Macro Indices Show a Moderate Increase – Investments Continued to Decline

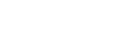

Against the backdrop of the geo-political and security upheavals in 2023, most of the macro indices in Israeli high-tech registered a moderate increase, primarily – a growth in the sector’s output and exports. The number of high-tech employees also increased, however at a lower rate compared to previous years.

One of the central high-tech indices to show a decline, was the investments in Israeli startups, thereby continuing the trend that began in early 2022. Fundraising by Israeli startups declined by approximately 55% in 2023, with most of this decline occurring in advanced funding rounds however, early rounds also showed a decline.

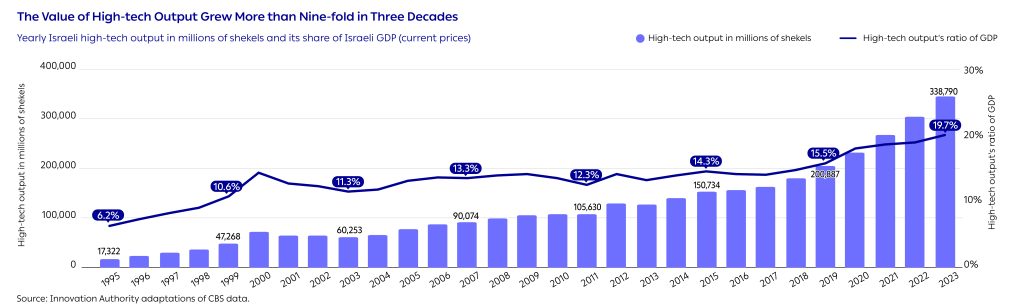

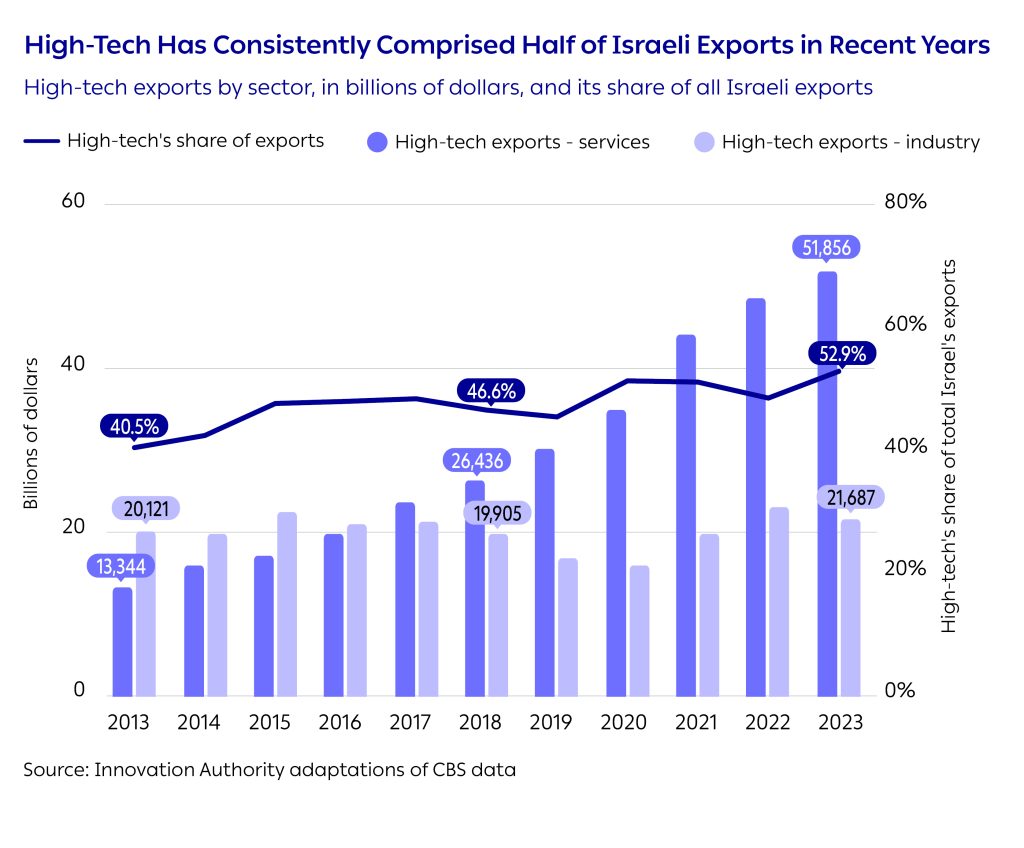

High-tech continued to reinforce its position as significant and central to the Israeli economy in 2023. High-tech was responsible for 53% of Israeli exports (73.5 billion dollars). High-tech’s share of Israeli GDP reached one fifth of the total GDP (19.7%) and was valued at 338.8 billion shekels.

The TASE Still Lags Behind the NASDAQ but Investors in Israeli Technology Companies are Unconcerned about the War

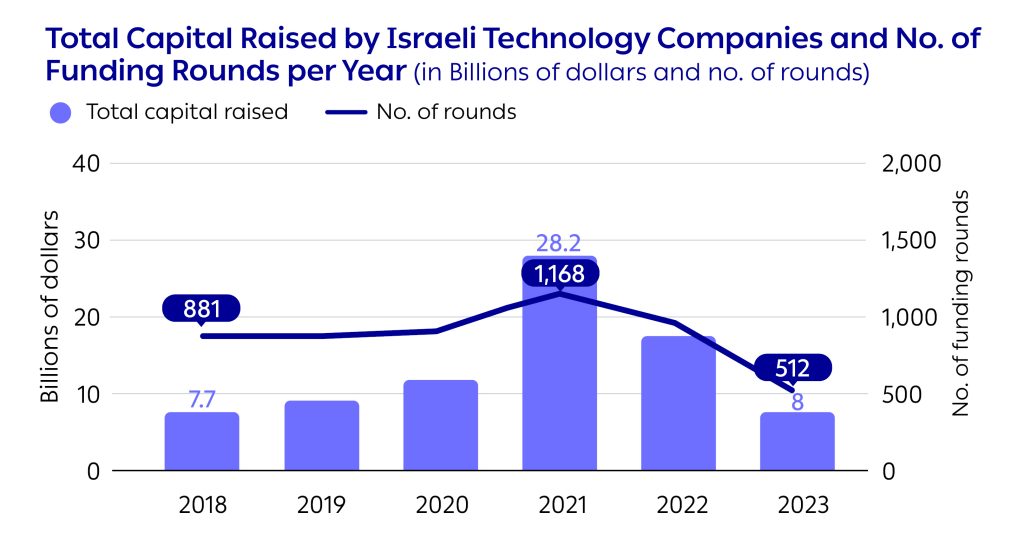

From the period between the outbreak of the Covid pandemic in 2020 until the proclamation of the planned legal reform in January 2023, the performance of the technology companies’ shares traded on the TA-Technology Index was almost identical to the fluctuations on NASDAQ.

In contrast, the TA-35 Index that represents companies from all sectors of the Israeli economy, underperformed during this period in comparison to the technology companies in Israel and overseas. With the outbreak of the Russia-Ukraine war in early 2022, the gaps between the NASDAQ and the TA-35 narrowed considerably.

In early 2023, with the proclamation of the planned legal reform, a process of separation began between the indices in Tel Aviv – both the technology and the TA-35 indices – and the NASDAQ Index with an ever-growing gap between them. While the NASDAQ Index enjoyed a positive trend, the companies in Israel stalled.

