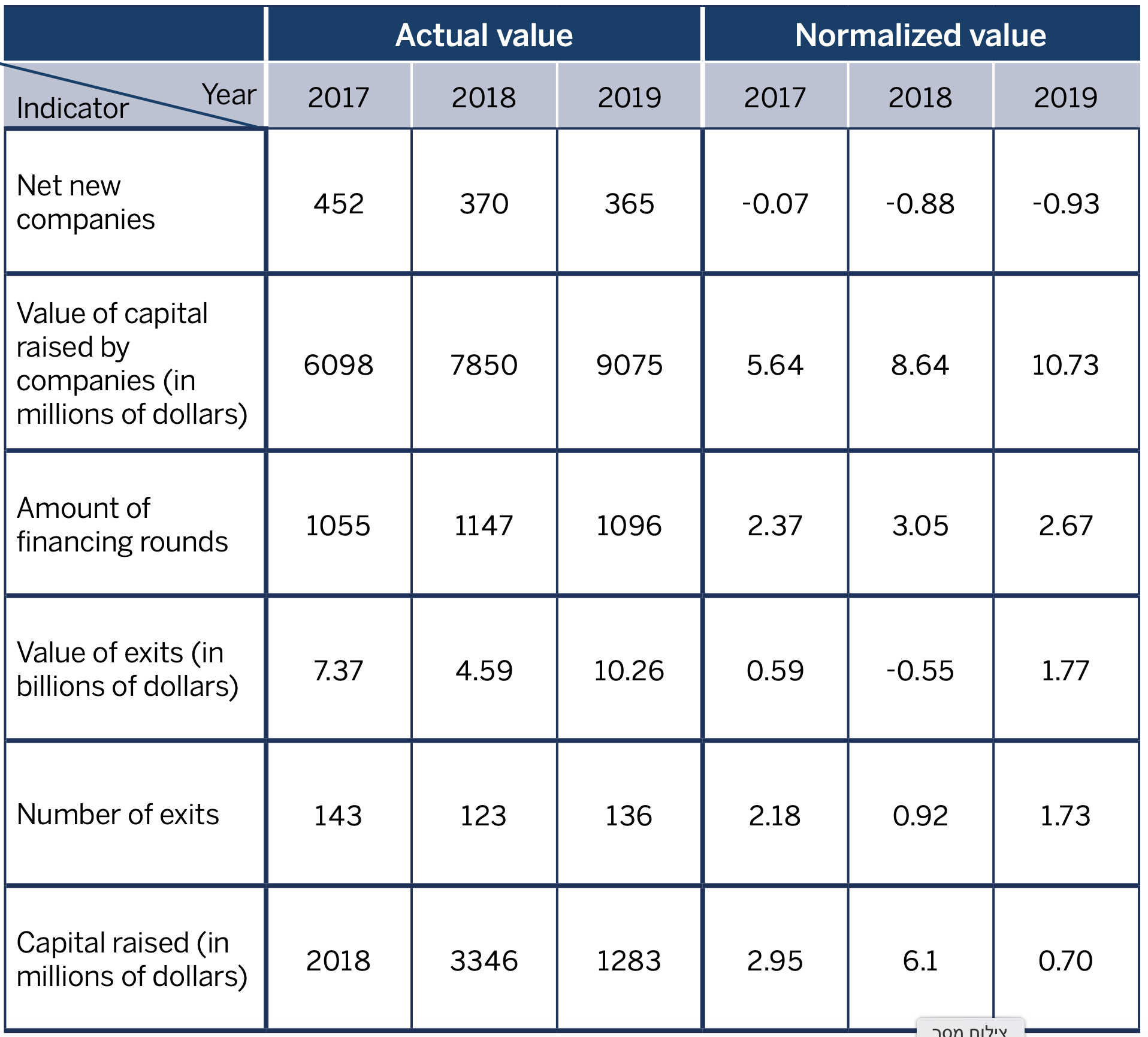

Sub index of start-up companies:

- Net new companies: This sub index represents the net change in the amount of Israeli companies operating in the high-tech sector; meaning, the amount of new Israeli high-tech companies after deducting the amount of Israeli high-tech companies that shut down.

- Amount and value of capital raised by companies: The amount and value of financing rounds that Israeli high-tech companies raised from all investors – venture capital funds, angel investors, and other investors.

- Amount and value of exits: The monetary value and amount of exits by Israeli high- tech companies after deducting exits valued at over one billion dollars. An exit is defined as both an IPO (Initial Public Offering) and an M&A (Merger and Acquisition).

- Capital raised: Total funds raised per year by Israeli venture capital funds. This figure is an indicator of projected future investments by those funds in Israel.

