High-tech exports exceed half of all Israel’s exports for the first time – but the technology companies’ value is declining

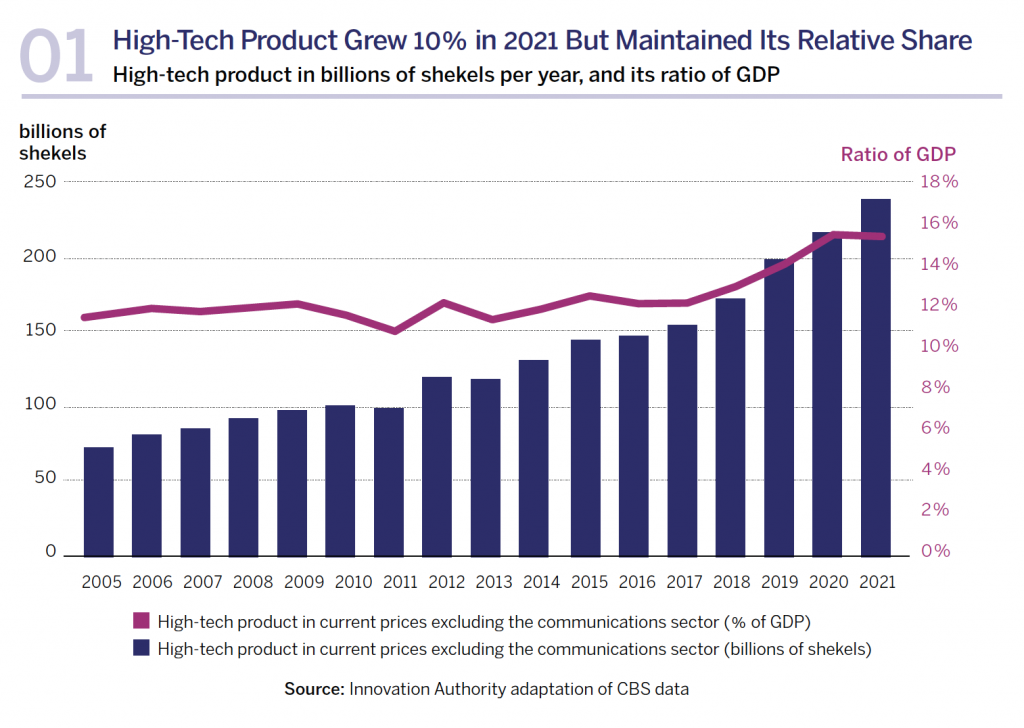

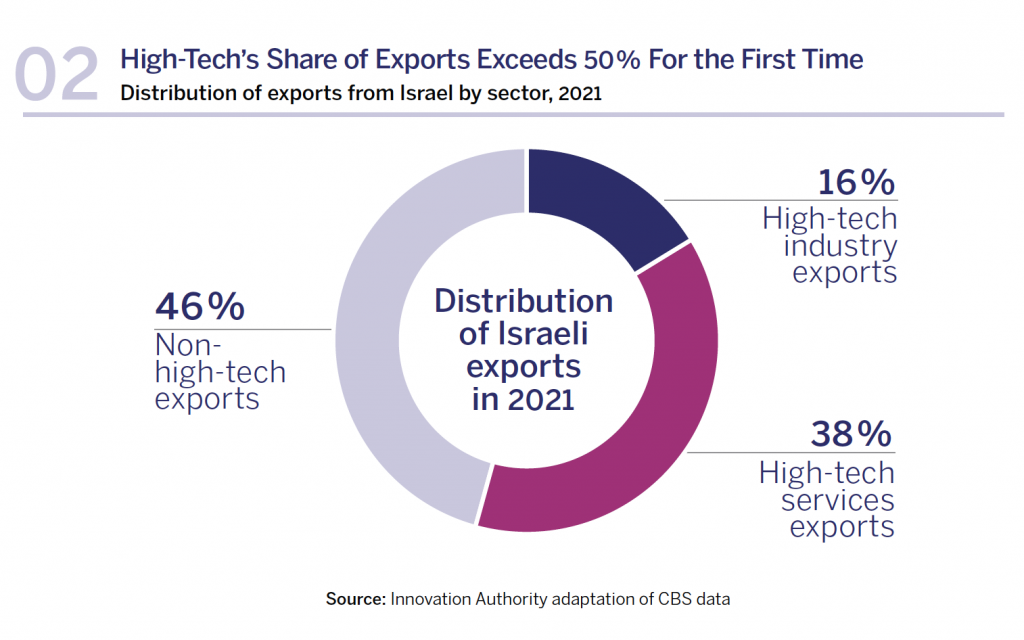

Israeli high-tech continued to prosper and to constitute the economy’s primary growth engine during the past year. The product of the high-tech sectors grew by more than 10% in 2021 and stood at 237 billion shekels, thereby maintaining its relative share of Israel’s total GDP – 15.3%. Furthermore, in 2021, high-tech exports exceeded 50% of the State of Israel’s exports and stood at 54% (compared to 43% in the previous year), constituting approximately 67 billion dollars.

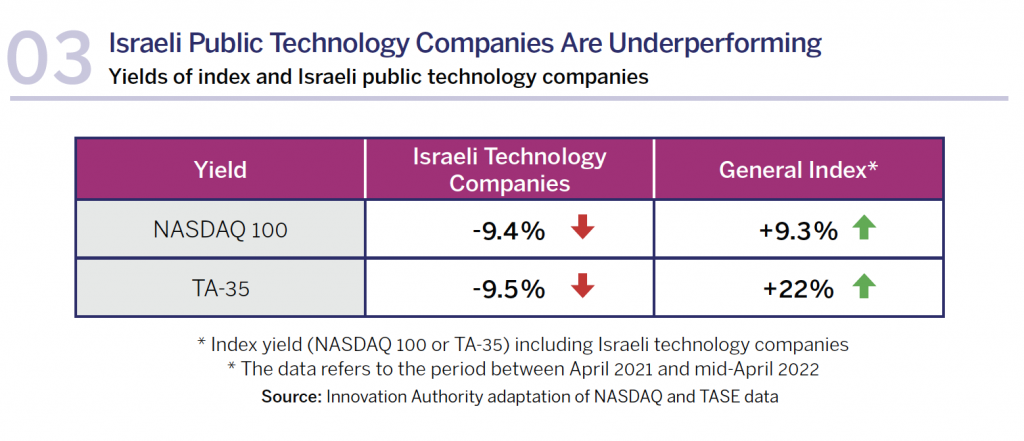

Innovation in Israel 2022 – Situation Report Source: Innovation Authority adaptation of CBS data Distribution of Israeli exports in 2021 38% 46% Nonhigh- tech exports 16% High-tech industry exports High-tech services exports 02 High-Tech’s Share of Exports Exceeds 50% For the First Time Distribution of exports from Israel by sector, 2021 Nevertheless, 2021 also raised several warning signs for Israeli high-tech that may, in the foreseeable future, impair its ability to maintain a position of global leadership. Among these signs is the decline in the aggregate value of high-tech companies on the various stock exchanges. The Innovation Authority examined the data of 125 technology companies with a connection to Israel,1The locations of company headquarters and offices were examined in this context as well as the identity of the companies’ founders and directors which are traded on the NASDAQ Stock Exchange and found that their aggregate value declined by 9.4% between April 2021-April 2022, from 252 billion dollars to 228 billion dollars. This, while the NASDAQ 100 Index rose by 9.3% during the same period. The results of the technology companies traded on the Tel Aviv Stock Exchange were even worse – while the TA-35 Index rose by 22% between April 2021-April 2022, the value of the technology companies included in this index dropped by 9.5% during the same period.2Neutralizing the changes in the composition of the indices negates the decline in the aggregate value of high-tech companies included in the index. However, the increase in value of the real-economy and financial companies in the index exceeds 40%. In addition, in the first quarter of 2022, the NASDAQ 100 Index declined by nearly 10%. During the coming year, fluctuations on the financial markets, especially those of technology companies, may also impact the Israeli companies in this field.

