After having presented high-tech’s contribution to the Israeli economy via tax payments, this section analyzes the distribution and characteristics of tax payments within the high-tech sector.

As shown above, 85% of the collected taxes from the high-tech sector can be attributed to the sector’s employees.

In this section, we expand on the differences in tax payments among various groups of high-tech employees. The primary variable influencing these differences is the salary paid in each respective group.

The analysis reveals that 70% of the taxes in the high-tech sector stem from employees in companies located in Tel Aviv and central Israel, and that most of the taxes collected from high-tech employees are from men employed in high-tech companies in these districts. It should be noted that this occurs following recent years’ increase in taxes collected from employees of companies in Tel Aviv.

80% of high-tech employees’ taxes are attributed to men employed in high-tech companies – although the ratio of men in the sector stands at 66%. This ratio is higher than the average in the rest of the economy, where 74% of the income tax is collected from men.

As we showed in the previous section, the income tax collected from high-tech sector employees increased during recent years, an increase that stemmed from a rise in both their number and their salary. The established high-tech companies, which are responsible for most of the tax payments were, originally, young startups1For further information about the opening of startups in Israel, see the study conducted by the Innovation Authority and the SNPI Research Institute. The continuous decline in fundraising by Israeli startups, as recorded in previous quarters, may curb this growth. Such a change will also impact the taxes collected from the high-tech sector in Israel.

Average High-Tech Salary Data

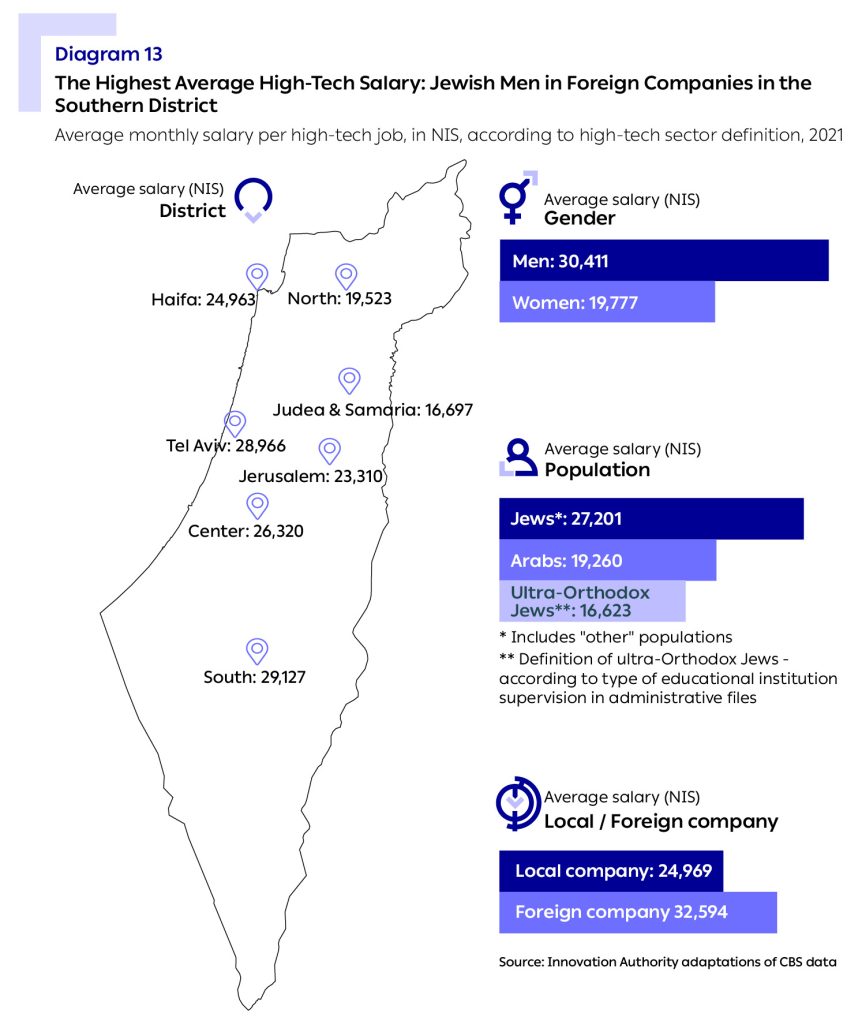

To conduct an in-depth analysis of the income tax payments of employees in Israeli high-tech companies, it is important to understand the differences in salary as are reflected in the various categories. As part of the data generated especially for this report, we are presenting in-depth data on the influence of gender, company headquarters’ location, the company’s designation whether international or local, and of specific population groups on the average salary in high-tech companies. We subsequently show how differences in the contribution of tax payments to state revenues are influenced by salary disparities according to the various characteristics examined.

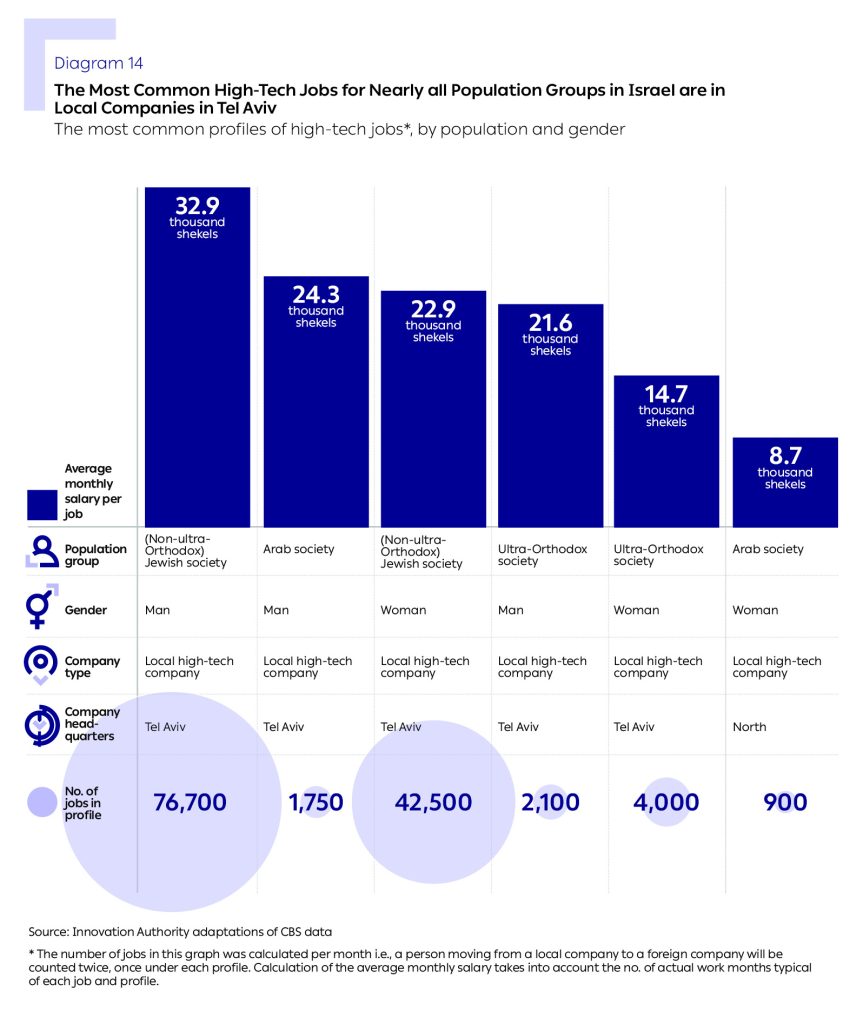

Salary and Tax Payments in Israeli and Foreign High-Tech Companies

The high-tech sector is divided between local companies that were founded in Israel and foreign (multinational) companies. The category of local companies includes a diverse range of companies – including companies that manufacture tangible products, veteran software companies, growth companies, and young startups. Among the category of foreign companies are those with widespread activity in Israel that includes possession of intellectual property (IP), and companies whose primary activity is overseas and their activity in Israel focuses on the development of innovative technologies in dedicated development centers. Some of the development centers were created as the result of M&A of local high-tech companies.