The TA-Tech and the TA-35 indices on the Tel Aviv Stock Exchange declined after October 7. The international shock at the events in Israel also influenced the performance of the NASDAQ in the immediate aftermath, with the index declining. However, while there was a correction in the technology indices on both the TASE and the NASDAQ with a sharp increase of 15% in their value compared to October 7 (as of preparation of this report in April 2024), the TA-35 increased by a modest 3%.

In other words, both the TA-Tech and NASDAQ indices returned to the typical levels of fluctuation registered prior to the proclamation of the planned legal reform. Nevertheless, a disparity still exists between them that stems from the underperformance of the TA-Tech during the period between the proclamation of the legal reform in early 2023 and the outbreak of the war. Furthermore, investors in the Israeli capital market seem to be unconcerned by the current war’s influence on Israeli technology stocks.

Situation Report:

High-Tech Output

High-Tech Output Reached One-Fifth of Israeli GDP for the First Time

High-Tech Output Reached One-Fifth of Israeli GDP for the First Time

The high-tech sector has grown significantly since the 1990s until, in 2023, it constituted one fifth of GDP, becoming one of the central sectors of the Israeli economy.

High-tech’s share of GDP has increased significantly since the sector began growing and strengthening in Israel: In 1995, high-tech’s share of GDP stood at just 6.2% and has since tripled. In real terms, high-tech’s output grew more than nine1The figure refers to the greater weight given to inflation so that in nominal terms, the increase is even greater – fold during this period while Israel’s GDP increased three-fold in real terms, reaching 1.7 trillion shekels in 20232According to CBS recommendations, GDP is referred to in base prices (total added value to economy).. In other words, the growth rate of high-tech output is higher than that of GDP.

The increase in high-tech output over the years was not uniform. A significant portion of the growth occurred between 1995-2000 (the dot.com bubble), and from 2018 until today. Between these two periods, for a decade and a half, high-tech’s share of GDP remained steady without any significant change.

Israeli High-Tech: The Shock Absorber of the Israeli Economy

Israeli High-Tech: The Shock Absorber of the Israeli Economy

Analysis of the data reveals that, since 2018, during times of crisis, the high-tech sector has strengthened its position as the shock absorber of the Israeli economy (e.g., Covid in 2020 and the geo-political upheaval in 2023) and as its growth engine. During these periods, high-tech contributed significantly to the growth in GDP. Since 2018, hightech has been responsible for at least 24% of GDP growth as experienced by the Israeli economy on a year to year basis. As we will see below, since 2018, there has been a marked increase in high-tech employment that corresponds with the growth in high-tech output.

Specifically, during the Covid year (2020), Israel’s GDP declined while high-tech outputs grew by 12% during the same period compared to the previous year. In other words, without the growth in high-tech in 2020, the damage to Israeli GDP during that year would have been even more severe.

As stated, in recent years high-tech has been responsible for at least a quarter of the growth in GDP measured each year. An overall examination of the entire period between 2018-2023 reveals that, cumulatively, high-tech is responsible for over 40% of the growth in Israeli GDP.

High-tech had a relatively large contribution to the growth in Israeli GDP already in the year 2000 – the growth in high-tech accounted for more than half of that year’s increase in Israeli GDP. In subsequent years, however, high-tech output declined and drove Israeli GDP downwards. In practice, high-tech experienced a “lost decade” from the collapse of the dot.com bubble in 2001. In most of the years since 2004, high-tech once again contributed to Israel’s GDP, albeit moderately, until the growth that began in 2018.

Situation Report:

High-Tech Exports

High-Tech Exports: 53% of Israeli Exports, Derived Primarily from Software Companies

High-Tech Exports: 53% of Israeli Exports, Derived Primarily from Software Companies

High-tech exports in 2023 accounted for 53% of Israel’s total exports. This ratio has remained constant in recent years: in three of the four years since 2020, high-tech exports accounted for over 50% of all Israel’s exports.

Over the past decade, the growth of the Israeli high-tech sector’s exports stems primarily from the significant growth in high-tech services exports. The high-tech services sector includes, among others, software companies, and its share of total high-tech exports increased from 40% in 2013 to 71% in 2023. In nominal terms, the value of high-tech services’ exports almost quadrupled over this period and reached 52 billion dollars in 2023.

Over the past decade, high-tech industry’s exports, that included hardware and pharma companies, maintained their relative share. Companies from the high-tech’s industrial sectors exported an average of 20 billion dollars a year over the past decade. Although there was a decline in the exports of high-tech industrial companies between 2019-2020, these have subsequently recovered, and exports have returned to their average levels.

Situation Report:

High-Tech Employment

High-Tech’s Growth Engine: Employment

High-Tech’s Growth Engine: Employment

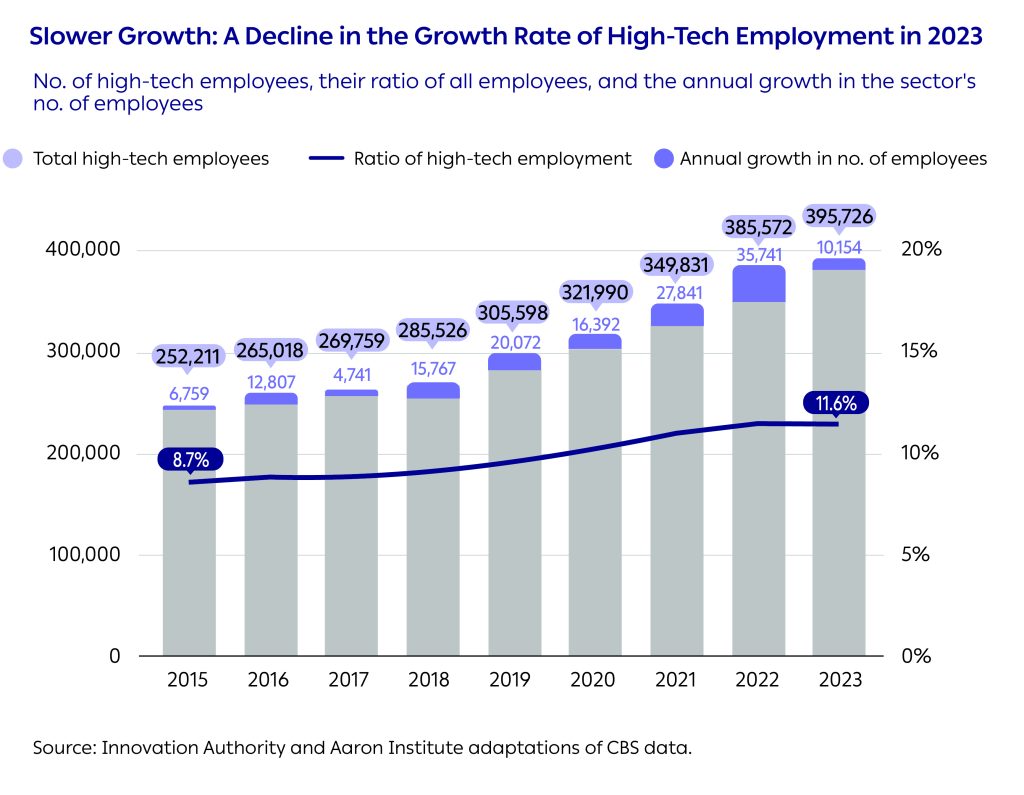

Approximately 396,000 people were employed in the high-tech sector in 2023, an increase of 10,000 compared to the previous year.3Unless stated otherwise, the reference to employees in the high-tech sector throughout this report is based on the recommendations of the Committee for Increasing the Human Capital in High-Tech (“The Perlmutter Committee”) i.e., employees aged 25-64 in the high-tech sector, according to the CBS definition, excluding the communications sector.

