Israel Innovation Authority Report: The Potential of Israeli Foodtech

The global food industry has been undergoing far reaching changes over the past few years. Foodtech may constitute a unique opportunity for Israel. The following are the challenges and opportunities for Israel vis-a-vis the global food industry

The food industry is considered one of the most significant industries in the world. The monetary value of the global food and agricultural industry was estimated at $8.7 trillion in 2018 – $700 billion in growth compared to the previous year.1https://www.plunkettresearch.com/statistics/Industry-Statistics-Global-Food-Industry-Statistics-and-Market-Size-Overview/ In Israel, according to data from StoreNext, sales of food and beverages in the market was assessed at NIS 37.4 billion in 2018.2https://www.storenext.co.il/%D7%A1%D7%99%D7%9B%D7%95%D7%9D-%D7%A9%D7%A0%D7%AA-2018/

Over the past several years, following the development of the data revolution, the food industry has been underoing significant changes – compared by some to the change wrought on this industry by the industrial revolution 3https://drive.google.com/file/d/1flu9JCp5uN8TpKEx_QljSi83OegRydr-/view?usp=sharinghttps://drive.google.com/file/d/1flu9JCp5uN8TpKEx_QljSi83OegRydr-/view?usp=sharinghttps://www.cbinsights.com/research-food-startups-report . Changes can be even more significant since the food sector is influenced by a wide variety of parameters: demography, climate, and of course humankind’s growing access to information and knowledge. Therefore, the food industry deserves considerable thought on both the global and local levels so that Israel too can realize the economic opportunities it presents.

Engines of change in the food market (stemming largely from the demands of the consumer market):

- The general public (especially in the West) prefers food that is natural, free of chemicals, sustainable, and which is perceived as locally made, fresh and healthy.

- Increasing awareness in developed countries to the damage caused by farming as a source of protein is a catalyst for the search of an alternative source of protein.

- Consumer demand for transparency in ingredients, responsibility towards social welfare and public health is leading food manufcaturers towards increased accountability and to develop higher quality food products.

- Technological developments steming from the digital innovation and big data technologies: i.e. an increase in the quality and monitoring of food production, prevention of food waste, etc. – all lead to developments in the supply chain, innovation and efficiency.4https://www.emerson.com/documents/commercial-residential/Dallas-Food-Industry-Forecast-Key-Trends-Through-2020-en-151204.pdf

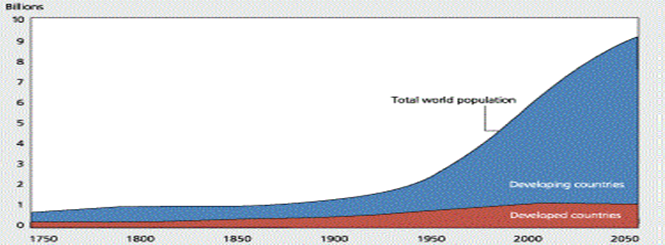

- Growth in the world’s population5https://www.wrsc.org/attach_image/world-population-1750-2050 and the expected rise in the demand for meat, beverages and processed foods (compared to grain-based foods).

The effect of food on public health

Much of the population in developed countries suffers from health issues characterized by an unbalanced diet.

A USDA dietary recommendation report reveals that half of US citizens suffer from chronic diseases that are related to poor nutrition.6https://health.gov/dietaryguidelines/2015/resources/2015-2020_Dietary_Guidelines.pdf

Another facet of public health refers to the manner in which food is consumed and the ingredients that make up food products. The consumption of food with high nutritional value is on the rise in the world, but this rise is not equal in different parts of the world. Most of the highly nutritious food is consumed in countries with middle to upper level incomes. In Israel, according to data from 2017, the rate of obesity stands at 17.5% and is lower than the OECD average (19.5%). Israel also enjoys a lower mortality rate from vascular diseases7http://www.oecd.org/health/health-systems/health-at-a-glance-19991312.htm ,8https://www.oecd.org/els/health-systems/Obesity-Update-2017.pdf

The foodtech environment and startups

Over the past several years, the foodtech sector has been growing in Israel, largely due to startups and the implementation of technologies from disparate fields, bringing a new kind of innovation aimed at integrating within the global food industry. This presents Israel with challenges and opportunities on a global scale, for which Israel’s industry must prepare. Whereas in 2014 there were 170 companies active in the Israeli foodtech sector according to IVC, in 2018 there were more than 300 startups active in this field.

Funding: According to data from Start Up Nation Central, Israeli startups in the field raised $84 million in 2016, $144 million in 2017, $123 million in 2018 and $135 in 2019 (up to Q3).

According to IVC data: in 2013 Israeli startups in the industry raised $52 million, $69 million in 2014, and in 2015, the sum more than doubled to $153 million. Israel is considered by top corporations and investors in the global food market as a leader in this growing sector – with the country itself seen as a kind of “incubator.”

- Databases of the Israel Innovation Authority for 2019 show that the number of foodtech companies in Israel stands at 250. Furthermore – according to an analysis of the industry’s subsectors, the number of startups in agtech in which foodtech companies are also involved (the line between these two fields is not entirely clear), stands between 400 and 450, according to Start Up Nation Central’s database and the scouting database of the Israel Innovation Authority, respectively.