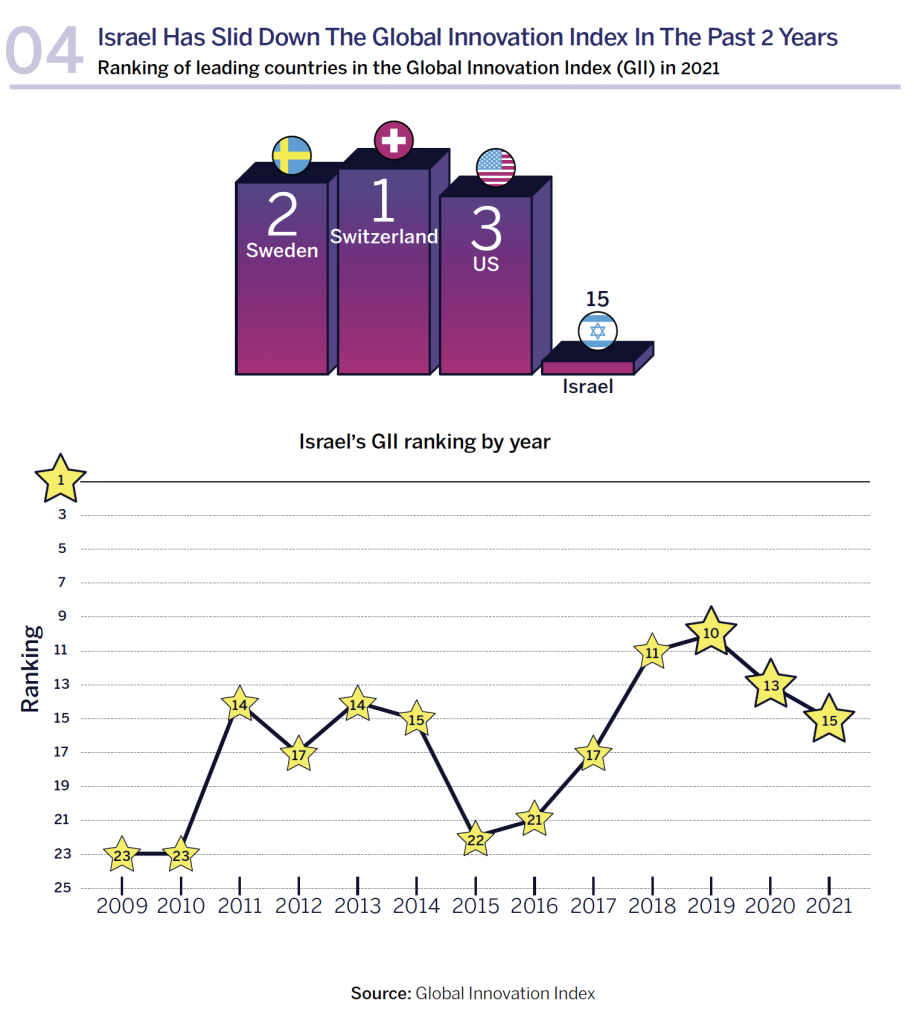

Another warning sign is Israel’s decline in the Global Innovation Index (GII) to 21st place in 2021. Israel had previously climbed in the ranking since 2015 and, in 2019, was included in the top 10 countries for the first time since the index was first published more than a decade ago. Since 2019 however, Israel’s ranking has dropped.

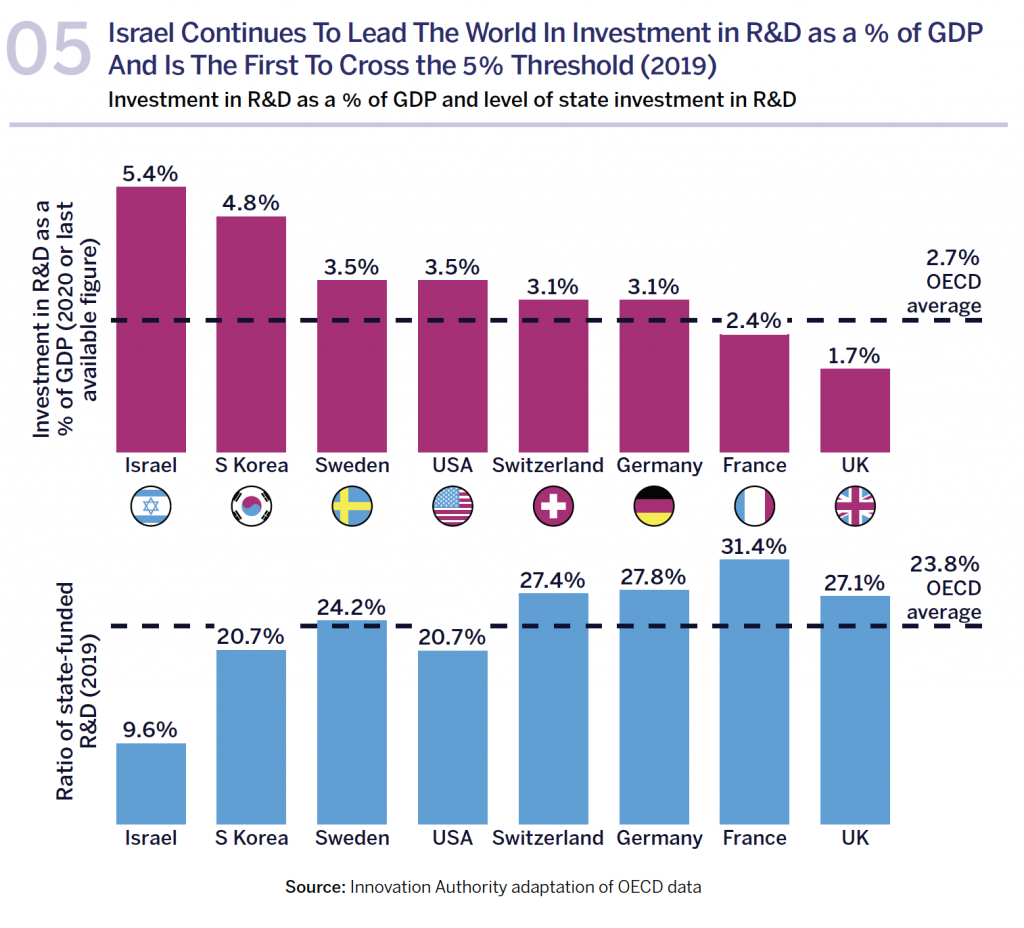

From a positive perspective, Israel continued to lead the list of OECD countries in R&D investments as a ratio of GDP in 2019 (the last year for which such data is available). However, the Israeli government’s share of investment in R&D is the lowest of all OECD countries and stood at just 9% in 2019,7 after declining significantly in the past decades. In other countries that are considered world leaders in investment in this field, the government share of R&D investment is significantly higher than that in Israel e.g., 20.7% in Korea, 24.2% in Sweden, and 27.8% in Germany. Even in a developed innovation ecosystem such as the US, state investment accounts for 20.7% of the total investment in R&D. This means that R&D funding in Israel relies almost exclusively on the private market compared to other countries, a reality that is indicative of the Israeli high-tech sector’s maturity and the high global demand for its products, but which also makes Israeli hightech particularly sensitive to fluctuations in global capital flows which may be influenced by the war currently raging in Ukraine and by other global trends.

