No Significant Change in Startups’ Fundraising During the War

A further metric that reflects the state of the high-tech sector is the capital raised by startups – capital that is used to hire new employees and to expand the business activity of the companies’ future generations.

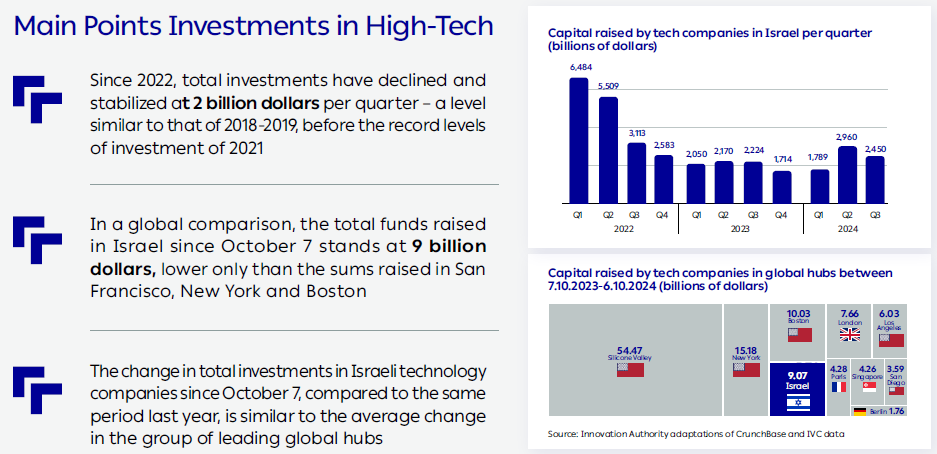

The total capital raised by technology companies in Israel during the war, in the period between 7.10.2023-6.10.2024, was about 9 billion dollars. This sum is similar to that raised by Israeli technology companies during the same period every year since 2017, except during the record fundraising periods of 2020-2022. In other words, the war has not slowed the total capital raised by Israeli startups and the long-term trend would appear to be continuing. We will also see below that Israel is still one of the leading global hubs in venture capital investments.

It is important to emphasize that there is a delay in identifying the number of funding rounds, primarily those attributed to the early stages, and we expect this number to increase over time.

Nevertheless, as will be detailed below, there were changes in the composition of investments in Israeli startups during this period in terms of the companies’ life-stage and their fields of activity. It is important to continue monitoring these trends.

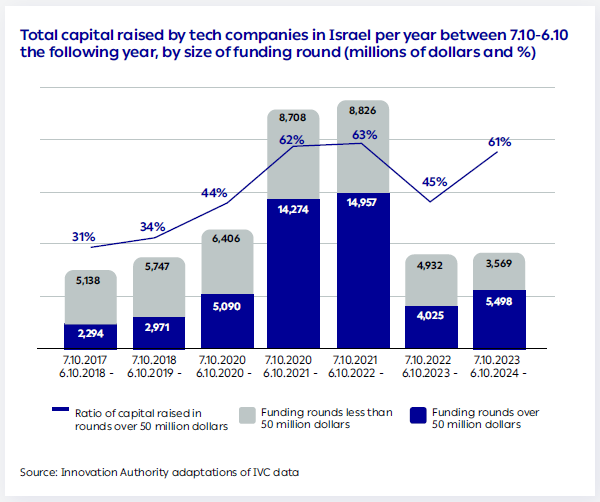

Investments During the War: Primarily in Mature Startups

Even though total investments in technology companies in Israel were similar to previous periods, a change can be identified in the composition of investments in terms of the life-stages of the companies in which capital was invested: about 60% of the total capital raised by Israeli technology companies since October 7 – approximately 5.5 billion dollars – was in funding rounds larger than 50 million dollars i.e., in mature companies. Consequently, the composition of investments during this period tends towards investment in mature and established companies.