Between 2014-2023, the number of employees in the sector grew by approximately 150,000 – a 60% increase. Most of this growth has occurred since 2018 with an increase of at least tens of thousands of workers since then.

High-tech’s contribution to GDP has also increased during this same period, as have the tax payments of high-tech employees and companies. This increase stems from an accelerated growth in the number of high-tech employees and an increase in the sector’s average salary, as will be presented below. This means that continued growth of the sector’s output will be directly influenced by the number of high-tech employees and that any significant change in high-tech employment will impact the entire Israeli economy.

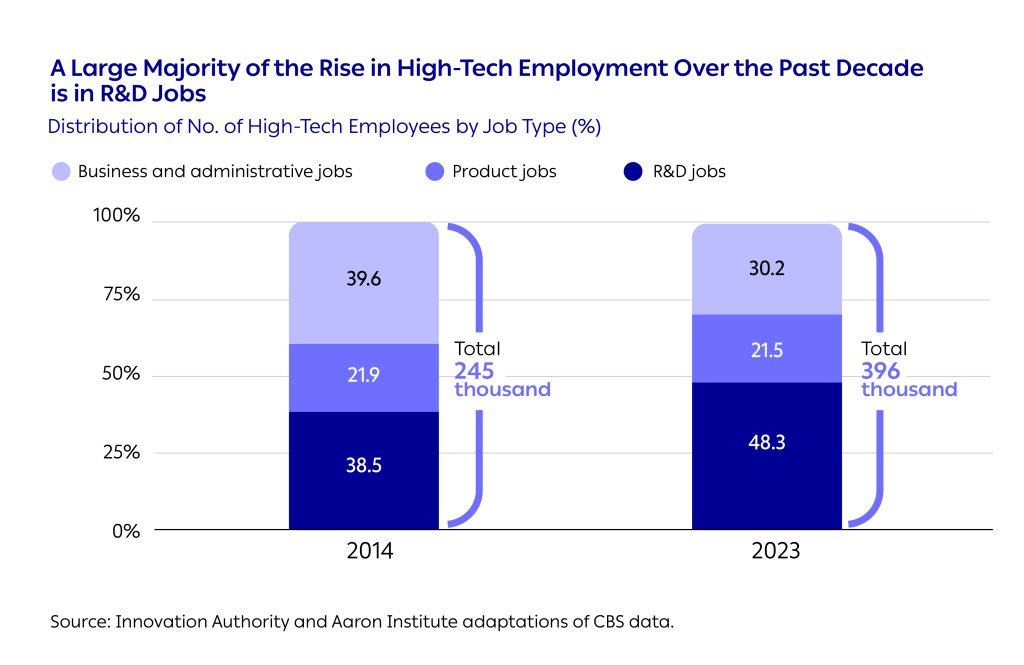

The composition of the roles in which high-tech employees work has changed over the past decade. In 2014, approximately 94,000 people worked in R&D jobs in high-tech. By 2023, this number had more than doubled and the ratio of all high-tech employees rose from 38.5% to 48.3% – an increase of 10 percentage points.

The ratio of workers in product jobs remained steady while the ratio of workers in business and administrative jobs declined during the same period, this despite the fact that the total number of employees in each job type has increased over the past decade.

In other words, despite the establishment of large Israeli companies with sales revenues of tens and hundreds of millions of dollars a year, most of the growth in high-tech employment in Israel still stems from R&D professions, the entry criteria to which are very high.

