Climate Tech Startups by Climate Challenge

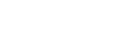

The updated mapping of Israeli startups identified a total of 784 startups that offer solutions to climate challenges, an increase of 90 startups compared to the 694 climate tech startups identified in 2022.1State of Israel’s Climate Tech, 2022 Figure 2 shows the distribution of the startups according to the main climate challenge they address.

The five most prolific challenges addressed by the startups are the same as those in the 2022 report: Climate Smart Agriculture, Clean Energy Systems, Sustainable Mobility & Transport, Alternative Proteins, and Eco-Efficient Water Infrastructure – with 137, 136, 78, 66 and 56 startups, respectively.

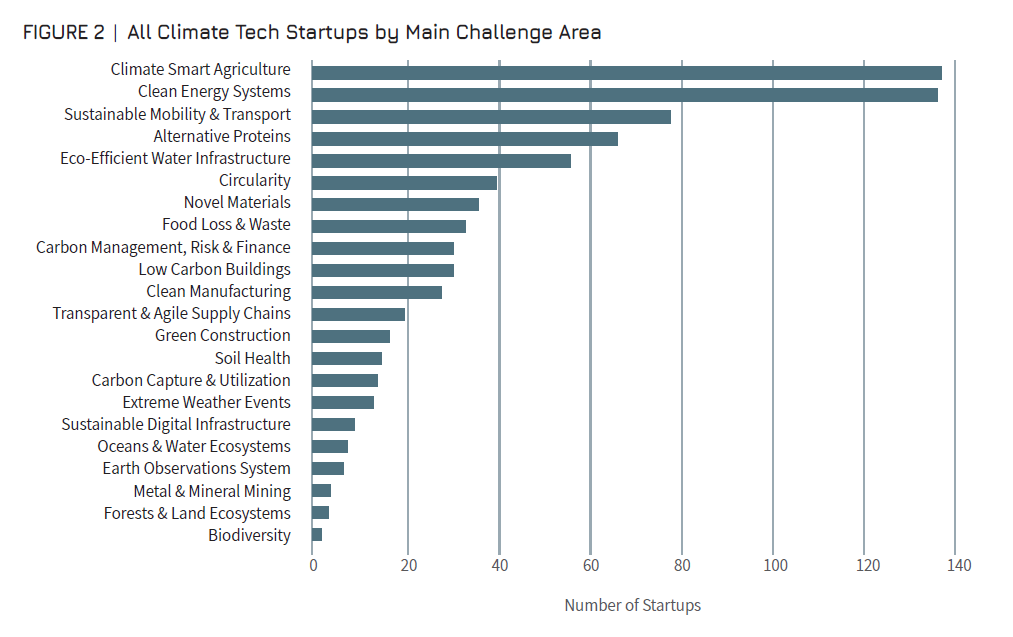

When conducting a similar mapping exercise exclusively for startups established since 2018 (382 startups, comprising 49% of all startups), we noted some changes in the positioning of the different climate challenges (Figure 3).

Carbon Management, Risk and Finance as well as Carbon Capture and Utilization rank significantly higher, reflecting the increase in startups addressing these two challenges in more recent years. In contrast, the Eco-Efficient Water Infrastructure challenge ranks much lower and Low Carbon Buildings no longer features in the leading 10 challenges – indicating that startups addressing these two challenges are now primarily mature companies.