The high ratio of investments in large funding rounds since the onset of the war is similar to that observed at the peak of the investments period between 2020-2022. Nevertheless, it can be assumed that this ratio will update and decline slightly as more data is revealed about early-stage transactions.1See the IVC Methodology Report

A global comparison reveals that the trend observed in Israel is not unusual in comparison to other central hubs such as Paris, London, and New York and that the high ratio of advanced-stage investments may indicate the maturation of companies and the maturity of the local ecosystem. At the same time, it is important to monitor early-stage investments as a metric of the sector’s future and of the growth of young startups and their transformation into mature companies.

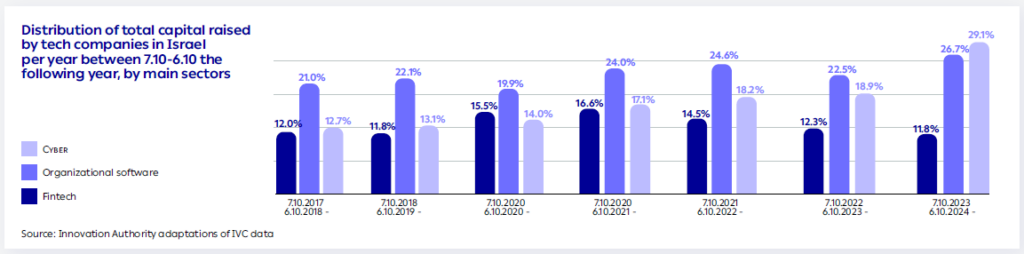

An Increase in Investments in Cyber Companies

During the first two quarters of the war (the fourth quarter of 2023 and the first quarter of 2024), it would seem there was a slight decline in total investments. In the second quarter of 2024, on the other hand, there was an increase in total investments, which were similar to the last two quarters of 2022 (after the significant decline compared to the period of record investments).

The factor explaining the increase in fundraising in the second quarter of 2024 is the number of very large funding rounds of high-tech companies in the cyber field – a field that has become more dominant since the beginning of the war.

About 29% of the total capital raised since the beginning of the war was by cyber companies. This is a significant increase when in parallel periods in previous years, cyber companies constituted only 13%-19% of capital raised.

Since the beginning of the war, there has been a change in the composition of investments in Israeli startups. In recent years, three fields constituted approximately two-thirds of total investments in startups: organizational software, cyber, and fintech. Since the start of the war, the share of investments in these three fields has increased to two-thirds of total investments in startups in Israel.

The Innovation Authority referred to the diversity of investments in Israeli startups in its annual report and will continue to monitor this trend.

Israeli Startups’ Fundraising is Fourth in the World – But Recovery is Slow and Competition is Growing

The sum raised by Israeli technology companies since the onset of the war –about 9 billion dollars – positions the Israeli innovation hub in fourth place in terms of fundraising2The calculation combines data from the CrunchBase international database and the Israeli IVC database. This combination may result in inconsistency regarding the way in which different companies are attributed to different territories., a sum lower only than that raised in San Francisco, New York and Boston.

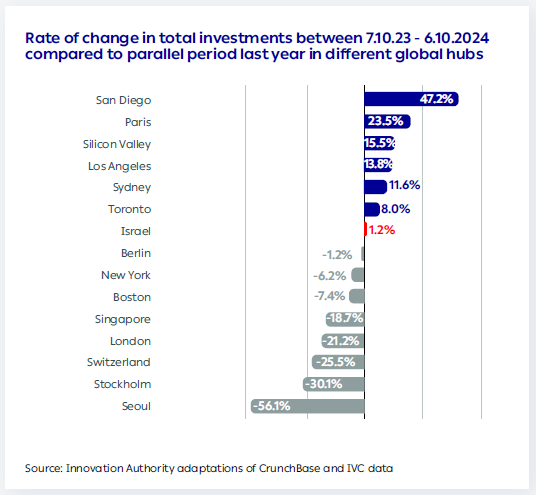

Alongside the positive news for Israeli high-tech, it is important to pay attention to the rate of recovery of investments in some of the world’s leading hubs which is faster than that observed in Israel. The total investments in technology companies in Israel in the year since October 7 are 1.2% higher than in the parallel period last year. In San Diego, Paris, Los Angeles, and Toronto – hubs that have raised lower sums than Israel since October 7 – the growth rate was higher, as it was in Silicon Valley, the global leaders.