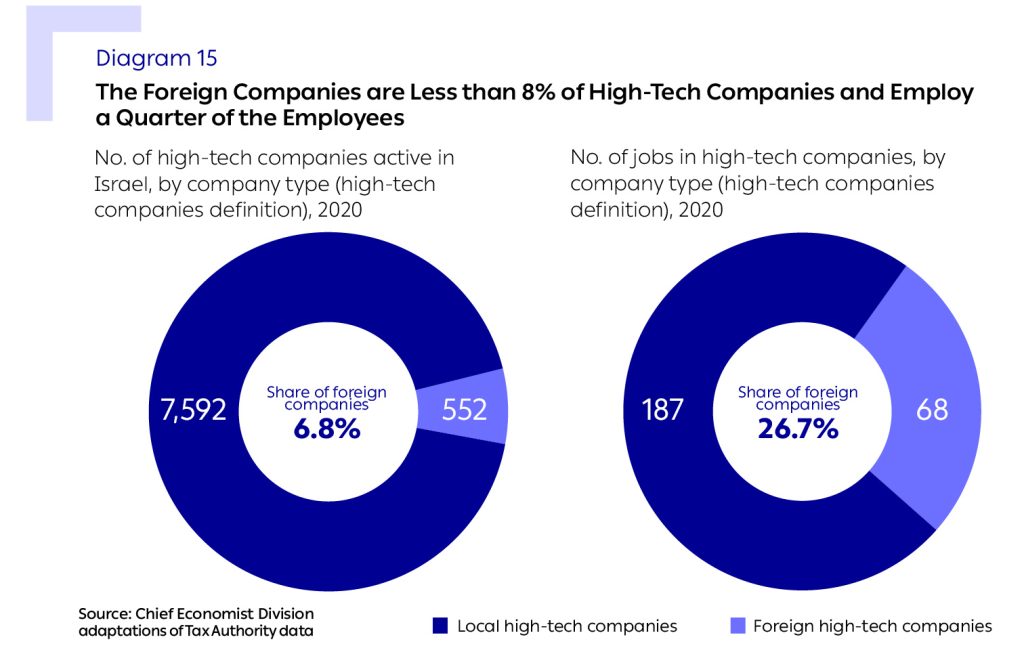

The category of foreign high-tech companies is relatively small and included 527 companies in 2020, compared to about 6,400 local high-tech companies2Local companies purchased by multinational companies may appear as a local or foreign company, according to the following principle: if the purchased company maintains managerial and product independence, it will continue to be defined as a local company. If not, it will, in most cases, be defined as a foreign company (according to IVC definitions).. In other words, the foreign companies constitute less than 8% of the high-tech companies in Israel. Nevertheless, their contribution to the Israeli economy is significantly larger than their relative size.

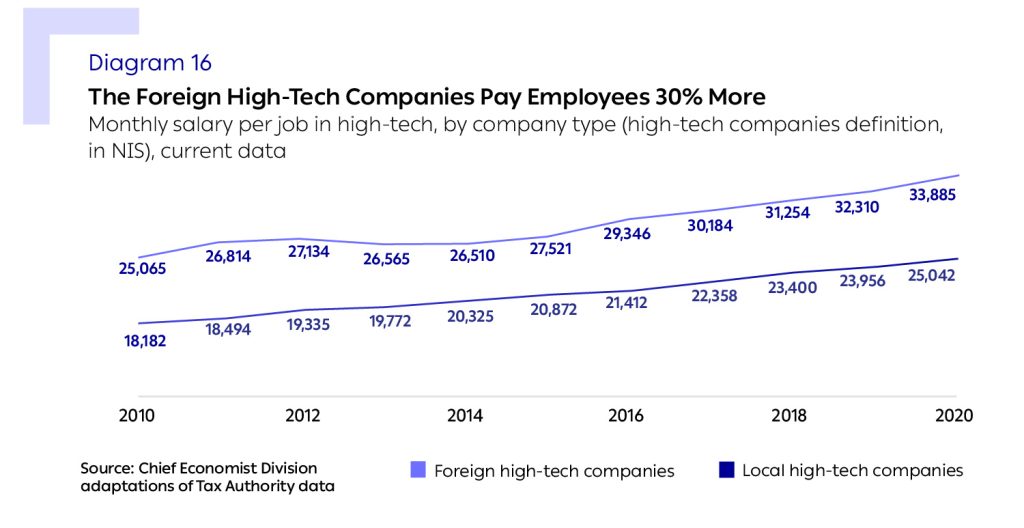

Two prominent characteristics typify the activity of foreign high-tech companies in Israel: the first of these is the salaries they pay their employees, which are higher than the accepted average in hightech. For example, in 2020, the average salary in foreign companies in the high-tech sector stood at 33,900 shekels – 35% higher than the average salary per job in the local high-tech companies that was 25,000 shekels on average i.e., an average monthly disparity of 8,843 shekels. The second unique characteristic of the foreign high-tech companies’ activity in Israel is the manner the taxable income is calculated according to the “cost plus” method3In many cases, the “cost plus” tax model refers to foreign-owned R&D centers whose primary activity is R&D. In this structure, the local company under foreign ownership, sells R&D services to another corporation in the group at a price that reflects the operating cost plus a fixed level of profit determined by a transfer pricing model..

