VC Funds Capital Raising Plummets: 73% Decrease Marks Lowest Amount Since 2015

According to the 2023 IVC – Gornitzky – KPMG Israel and the Israel Innovation Auority Investors Report that examines the trends and activities of investors in the Israeli tech ecosystem

The report analyzes fundraising and investment activity by Israeli VCs, the availability of capital for local tech ventures (Dry Powder), foreign VC funds, Israeli and foreign corporate VC funds, and Israeli institutional investors.

The Israeli VC ecosystem includes 226 active VC management companies (MCs). The largest 24 Israeli MCs, each with over $500m under management, have an estimated total of over $29 billion under management

Dror Bin, CEO of the Israel Innovation Authority, said: “Following the report’s findings and the market’s negative trends in 2023, the Innovation Authority implemented strategic initiatives to boost available capital. Notably, the Fast-Track program injected NIS 400 million into companies with significant business and technological assets and limited runway. The recently launched Start-up Fund plans to conduct 100 funding rounds for Pre-Seed, Seed, and Round A companies, investing approximately NIS 500 million. In the near future, we also plan to launch the Yozma 2.0 Fund, which will engage Israeli institutional investors and incentivize them to increase their investments into Israeli Venture Funds to an overall investment of NIS 4 billion within 2024-25.”

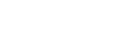

Israeli VC Fund Capital Raising

Israeli VC fundraising suffered a notable decline in 2023. Just 21 Israeli VC funds succeeded in raising a mere $1.52 billion in total, a 66% fall in the number of funds and a 74% drop in capital volume compared to 2022. The amount was the lowest since 2015, while the number of funds aligned with 2015 and 2017.

Three VC funds accounted for 51% of the total capital, raising over $200m each: Qumra Capital IV, TLV Partners V, and Viola Growth IV.

Info 1 – Israeli VC Funds Capital Raising by Vintage Year ($m) | 2015 – 2023

Source: 2023 IVC – GNY – KPMG Investors Report

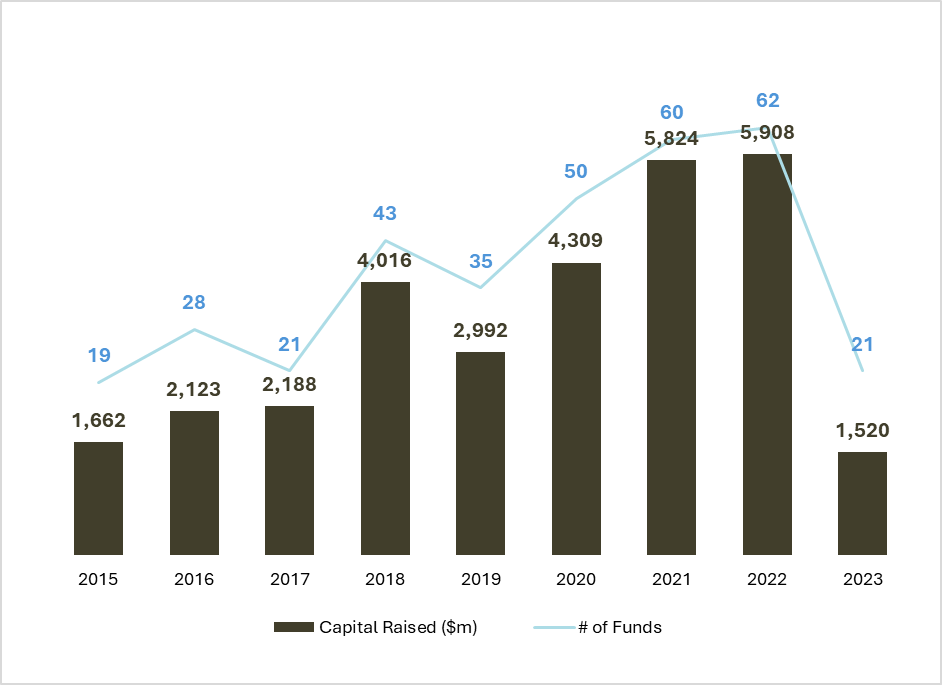

Availability of capital

According to IVC’s measuring model of Israeli VC funds allocations and capital availability, 2023 concluded with $1.14 billion, reflecting the lowest Israeli VC fund capital allocation volume since 2015.