Growth of Climate Tech Startups Compared to All Tech Startups

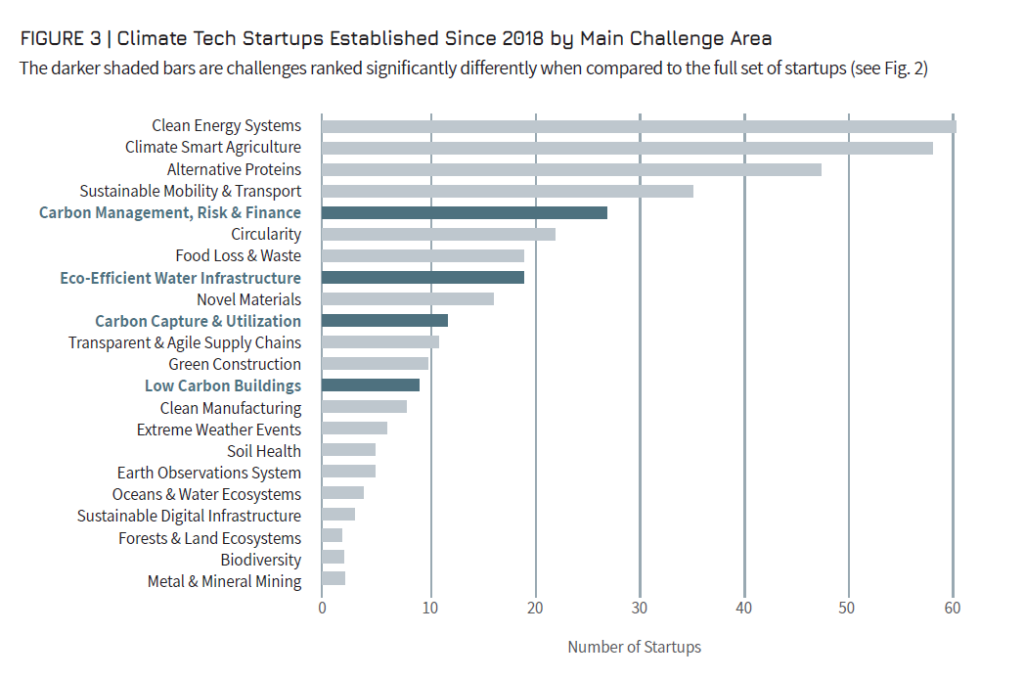

Our 2021 and 2022 reports have already showed that climate tech startups comprise an increasing proportion of all newly established Israeli startups each year. The ratios presented for any given year differ slightly from those in the previous reports due to amendments in the documentation of the total number of startups founded in recent years,2IVC -LeumiTech Israeli Tech Review Q1/2023. as well as additions to the database of previously unidentified climate tech startups. The trend here is, however, identical, with a consistent yearly growth in the ratio of climate tech startups out of all startups established, and a striking increase in the last 2 years (Figure 4). In 2022, climate tech startups comprised 17.4% of all newly established tech startups, i.e., one out of every six new tech startups is a climate tech startup.

This high ratio is despite the slightly lower number of climate tech startups established in 2022 compared to 2021 and reflects an even greater decline in the total number of startups established that year compared to previous years. This indicates that climate tech innovation is perceived as an opportunity and to be less susceptible to the ongoing decline in the numbers of newly established Israeli startups.

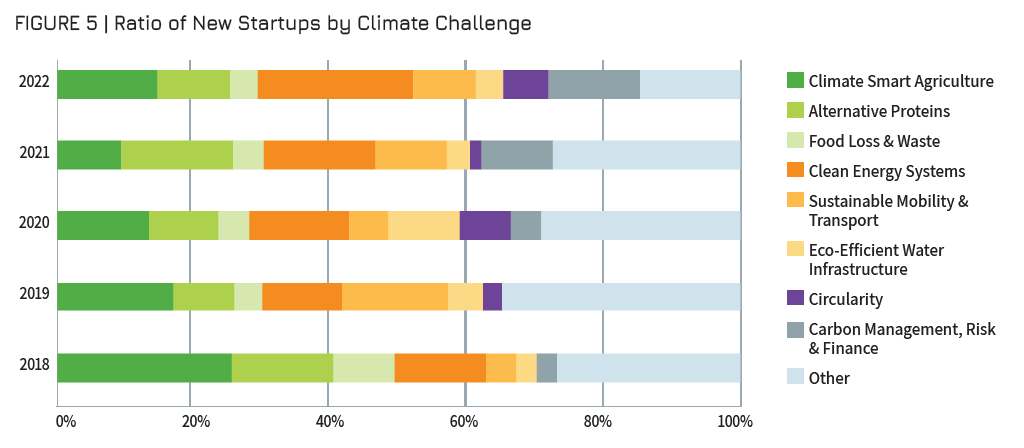

The Emergence of New Climate Tech Startups by Climate Challenge

To better understand the emergence of new climate technologies on a yearly basis we mapped the new startups established each year by their climate challenge. Figure 5 shows the 8 challenges with the highest cumulative number of startups over the period 2018-2022.

- These 8 challenges comprise between 63%-80% of all the startups established each year.

- Clean Energy Systems and Climate Smart Agriculture startups are the dominant challenge areas of new startups each year. Clean Energy startups show a steady increase in the ratio (and number) of new startups each consecutive year – even when the total numbers decline. In contrast, Climate Smart Agriculture startups show a decline in the ratio (and number) each year – although 2022 again shows an increase.