Income Tax Paid by Employees of Foreign High-Tech Companies in Israel

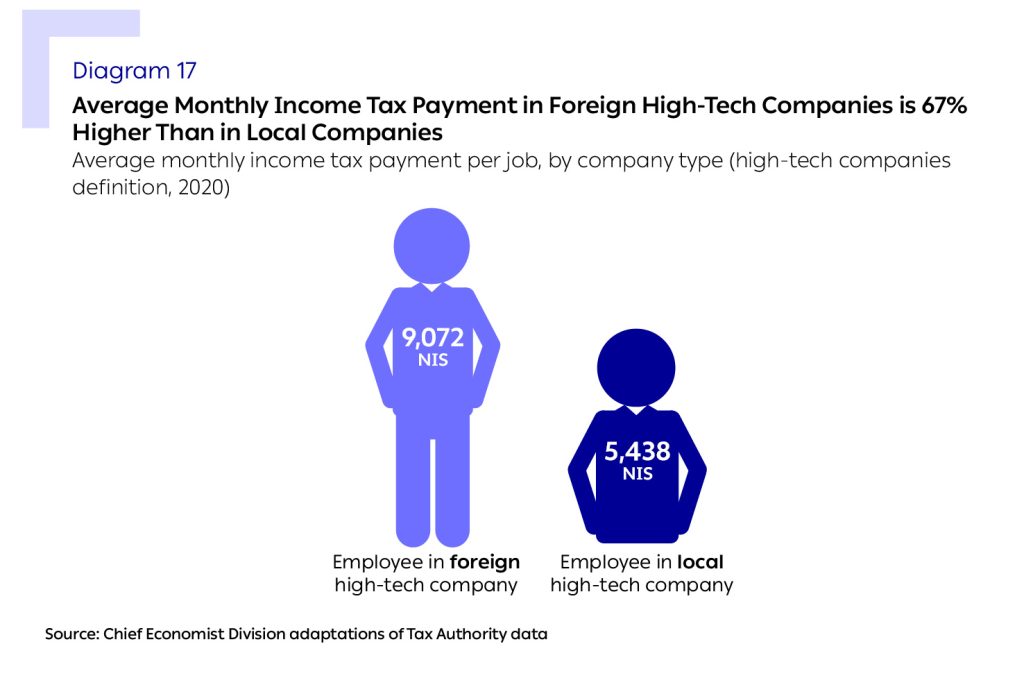

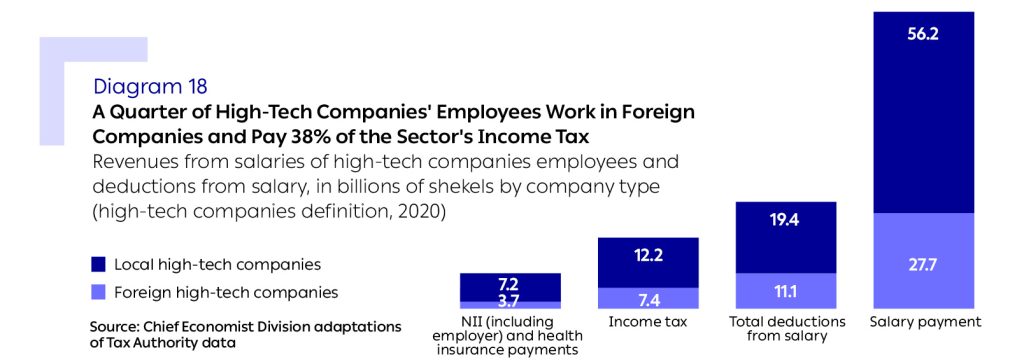

In 2020, the collection of income tax from employees of the foreign high-tech companies totaled 7.4 billion shekels compared to 12.2 billion shekels collected from employees in local high-tech companies. In 2020, the annual average monthly income tax payment of the employees in the foreign high-tech companies stood at 9,072 shekels per employee, 67% higher than that of the employees in the local companies that stood at 5,438 shekels.

Like the foreign high-tech companies themselves, the contribution of the employees in the foreign high-tech companies to state revenues is higher than their relative share of high-tech company employees. 27% of all the high-tech employees who worked in foreign companies in 2020 received 33% of the total salary payments in the sector’s companies – a total of 27.7 billion shekels. Nevertheless, because their salary is in the highest tax bracket, their share in total income tax payments is 38% (7.4 billion shekels). Of the total sums (including NII payments and income tax) deducted from employees in high-tech companies, their share stood at 36%.

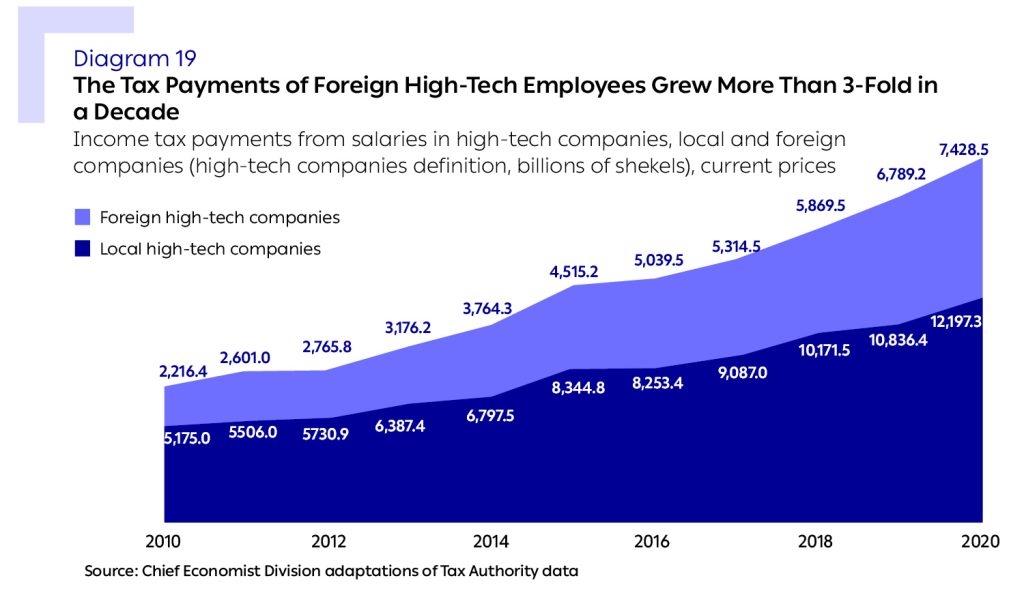

In 2020, the employees in the foreign high-tech companies were only 2% of all the salaried employees in the Israeli economy but were responsible for 12% of the country’s income tax payments i.e., six-times higher than their relative share of the total number of the economy’s salaried employees. This compares with 5.5% of the economy’s salaried employees who worked in the local high-tech companies and were responsible for 20% of the income tax payments in Israel that year (i.e., 3.6 times more than their relative share). In terms of the rate of increase, between 2010-2020, the local companies’ employees increased their income tax payments by 119%,4The rate of change here and later in this chapter is presented in 2010 prices. while the foreign companies’ employees increased their payments by 212%. In other words, the share and importance to the economy of the foreign companies’ employees is steadily increasing.

One explanation for the higher increase in the income tax payments of foreign high-tech companies’ employees in relation to the local companies is the high salaries they pay. Between 2010-2020, the salaries in the local high-tech companies increased by 38% (an increase of 6,860 shekels), while in the foreign high-tech companies they increased by a similar rate of 35% (8,802 shekels). Although the rate of salary increase was similar during the period examined, the higher salaries in the foreign companies and the compassionate progressive tax model in Israel mean that the tax payments of the foreign companies’ employees increase at a higher rate.