Info 2 – Israeli Venture Capital Management – Capital Allocation | 2015 – 2023

Source: 2023 IVC – GNY – KPMG Investors Report

Dry Powder

According to the Investors Report, Israeli venture capital funds have an estimated $10.08b remaining for investments in Israeli tech companies. Approximately $2.38b (24%) is available for new investments, while $7.7b (76%) is allocated for existing portfolio companies.

Shlomo Landress, Partner and Head of Technology Practice, Gornitzky GNY: “There is a decrease in the valuations of Israeli start-up companies, making them more attractive for investments. The Start-up Fund launched by the Israel Innovation Authority seeks to invest NIS 0.5 billion in early-stage rounds alongside VC funds. These two factors lead to the expectation that a significant portion of the $10.08 billion reported as available for investment by VC funds be deployed in the near future.” Landress added that: “the recent improvement in the technology sector in the United States could also contribute positively to the technology investment landscape in Israel.”

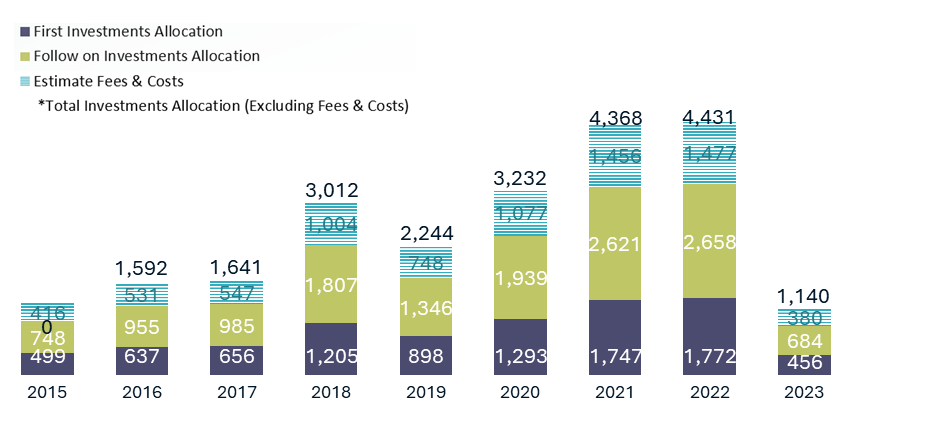

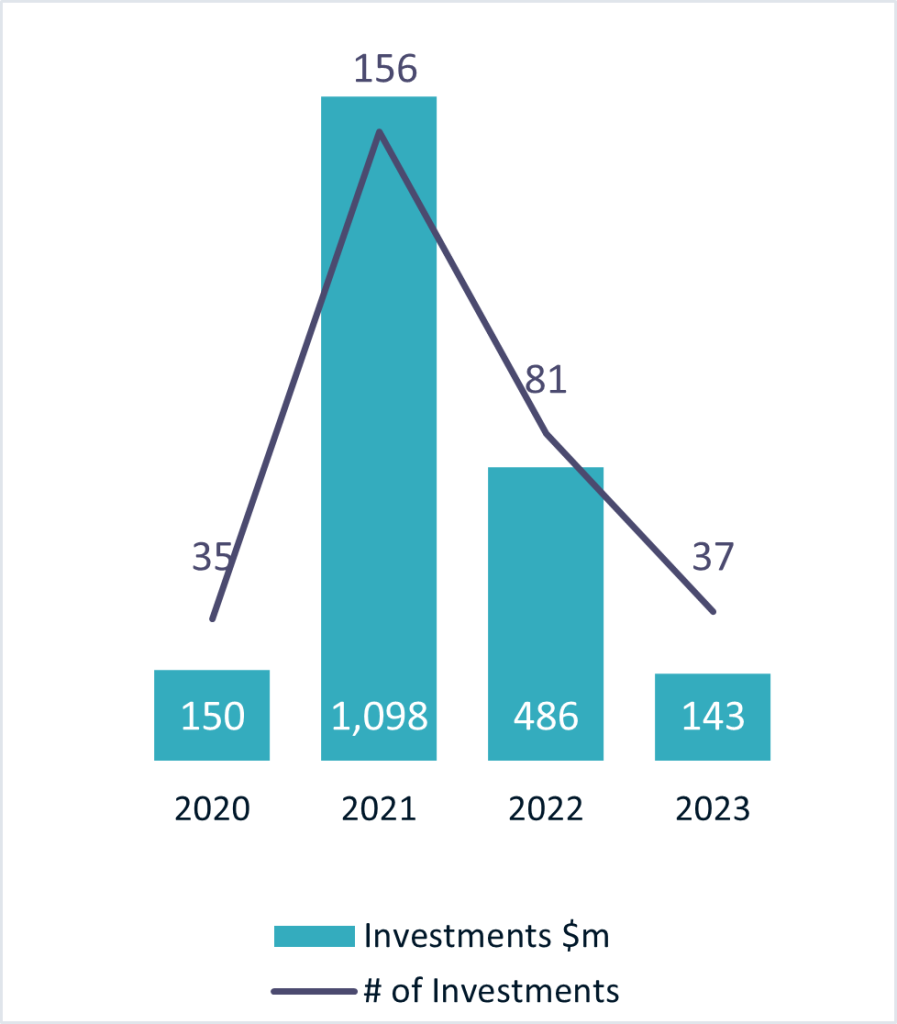

Israeli Institutional investors

In 2023, Israeli institutional investors contributed an estimated $143 million in direct investments in Israeli tech companies (depending on the final institutional activity report, this number may vary by up to 20%), a notable 70% fall from $486 million in 2022. The number of deals dropped by 55%.