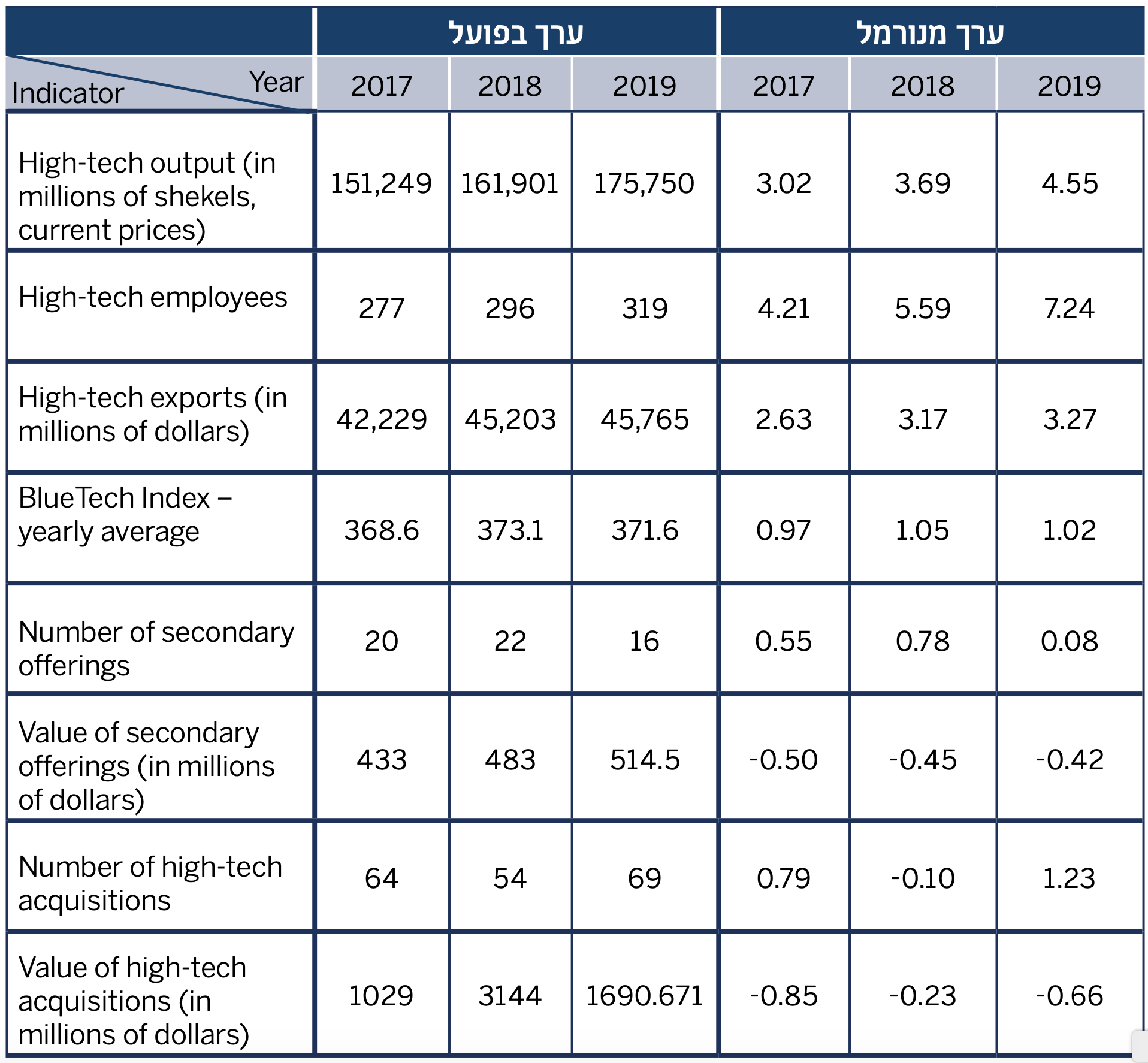

Sub index of mature companies:

- High-tech output: The sum total of output in commodities sectors and the output of software and R&D sectors after deducting communications services.

- High-tech employees: The number of people employed by the high-tech sector, excluding those employed by the communications services sector.

- High-tech exports: Total high-tech exports in services and industry.

- BlueTech Index: The Tel Aviv Global-Blue-Tech Index, which is comprised of all shares included in Technology and Biomed sectors. The data is calculated as an average of end-of-day indices for the year.

- Value and amount of secondary offerings: The number and size of public funding rounds performed by Israeli high-tech companies whose securities are registered for trade (secondary offerings). These variables depict the continued growth in the value of public Israeli companies.

- Value and amount of high-tech acquisitions: The value and amount of transactions, mergers and acquisitions by Israeli high-tech companies where the acquired company is not necessarily Israeli or technological.