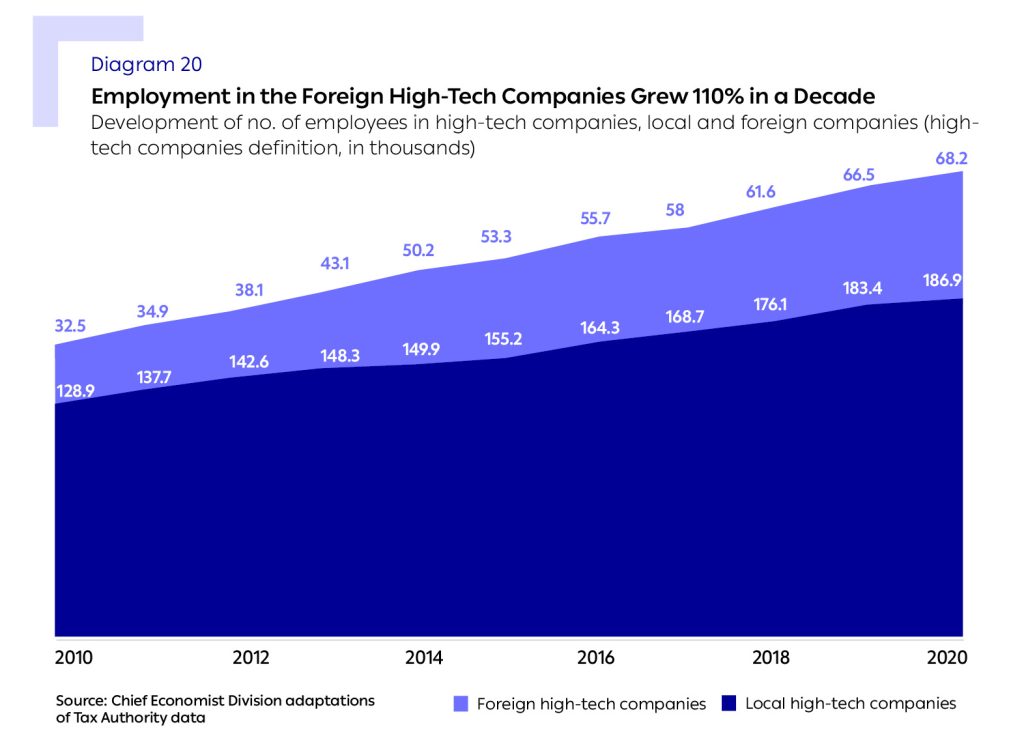

Another explanation for the increase in the income tax collected from the foreign companies’ employees is the rapid growth in employment these companies. According to the high-tech companies’ definition, between 2010-2020, the number of jobs in the local high-tech companies grew by 45% (about 58,000 jobs), compared to an increase of 110% in the foreign high-tech companies (36,000 jobs). Consequently, the relative share of the foreign companies’ employees out of the total number of high-tech companies’ employees increased from 20% in 2010 to nearly 27% (68,000 employees) a decade later in 2020.5According to the R&D survey conducted by the CBS, that is based on the high-tech sector definition, the ratio of jobs in the R&D centers out of the total jobs in the high-tech sector stood at 17.7% in 2021: 58,500 jobs in the R&D centers out of a total of 331,200 jobs in the high-tech sector (excluding communications). See here and here

The increase in employment in the foreign high-tech companies has led to a change in the composition of tax collection between the local and foreign companies, and the share of the foreign companies in the economy’s total income tax payments from salaries has risen significantly from 7% to 12%.

The high salaries paid by the foreign high-tech companies in Israel, and their ability to continue competing for employees by virtue of these salaries led to a growth in state revenues from income tax deducted from salaries in these companies.

In light of the salary disparity and, considering the fact that the income tax payments of the foreign high-tech companies constitute 38% of all income tax payments in high-tech, the decisions made at the foreign companies’ headquarters about employing workers in Israel or their remuneration, will directly influence state revenues from high-tech.

Corporate Tax Paid by the Foreign High-Tech Companies in Israel

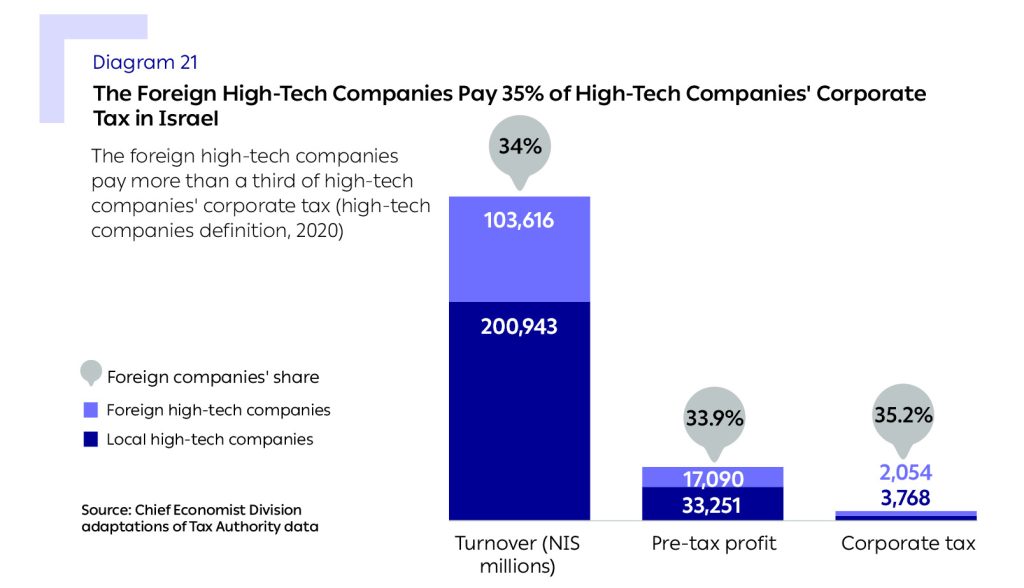

Although the foreign companies constitute just 8% of the high-tech companies in Israel and employ one fifth to a quarter of the high-tech employees in Israel (according to the different definitions) – they are responsible for a third of the sales turnover of high-tech companies, amounting to 103.6 billion shekels in 2020. Furthermore, the foreign high-tech companies’ share in the total pre-tax profits and corporate taxation also stands at about a third of all the high-tech companies.

In terms of numbers, the foreign high-tech companies constitute less than 0.3% of all the economy’s commercial companies, however they are responsible for 5% of the sales turnover of all the commercial companies in Israel. The average turnover of a foreign high-tech company in 2020 stood at 196 million shekels, while the average turnover of a local high-tech company was just 31 million shekels – more than 6-times higher.

Approximately 60% of the foreign high-tech companies reported an average profit rate of 19% (compared to an average of 23% reported by the local high-tech companies), and the tax rates paid by these companies on their profit stood at 12%, similar to the average of the local high-tech companies (that stood at 11%).

In total therefore, the foreign companies’ share of the corporate tax paid by companies in the high-tech sector in Israel stands at 35%. The tax paid by the local high-tech companies in 2020 was 3.8 billion shekels, whereas the foreign companies paid 2.1 billion shekels. The five foreign high-tech companies with the largest sales turnover account for about half of the corporate tax paid by the foreign high-tech companies in Israel.