High-tech is growing and has passed 10% employment – but the Arabs and ultra-Orthodox are not joining the party

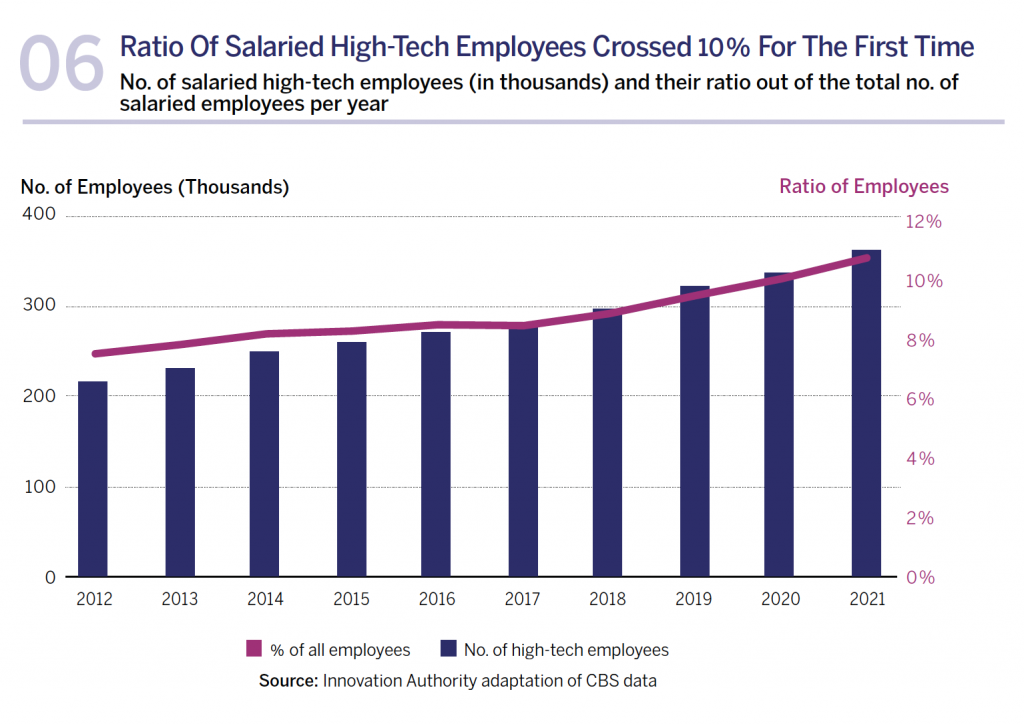

High-tech is one of the most in-demand sectors of the Israeli economy, attracting workers interested in becoming part of a global and rewarding industry. The number of salaried employees in the Israeli hightech industry continued to grow and stood at a yearly average of 362 thousand in 2021.3This is the average for 2021. In December 2021, the number of salaried employees in the high-tech industry stood at nearly 400 thousand. By the end of the year, in December 2021, the number of salaried employees in the high-tech industry had reached nearly 400 thousand. Moreover, the level of available high-tech jobs during the last quarter of 2021 stood at 7.17% compared to 4.61% in the rest of the economy. In other words, the high-tech sector is recovering from the impacts of Covid faster than the rest of the economy, yet another indication of the severe shortage in hightech workers.4According to an analysis conducted of high-tech sectors between 2013-2021, based on the Available Jobs Survey. The high-tech industry is characterized by rapid growth: according to CBS data, the number of salaried employees in high-tech grew by 8% compared to the previous year, while the number of salaried employees in the economy at large rose by only 1%.

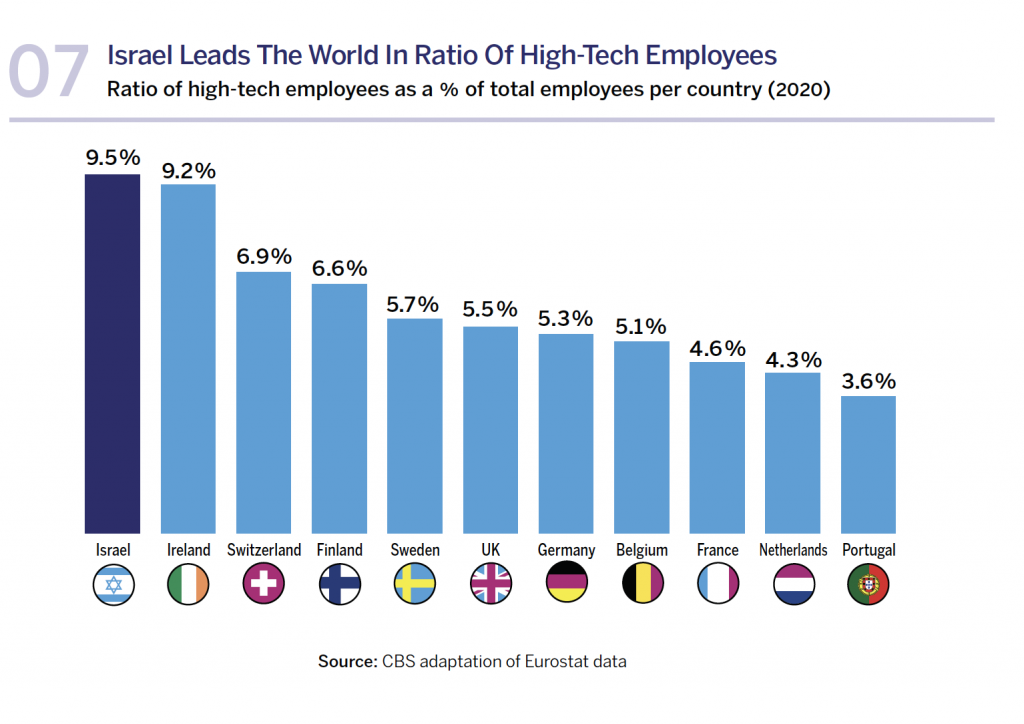

Israel continues to be a world leader in the ratio of employees in the high-tech industry. This is a further indication of high-tech’s centrality in the Israeli economy. For the first time, this ratio exceeded 10% in 2021, reaching 10.4%. The government’s goal is to reach a level of 15% by 2026.