Foodtech sectors in which Israel has a significant presence

- “Cultured meat” (Israel is home to five startups out of 8-9 active companies in the world)

- Reducing sugar and sugar alternatives

- New sources of protein

- Individually tailored nutrition and food products

- Food monitoring and safety across the production and supply chain

- Digitization, connectivity and apps in the field of food, from farm to table.

Segmentation according to fields

Twenty-six startups are active in Israel in various aspects of food monitoring, including raw ingredients and prepared foods. Some 35 companies develop smart packaging technologies. Thirty-one innovative tech companies are developing solutions for digitization and connectivity between different parts of the food supply chain. Some 43 companies are active in developing novel ingredients, including alternative proteins, sugar substitutes, milk alternatives, etc. Twelve companies are active in the field of nutritional counselling and nutrition advice. Some 22 companies are developing advanced processes for mechanizing food production (robotics, 3D food printing, new processes to produce vegetable proteins, etc.) Another 10 companies are working on innovative kitchen appliances for the home.

Government activities to position Israel as a leader in the field of foodtech are currently underway. The government recently approved an investment of NIS 100 million for several foodtech initiatives in the north of the country.

Summary: Challenges and opportunities for Israel’s foodtech industry

Challenges:

- A very small local market – the challenge: developing an array of exports, while adapting food products with a long-enough shelf life to reach the final consumer.

- Increasing productivity in the food industry – the challenge: promoting innovation to transform this industry from traditional to advanced.

- Reducing high production costs – the challenge: establishing new factories and upgrading existing factories based on advanced technologies and managing production and personnel costs considered high compared to countries around the world.

- Continuing to support the Israeli foodtech ecosystem – the challenge: bringing Israeli foodtech startups to the world’s attention and expanding Israel’s technological prowess in this field.

Opportunities:

- Developing foodtech products by implementing innovative technologies and/or setting up new factories in the country and upgrading existing industries to help increase productivity in the food industry and increase market share of Israel’s exports.

- Exporting traditional and innovative foods produced in Israel to the kosher market (though this is of limited size).

- Leveraging Israel’s scientific and entrepreneurial capabilities along with its top-level connections amongst executives in the food and tech industries (biotech, advanced agriculture, etc.) as well as relevant academics. This connectivity fosters new ideas and the implementation of innovation in the foodtech and food industries.

- Improving interaction between the food industry and the agricultural sector –better aligning the needs of the food industry with the improvement of agricultural produce; helping conform with international standards (i.e. organic foods, pesticides, etc.); planning agricultural supply year-round; and developing produce intended for alternative sources of protein and other foodtech needs.

Promoting the sector: The Israel Innovation Authority

The Israel Innovation Authority supports the traditional food industry under its Department for Advanced Production in the MOFET program.

In addition:

- The Authority runs an R&D program[9] which allows food companies interested in new directions for new products or innovative processes (mapping and examining existing capabilities, formulating future goals, defining technological gaps and improving capabilities through products). One of the key goals is to prepare the company to participate in one or more of the appropriate Israel Innovation Authority programs. The Israel Innovation Authority also supports The Kitchen (https://www.thekitchenhub.com) as part of its incubator program – a tech incubator owned by the Strauss Group for the development of advanced technologies in the field of foodtech. Another incubator supported by the Israel Innovation Authority is the Trendlines Agtech incubator, supporting startups in the field of agritech. This incubator acts mainly to diversify and develop alternative food sources for the food industry.

- The Israel Innovation Authority recently launched its “Innovation Labs” program which provides entrepreneurs access to unique technological infrastructure, helps with market research and marketing channels, and pairs them with high-level experts for “proof of concept” for commercial products. As part of the competitive process run by the Startup Division at the Innovation Authority, Frutarom was selected to operate the FoodNxt innovation lab. The lab’s fields of activity include foodtech and creating functional and natural ingredients for the food industry (currently being established).

- Another foodtech incubator was established in Kiryat Shmona as part of the government decision to create a foodtech center in the northern region. The franchise holders that submitted offers in the tender included Tnuva, Tempo and the OurCrowd and Fitnese Ventures funds. The incubator is expected to begin operations in September 2019.

- Calls for submissions for R&D and production of “health food” products, with joint funding from the Nutrition Department at the Israeli Ministry of Health.

- Research infrastructure, as part of the Technological Infrastructure Division: Joining food and technology companies in the IoT field, creating routes for transferring knowhow from academia to industry, including a soon to be issued call for submissions for joint ventures between academia and industry in the USA and Israel, with additional funding from the US NIFA and BARD funds.

Beyond the diverse support spearheaded by the Israel Innovation Authority in the fields of foodtech and the food industry, the Authority’s most important role is creating significant connections between food manufacturers and startups in the food industry and adjacent fields, as a lever for growth and an increase in productivity.

Today, the foodtech industry is supported on a governmental level primarily by the Israeli Ministry of Economy and Industry and its branches: the Israel Export Institute recently detached the foodtech sector from the food sector, signaling the importance of this sector for export and growth9http://www.export.gov.il/files/food/foodtech17.pdf?redirect=no and, as mentioned, the government recently announced the establishment of a NIS 100 million foodtech center in Kiryat Shmona.