Tax Payments According to Location of Company’s Headquarters

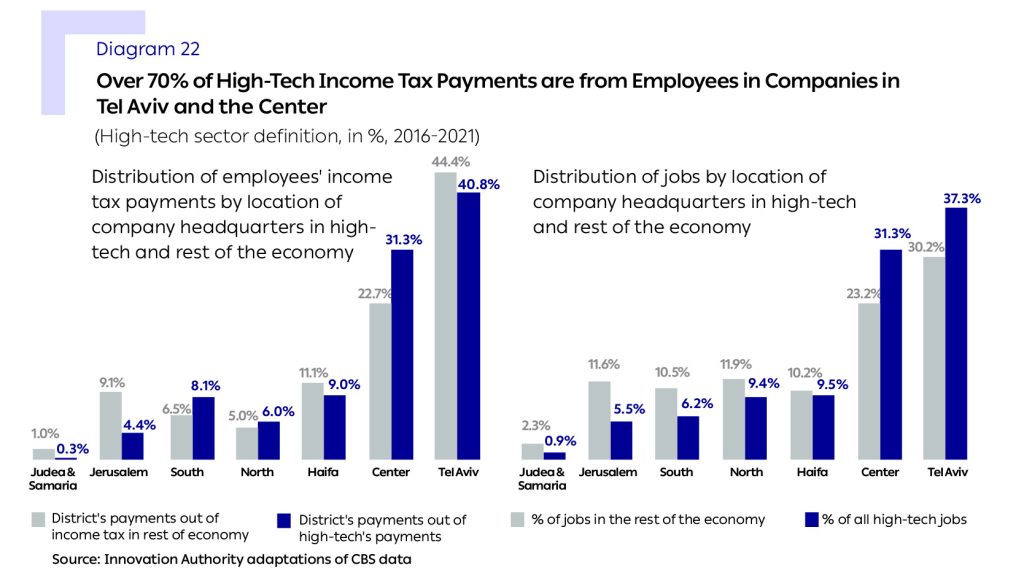

As far as the rest of the economy is concerned, the high-tech sector is characterized by a high degree of centralization of its employment centers and employees, primarily in central Israel. 68% of the jobs in the hightech sector in 2016-2021 were in companies registered in the Tel Aviv and Central Districts, compared to 53% of the jobs in the rest of the economy.6An analysis of the regional distribution is based on the location of the company’s headquarters as known to the CBS. There may be certain deviations, among other reasons due to the fact that some of the companies conduct activity in several locations around Israel while the company’s headquarters are listed in a single location to which all the company’s activity in this analysis is ascribed. The data indicates a concentration of the technology companies in a relatively limited area, and that there are relatively fewer high-tech employment opportunities in Israel’s geographical and social periphery. The tax payments by high-tech sector employees also reflect this trend, although to a lesser degree. 72% of the income tax payments by high-tech employees between 2016-2021 were paid by those employed in high-tech companies located in the Tel Aviv and Central Districts (this figure reached 75% in 2021). In the rest of the economy, the employees in these two districts paid 67% of the income tax. The tax payment by high-tech sector employees in the Tel Aviv District is especially prominent. While the employees in the rest of the economy in the Central District pay 23% of all income tax payments, among high-tech employees, this figure stands at 31%.7According to the division of districts, the Northern District does not include Haifa, and the Central District does not include Jerusalem or Tel Aviv.

The ratio of jobs and tax payments in the high-tech sector in the Haifa and the Northern Districts is similar to the relative share of the employees in the other sectors of the economy. In contrast, the ratio of jobs and tax payments of high-tech sector employees in the Jerusalem District is about half that of the employees in companies in the other sectors in that district. In the Southern District, the ratio of high-tech jobs out of all the jobs in that sector stands at 2.6% compared to 5.1% of the jobs in the rest of the economy. Nevertheless, when examining the tax payments of employees in companies in the district, the share of workers in the high-tech sector increased to 18% whereas the share in tax payments by employees in the other sectors in that district drops to 5.6%.

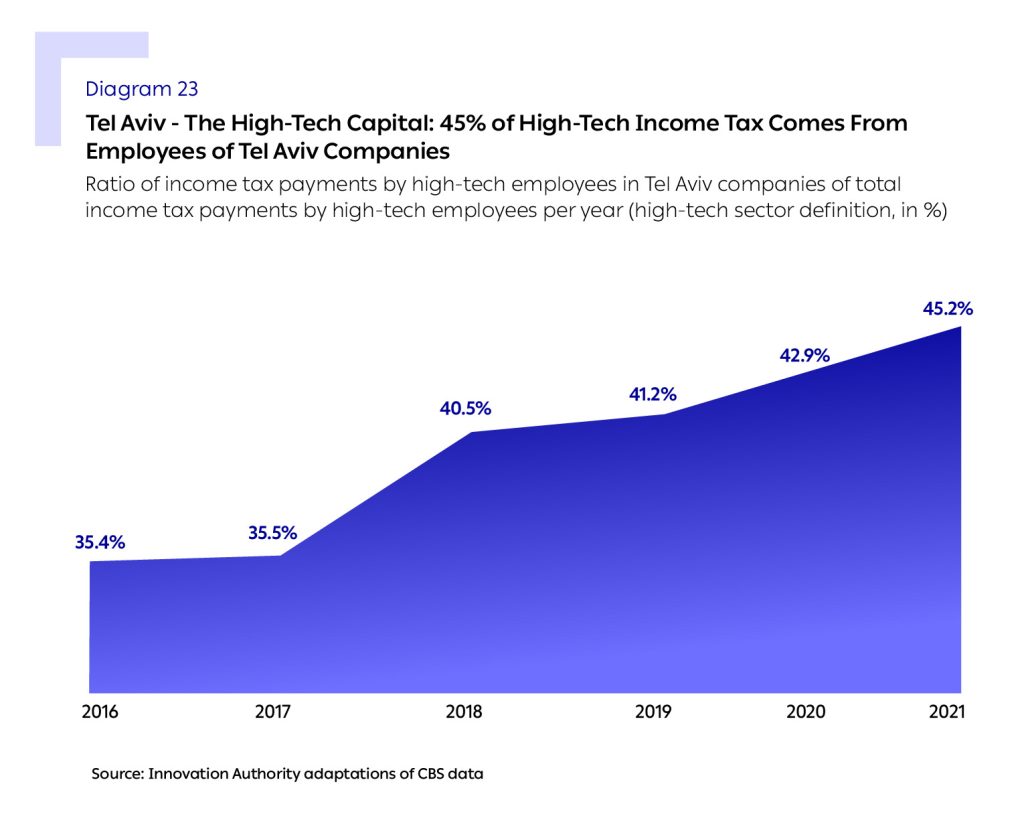

Another significant expression of the “centralization” of the high-tech sector is the increase in the ratio of income tax collected from employees in high-tech companies in the Tel Aviv District, out of the total income tax collected from the sector’s employees. The ratio of income tax payments by employees in the high-tech sector in Tel Aviv increased from 35.4% of the total income tax collected from high-tech employees in 2016 to 45.5% in 2021.

During the same period, the total tax collected from employees in the high-tech sector in Tel Aviv increased so that the nominal tax payment more than doubled, from 4.5 billion shekels collected in 2016 to almost 10 billion shekels in 2021.

The Central District, that is also a significant area in terms of the concentration of employees in high-tech companies, maintained its relative share and did not change significantly. In the last two years for which data is available (2020-2021), it appears that there was a slight decline in the Central District’s relative share of total income tax payments.