Lack of Demographic Diversity in Israeli High-Tech

Lack of Demographic Diversity in Israeli High-Tech

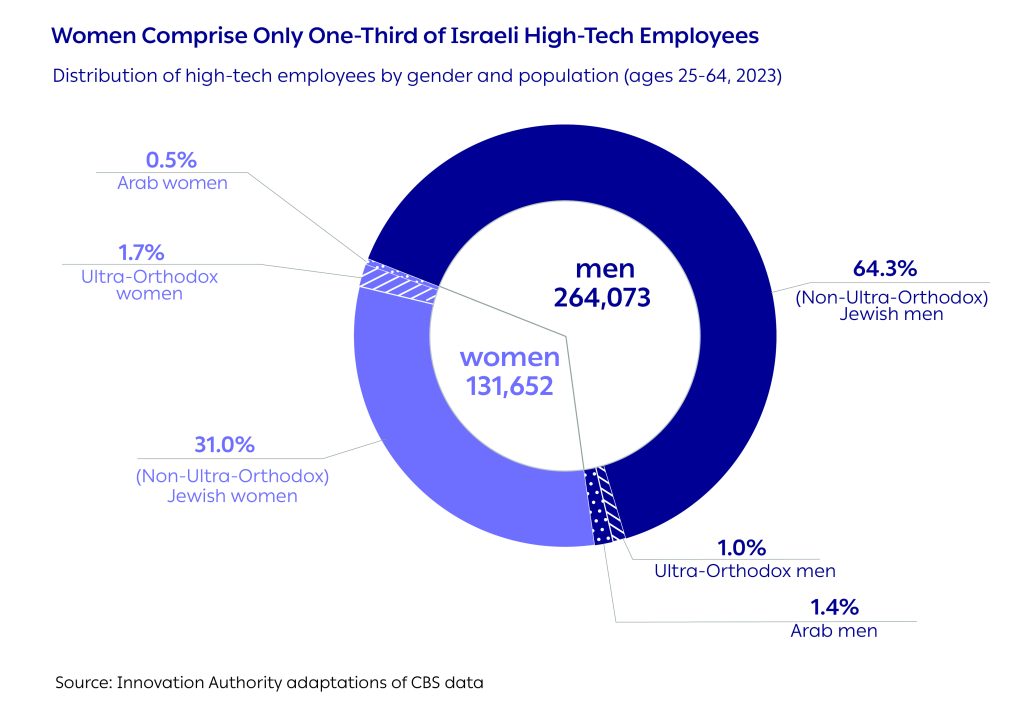

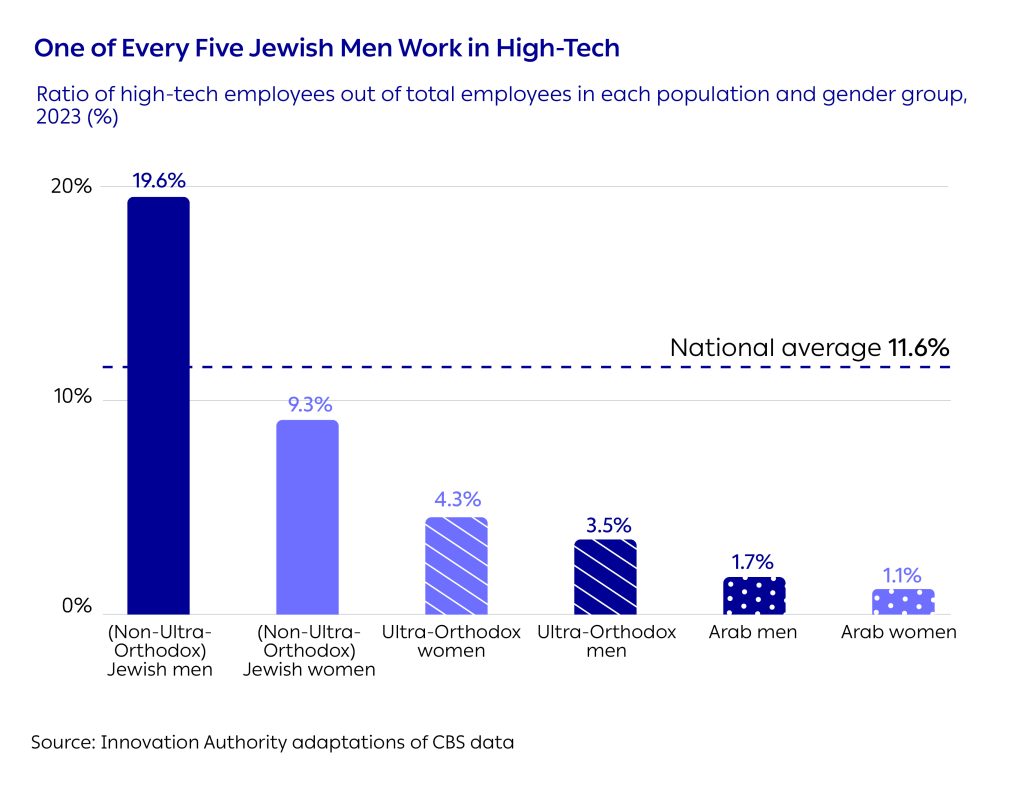

There was no significant change in the high-tech sector’s demographic diversity in 2023. About 65% of the sector’s employees (254,400) are (non-Ultra-Orthodox) Jewish men. In effect, nearly 20% of the (non-Ultra-Orthodox) Jewish men currently employed work in high-tech. In 2014, this ratio stood at 13.7%, reflecting a significant increase over the past decade in the recruitment of Jewish men to this sector.

The second largest group in Israeli high-tech is (non-Ultra-Orthodox) Jewish women who comprise 31% of the sector’s employees – a total of 122,700 women. Of all the (non-Ultra-Orthodox) Jewish women employed in Israel, 3.9% are employed in the high-tech sector.

The Arab and Ultra-Orthodox-Jewish sectors continue to be under-represented in high-tech. Ultra-Orthodox-Jewish men comprise 1% of high-tech employees and Ultra-Orthodox-Jewish women make up 1.7% of the sector’s employees. Arab men make up 1.5% of high-tech employees in Israel while Arab women comprise just 0.5% of high-tech employees.

The low level of participation in the workforce of Ultra-Orthodox Jewish men and Arab women means that when examining the number of Ultra-Orthodox Jewish men employed in the Israeli economy, only 3.5% are employed in high-tech. Similarly, the ratio of Arab women employed in high-tech is just 1.1% of the total number of Arab women employed in Israel. In other words, one of every hundred Arab women in the workforce is employed in high-tech.

Situation Report: The Impact of October 7 on High-Tech

A Downturn in Business Activity and Difficulty in Fundraising

A Downturn in Business Activity and Difficulty in Fundraising

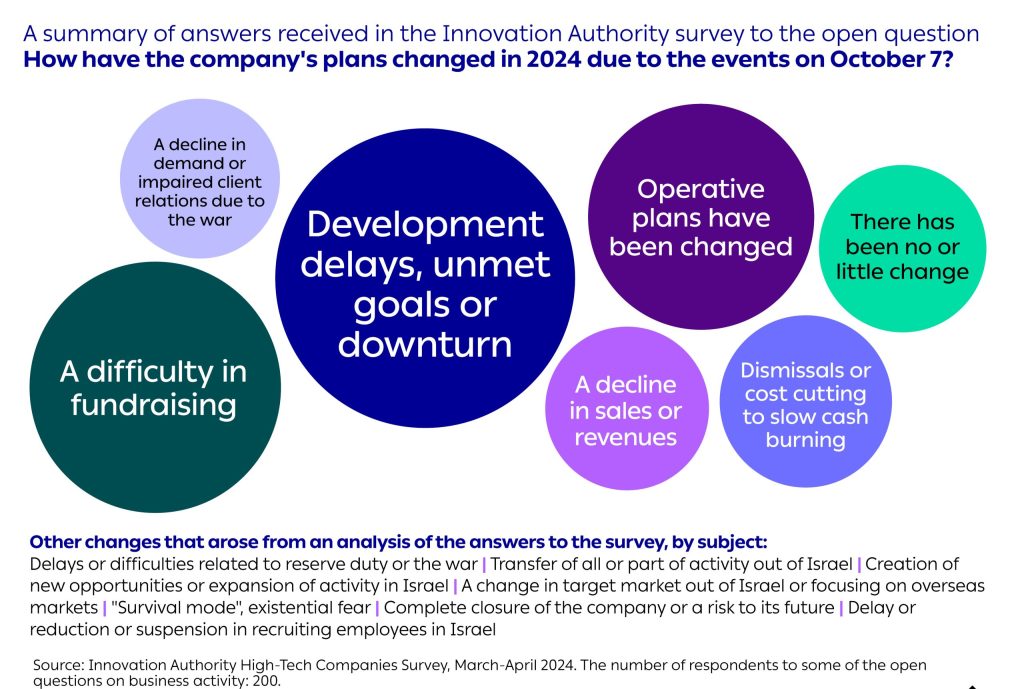

One of the most influential events on high-tech during the past year was the outbreak of the war on October 7. In a survey conducted by the Innovation Authority in March and April 2024, 500 senior executives in Israeli high-tech companies were asked to describe how the war had impacted their company’s plans for 2024.4For more details on the way in which the survey was conducted ,see Appendix 1

The Main Insights Arising from the Survey

The primary influence mentioned by the Israeli technology companies relates to the damage caused to the company’s business activity. This was manifested in a downturn in activity, in delays in product development, or in failure to meet the company’s goals. In some cases, the damage to business activity was caused by the absence of employees for reasons related to the war – reserve duty, being evacuated from their homes, etc. Furthermore, the survey reveals that in more than half the high-tech companies, the reserve duty of company employees or their spouses had a moderate to severe impact on meeting the company’s goals. As expected, a higher ratio of employees called up to reserve duty corresponded to a greater influence on the company.

Another prominent difficulty mentioned by the companies relates to fundraising. This challenge is always significant for startups but some of the respondents noted that funding rounds that were already underway during this period had been canceled or suspended due to the war. They claimed that some investors are refraining from investing in Israel at this time. Consequently, some of the companies were compelled to cut costs and, sometimes, slow the rate at which they “burn” cash. Furthermore, some of the companies reported a decline in demand for their products or partners who changed plans related to the company due to the war, leading to ramifications that were expressed in a decline in the company’s revenue or sales.

As a result of the situation, a smaller group of companies reported transferring part or all of their activity out of Israel, hiring employees overseas, and focusing the company’s business activity on markets outside Israel i.e., reducing the company’s exposure to the impact of the war in Israel. Some companies referred to the difficulty of operating in an environment characterized by high levels of uncertainty. In some cases, the war led to the closure of the company or to a real threat to its continued activity. Some companies mentioned that the company had moved to “survival mode”.

It is important to note that some companies’ activity remains unaffected by the war and that others – for example, in the fields of defense or mental health – have benefitted from new opportunities created by the war (e.g., increased demand in Israel, adaptation of products to local needs, etc.).

CEO of a food-tech company: “Instead of completing technological developments and raising capital from the market, we raised funds from existing shareholders, gave up on several areas of development, and focused on achieving sales at any price”.

CFO of a software company: “The first quarter results were affected, and the company met only 30% of its quarterly sales goals”.

CEO, EdTech: “We accelerated the initiation of activity overseas whereas we had previously been focused on Israel. We prepared a plan for introducing a strategic investor and are currently in negotiations. This is a dramatic change”.

CFO, advanced manufacturing company: “Visits of clients who were supposed to come and see the company’s products ahead of placing orders were canceled”.

