Preliminary survey on the state of high-tech since the war broke out

Date :

23/10/202

Israel Innovation Authority and SNPI Institute publish a preliminary survey on the state of high-tech since the war broke out

Israel Innovation Authority and SNPI Institute publish a preliminary survey on the state of high-tech since the war broke out:

Seventy percent of the companies report that their operational continuity has been affected due to a significant portion of their employees being called up for reserve duty

Dror Bin, CEO of the Israel Innovation Authority: “The slowdown in capital-raising processes, along with employees’ call-up to reserve duty because of the war, pose a challenge to a significant number of high-tech companies. It was important to us to do an up-close “pulse check” of the industry, and we immediately realized that our findings demand action. This preliminary survey follows up on many deep conversations we have had since the war broke out. They indicate a significant number of high-tech companies with a short Runway for whom the war has delayed or stopped their capital raising round. This means that there are companies in danger of being closed within the next few months. This is why we came out with a rapid bridging channel (the “Fast-Track”), with an initial scope of NIS 100 million, intended to provide a rapid cash flow, both by the Innovation Authority and by private investors, in order to extend these companies’ runways. We will continue monitoring the high-tech industry and will continue to meet needs as they develop throughout the ongoing military conflict and after it. This is the time for the Authority to work closely with the industry and for maximal flexibility of our investment tools in order to adapt them to companies’ real needs in the current situation. We will do everything in our power to ensure that in this crisis, as in previous crises, Israeli high-tech will come out stronger than ever.”

Uri Gabai, CEO of the research and policy institute SNPI: “In these difficult days that Israel is facing, the war is also leaving its mark on the Israeli economy, which appears to be facing a severe crisis. We must remember that recovering national resilience includes, alongside the security aspect, economic rehabilitation as well. High-tech is the leading sector of the Israeli economy and returning it to growth as rapidly as possible is not only vital– it’s absolutely necessary. Over the years, one of Israeli high-tech’s strong points has been that it is based on the entrepreneurial culture, with hundreds of new start-ups established every year — but in a period of security-related and economic instability, start-ups are also the most vulnerable. To make sure that the local high-tech industry survives the challenging period before us, we will continue to closely monitor the difficulties and challenges arising in this period, with the goal of leading the Israeli economy forward.”

Background:

The “Iron Swords” war which broke out over two weeks ago has already begun to leave its mark on the Israeli economy. Following the many fluctuations of the past year, the weakening of the shekel and the beginning of Israel’s negative monitoring by the rating agencies may indicate the beginning of an economic crisis whose force is still unknown. The critical role of the high-tech industry in the Israeli economy has become more important than ever during these times — both for restraining the crisis and for the speed of recovering strength on the day after.

Israeli high-tech entered this period at the lowest point we have seen in years. Even before the war broke out, for the past year and a half, negative trends have been observed in all aspects of the Israeli high-tech industry, including capital raising and establishment of new companies. This is due in part to the global recession, as well as to the social and political instability in Israel. The current war naturally adds more uncertainty to the Israeli innovation ecosystem and threatens to affect the stability and economic resilience of the entire country.

Survey of the state of high-tech:

To identify the needs of Israeli high-tech companies and start-ups in dealing with the difficulties posed by the war, the Innovation Authority and the research and policy institute SNPI conducted an initial declarative survey to evaluate the challenges facing the companies and their needs at this time. A similar survey will be disseminated later for the purposes of monitoring the state of the industry and finding appropriate solutions for Israeli high-tech.

About five hundred high-tech companies and start-ups responded fully to the survey, from various sectors and at various stages of raising capital. It is important to note that the survey is not a random sampling of companies: all high-tech companies were invited to respond, but it can be assumed that those companies in greater distress had more motivation to respond. Nevertheless, the respondents do constitute a representative sample of the high-tech sector regarding company size and stage of capital raising. Thus, it can indicate trends and the types of difficulties the companies are facing, as well as how these difficulties vary according to the company’s stage of capital raising.

Survey data, Israeli high-tech affected across the board:

As part of the survey, companies were asked about the main challenges they are facing in the wake of the war, with these challenges being divided into several categories. The first category, human capital challenges, focused on its effect on the company’s functional continuity due to a significant portion of their employees being called up for reserve duty. Another category, financing, focused on the cancellation or delay of investment agreements and the difficulty in reaching investors.

Cross-referencing companies’ reports on human capital and financing challenges creates a picture of comprehensive effect on the Israeli high-tech– more than 80% of the companies reported damage resulting from the security situation. Over a quarter of the companies reported double damage, both in human resources and in obtaining investment capital.

The most significant effect has been in terms of employees: 70% of the companies report damage to their functional continuity due to a significant portion of their employees being called up for reserve duty. There are repeated reports of reduced functionality even for those employees who are not in reserve duty, either due to a lack of framework for their children or due to emotional preoccupation.

Israeli high-tech has also experienced significant damage in terms of financing, an essential resource for companies’ existence. Over 40% of the local companies reported cancellation or delay of an investment agreement. This number is even greater among companies in danger of immediate closure (up to three months runway), where over 60% reported damage to their funding, and only 10% are managing to have meetings with investors. Of course, one must take into account that the shorter a company’s runway, the more frequently it is likely to hold meetings with investors, and accordingly the greater risk of such meetings being cancelled due to the war.