- Alternative Proteins and Sustainable Mobility & Transport are the next leading challenge areas – with the number of new startups established varying each year.

- Startups addressing the Carbon Management Risk and Finance challenge emerge again in 2020, growing to prominent numbers in 2021 and 2022.

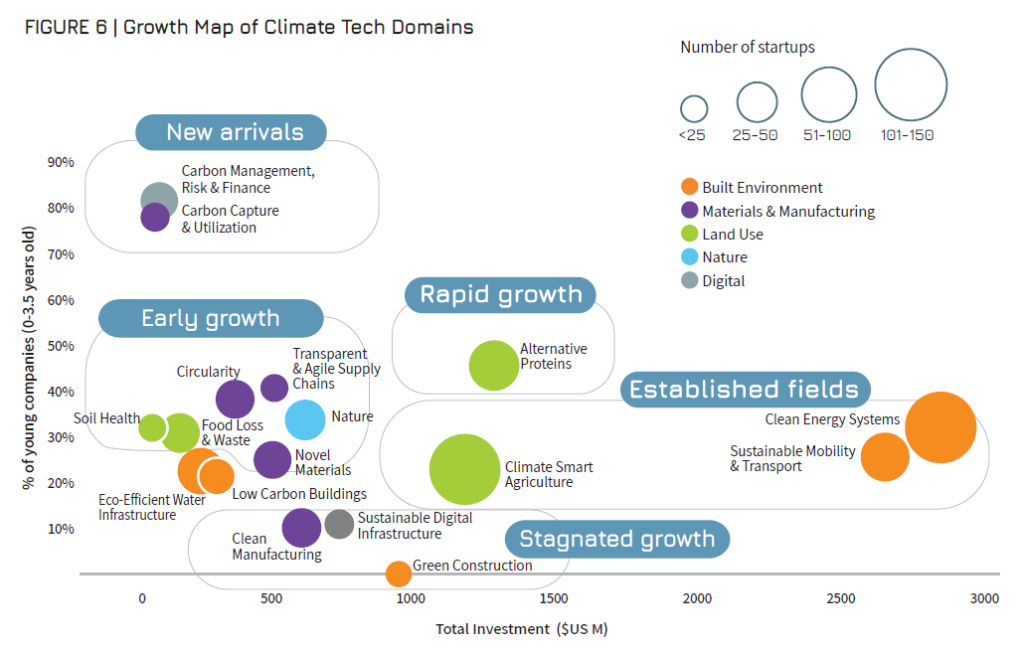

Growth Map of Climate Tech Domains

An analysis of startup companies’ growth rate for each specific challenge is shown in Figure 6. The figure depicts the percentage increase in the number of startups over the last 3.5 years (2020-H1 2023), the size bracket of the total number of startups for each challenge, and the total known investment per challenge.

The challenges are grouped into a number of clusters, each defined by common characteristics. Cluster 1 – Established Fields – consists of Sustainable Mobility & Transport, Clean Energy Systems, and Climate Smart Agriculture. These challenges have the highest number of startups, the largest total funding over time, and steady investment growth. We note that the relative increase of 20%-30% in young startups in these challenges actually dominates the newly established climate tech startups with regard to absolute numbers each year (Figure 5).

The challenge of Alternative Proteins is the only one in Cluster 2 – Rapid Growth. It shows that a large proportion of the existing companies are young and that significant capital has been raised.

It is noteworthy that in our 2021 and 2022 reports, Green Construction was also attributed to the Rapid Growth cluster, leading us to anticipate this challenge’s continued growth. However, despite the entry of new and disruptive startups in the past, we did not identify the establishment of any new startups with Green Construction as their main challenge in the last 3.5 years. Green Construction is now in Cluster 3 – Stagnated Growth – alongside Clean Manufacturing and Sustainable Digital Infrastructure, challenges with very few new startups yet well above the median of total investments per climate challenge. These challenges are central to decarbonization, and opportunities could abound if entrepreneurs seize the opportunity and investors follow suit.

Cluster 4 – Early Growth – includes a group of challenges, each with less than 50 startups at varied stages of maturity and for which investment growth is still limited. Here, we include aggregated data for the Nature challenges.3https://innovationisrael.org.il/en/wp-admin/post.php?post=7049&action=edit

Cluster 5 – New Arrivals – includes Carbon Management, Risk & Finance, and Carbon Capture & Utilization, two challenges that have attracted entrepreneurs in line with the global interest in these domains, and in which opportunities are expected to grow. Both challenges include a very high percentage of young companies, with a larger number of startups emerging in the software-based Carbon Management, Risk & Finance platforms (see also Figure 5) compared to the hardware-intensive Carbon Capture & Utilization challenge. Both challenge areas are still at an early stage of investment.