From an Innovation Authority survey of high-tech companies, March-April 2024

More Job Seekers, Less Stability

More Job Seekers, Less Stability

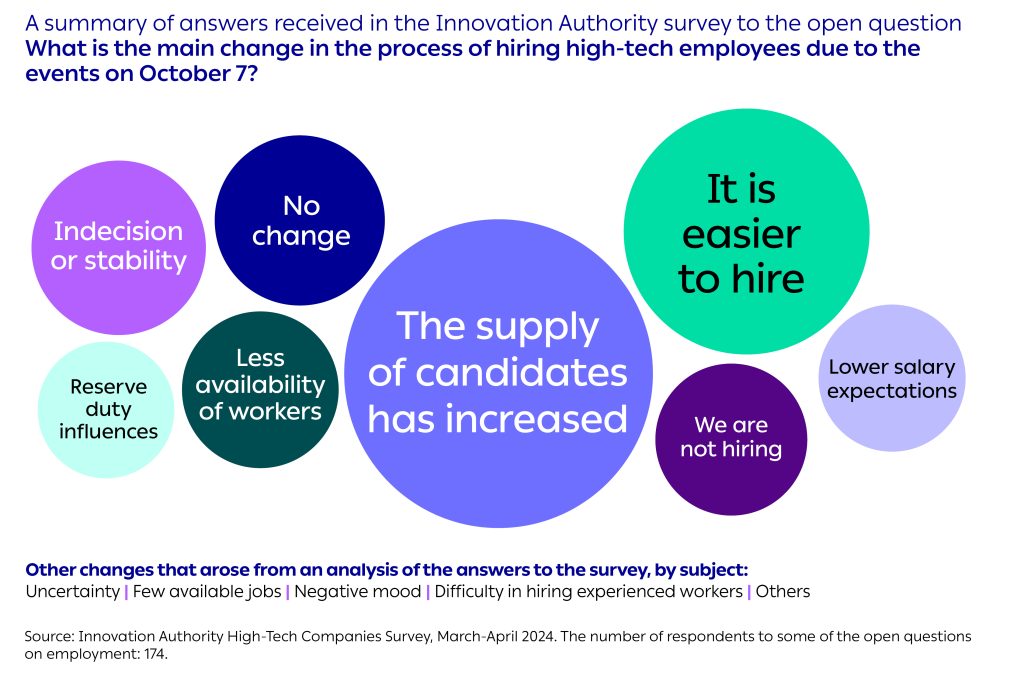

The Main Insights Arising from the Survey

The present point in time constitutes a unique situation for the Israeli high-tech industry that differs from that of recent years: following several years of significant growth in the hiring of workers, this rate slowed during 2022. Consequently, the market has moved from being an “employees’ market” in which there is significant competition for each candidate to an “employers’ market”. In other words, the power seems to have moved to the hands of the employers as a result of fewer available jobs and more job seekers.

As part of a survey conducted by the Innovation Authority in March-April 2024, senior executives in early-stage high-tech companies were asked to describe the main changes that had occurred in the hiring of high-tech employees since October 7. The responses revealed that the most common change mentioned was the increase in supply of job candidates. The second most common change mentioned was that it is now easier to recruit personnel. These changes are not necessarily con-nected to the war. Some respondents relate to the connection between the state of fundraising by startups during this period – against the backdrop of the war and the global crisis – and the hiring of employees. The survey further reveals that for 76% of the companies it took less than three months to fill technology jobs and for 87% of the companies it took the same time to fill a nontechnology job.

Furthermore, some of the respondents mentioned that despite the increase in supply of jobseekers, the competition for experienced technology personnel remains fierce, whereas there is greater availability of non-technology workers. Some of the respondents mentioned the problems related to the availability of workers in the current environment, among others because of reserve duty, civilian evacuations, etc.

A unique characteristic of this period was expressed in the answers relating to the phenomenon whereby, against the uncertainty typical of the current period, high-tech workers prefer job stability and therefore tend less to change jobs. Moreover, the responses also included references to the more negative mood characterizing the current period which also influences job recruitment processes.

The market’s transition to an “employees’ market” is also expressed in the fact that salary expectations are now lower than previously. Nevertheless, the average salary figures in the high-tech sector in 2023 showed that salaries continued to rise. It should be noted that market sentiment may precede the actual data and that most of the respondents represent relatively small startups and not the entire sector.

It is also important to note that some of the companies reported that there had been no changes in the hiring of employees since October 7.

CEO, content and media company: “There has been almost no change in the hiring of highly qualified and experienced technology personnel. It was and still is difficult”.

CEO, agri-tech company: “It is easier to recruit employees, but people aren’t as focused as they were in the past”.

CFO, smart transportation company: “The uncertainty causes workers to maintain employment stability more than in the past so there is less demand to move to a new job”.

CEO, e-commerce company: “There are far more high-quality workers available for work at a lower cost relative to that of a year ago”.

CEO, medical devices company: “We had difficulty in hiring workers during the war because many people were simply unavailable. We eventually hired a subcontractor”.

From an Innovation Authority survey of high-tech companies, March-April 2024

High-Tech Mobilization: Almost 30,000 High-Tech Employees Serve in Reserve Duty

High-Tech Mobilization: Almost 30,000 High-Tech Employees Serve in Reserve Duty

The widespread mobilization order of reservists issued when the war broke out on October 7 is the most significant factor to impact Israeli high-tech during the final quarter of 2023 and continues to influence the beginning of 2024.

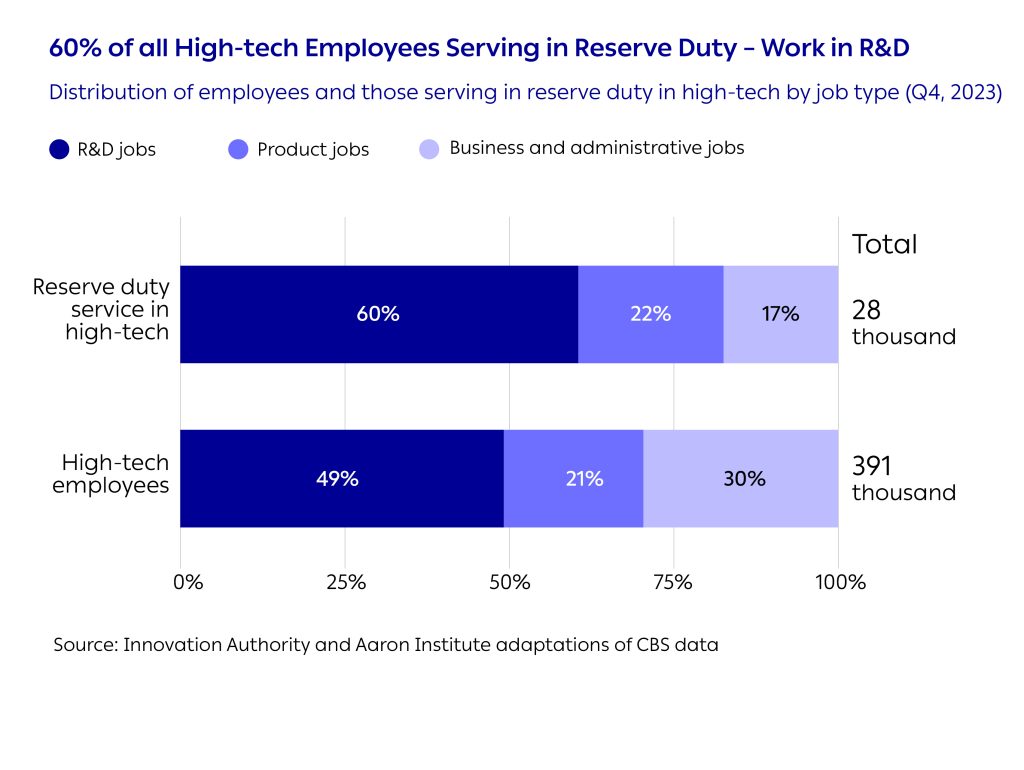

An analysis of the CBS human capital survey reveals that 7% of the high-tech sector’s employees – 28,000 workers – were absent from their workplace during the fourth quarter of 2023 due to reserve duty. On average, during a normal quarter, this figure stands at several hundred employees.

