In this report, we examine the contribution of the high-tech sector and its employees to the Israeli economy. The report is the result of collaboration between the Innovation Authority and the Chief Economist Division in the Ministry of Finance. This analysis was performed during the past year and includes, for the first time, an in-depth examination of payments of income tax, corporate tax, and other revenues to the state treasury related to work in high-tech.

The report’s objective is to provide a situation analysis of state revenues from the high-tech sector with the aim, among others, of adapting future government policy in this field.

High-Tech Sector’s Contribution to State Revenues from Individuals and Companies

High-tech is one of the central sectors of the economy. As presented in the Innovation Authority’s annual report “The State of High-Tech 2024“, the sector was responsible for 20% of Israel’s GDP in 2023 and 53% of the country’s exports. Moreover, the rate at which employees joined the sector in the decade between 2013-2022 was three times higher than that of the rest of the economy, and the salary paid in this sector was significantly higher than the economy’s average salary: 2.7 times higher than the economy’s average monthly salary for a salaried employee in 2021.

Against the backdrop of the sector’s increasing predominance in the economy in terms of employment and output, the need to examine the influence of these changes on the sector’s contribution to state revenues became apparent.

This document is divided into two sections: in the first section, we present the distribution of state revenues from individual income tax of salaried employees and corporate tax in high-tech and in the rest of the economy, while the second section presents an in-depth analysis of revenues related to the high-tech sector while looking at gender disparities, differences between populations, tax payments in different areas, differences between local and foreign companies etc.

The publication’s main findings are as follows:

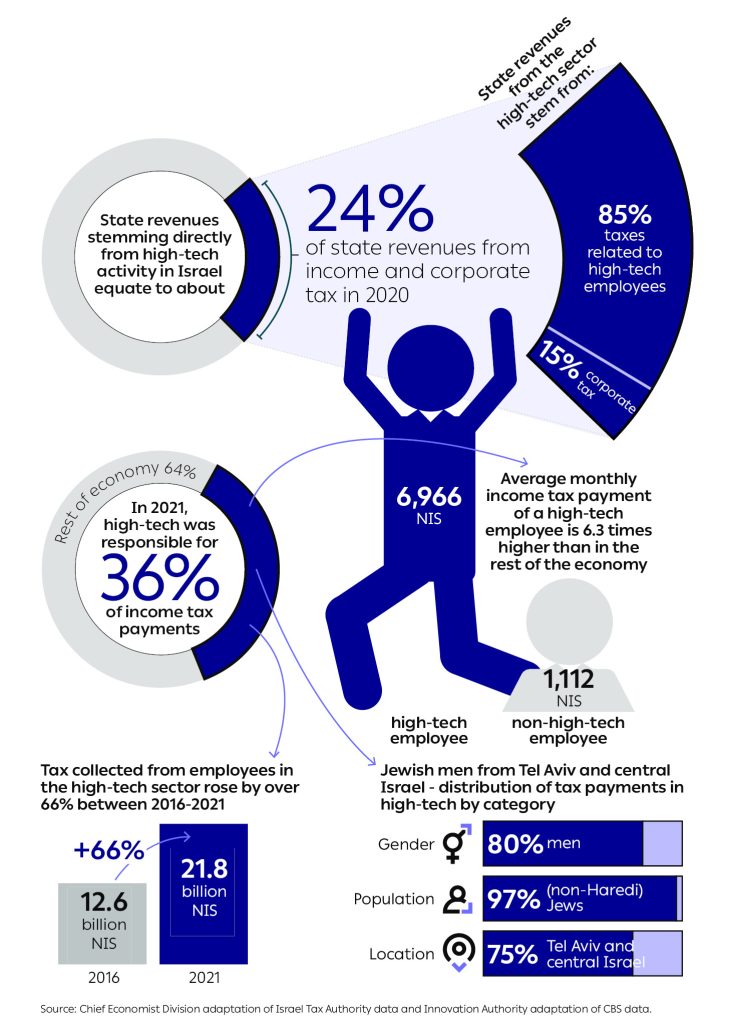

- In 2020, approximately 24% of all tax payments in Israel stemming from companies and salaries came from the high-tech sector.

- In 2021 (the last year for which the figures were published), the salaried employees in the hightech sector were responsible for approximately 36% of salary income tax payments.

- In 2020,1The last year for which the figures were published. the total state revenues stemming directly from high-tech activity in Israel constituted about 9.2% of the state budget.2The state budget without designated budget increments because of Covid.

- 85% of state revenues stemming from the high-tech sector are related to the sector’s employees. Only 15% of state revenues stemming from the high-tech sector are directly related to companies.

- High-tech employees are responsible for higher tax payments than the employees in the economy’s other sectors. In contrast, the high-tech companies are responsible for lower tax payments than companies in other sectors of the economy. This divergence stems from several prominent reasons: a high average salary in high-tech that leads to high income tax payments by employees. With regard to the companies, startups generally lack profits on which to pay corporate tax, whereas most of the profitable companies in the sector benefit from reduced levels of taxation as part of the Encouragement of Capital Investments Law.

- The average monthly income tax payment of a high-tech employee in 2021 was NIS 6,966 – 6.3 times higher than the average in the rest of the economy (NIS 1,112).

- High-tech employees’ tax payments increased by 66% between 2016-2021.3Throughout this report, any reference to changes between different periods will be presented in real terms.

- 57% of the tax payments in 2021 stemmed from the sector’s dominant group of employees – (non-Haredi) Jewish men who work in central Israel and in Tel Aviv. This figure stems from the low participation in high-tech of the rest of the population.

In summary, this report reflects that state revenues from high-tech will change – for better or worse – by the number of employees the companies employ in Israel. Furthermore, in light of the progressive structure of Israeli income tax, a change in the salary of a high-tech employee who pays higher than average tax rates will have a greater influence on state revenues than that of an employee in the rest of the economy.4Throughout this report, “rest of the economy” refers to the economy’s other sectors.

Based on the increase in the number of high-tech employees during 2021-2023, alongside an increase in the sector’s average salary that continued to increase the disparity vis-à-vis the general economy’s average salary, it can be assumed that the high-tech sector’s direct contribution to state revenues and its share of the revenues pie increased during these years.

Methodological Notes:

The information presented in this publication is based on administrative figures pertaining to all high-tech employees in Israel which were collected by the tax authorities and received from the CBS and the Ministry of Finance.5 The figures were analyzed according to two different approaches to the definition of the high-tech sector, as will be presented below. Despite the discrepancy sometimes created in the figures which stems from different definitions, the trends revealed in the data are similar.

The most updated data regarding tax payments in Israel available at the time this report was prepared is from 2021, due to the timing of reports submitted to the tax authorities. Some of the figures are not available for this year and we therefore used the most updated data that existed for each analysis. Considering the trends in the high-tech sector arising from a variety of sources used to analyze the sector’s situation report, including CBS surveys and fundraising data (from databases such as IVC), we estimate that the increase in the high-tech sector’s relative contribution to the various metrics continued in 2022-2023, as will be detailed later in this report. Finally, it should be noted that in cases where the Covid year (2020) was the most updated year for analysis, we strove to add additional figures pertaining to the long-term trend. The appendices of this report include data for 2019 to show that there was no digression from the trend caused by the Covid period.

Highlights infographic

High-Tech’s Contribution to State Revenues