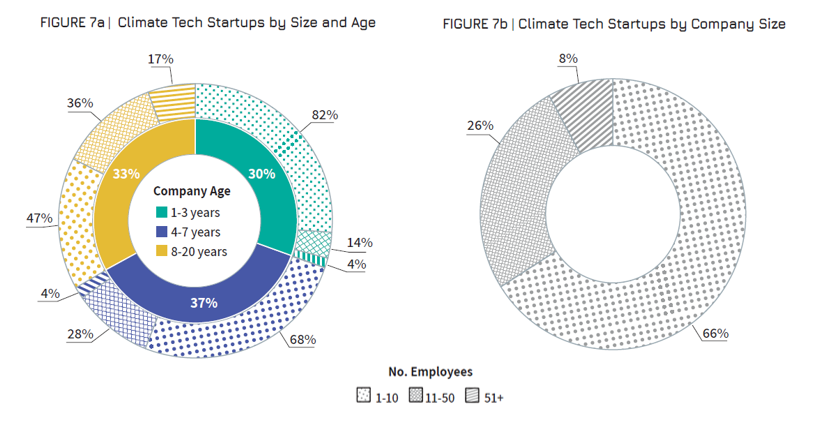

The Onset of Growth for Climate Tech Startups

While the Israeli climate tech domains are at different stages of growth, the majority of the startups (67%) are less than 7 years old, with nearly even distribution between the three age subgroups, the largest fraction being between 4-7 years old (Figure 7a).

As expected, the older the company, the higher the fraction of larger size companies. The size bracket of 11-50 employees increases from 14% to 28% to 36% when progressing across the three age groups and the size bracket of 51+ employees increases from 4% for the younger companies (up to age 7) and then increases to 17% for companies older than 8 years old (see Figure 7a). Nevertheless, the data shows that 66% of all companies have less than 10 employees (Figure 7b), and that the majority of these smaller sized companies (50% of all startups) are aged 7 and lower. This emphasizes the long development period and late onset of growth for climate tech companies.

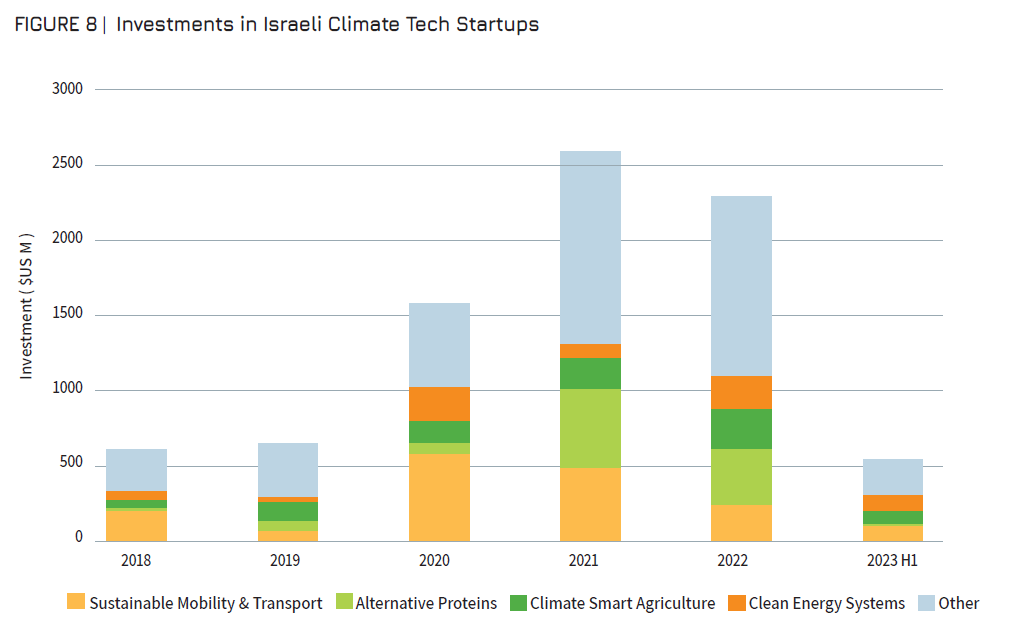

Capital Investments

Investments in Israeli climate tech ventures totaled $8.2B between 2018-H12023 (Figure 8). Climate tech investments in 2022 totaled $2.27B, and in the first 6 months of 2023 (H1 2023) totaled $551M.