60% of the high-tech reserve duty soldiers (16,900) are employed in R&D jobs and work in developing the technology core of the companies in which they work. This represents a ratio higher than the share of those working in R&D out of all high-tech employees (49%). In other words, almost one of every ten R&D employees in the fourth quarter served in reserve duty.

Women comprise less than 6% of the high-tech employees serving in reserve duty. This is lower than the general ratio of all women serving in reserve duty in Israel during the war which stood at 2.19%.5 Of all the women employed in the high-tech sector, the ratio of those serving in reserve duty in the fourth quarter of 2023 was 1.8%.

During January-February 2024, the number of high-tech employees serving in reserve duty dropped to less than 12,000, approximately 3% of all high-tech employees.

A Cautious Recovery in New Jobs in the Second Quarter of the War

A Cautious Recovery in New Jobs in the Second Quarter of the War

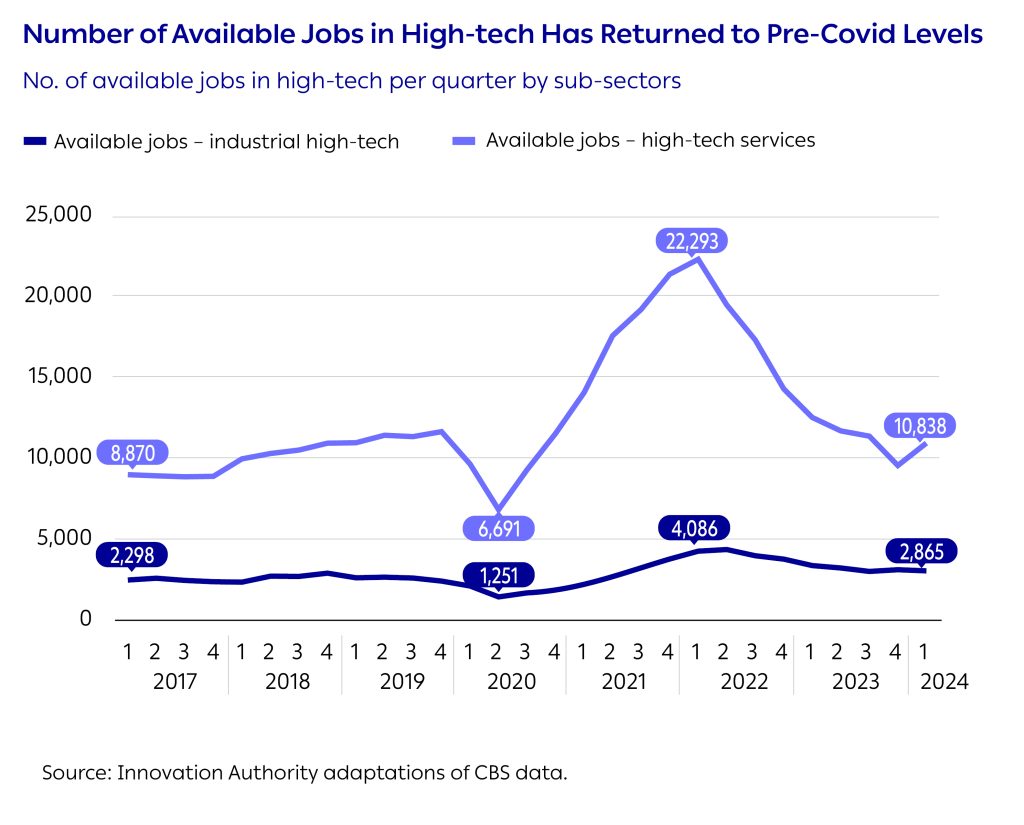

A significant increase was registered from the beginning of 2020 in the number of available jobs in technology companies,5An unstaffed job ,new job or a job about to be vacated for which the company is actively searching for a replacement employee. primarily those from the high-tech services sector.

Previous analyses reveal a correlation in recent years between the total funds raised by startups and the rate of new job openings in the high-tech sector in subsequent quarters. For example, after investments in startups reached a peak in the final quarter of 2021, the number of available jobs also reached record levels in the first quarter of 2022, primarily in software companies (the high-tech services sector). From that point onwards, there was a sharp decline in investments that led to the number of available jobs on the eve of the war to be identical to that prior to the large increase of 2021-2022. The significance of this is that high-tech has returned to the growth trend that characterized it before the accelerated growth witnessed at the beginning of the decade.

There was a further decline in the number of available jobs in the third quarter of 2023, primarily in the Tel Aviv and central regions. However, a recovery to pre-war levels was already registered by the first quarter of 2024.

High-tech on unpaid leave?

While other sectors saw large numbers of workers

being sent on unpaid leave at the beginning of the war, this phenomenon was

relatively minor in high-tech. In the fourth quarter of 2023, only 1% of the workers

(approx. 4,000 people) were sent on unpaid leave. This compares to some 100

employees in the previous quarter (0.03% of high-tech employees). It seems that in

contrast to Covid when 19,000 (mainly inexperienced) high-tech employees (5.7%)

were sent on unpaid leave, the current war has not caused high-tech companies to

react in a similar manner.

Expectations for Hiring Workers in Startups: Mainly Overseas

Expectations for Hiring Workers in Startups: Mainly Overseas

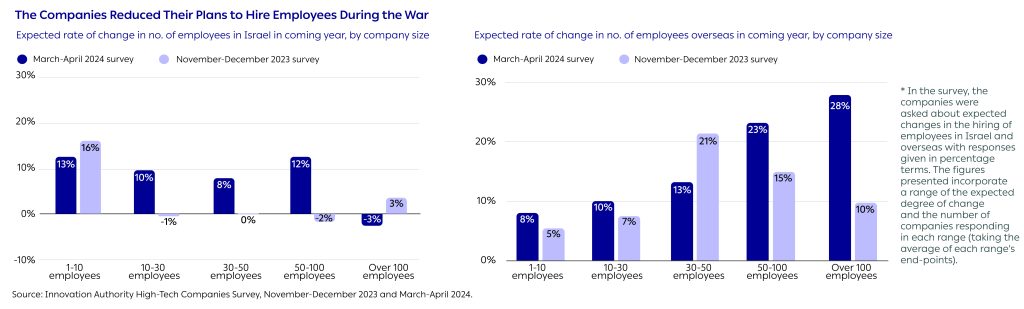

The Innovation Authority survey asked technology companies about their plans to hire workers in Israel and overseas during the coming year. This was to obtain a preliminary indication as to the growth plans of the companies in Israel during the upcoming period and of how they view the current situation and business environment in Israel. An analysis of the two occasions on which the survey was conducted – the first in November-December 2023 and the second in March-April 2024 reveals that the companies expect a decline in their hiring of personnel following the events of October 7, both in Israel and overseas.

Furthermore, it appears that startups in Israel are experiencing a larger downscaling of their plans to hire workers in Israel than overseas. For example, companies that employ 10-30 workers estimated in November-December that they would increase their workforce in Israel by 10% over the coming year whereas they later estimated that they would reduce employment in Israel. A similar situation can be seen with regard to companies that employ between 30-100 workers, where the expected growth in Israel declined to a negligible level. Plans to hire workers overseas shared a similar tend although these remained positive in March-April. The responses to the survey may testify to the companies adjusting their plans due to the ongoing war and to the difficulty to raise capital.