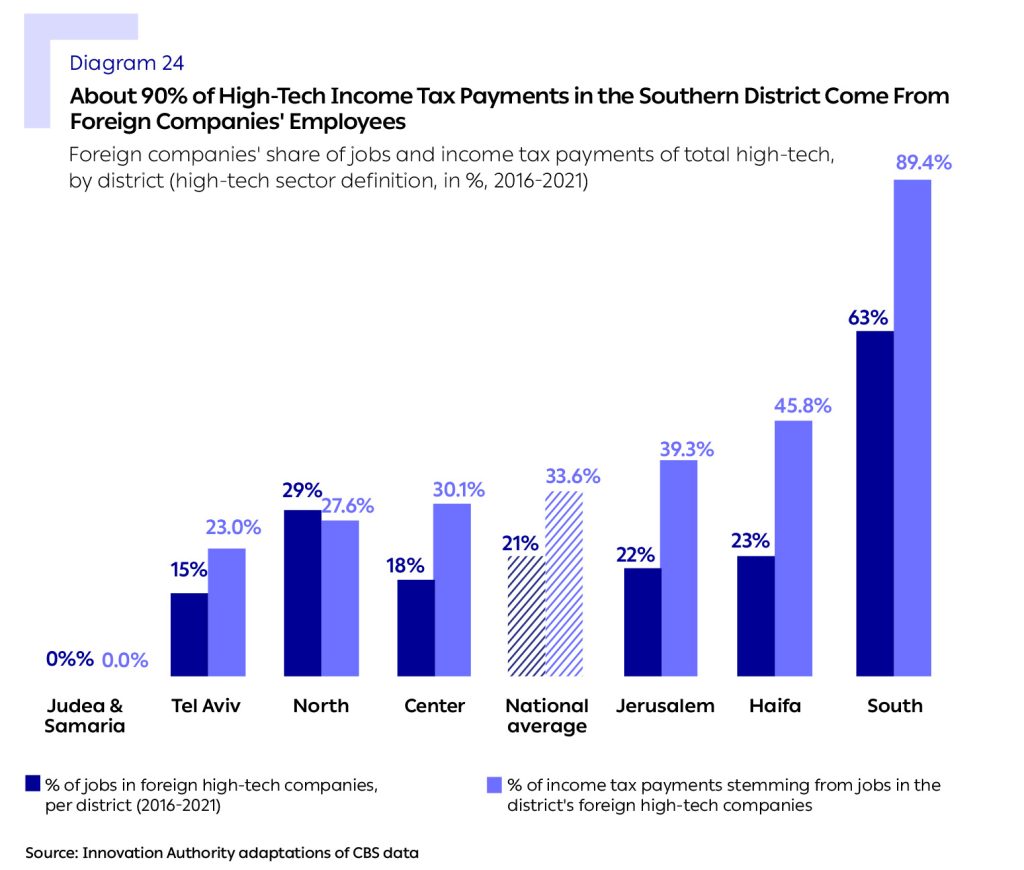

To evaluate the impact of the foreign companies as employers in the various districts, we examined the level of income tax payments in the high-tech sector in each district, while distinguishing between foreign and local high-tech companies.

The analysis revealed that in the Southern District, most of the high-tech jobs are in foreign companies – this is the only district in which there are more jobs in foreign companies than there are in local companies. The foreign companies in the Southern District pay very high salaries relative to the district, so that although 63% of the jobs between 2016-2021 were in foreign companies, the employees paid almost 90% of high-tech’s income tax payments in this district.

Jerusalem and Haifa also have a prominent representation of foreign companies, primarily in terms of income tax payments by their employees. In contrast, in the Tel Aviv, Northern and Central Districts, the rate of tax paid by employees in foreign companies is lower than the national average.

Integrating the data presented above reveals that Tel Aviv is characterized more as “the startups city”, with local companies alongside a relatively small group of foreign companies compared to the overall national average.

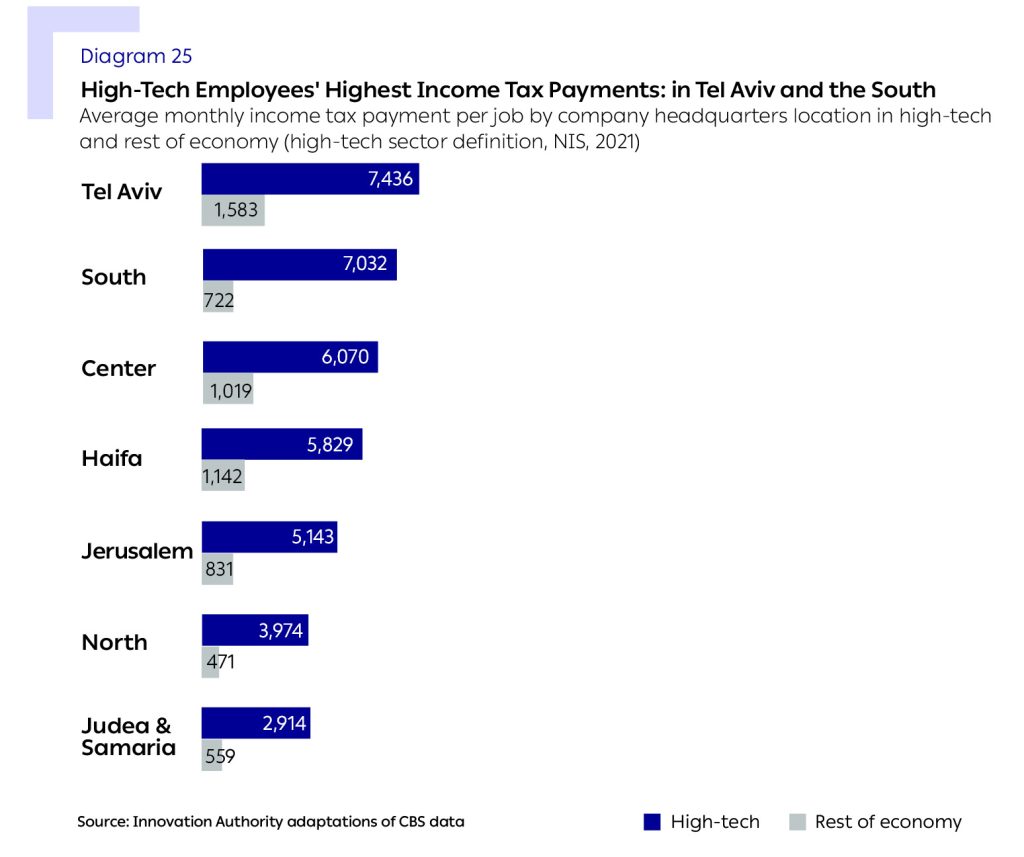

Thus far, the tax payments have been presented according to the district in which the high-tech companies’ headquarters are located. We will now examine the average tax payment at the level of the high-tech employee, according to the district in which they work. The list of income tax payments in high-tech is headed by high-tech employees in the Tel Aviv and the Southern Districts (7,436 shekels and 7,032 shekels respectively). It is interesting to note that, as we presented on page 26, the average salary in the Southern District is slightly higher than that paid in the Tel Aviv District, apparently due to the high concentration of foreign companies in this district. Nevertheless, the average monthly tax payments in the Southern District are slightly lower than those paid by employees who work in companies that have their headquarters in the Tel Aviv District. This is evidence of the progressive tax regime instituted in Israel as part of which, residents of peripheral areas are entitled to an income tax credit reducing their tax payments.

The Southern District also demonstrates the largest differential between the average tax payment of high-tech employees and that of employees in the economy’s other sectors. On average, the high-tech employees’ tax payments in the south are ten times higher than those of the district’s employees in the other sectors of the economy. A similar finding can be seen in the Northern District where the average monthly tax payment by employees in high-tech is 3,974 shekels – 8.4 times higher than the average in the other sectors in the district. In contrast, the smallest disparities exist in the Tel Aviv and Haifa Districts – two cities that have significant concentrations of high-tech.

