Pre-Seed Program: Israel Innovation Authority grant covering 60% of the total funding round, capped at NIS 1.5 million, with a budget ceiling of NIS 2.5 million.

- Seed Program: Israel Innovation Authority grant covering 50% of the total investment round, up to a grant cap of NIS 5 million, and a budget ceiling of NIS 10 million.

- Round A Program: Israel Innovation Authority grant covering 30% of the total investment round, with a grant cap of NIS 15 million, and a budget ceiling of NIS 50 million.

Companies with founders from underrepresented populations or predominantly operating in Priority Area A will receive an enhanced grant in various programs.

- Updated Tnufa Fund

The fund grants approximately 100 entrepreneurs each year with breakthrough ideas a grant of NIS 200,000 to promote idea development, initial prototyping, preparation for the Proof of Concept (POC) stage and initial funding. Unlike other Israel Innovation Authority investment programs, Tnufa is available for independent entrepreneurs even prior to the establishment of a company. The updated program was expanded from a total grant of NIS 100,000 that allows for two applications per cycle, to a total budget of NIS 250,000 per single application, at a grant rate of 80% (NIS 200,000). Moreover, the application process has been streamlined.

- Establishment of New Innovation Centers Nationwide

Nine new innovation centers will be established across the country, from north to south. Through a competitive process, nine winners were selected, combining Israeli and foreign corporations, investors, regional clusters, and associations throughout the periphery, aiming to promote the ideation and growth of startups with strong regional connections and foster high-tech employment in those regions. Among others, new centers were selected in the Upper Galilee, the Kinneret region and the valleys, the Negev, Eilat, and the Gaza envelope. The centers selected to focus on high-tech sectors with substantial global potential, while leveraging the region and Israel’s competitive advantages such as innovative agriculture technologies (Agritech), food (Foodtech), renewable energy, environmental construction, water technologies, response to the climate challenges and desertification (Climate-tech) and health (Health-tech).

The joint investment in the new innovation centers, shared by the Innovation Authority and several government offices participating in the program, will amount to approximately NIS 100 million over a 5-year period.

- Incubation Fund

A new investment model for the establishment of new Venture Creation entities. A tender will be published in the coming months, allowing international entities to participate. The fund has two main goals: first, to promote the establishment of new companies in the Deep-Tech fields based on research and in-depth knowledge with significant business potential; second, to assist in creating new and large Venture Creation entities in Israel, in partnership with major international financial entities, developing and establishing Deep-Tech companies that can grow and develop independently while raising the required capital for their growth in these areas. Winning entities in this competitive process will gain significant participation, of up to NIS 40 million (about $10 million) over a 5-year period, in the operational expenses of the incubator and the establishment of a central laboratory for the use of the incubated companies. Additionally, companies established by these entities can also receive direct funding through the previously mentioned Startup Fund, throughout the company’s lifecycle, via competitive process with other companies applying for investment. It is estimated that these entities, once established through the tender, will create dozens of new companies in Israel and will continue their significant investment activity even at the culmination of the franchise period.

Initiatives to Tackle Investment Challenges

- 2.0 Yozma Fund:

Establishment of the “Yomza (Initiative) Fund” for co-investment alongside Israeli institutional investors in Israeli venture capital funds, with the aim of expanding funding availability for the Israeli venture capital market in the coming years and increasing local capital’s influence and stability.

The fund’s goal is to increase the share of local capital in the Israeli high-tech sector, intending to reduce dependence on foreign capital and thus enhance the stability of the Israeli venture capital market, with a focus on times of crisis. The plan is expected to inject approximately one billion dollars into Israeli venture capital funds in the years 2024-2026. It should be noted that the investments conducted by the institutional investors will be autonomously managed with no government intervention other than the initial approval provided to the Israeli venture capital funds.

The investments of the 2.0 Yozma Fund 2.0 are expected to take place in two rounds, with the government commitment towards institutional investors at a ratio of 0.3 government dollars for every 1 institutional dollar. The first round, with a combined institutional and government investment of $700 million, is expected to commence in the third quarter of 2024. The second round, with a combined institutional and government investment of $300 million, is expected to start in the first quarter of 2026. Thus, the government commitment is expected to exceed NIS 800 million.