The uncertainty and the resulting decision of many investors to “sit on the fence” due to the current situation hits an ecosystem that was already struggling to raise capital, partially due to the political instability on the eve of the war, combined with the worldwide economic recession.

Although an evaluation by a company’s most recent stage of investment shows, not surprisingly, a higher number of early-stage companies who experienced cancellation or delay of an investment deal due to the war (47%), there is also a significant number of late-stage companies in such a situation. About 30% of companies with a round B or higher reported a similar challenge, despite their being more mature companies with reduced risk and a richer history of investment.

Likewise, over 70% of the respondent companies reported postponement or cancellation of orders and significant projects. The inability to conduct pilots and clinical trials or to advance important R&D projects, alongside difficulties in exporting and importing from abroad, indicate broad damage across a diverse range of Israeli high-tech companies. About two thirds of the companies reported technical and operative problems connected to the war situation. Many companies state that the challenge is not only regarding clients and partners from abroad, but mainly regarding Israeli clients who themselves are freezing their own activity.

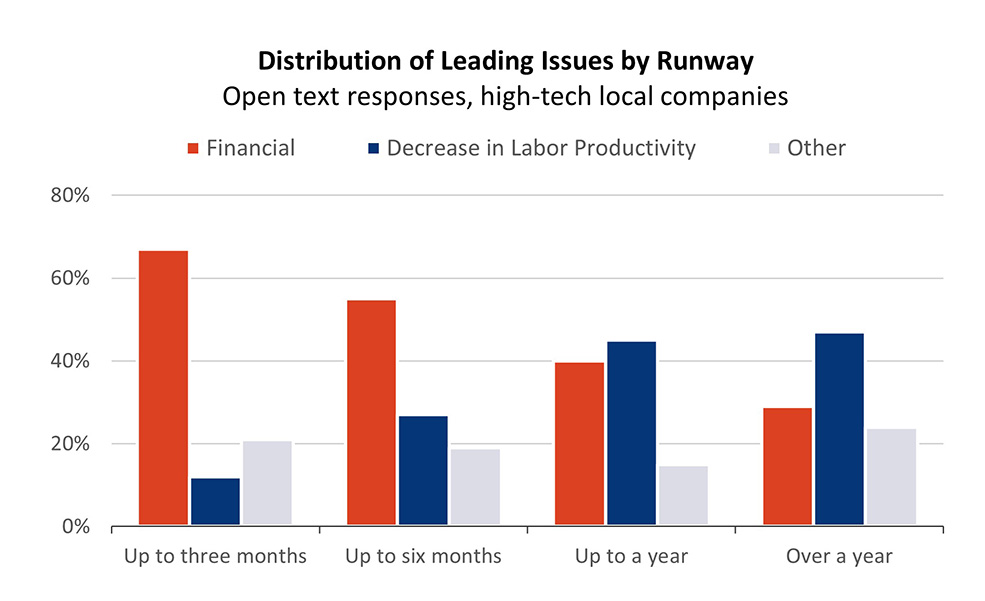

The survey also included the option for a freestyle response, an option which almost half (46%) of the local companies took advantage of. An analysis of these responses, similarly to the analysis of the closed questions presented above, shows that financial difficulties (difficulties in raising capital and a decrease in revenues) are the main problems facing companies in the early stages, with more than half the companies indicating these difficulties. In contrast, companies at later stages emphasized the reduction in employees’ productivity as the main factor (54%) while financial issues were mentioned by only 31% of these companies.

Breaking down the textual responses according to companies’ runway length shows that, as expected, the more depleted a company’s cash period, the more critical are issues of capital raising and revenues, compared to the reduction in personnel:

In conclusion, we note that there is a difference between reports by locally-owned companies (75%) and multi-national companies (54%) regarding the challenges of projects and orders, apparently stemming from the existence of the parent company’s business activities abroad. However, a significant majority of the multi-national companies (80%) still reported damage to their functional continuity due to the significant number of employees called up for reserve duty.

Israel Innovation Authority, responsible for the country’s innovation policy, is an independent and impartial statutory public entity that operates for the benefit of the Israeli innovation ecosystem and Israeli economy as a whole. Its mission is to invest in innovation in order to promote sustainable and inclusive growth. The Authority functions as an enabler with all things related to the Israeli innovation ecosystem. It provides conditional grants to support disruptive technological innovations as well as engaged in creating the groundwork and infrastructure to prepare for future technologies in order to maintain both technological and economical leadership as well as improve productivity and global competitiveness of the Israeli economy.

SNPI is a research and policy institute in the sphere of innovation and technology, whose objective is to preserve and promote Israel’s technological-economic leadership via research, policy recommendations and cross-sector cooperative ventures. The Institute is headed by leading experts with a rich, varied background in research, innovation policy, and building a technological ecosystem. SNPI is an independent, apolitical research institute funded by philanthropy, and operates in cooperation with the government, the high-tech industry, civilian social organizations, and international organizations.