Tax Payments in High-Tech, According to Gender

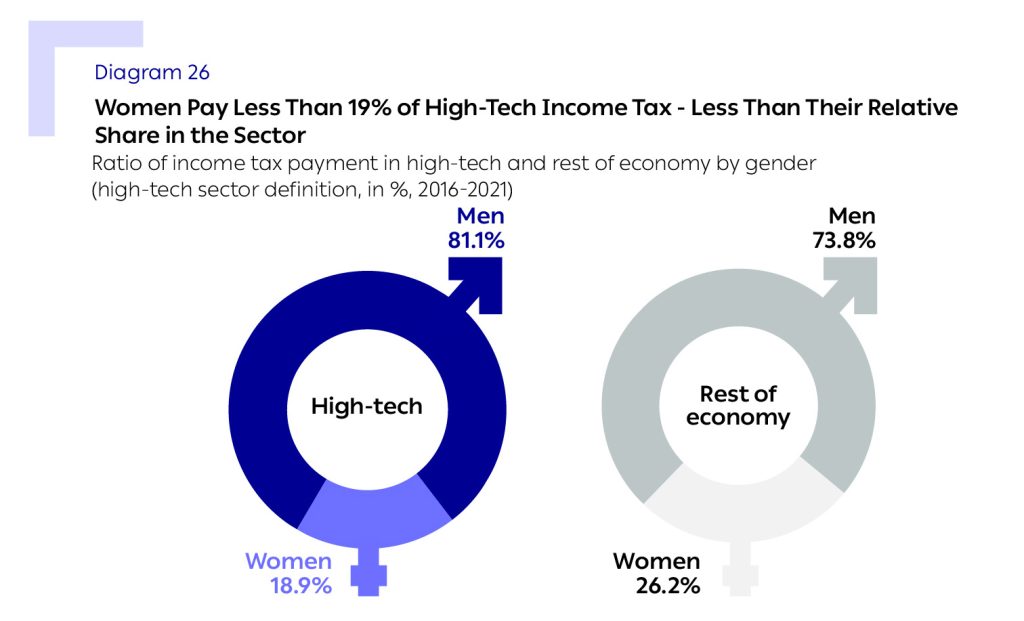

The high-tech sector is characterized by a lack of gender equality: women, who constitute half the population, comprise only one third of the workforce in the high-tech industry. Their representation in core-technology roles is even lower. An analysis of tax data reveals that salary disparities in the sector also lead to differences in the tax collected from women and men.

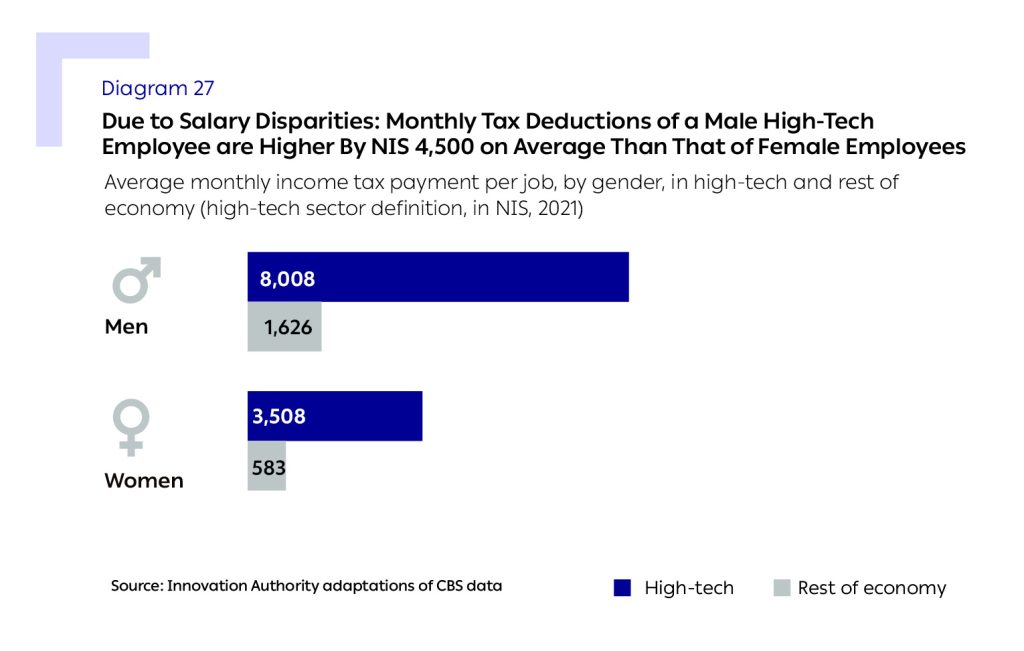

The average monthly salary of women in the high-tech sector in 2021 was 19,777 shekels, compared to the average salary for men which stood at 30,411 shekels a month. This gap stems, among other reasons, from the difference in the employment fields of men and women in the industry – women tend to occupy less core-technology roles (where salaries are higher) – and from differences in work hours, job scope etc. Nevertheless, there still an unexplained disparity of 20% between the salary of men and women in high-tech, even when neutralizing prominent characteristics that influence salary – such as education (the type and field of a degree, the educational institution, psychometric score and others), experience, family status, and other demographic factors. Among the group of employees with technological education in high-tech, the disparity stands at 17%.8The data refers to employees who began working in high-tech between 2005-2018 and whose age was less than 30 when beginning work in high-tech. See: Itai Ater, Noa Barnir, Noam Gruber, Assaf Kovo, Sarit Weisburd (2023), “Gender Wage Gap and Job Mobility. Evidence from the Tech Sector”, Working paper.

The salary disparity was also expressed in income tax payments from employees in the high-tech sector: approximately 19% of the income tax was collected from women and 81% from men. In other words, the level of tax collected from women in high-tech is lower than their share of high-tech employees.9One of the reasons for the lower income tax collection from women compared to men is the difference in tax credits. Women receive 0.5 credit points more than men (equivalent to the payment of 110 shekels tax a month). Furthermore, there is a difference in tax credits between men and women for raising children. It should be noted that since 2017, an equal number of tax credits is awarded to the mother and the father for their children, until the children reach age 6.

In relative terms, the ratio of taxes paid by women in the Northern District out of the total taxes paid in that district is 15%, compared to 19% in the high-tech sector in general.

When examining employees by gender, a female high-tech employee pays, on average, income tax of 3,508 shekels a month – 6-times higher than that of a female employee in the economy’s other sectors, who paid, on average, 583 shekels a month in 2021. The gap in income tax payments of men is slightly lower than that of women: a high-tech employee paid an average of 8,008 shekels per month in income tax, almost five times higher than a male employee in the other sectors of the economy, who paid an average of 1,626 shekels a month.

A significant taxation disparity exists, both in high-tech and in each of the other sectors, between men and women. In the high-tech sector, a male employee pays on average 2.3-times more income tax than a female employee – a gap that stands at approximately 4,500 shekels a month. In the rest of the economy, the gender disparity in income tax payments is greater and stands at 2.8-times higher – 1,043 shekels a month.