Situation Report:

High-Tech Fundraising

A Decline in Investments in Startups During the First Two Quarters of the War

A Decline in Investments in Startups During the First Two Quarters of the War

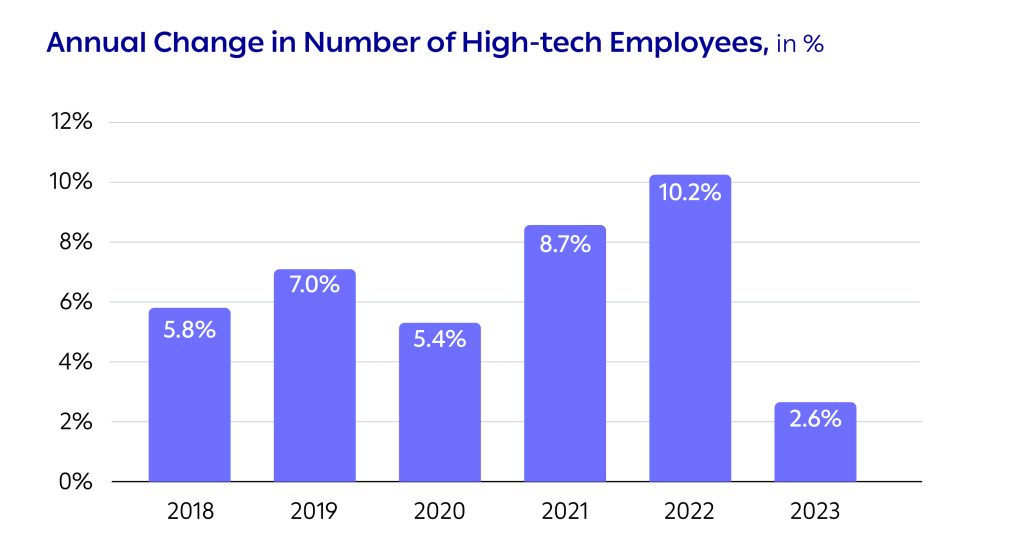

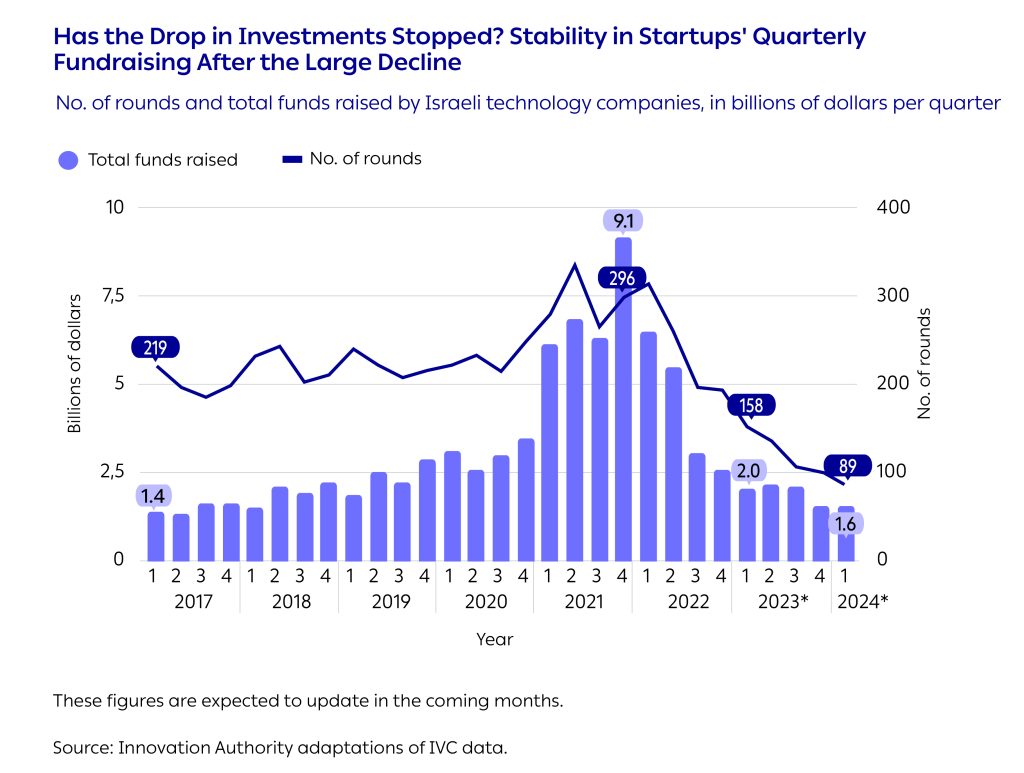

After a decade of growth in most of the indices related to investments in startups in Israel, the second quarter of 2022 marked a change in this trend and the beginning of a decline in investments.

It seemed as if the negative trend in startups’ fundraising had been curbed during 2023: the total capital raised stood at a quarterly average of 2 billion dollars throughout the year. Moreover, this level is similar to the quarterly levels of startups’ fundraising between 2018-2019.

The total funds raised in the first quarter of 2024 also reached a similar level. Furthermore, it is worth noting the mega-deal completed by Wiz in May 2024 where the company raised approximately 1 billion dollars. This deal is expected to have a positive influence on the figures for the second quarter of 2024 which, as of the writing of this report, already exceed 2 billion dollars.

The decline in the number of quarterly funding rounds continued during 2023 and into the first quarter of 2024. It should be noted that these figures are expected to be slightly adjusted upwards in the coming months but it can be estimated with a high degree of certainty that the number of rounds in 2023 and early 2024 was the lowest since 2017.

Fundraising: Distribution of Investments in Startups According to Field of Activity

Fundraising: Distribution of Investments in Startups According to Field of Activity

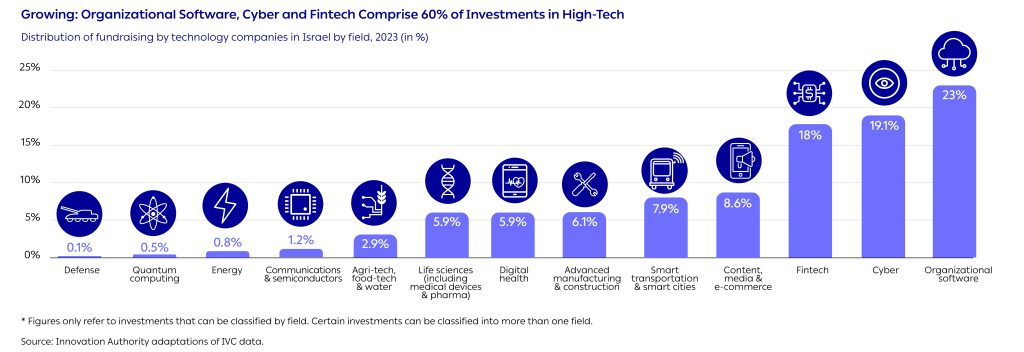

An examination of the distribution of investments in technology companies in 2023 reveals that, like the trend in previous years, most of these investments were concentrated in startups operating in the fields of organizational software, cyber and fintech. These three fields accounted for 60% of the capital raised by technology companies last year. This figure represents an increase in the centrality of these three fields compared to 2022 when their share of investments stood at 53%. Alongside this increase, there was a decline in the ratio of investments in the fields of communications, life sciences, advanced manufacturing, agri-tech, food-tech, and water. Moreover, in light of the growth in the ratio of investments in quantum computing and considering its future strategic importance, this field was included in the survey for the first time this year.