The four climate challenges which attracted the most funding between 2018-2022 were Sustainable Mobility & Transport, Alternative Proteins, Climate Smart Agriculture, and Clean Energy Systems, together comprising 52% of the total funding in this period (20.6%, 13.5%, 10.4%, and 8.1 % respectively).

These are the same four leading challenge areas by startup numbers in the Israeli climate tech ecosystem (Figures 2 and 3), although the order of proportional investment in each challenge is exactly opposite to the number of startups established in each challenge area over the last 5 years (Figure 5). It will be interesting to follow investment trends in these challenge areas as the more recently established companies mature, to see if they receive a greater share of future investments.

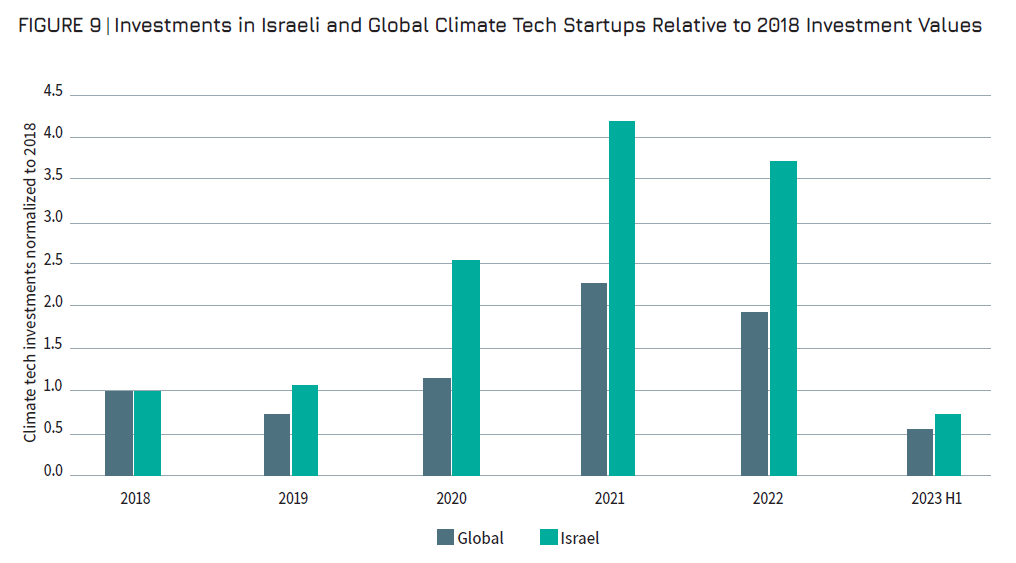

The slight decline in funding between 2022 compared to 2021 comes after a 320% growth between 2018-2021. The decline is small (12%), and the near stability between the two years parallels global climate tech trends over the same period, with investments remaining around $40B in 2021 and 2022 (Figure 9).4https://pitchbook.com/news/articles/VC-climate-tech-drop-2023-startups-founders; https://www.ctvc.co/climate-tech-h1-2023-venture-funding (both Pitchbook and CTVC report on global investments of approx. $40 billion in 2021 with slight increase/decline around that figure for 2022).

Overall investments in early and growth stage startups in Israel decreased from $28.2B in 2021 to $15.9B in 2022,5IVC -LeumiTech Israeli Tech Review Q1/2023. and when excluding the climate tech investments in each year, show a decline of 47%. In other words, overall investments in Israel declined 4 times more than climate tech investments between 2021 to 2022. A comparison of the drop in investments in Israel for fintech, the leading field for 2021 investments,6IVC -LeumiTech Israeli Tech Review Q1/2023 July 2023. reveals that the decline in fintech investment was 5 times higher than that in climate tech investments. This demonstrates that climate tech is extremely resilient to the general slowing of investments that evolved in Israel during this period.

The above investment values for 2022 mean that for every dollar invested in Israeli high tech in 2022, 14 cents went towards climate tech.

