Israeli High-Tech at a Crossroads

The Innovation Authority’s 2024 annual report reflects the crossroads Israeli hightech is currently facing. Over the past decade, and specifically since 2018, there has been a boom in investments in startups and new employees joining the hightech sector.

During this period, high-tech has become established as the growth engine of the Israeli economy – a factor that explains, on average, 40% of the Israeli economy’s growth since 2018 – and as its shock absorber. Furthermore, it also drove the growth in GDP during years of crisis in which the Israeli economy stagnated. High-tech’s primary contribution to the Israeli economy stems mainly from the growth in hightech employment that is characterized by high salaries – in turn, contributing to tax payments, to growth in the sector’s output, improvement in the national balance of payments via increasing exports, and more.

Nevertheless, against the backdrop of global macro-economic trends, high-tech’s growth has suffered a downturn since 2022. While global trends also impacted other global innovation hubs, this phenomenon was compounded in Israel by local circumstances that are still affecting the high-tech sector today.

The crossroads of Israeli high-tech relates to the path the sector will take from this point onwards: looking forward, will high-tech return to a growth trend, stagnate (as happened in the decade following the dot.com bubble) or will it move towards a process of retrenchment?

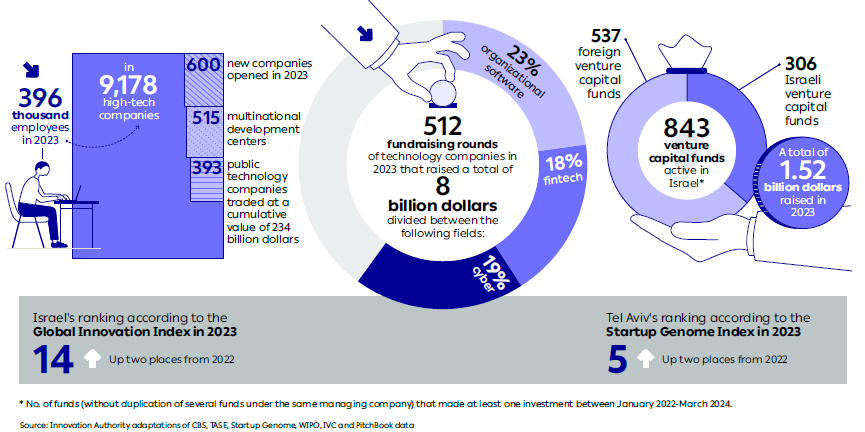

In some leading macro-economic indices, primarily the increase in high-tech output and the sector’s exports, the growth continued in 2023. At the same time, a series of significant indices declined. First, the growth in high-tech employment diminished to just 2.6% in 2023 i.e., a rate slightly higher than the natural growth rate of Israel’s population. This is an important index because high-tech employment has a significant impact on state revenues from taxation, GDP etc. Many indices linked to business activity in high-tech returned to the levels that characterized them in 2018 or previously, including fundraising for startups and Israeli venture capital funds. Startups’ fundraising in 2023 declined by 55% – a sharper decline than that observed in US hubs and in some of the European hubs.

A series of surveys among high-tech companies and venture capital funds conducted by the Innovation Authority in recent months reflects the concerns in the high-tech industry that have arisen in the wake of the October 7 events. Among others, over a third of the startups currently engaged in fundraising estimate that they will raise capital at a significantly lower value than their current value (Down Round).

In addition to the influence of the situation in Israel on the mood in the sector, it also impacts the companies’ business activity. According to reports of some of the companies, since October 7 they are primarily affected by a slowdown in their business activity, delays in product development, or a failure to meet goals.

Furthermore, during the months of the war, Israeli startups have reported that they downscaled their plans to hire employees during the coming year, with most of this reduction expected in the hiring of employees in Israel.

High-tech’s centrality to the Israeli economy is exceptional by global comparison. The sector’s share in the Israeli economy is similar to the share of natural resources in countries where the economy relies on commodities such as oil or gas. Human capital in high-tech therefore constitutes “Israel’s natural resource”. From this perspective, high-tech employment directly influences economic activity and growth, both of the sector itself and of the entire Israeli economy. As long as the growth in high-tech employment continues at a higher rate than the growth of the population, the sector will continue to exert a positive influence on the economy.

High-tech’s importance to the Israeli economy is especially heightened during a period when the state’s funding needs – both military and civilian – have increased. Because the flow of tax payments from the high-tech sector is so important at this time, it is vital to preserve the sector’s significant levels of economic activity. In this context, later this year, the Innovation Authority and the Chief Economist in the Ministry of Finance expect to publish a report on the high-tech sector’s contribution to state revenues from taxation. The report will present the contribution of high-tech employees and commercial companies to state revenues.

Alongside the importance of high-tech to the economy at this time, the challenges are also increasing. Israeli high-tech is characterized by a high degree of dependence on multinational factors that influence the sector’s prosperity: startup investors, multinational companies that are significant employers and buyers of startups, clients of Israeli companies, international academic and industrial research affiliations, supply chains of raw materials, including for the defense industries, and more.

Consequently, damage to Israel’s reputation against the backdrop of the current situation, that may result in a decline in a variety of activity indices noted above, presents a risk for the short-term future of Israeli high-tech and even beyond. The act of lowering Israel’s credit rating in recent months is an expression of this damage and of foreign investors’ concerns for the future of the Israeli economy.

In light of high-tech’s importance and its current challenges, alongside increasing global competition in fields of innovation, there is a need for a state policy that will guarantee the sector avoids regression to a negative trend that will negatively affect the entire Israeli economy, as happened at the beginning of the century. The sector’s success in the past is no guarantee of its future success and the assets it relies on, including capital and reputation may dwindle.

Currently, despite high-tech’s centrality to the Israeli economy, state investment in it is lower than the investment in prominent global hubs such as the US, the UK, and South Korea. In the current reality of limited state investment and extremely high dependence – in global terms – on foreign investments, without a significant local safety net, the sector may have difficulty in successfully negotiating crisis periods.

In the short-term, the role of state policy is to manage market expectations and to create certainty in order to restore Israel’s reputation as an attractive investment destination for high-tech investors. Furthermore, for long-term hightech growth, it is important to invest in quality education for all groups of the population, throughout the country, and at different stages of the educational and professional timeline.

In order to mitigate some of these challenges, last year the Innovation Authority presented several programs aimed at supporting the sector. The main ones are the “Fast Track” program for companies with a short runway and the launch of the Startup and “Yozma 2.0” funds. The Innovation Authority is constantly striving to present additional solutions to meet the needs of Israeli high-tech.

In summary, considering the importance of the high-tech sector to the Israeli economy, especially now when it finds itself at a crossroads, it becomes more essential for the government to prioritize a policy that ensures this sector will not shrink, thus dragging the entire economy with it, as it did in the early 2000s.

This report is divided into two main sections. In the first section of the report, we present the an update situation report of Israeli high-tech. The main findings are:

In the second section of the report, we discuss of four core issues related to the future of Israeli high-tech

Israeli High-Tech in Numbers

Thanks:

The Innovation Authority wishes to thank Dr. Sergei Somkin from the Aaron Institute for the extensive assistance in processing and analyzing employment data and for the joint work and thought. The Innovation Authority also thanks the Israel Advanced Technology Industries Association (IATI) that partnered us in conducting the venture capital funds survey. Finally, the Authority thanks Yair Ben Netanel from the Central Bureau of Statistics who assisted in locating data for this report.

Compilation and Editing: Innovation Authority – Economy and Research Division

Advisor and content editor: Inbal Orpaz

Linguistic and graphic editing: Calltext