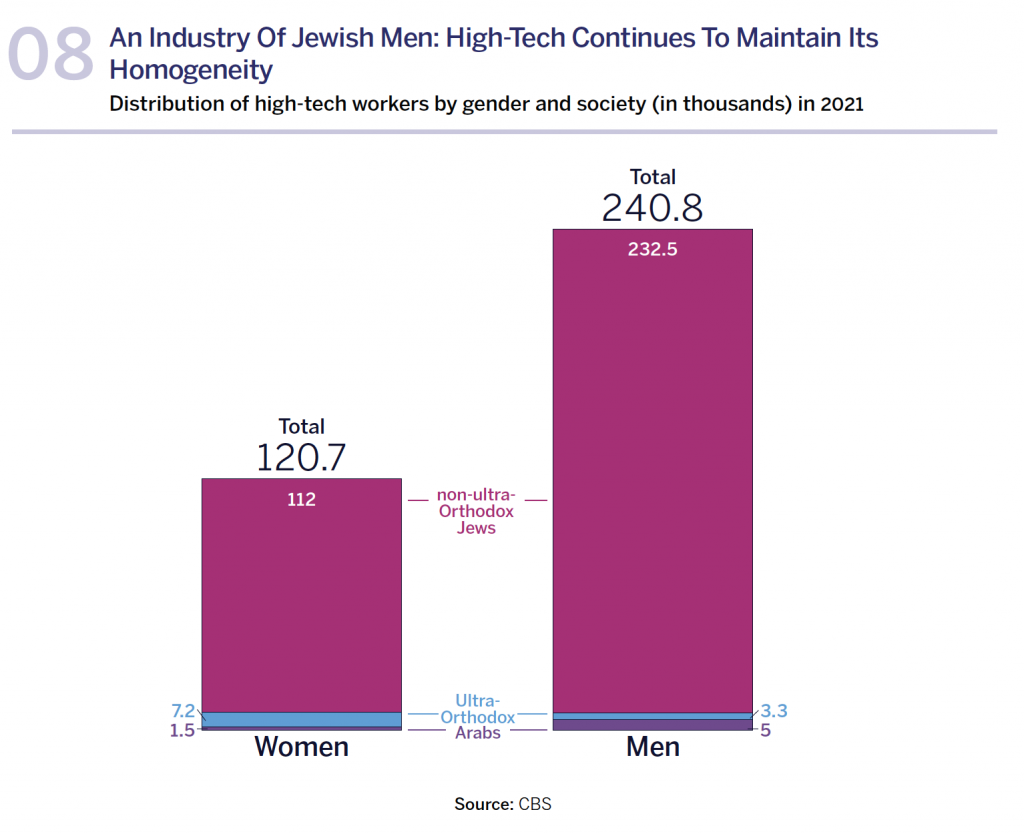

This growth does not however include all sectors of the population. The number of salaried high-tech employees in the Arab sector rose by just 200 in 2021, while the corresponding figure in the ultra-Orthodox sector dropped by 700 employees during the same year, according to CBS data. When searching for the positives in the data for 2021, it is worthy to note the increase of 500 ultra-Orthodox men who joined the high-tech industry in 2021 however this should be considered alongside a decline of 1,200 women employees from the same sector. This figure is an accentuation of the entire high-tech industry where the growth rate of women employees was lower than that of men – 5.9% compared to 9.1% respectively, in 2021. This disparity between men and women can perhaps be attributed to the Covid lockdown periods and restrictions that severely disrupted the education system.

In general, high-tech is preserving its homogeneity as a Jewish industry: less than 20% of its salaried employees are Arabs, most of its employees are non-ultra-Orthodox men, women comprise less than one third of all the industry’s salaried employees, and ultra-Orthodox men and women comprise only 3%.

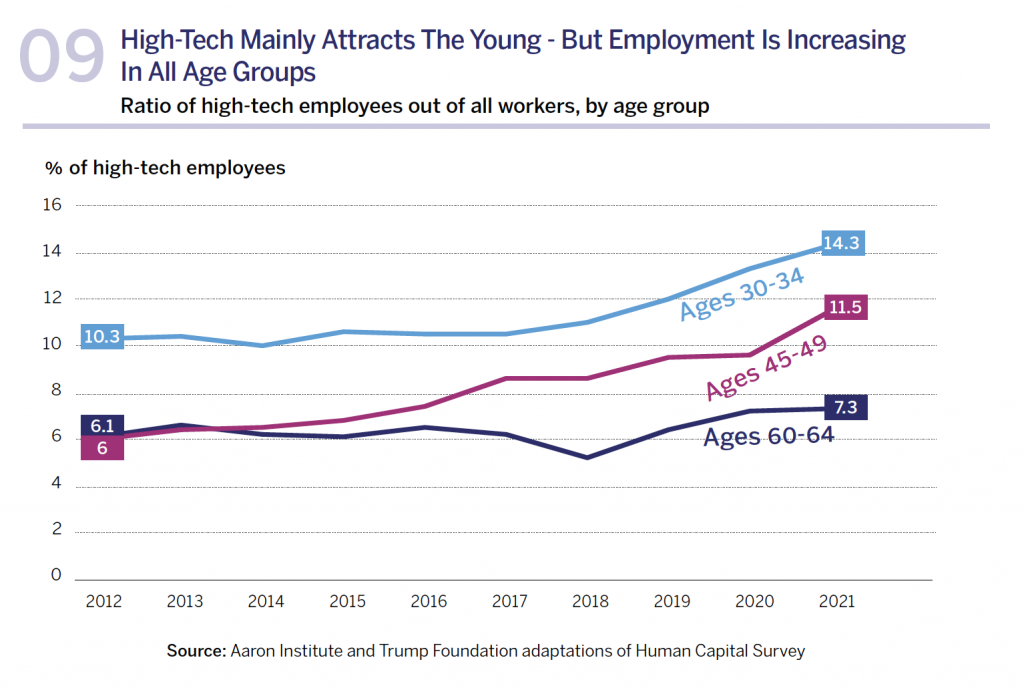

As can be expected, those choosing to work in the high-tech sector predominantly belong to the younger age groups. Nevertheless, it is interesting to also note a growth in the number of people working in “high-tech” professions in industries outside high-tech. In other words, more people are employed in technology roles that contribute to advancement and digitization in all sectors of the economy at large. A study conducted by the Aaron Institute in conjunction with the Trump Foundation examined the ratio of employees in high-tech and in technology professions in the general economy. The study found that between 2012-2021, the number of those employed in technology professions in Israel rose by more than 160 thousand, with a quarter of these being employed in companies outside the high-tech industry. Furthermore, the ratio of those employed in high-tech and in high-tech roles outside the industry increased, a trend also reflected in older age groups. In other words, technology-oriented professions are not exclusive to the high-tech industry and are becoming increasingly common in all sectors of the economy.

For example, in the 30-34 age group, the ratio of those employed in technology professions in Israel stood at 13% in 2012, a ratio that remained similar until 2017. In recent years however, there has been an increase in the ratio of those integrating into technology jobs, and the figure currently stands at 19% in this age group. An examination of the ratio of employees in companies that belong only to the high-tech sector reveals a growth in this age group from 11% in 2017 to 14% in 2021.

The rate of participation in high-tech also rose in older age groups. For example, according to the study, in the 45-64 age group, the ratio of employees in technology professions rose from 9% in 2017 to 11% in 2021. This reflects significantly slower growth than the younger age groups, but it should be remembered that this is an age group that tends to change their occupation less frequently. The share of employees in high-tech companies in this age group rose from 7% to 9% during the same period.

As a side remark, it should be noted that workers from overseas are another possible source of skilled high-tech workers in the near future. The war currently taking place in Ukraine and its further impact on the Jews in Russian and the region may lead to waves of immigration, among others, of potential hightech workers.

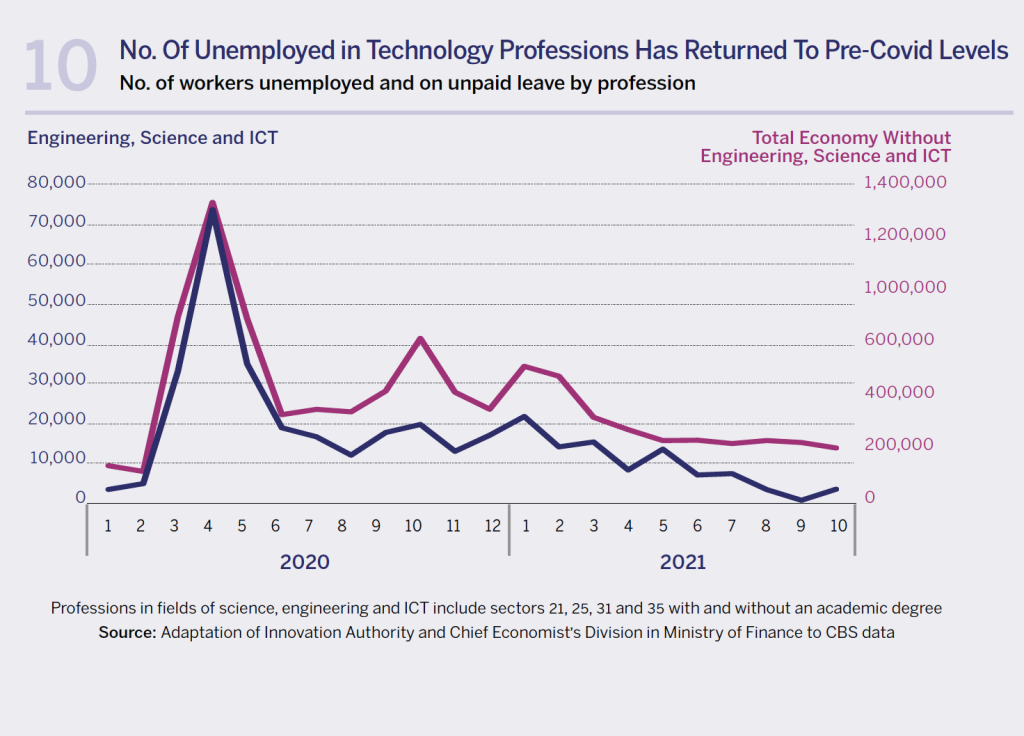

After the pandemic: high-tech unemployment has returned to its low pre-pandemic level