The climate tech investments for H1 2023 show less resilience to the slowing market, with investments decreasing by approximately 60% compared to the sums we reported for H1 2022, a ratio that parallels the sharp decline in Israel for all tech investments between H1 2022 and H1 2023.7IVC -LeumiTech Israeli Tech Review , Q2 2023/July 2023. This is also consistent with the trend seen in the global climate tech market, where investments declined sharply (Figure 9).8https://www.ctvc.co/climate-tech-h1-2023-venture-funding/ We can characterize Israeli climate tech investments as having developed rapidly since 2018 – even outpacing global growth – whereas since 2021, it has behaved more similar to the global climate tech ecosystem, perhaps a sign of the mainstreaming of the market.

Funding Stage of Climate Tech Startups

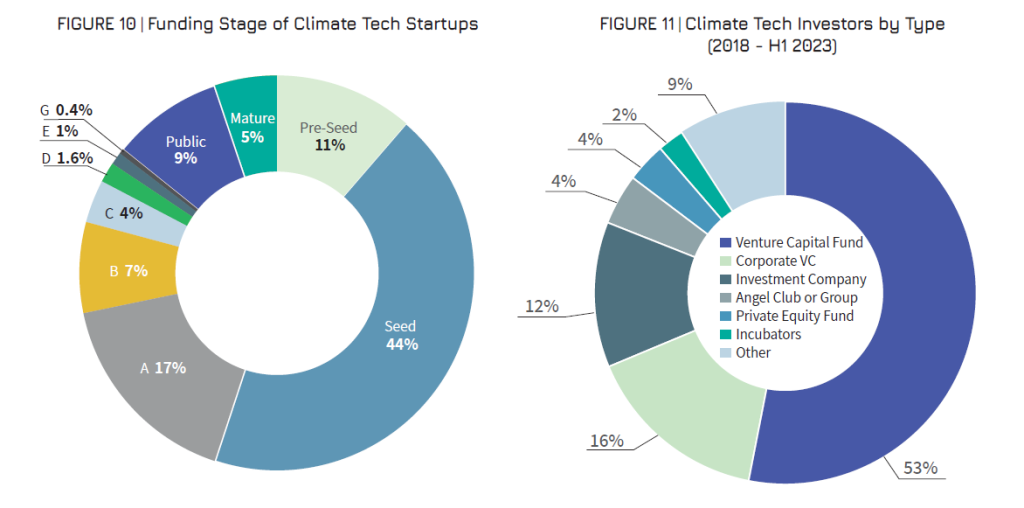

The funding stages for the set of climate tech startups is shown in Figure 10. The majority of funded startups are still at the seed stage (44%), and less than 8% of companies have progressed beyond Round B.9Not including companies that went public or were merged or acquired. This is consistent with the finding that most startups (67%) are still relatively young and thus, for the most part, still in early fundraising rounds. Over 14% of the companies are either publicly traded or have completed an exit through acquisition or merger (termed “Mature”).