The Foreign Venture Capital Funds are Maintaining their Presence in Israel

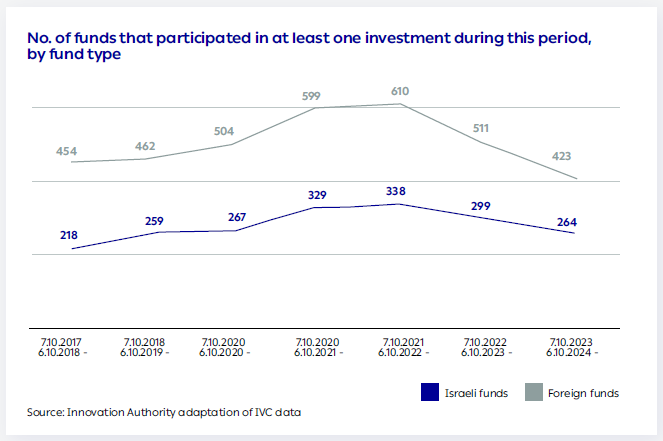

An examination of the venture capital funds active in Israel (funds that have made at least one investment in Israel since October 7), reveals no significant decline in their number which remains similar to that of the end of 2020.

Despite the increased risk in the State of Israel during the war period, the number of foreign venture capital funds active in Israel remained at a similar level to that of the past five years. Even during this turbulent period, more foreign venture capital funds have been active in Israel than Israeli funds.

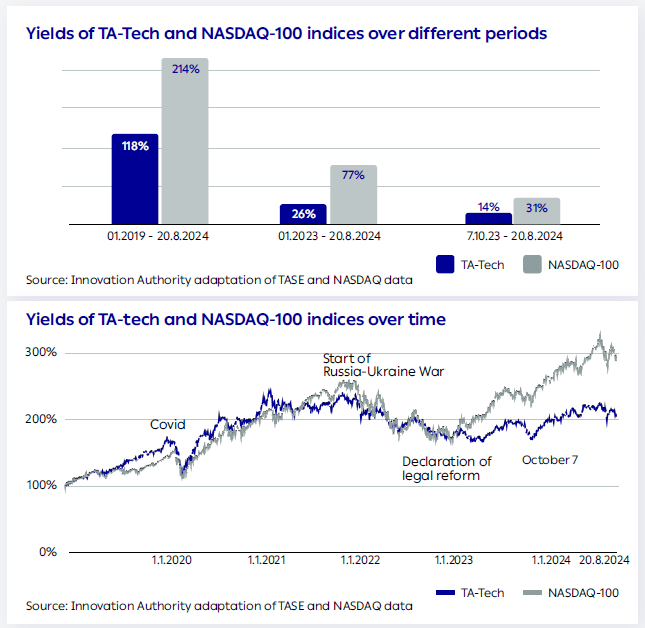

The Disparity in Yields Between NASDAQ and Tel Aviv Continues to Grow

After several years during which the Tel Aviv Technology Index and the NASDAQ returned similar yields, a disparity in their yields began to appear in early 2023. On the eve of October 7, the NASDAQ Index had returned a yield of 37% since the beginning of the year whereas the TA-Tech Index had returned a yield of only 10%. This disparity is steadily growing, the longer the war continues. Although the yield of the technology companies traded on the Tel Aviv Stock Exchange stands at 14% since the onset of the war, this figure pales in comparison to the 31% yield of the NASDAQ 100 Index i.e., the NASDAQ’s yield has been more than double that of Israel since the beginning of the war.

Overall, when examining the disparity in yields since the beginning of 2023, the technology companies in Tel Aviv have yielded 25% compared to the NASDAQ which has yielded 76% – three times more.

This disparity, combined with the lowering of Israel’s credit rating, illustrates the global erosion of Israel’s reputation.