The structure of the government commitment creates a dual incentive. Firstly, it encourages institutional investors to enter the venture capital market by providing government matching and additional yield on government funds. Secondly, it reduces uncertainty in the process of establishing venture capital funds and raising their capital since it generates significant anchor investors in the form of institutional entities alongside the government. This, in turn, incentivizes additional private investors to participate in the funds. The estimated leverage of the dual commitment amounts to around $4 billion.

- Angel Investor Clubs

The Israel Innovation Authority will fund up to three private investment clubs (for Angels) that will operate to establish platforms for private investors to join forces, synchronize investments in early-stage highly innovative technological ventures, provide them with support and additional value in business and management knowledge. Additionally, the Clubs will assist investors with the legal and financial aspects required, including familiarity with the Law for Encouragement of Industry Knowledge, ratified last July, which includes significant tax benefits for private investors in startup companies. Moreover, the networks will support companies in the submission processes of the Innovation Authority’s funding programs or the examination of the required private funding in approved companies. The total investment in this program amounts to approximately USD 9 million over three years period. The networks established under this program aim to attract private investors from Israel and around the world, enabling them to join forces and invest in Israeli startups with high technological depth in the pre-seed and seed stages, all while leveraging the support provided by the Innovation Authority’s fund.

- Knowledge Intensive Industries Law

The law, approved in July 2023, grants tax benefits to investors in Israeli high-tech companies in the pre-seed and seed stages with the aim of increasing the share of Israeli investors in the high-tech sector. It provides benefits for Israeli companies acquiring other technology companies, as well as benefits for Israeli companies receiving funding from foreign entities. The first part of the law grants a benefit that allows an investor who made an investment in an R&D company to receive a tax credit, deferring some of his tax payments until he sells the company’s stocks. The second part grants a benefit allowing investors who sold stocks of an Israeli R&D company not to pay tax at the time of sale on the capital gains or exit, but rather to invest in another Israeli company within 12 months from the date of the sale of the stocks. The third part grants tax benefits to Israeli high-tech companies acquiring other technology companies. These companies can deduct the purchase amount from the preferred technological revenues, thereby paying less tax. In other words, their investment will be considered an expense for tax purposes. The rationale is to encourage Israeli companies to grow and thrive in Israel and not sell their activities or merge with international companies.

In addition to the above, the Fast Track program launched in recent months will continue to operate to assist startups facing financial difficulties due to the war.

The Fast Track channel began operating less than a month after the start of the war to assist early stages high-tech companies with sufficient cash reserves of less than six months (Runway) and significant technological and/or business assets to survive the war until they can complete a full funding round. So far, about NIS 200 million has been distributed to approximately 120 companies via this program, and an additional NIS 200 million are expected to be distributed by the end of its activity in March 2024.

All of this complements the national programs for artificial intelligence, bio-convergence, and quantum computing, whose budgets were unaffected and are intended to prepare the new Israeli innovation hub for the next technology trends.

[1] Bernstein, Shai, Josh Lerner, and Filippo Mezzanotti. “Private Equity and Portfolio Companies: Lessons from the Global Financial Crisis.” Journal of Applied Corporate Finance Vol. 32, 3 (2020);

Bernstein, Shai, Xavier Giroud, and Richard Townsend. “The Impact of Venture Capital Monitoring.” The Journal of Finance (2015)

Chen, Henry, Paul Gompers, Anna Kovner, and Josh Lerner. “Buy local? The geography of venture capital.” Journal of Urban Economics (2010).

Bai, Jessica, et al. Public entrepreneurial finance around the globe. National Bureau of Economic Research, 2021.

[2] The investment data in Israel is based on the data foundation IVC and includes all known investments as of January 4, 2024. The total investments in American startups in 2023 are calculated as an extrapolation of the sum of investments in the first three quarters from the CrunchBase database