Investor Types and Origin

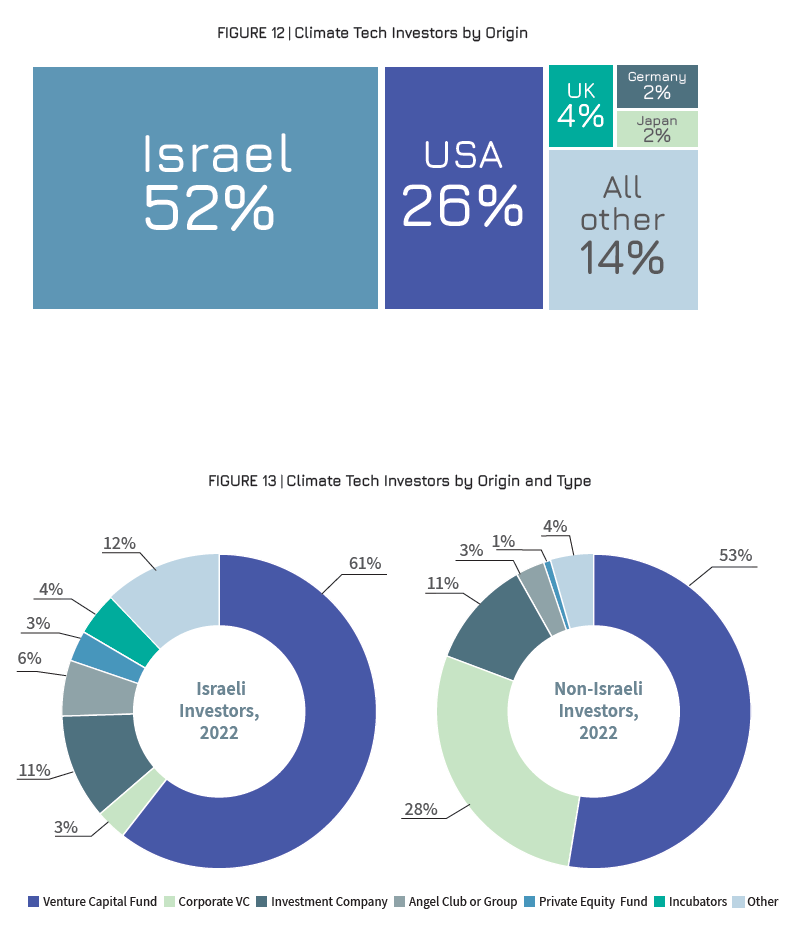

Since 2018, Israeli climate tech has attracted almost 540 investor groups as well as a large number of additional private investors. Many of these investor groups have invested multiple times – averaging 2.7 investments per investor. Over 50% of the funding derives from Venture Capital Funds (Figure 11). 52% of the investors are Israeli and 48% are non- Israeli, predominantly from the USA (Figure 12). VC investors’ origins are quite evenly distributed between Israel and overseas However, corporate VC’s investments originate nearly entirely from non-Israeli entities (Figure 13).10Figure 13 is for 2022, but the distribution is nearly identical for each of the years 2018-2022. Most of the private investors – not shown in the charts – also originate from outside of Israel.

Government Investments

Government support for climate tech originates from several ministries and entities. The Israeli Innovation Authority occupies a unique position as the government entity responsible for accelerating and strengthening Israel’s hi-tech entrepreneurship and leadership, doing so through R&D investments in sectors addressing global and local technological challenges. Since 2021, the Authority has made climate tech one of its focus areas, supporting and de-risking climate tech technological development and ecosystem growth.

In 2022, the Authority supported 273 climate tech ventures with a total budget of $71.4 M, which comprised 16% of its annual budget. This support was provided through various tools of the Authority.

- Incubators and Labs: The Authority supported ideation and early-stage ventures via 7 incubators and innovation labs, 2 of which were established in the last two years.

- R&D Consortiums: 3 new “MAGNET” consortiums were established11MAGNET provides grants for R&D collaboration as part of a consortium between industrial companies and research institutions. – in the fields of Cultured Meat, the Black Soldier Fly (Circularity), and Bioplastics.

- Pilots’ Program: Together with other government ministries and entities – the Ministry of Environmental Protection, the Ministry of Energy, the Ministry of Agriculture, and the Government Companies Authority – the Authority invested $9M in climate tech startups with ventures in their later-phase R&D pilot testing and implementation.

- Advanced Manufacturing: The Authority provided support for climate tech companies in their scale-up of R&D projects within commercial manufacturing facilities.

- Human Capital: The Authority utilizes its Human Capital support tracks to increase capacity building in climate tech fields, to enhance entrepreneurship skills of climate tech experts, and to fill the gaps in capabilities for new and modified fields of expertise.

- International Collaboration: The Authority, under its International Division, has launched a program to promote collaboration in R&D and pilots of Israeli startups and multi-national corporates in climate-related fields. This program promotes the exposure of Israeli innovation to global markets and global collaborations.

- The participation of Israel, as an associated country, in the European framework program for R&D: Horizon- Europe enables startups, academic researchers, and other entities to collaborate in European projects to promote climate-related solutions. Membership is funded by the Authority, the Council for Higher Education, and the Ministry of Innovation, Science and Technology. Under the framework of Horizon-Europe, additional governmental ministries, e.g., the Ministry of Environmental Protection and the Ministry of Energy, also support Israeli entities participating in different European climate related collaborative projects.

Additional Government Support from Ministries

- In addition to collaborating with the Authority Pilots’ Program, the Ministry of Environmental Protection has collaborated with the Authority in supporting early-stage ventures in ESIL – a joint public-private innovation lab focused on Energy and Sustainability.

- In addition to collaborating with the Authority in the Pilots’ Program, the Ministry of Energy also promotes climate innovation in dedicated support programs from academic research to pilots (totaling 30% million for 2022).

- Additional ministries operate climate support projects via their Chief Scientist departments.

- In July 2023, Israel’s Council of Higher Education approved it’s 5-year-plan and will allocate $130 million over the next five years for research into the climate crisis and sustainability.

Activity in Global Funding Programs – Horizon Europe

Participation and success rates of Israel within Horizon Europe, Europe’s largest climate funding program and the largest R&D program in the world, provide an indicator of Israel’s capacity and readiness level in climate tech domains.