The Covid pandemic naturally had a serious impact on high-tech employees and on the level of employment in the industry. If the first year of Covid (2020) witnessed unemployment in the high-tech industry, that usually suffers from a chronic shortage of employees, the industry resumed “normal business” during 2021, despite new virus strings, among others thanks to the extensive vaccination campaign. Nevertheless, Covid had a fundamental impact on high-tech, namely, a significant increase in the scope of work performed from home during the past two years.One of the signs of the high-tech industry’s recovery in 2021 is an increase in the number of its new employees. If in 2020 the number of workers in the high-tech industry rose by only 14,000, in 2021 this increase nearly doubled, standing at 27,000 new employees. Furthermore, the diagram below shows that the level of unemployment among workers with technology-related vocations that typify high-tech returned to the pre-Covid level. This occurred in contrast to the total economy’s general unemployment rate that remained slightly higher than the months preceding Covid.

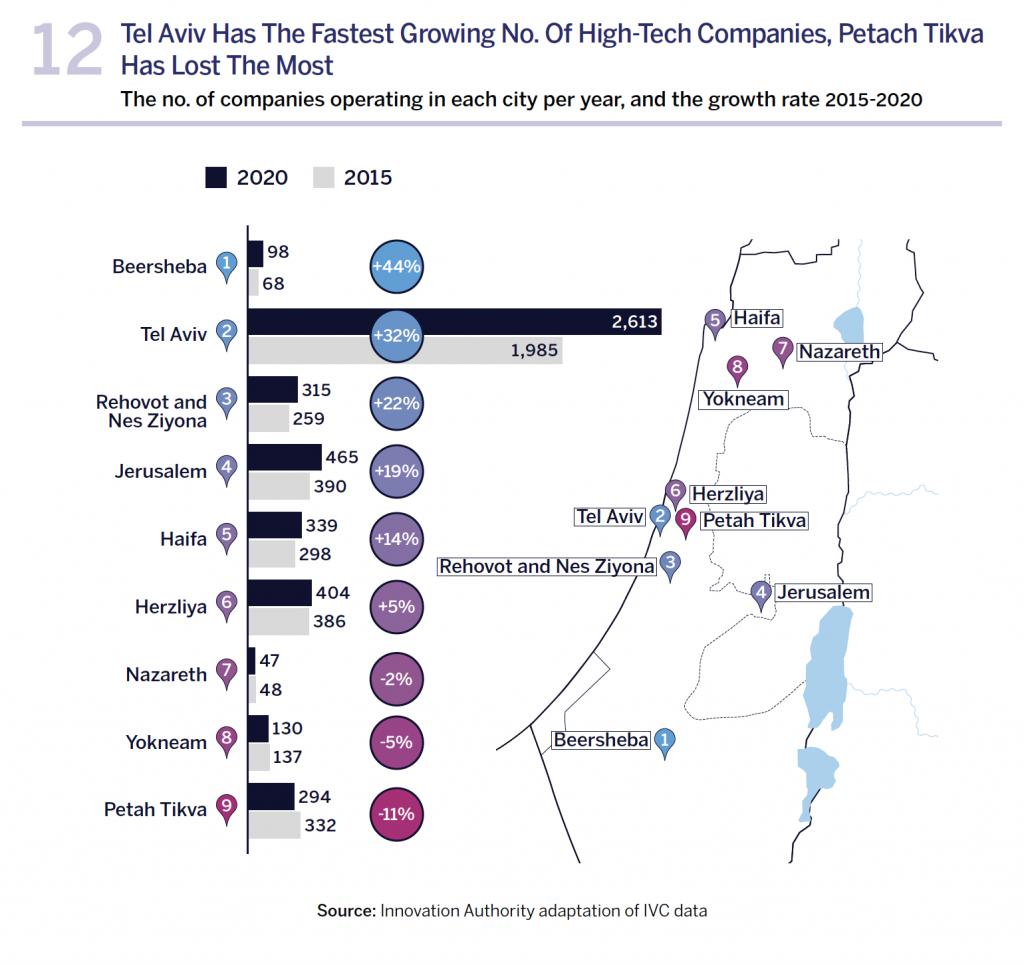

Tel Aviv is the undisputed high-tech capital of Israel and most high-tech workers are not employed in startups

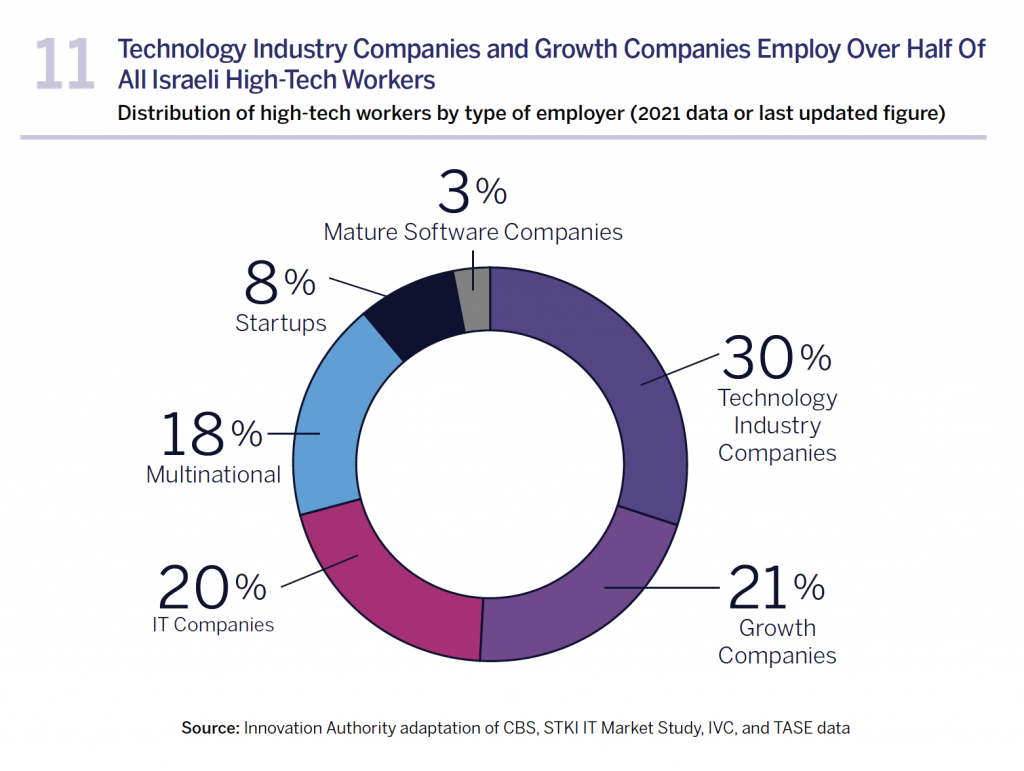

As part of the preparation for compiling this report, the Innovation Authority conducted a comprehensive analysis, being published here for the first time, of the characteristics of Israeli high-tech employers and employees. Its goal was to arrive at an accurate and updated map of the distribution of high-tech workers between the different types of companies, while relating to the companies’ geographical dispersion, thereby obtaining an updated picture of the industry’s demographic characteristics.

