The global innovation system is witness in recent years to two prominent financing trends that could also influence the Israeli high-tech industry.

Firstly, the “unicorn'” phenomenon (companies valued at more than USD 1 billion), that began to spread throughout the global innovation industry in 2014, sometimes hinders capital raising during advanced stages or ‘exits’ for start-up companies. During the phenomenon’s early stages, unicorns raised capital on a massive scale, at valuations of billions of dollars. Today, many investors who participated in these capital-raising transactions, are now waiting, sometimes in vain, to see whether these companies will succeed in increasing their value even more, thereby making an exit worthwhile. A current example, recently becoming public knowledge, is the collapse of the American Jawbone Corporation, that developed wearables technology and that at its peak had an estimated value of USD 3.3 billion. The company received an acquisition offer prior to its collapse, that it was however forced to reject as it reflected a value significantly lower than the previous capital recruitment – only USD 1.5 billion.

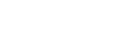

There are those who claim that the deceleration in venture capital investments in the United States during 2016 stemmed, among others, from this phenomenon. Venture capital funds preferred follow-up investments in later-stage companies in their portfolio rather than investment in new and young companies, however the high valuations according to which companies recruited capital between 2014-2016 hindered implementation of successful follow-up investments. Nevertheless, the first half of 2017 has witnessed a trend of recovery in the global venture capital industry. Specifically, during the second quarter, the trend of stagnation in valuations for later cycles ceased and 16 companies became new unicorns1, suggesting that it is still too early to eulogize this phenomenon.

In any case, it seems that the difficulties created by the unicorn phenomenon have thus far passed over Israeli industry. We are witness in Israel, and indeed worldwide, to an increased emphasis on follow-up investments at later stages and to a parallel consistent increase in the value according to which companies recruit capital. It appears therefore that the valuations assigned to Israeli companies at the market height in 2015 reflected their real value.

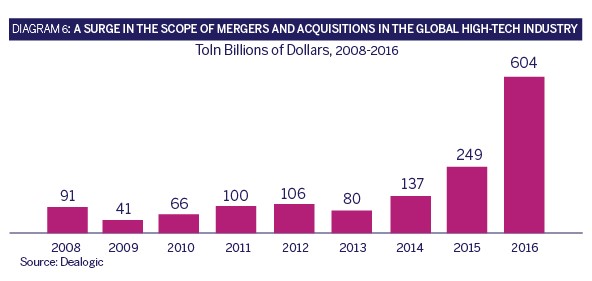

An additional global trend is the consolidation process occurring among the large technology companies. In 2016, a record number of merger and acquisition transactions was recorded in the international high-tech industry (see Diagram 6), including huge deals such as the acquisition of NXP by Qualcomm for USD 47 billion and the purchase of LinkedIn by Microsoft for USD 28 billion. There are those who claim that this trend may reduce the feasibility of strategic acquisition for young technology companies. This is because the abundance of giant mergers means a reduction in the number of potential buyers, and among those that remain – a depletion of cash reserves and the shifting of managerial attention to the application of integrational processes that accompany mergers.

While the possibility of acquisition by larger technology companies is diminishing, the giant corporations, active in other areas, are beginning to express interest in purchasing and assimilating innovative technologies. This phenomenon is part of a broader process of blurring borders between the high-tech industry and “traditional” sectors in which the latter are becoming increasingly technology based. For example, in 2016, the American retail giant Walmart purchased technologies for a total sum of USD 3.3 billion and both Unilever and GM acquired technologies for approximately 1 billion dollars each. Walmart even launched a business incubator for startup companies during 2017 with the objective of investing in pioneering technologies for the retail world. The flip side of the phenomenon is that technology companies are becoming interested in acquiring businesses from “traditional” sectors. One such example is the acquisition of the food retail chain Wholefoods by Amazon. The scope of this trend is still limited however its development should be monitored.

- KPMG. (July 2017). Venture Pulse Q2 2017. ↩︎