Data on Israeli participation in the European Framework Program for Research and Innovation “Horizon-Europe” was taken from the Horizon Dashboard, on the European Commission Funding and Tenders Portal,12Updated for July 21, 2023. and refers to the years 2021-2022. The data on participation in Clusters 5 and 6 of Pillar 2 of the program (with the titles “Climate, Energy and Mobility” and “Food, Bioeconomy, Natural Resources, Agriculture and Environment”, respectively) were considered climate-relevant, including the European Missions – Soils, Ocean, Climate and Smart Cities. This data was considered comparable to the 2020 data presented in “Israel’s State of Climate Tech Report, 2021”,which presented the results of the 20 calls for proposals that comprised the Horizon 2020 Green Deal.

The number of participants in 2022 was significantly higher than in 2021, (219 vs 142), a fact that may partly be explained by Israel’s official inclusion in the Horizon Europe Program only towards the end of 2021, but which also reflects the larger number of Israeli entities – startups, academic researchers, and others – involved in climate-relevant technologies, research, and actions. A total of 317 Israeli entities submitted a project proposal in climate-relevant fields in 2022, with 62 of them (19%) being part of 55 projects selected for funding, securing over €22 million.

The success rate for acceptance and funding of proposals increased from 14% to 19% between 2021-2022. This bridges much of the gap between Israel and Europe, the UK, and the associated countries, whose average success rates for projects decreased slightly in the same period, to a little below 25%.

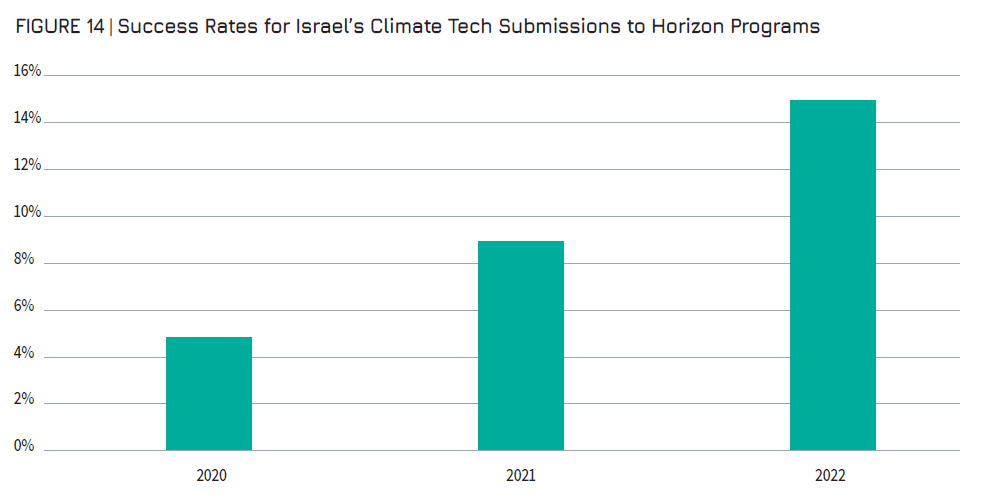

Assessing the improved success rates for participants, rather than projects, shows slightly lower numbers, but there is a clear progression in approvals and funding when compared to the 2020 Horizon Green Deal results (Figure 14).

The fields with the highest number of Israeli participants were “Sustainable, Secure and Competitive Energy Supply” (“Energy” – 44 applicants, with a 14% success rate), “Fair, Healthy and Environmentally-friendly Food Systems from Primary Production to Consumption” (“Food and Agriculture” – 44 applicants, with a 21% success rate) and “Safe, Resilient Transport and Smart Mobility Services for Passengers and Goods” (31 applicants with a 10% success rate). It is noteworthy that these fields reflect the four most prolific climate challenges addressed by Israeli startups (see Figure 2).

Food and Agriculture, Israel’s well-established area of expertise, tripled its 2021 funding as the result of an increase in the total number of submissions from the field. Energy secured no funds in 2021, despite having the highest number of submissions, however this was rectified in 2022 with increased submissions, an above-average success rate, and high funding.

Israeli participants are increasingly and more successfully involved in the Horizon programs with success rates by participant numbers tripling since 2020 (5% vs 15% in 2020 and 2022, respectively). Project success rate is even higher than participant success rate, a fact that may allude to the innovative technologies involved, and the high quality of the proposed projects.