Situation Report:

High-Tech Fundraising – Global Comparison

Similar to Europe: A Sharp Decline in Investments in Israeli Startups over the Last Two Years

Similar to Europe: A Sharp Decline in Investments in Israeli Startups over the Last Two Years

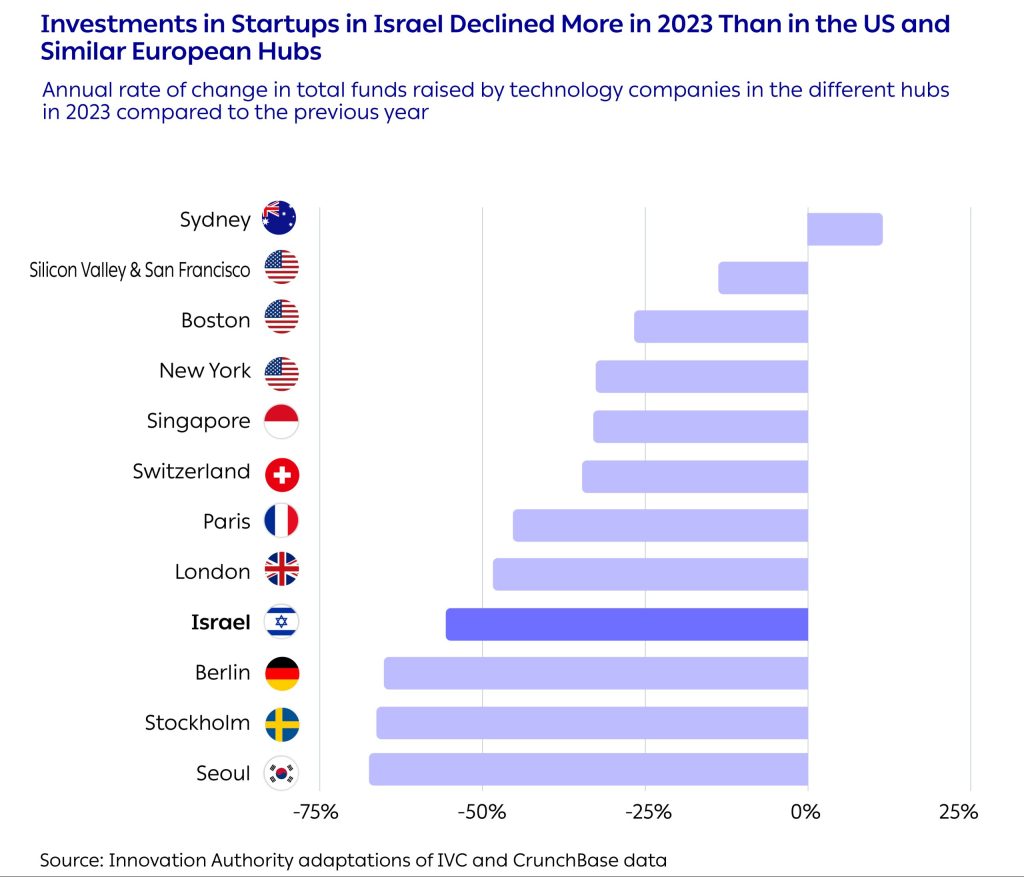

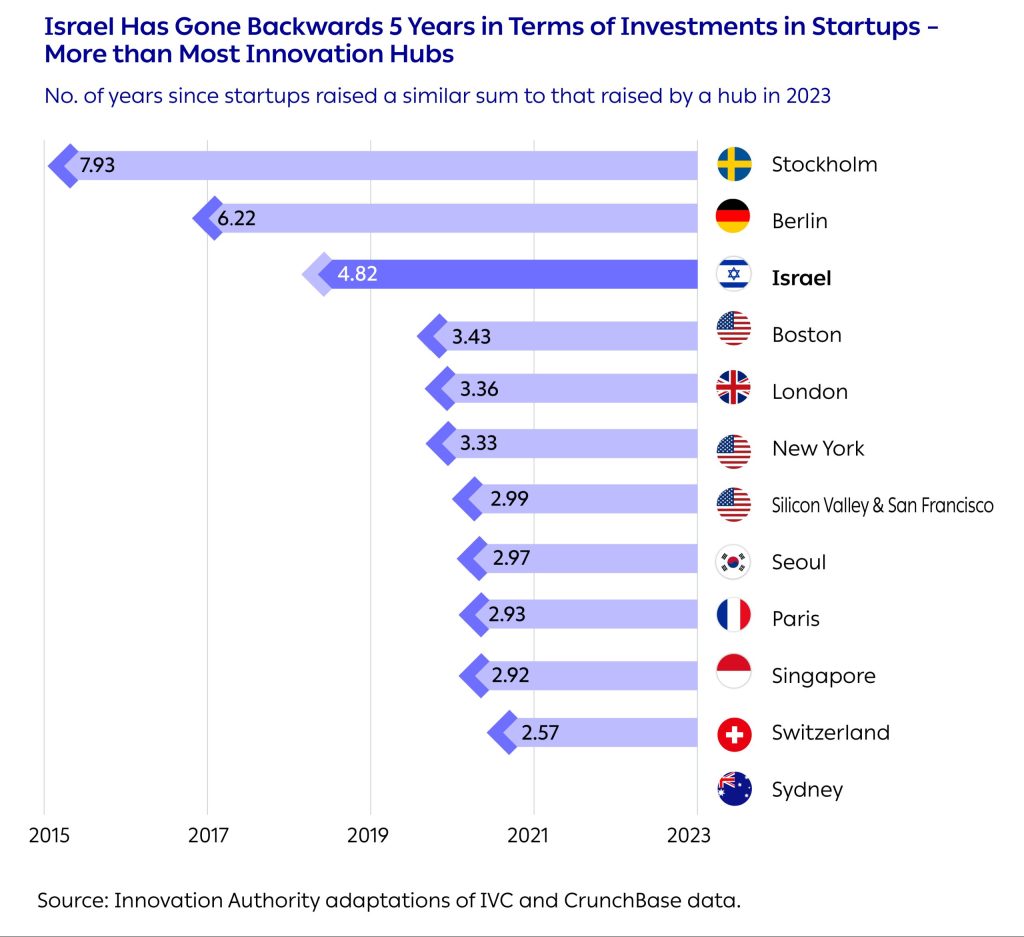

In 2023, Israeli startups raised a total of 8 billion dollars. This represents a decline of 54% in investments in startups compared to 2022 during which there was also a decline of 38% in investments in startups compared to the record levels of 2021.

The decline in investments in Israeli startups is part of a global trend and Israel seems to be in a similar situation to that of Europe. On average, the investments in European hubs declined by 45%. Specifically, investments in Berlin declined by 65%, in Stockholm by 67%, in Paris by 45%, and in London by 49%.

Nevertheless, after the decline in investments in 2022, this trend slowed in the US in 2023. In most of the large hubs in the US, the declines in investment were moderate compared to those recorded the previous year. In New York, the capital raised by startups in 2023 declined by 33%, in San Francisco by 14%, and in Boston by 27%.

The decline in investments takes Israel back to the level of total investments in startups registered in 2018 – five years ago. As stated, most of the world’s main startup hubs have registered a decline in investment. A study aimed at examining how many years each hub “went backwards” in terms of investment – i.e., to which year’s total investment it went back, in relation to the capital it raised in previous years – reveals that most of the hubs lost 2.5-3.5 years. Stockholm and Berlin, two European hubs that compete with Israel, lost eight and six years, respectively.