Dina Pasca Raz, Partner and Head of Technology, KPMG Israel: “2023 marked a year of profound challenges for the high-tech and venture capital sectors, primarily due to significant macroeconomic shifts worldwide. Despite these hurdles, the Israeli tech ecosystem, from start-ups to mature companies, from defense corporations to local R&D centers of the largest multinational, showcased exceptional resilience”. According to Pasca Raz: “The importance of fundraising and investment rounds is undeniable, yet our industry’s strength lies in many factors. To prevent an exodus of innovation, it’s crucial to offer compelling incentives to entrepreneurs, preventing companies from leaving Israel, thus sustaining and bolstering this robust foundation”.

Info 3 – Israeli High-Tech Rounds with Institutional Investors in Israeli High-Tech Companies

Source: 2023 IVC – GNY – KPMG Investors Report

Most Active VCs

Analysis of the most active VCs by First Investments in Israeli high-tech companies revealed a notable decrease in Israeli portfolio expansion by foreign VCs. Samsung Next (13), Longevity Venture Partners (7), and NFX (6) led the first investments in 2023, compared to 2022 when four foreign funds accounted for more than 12 first investments each. The most active Israeli VCs in 2023 were Fusion (a micro-fund), with an exceptional 23 first investments, followed by imvestment platform OurCrowd (16) and mico-fund Fresh Fund (9).

Corporate VCs

The First Investments level by foreign CVCs in 2023 dropped to 2015, while Israeli CVC activity almost ceased. Intel Capital and PayPal Ventures led the 2023 first investments list with four new portfolio companies each.

Ben Klein, IVC’s CEO: “The Israeli tech ecosystem struggles to overcome one of the worst crises in the last three decades. In IVC, we believe that a profound study of the investors’ data mirrors our challenges and suggests an opportunity to learn new ways to move forward successfully”.

Info 4 – Most Active CVC Funds