The distribution of high-tech employees between the different company types reveals that despite Israel’s image as the “startup nation”, only 8% of the industry’s employees work at companies defined as startups (i.e. young startup companies). In practice, most of them (30%) are employed at high-tech industry companies that primarily include the defense industry which is the largest high-tech employer. The next largest employers are growth companies (21%), IT companies (20%) and multinational corporations (18%).

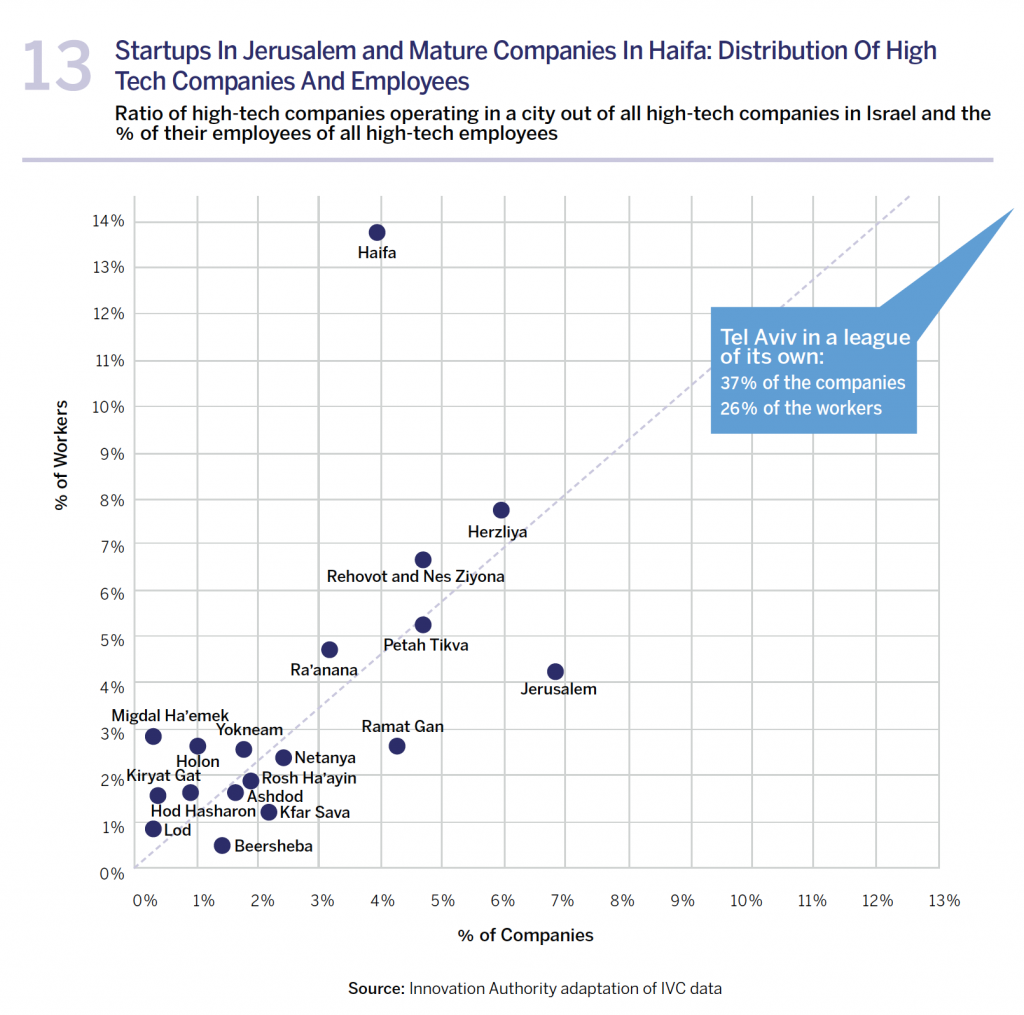

Analysis of the high-tech companies’ geographical dispersion reveals that Tel Aviv is home to more than one third of the companies operating in Israel and to one quarter of high-tech employees. The next cities in the ranking for number of high-tech employees are Haifa and Herzliya with 13.6% and 7.7% respectively. The neighboring cities Rehovot and Nes Ziyona collectively host 6.6% of the country’s high-tech employees.

An examination of changes over time reveals that Tel Aviv is also the city in which the most technology companies were opened between 2015-2020, both in terms of the number of companies and the growth rate.5After neutralizing the cities with less than 100 companies in 2020. It should be noted that although Jerusalem is home to 6.8% of Israel’s high-tech companies, these employ only 4.2% of the workers. In other words, Jerusalem is characterized by an abundance of small startups and not of large companies that employ significant numbers of workers. This contrasts to Ra’anana – a city with a similar share of the country’s high-tech employees (4.6%) but with less than half the number of companies (3.2% of all the companies) i.e., a city typified by a concentration of large companies rather than startups.