Tax Payments in High-Tech, by Population

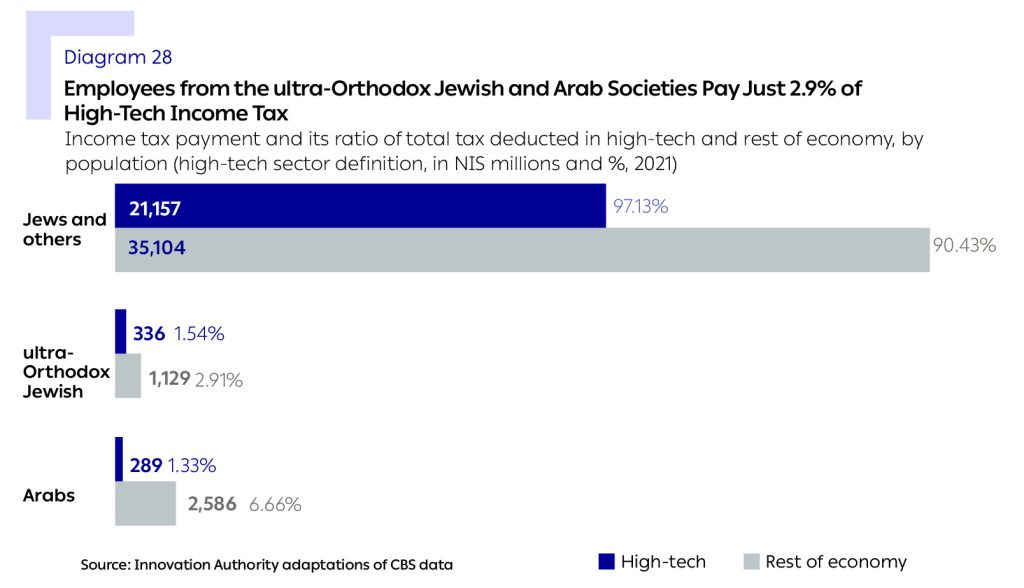

The high-tech sector is also characterized by an under-representation of various population groups in Israeli society. As presented in the 2024 ‘State of High-Tech Report’, 95% of the sector’s employees are (non-ultra- Orthodox) Jews. Women and men from the ultra-Orthodox Jewish society comprise 3% of the sector’s salaried employees (compared with 7.8% of the employees in the general economy) and a further 2% belong to the Arab society (compared with 15.7% of the employees in the general economy).10The percentage of employees refers to workers aged 25-64 in 2023.

A similar trend can be noted in the distribution of income tax payments by employees from these population groups: 91.7% of the income tax payments in high-tech companies in 2021 come from (non-ultra-Orthodox) Jewish employees,11In accordance with CBS practice, the (non-ultra-Orthodox) Jewish population also includes the population classified as “other”. This population’s share in income tax payments stands at 3.9% in high-tech and 3.7% in the rest of the economy, and its total income tax payments in 2021 stood at 2.4 billion shekels. representing a total of over 21 billion shekels. The income tax payments of employees from the ultra-Orthodox Jewish society are also lower than their share of the population in the other sectors of the economy, and not just in high-tech. This figure stems both from a low level of participation in the workforce and from lower than average salaries compared to the general economy, and especially in high-tech. The total income tax payments of ultra-Orthodox Jewish employees in the general economy totaled 1.46 billion shekels in 2021, a sum that constitutes 2.4% of the economy’s total income tax payments, of which 336 million shekels were from work in high-tech (1.5% of all income tax payments in high-tech companies).

In the Arab society, in contrast, the picture is more complex: there is a marked under-representation in high-tech of employees from the Arab society compared to their integration in the general Israeli workforce. The employees from the Arab society pay only 1.3% of the income tax of high-tech companies’ employees (approx. 290 million shekels) – compared to 6.7% of the tax payments in the rest of the economy (2.6 billion shekels). This figure testifies to the potential for more significant integration of the Arab society in the high-tech workforce.12It should be noted that the low tax payments of the ultra-Orthodox population and the Arab population may stem from different tax benefits, such as tax credits for children and reduced tax payments for living in areas of national preference.

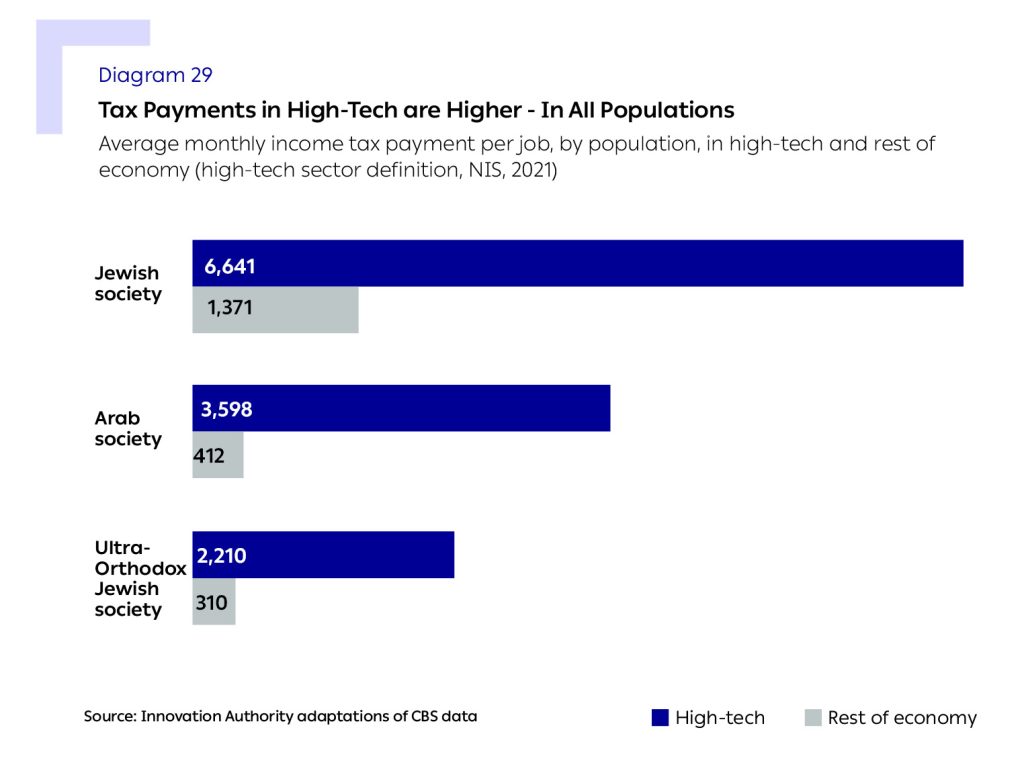

Average Tax Payment, by Population

Differences in skills, education, and training influence disparities in salaries between the different population groups in Israel and, in turn, naturally also lead to differences in the monthly income tax payments of high-tech employees in each group.13See for example surveys on this topic by the Chief Economist in the Ministry of Finance here and here:

In the (non-ultra-Orthodox) Jewish society, the average income tax payment per job is the highest and stands at a monthly average of 6,641 shekels, compared to 1,371 shekels in the rest of the economy.

In the Arab and ultra-Orthodox Jewish societies, the difference in high-tech employees’ tax payment vis-à-vis those in the rest of the economy is significantly higher than in the (non-ultra-Orthodox) Jewish society. The average monthly income tax payment per job by an employee in the Arab society stands at 3,598 shekels – nearly 9-times higher than the average in Arab society in the rest of the economy (412 shekels per month). In the ultra-Orthodox society, the average monthly income tax payment for each high-tech job is 7-times higher than the economy average and stands at 2,210 shekels (compared to 310 shekels a month in the rest of the economy).