Most popular course of study in Israel: Computer Science

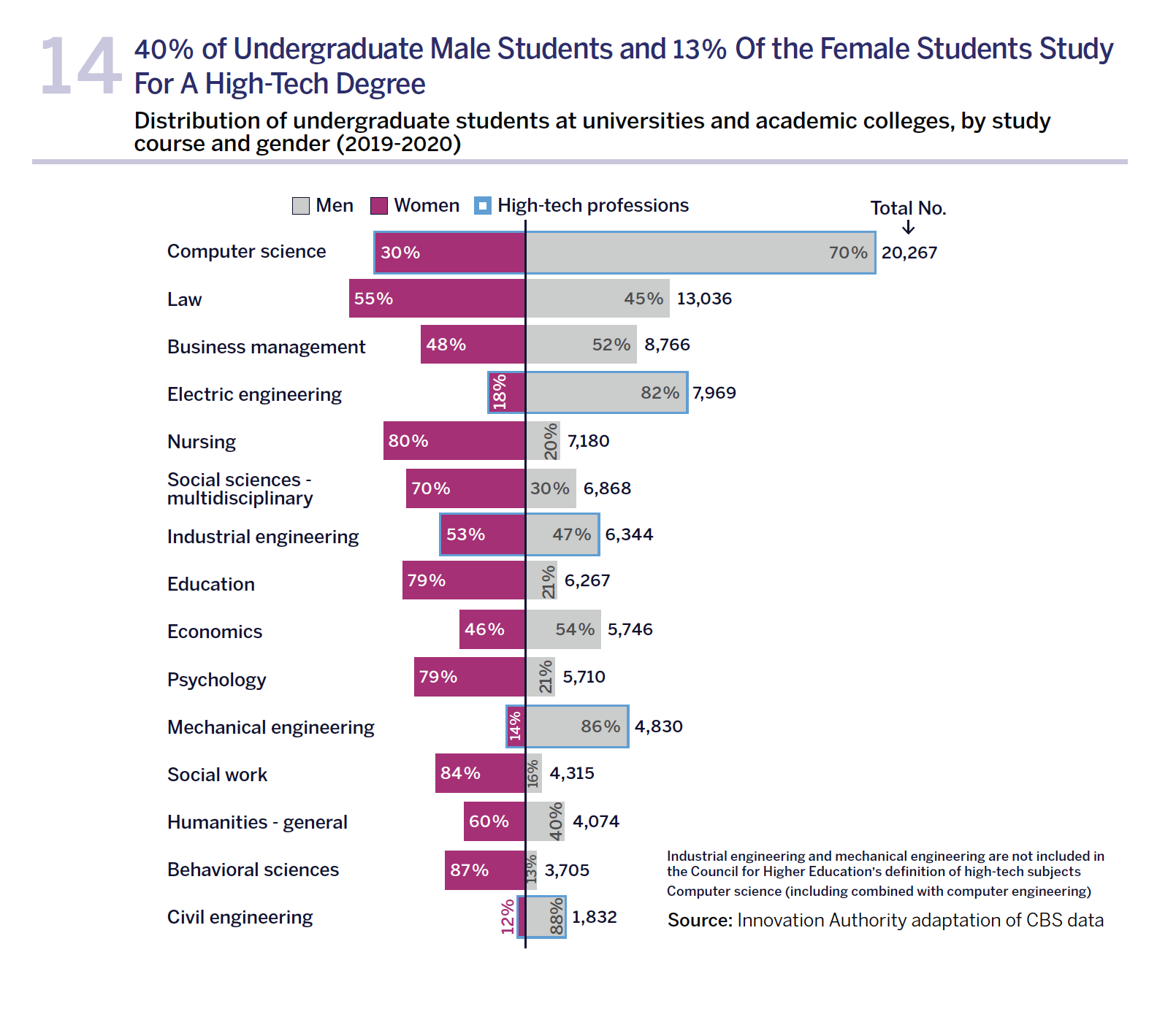

Young Israelis identify the opportunities waiting for them in the high-tech industry and acquire an education that will enable them to join its ranks. Evidence of this can be seen in the fact that high-tech subjects star in undergraduate students’ study preferences at universities and academic colleges. Female students are however a distinct minority in these departments and only few graduate students choose to further their professionalization via more advanced degrees.

In the 2019-2020 academic year, computer science was the most popular course of study among academic undergraduate students in Israel.6Academic colleges and universities, excluding colleges of education. The number of students in courses that included some combination of this subject stood at 20 thousand – 10.8% of all undergraduate students.

At the same time, the popularity of the different high-tech subjects is not the same among men and women. While computer science is popular to a similar degree among men and women (1st and 2nd places, respectively), electrical engineering is ranked second among male students but only 20th among female students (6,545 male students compared to 1,424 female students). Less distinctly high-tech subjects such as mechanical engineering and industrial engineering also rank higher among men (5th and 7th, respectively) than among women (33rd and 9th, respectively) who prefer to study law, education, and nursing. The ratio of female students in industrial engineering (3,394) is however higher than that of male students (2,950 in number).

Considering these gender differences in preferences it is unsurprising to find that while nearly 40% of the male students turn to high-tech subjects in academia, only slightly more than 13% of the women choose these subjects. This is a significant disparity that subsequently influences the ratio of women employed in high-tech.

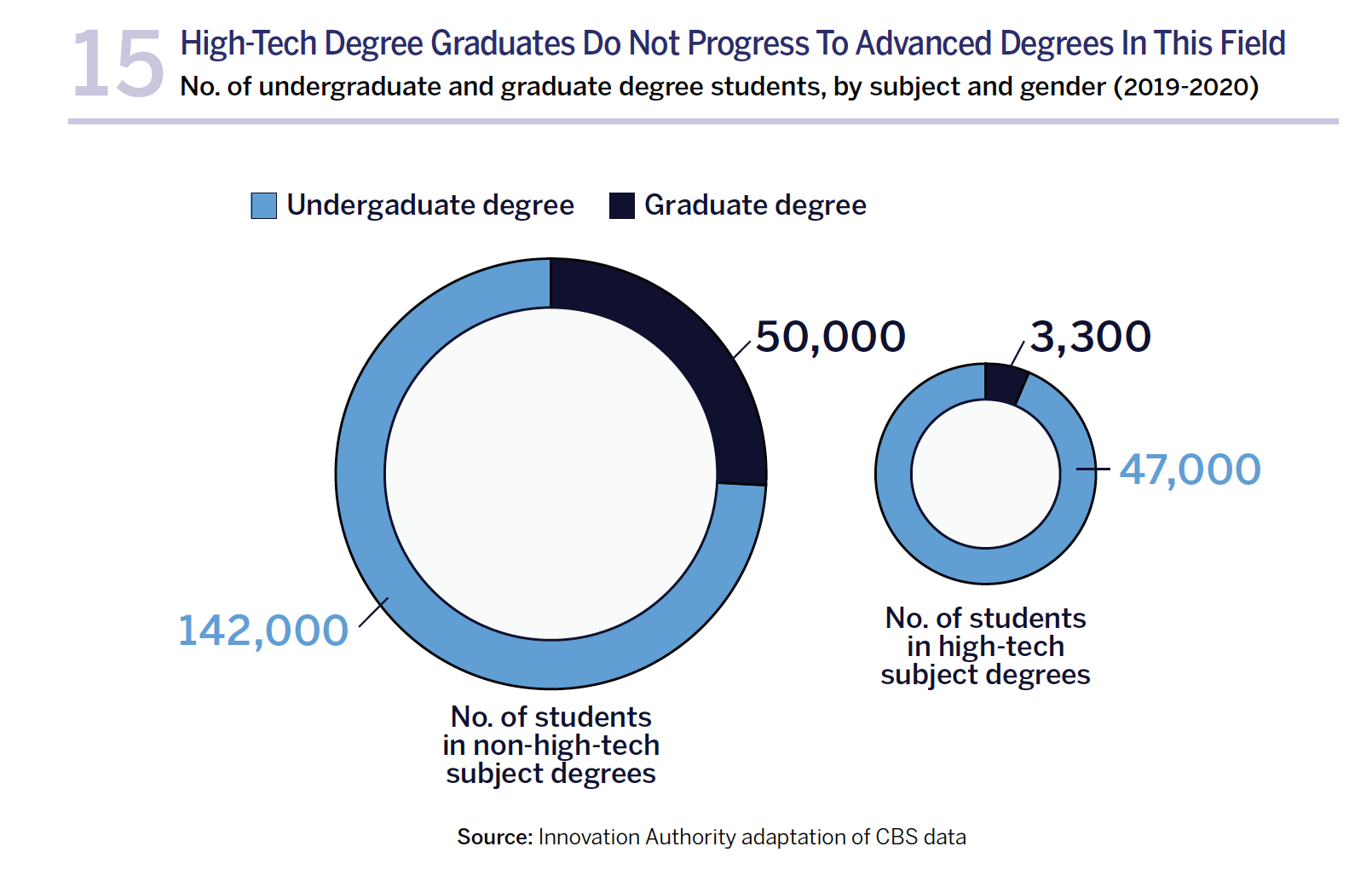

Despite the large number of students choosing to study high-tech subjects, only a small proportion of them continue to more advanced degrees in this field. An examination of the number of graduate students reveals that there were only 3,000 high-tech graduate degree students in Israel in the 2019-2020 academic year, comprising 7% of those who studied for an undergraduate degree. This figure is five times higher in the other academic fields i.e., a ratio of 35% of undergraduate students who continue to graduate degrees.

These figures were among the considerations that led to Government Resolution No. 455 in October 2020 aimed primarily at increasing the number of research graduate students in high-tech subjects by 60%, and at doubling the number of doctoral students in these subjects compared to 2019. These goals were to be achieved by the 2024-2025 academic year.7See: Government Resolution 455 One of the explanations for the choice of undergraduate hightech students not to continue to more advanced degrees would seem to be the high salaries waiting for them when they enter the job market after their studies. The attractive conditions offered to university graduates fail to incentivize them from investing further time and resources in advanced academic degrees.

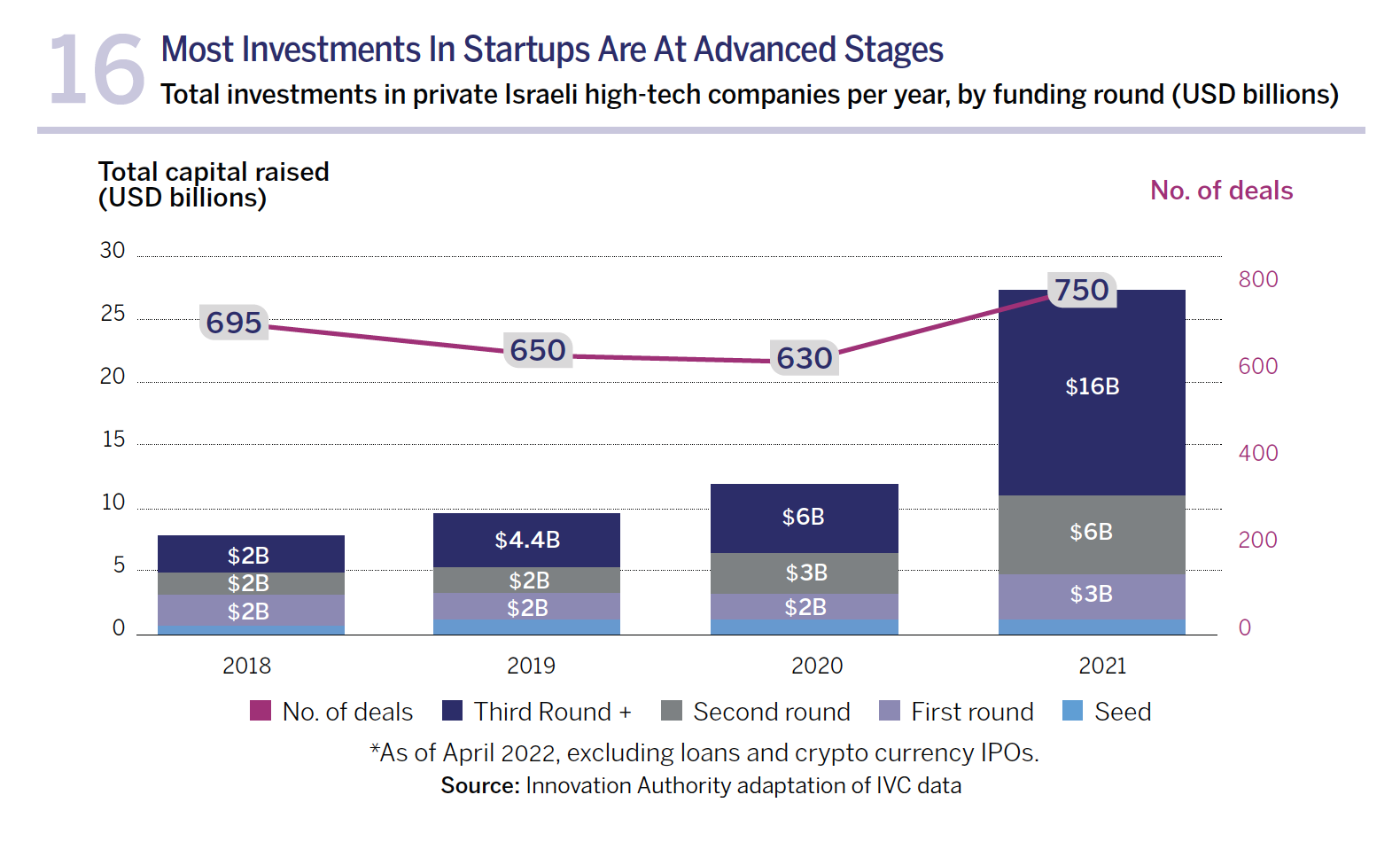

Israeli startups raised over 25 billion dollars in a year – 56% of the investments were in enterprise software, cyber, and fintech

Israeli startups raised over 25 billion dollars in a year – 56% of the investments were in enterprise software, cyber, and fintech

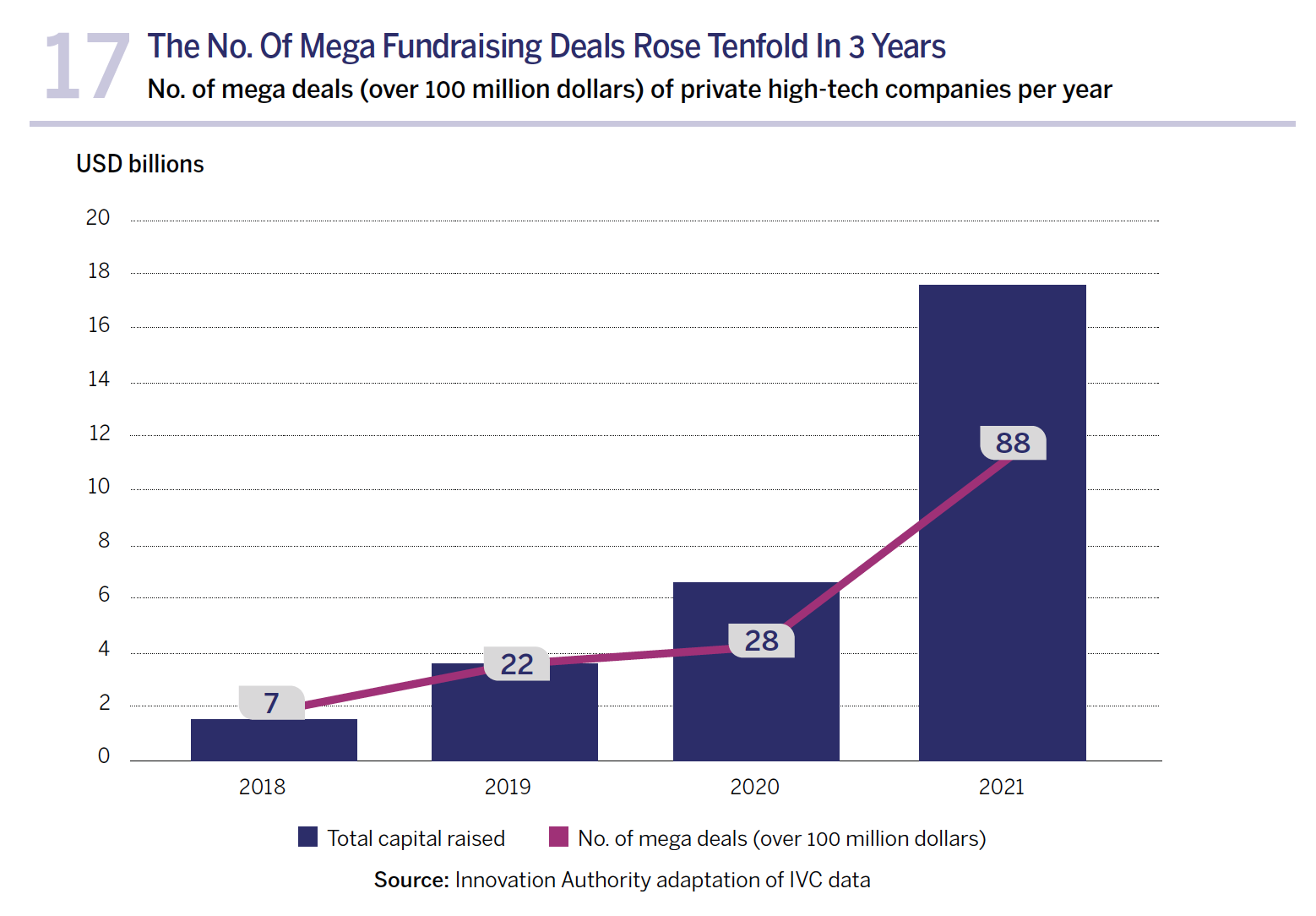

The central contributing factor to the rise in fundraising is the increasing frequency of funding rounds, each of which raising over 100 million dollars. About two thirds of the capital raised in 2021 was in funding rounds of this size. The number of “mega” rounds increased more than tenfold within 3 years – to 88 in 2021. At the same time, the number of funding rounds grew in each stage. The rate of growth in the sum raised in seed, A, B, and later funding stages during 2021 was 60%, 80%, 110%, and 160%, respectively.

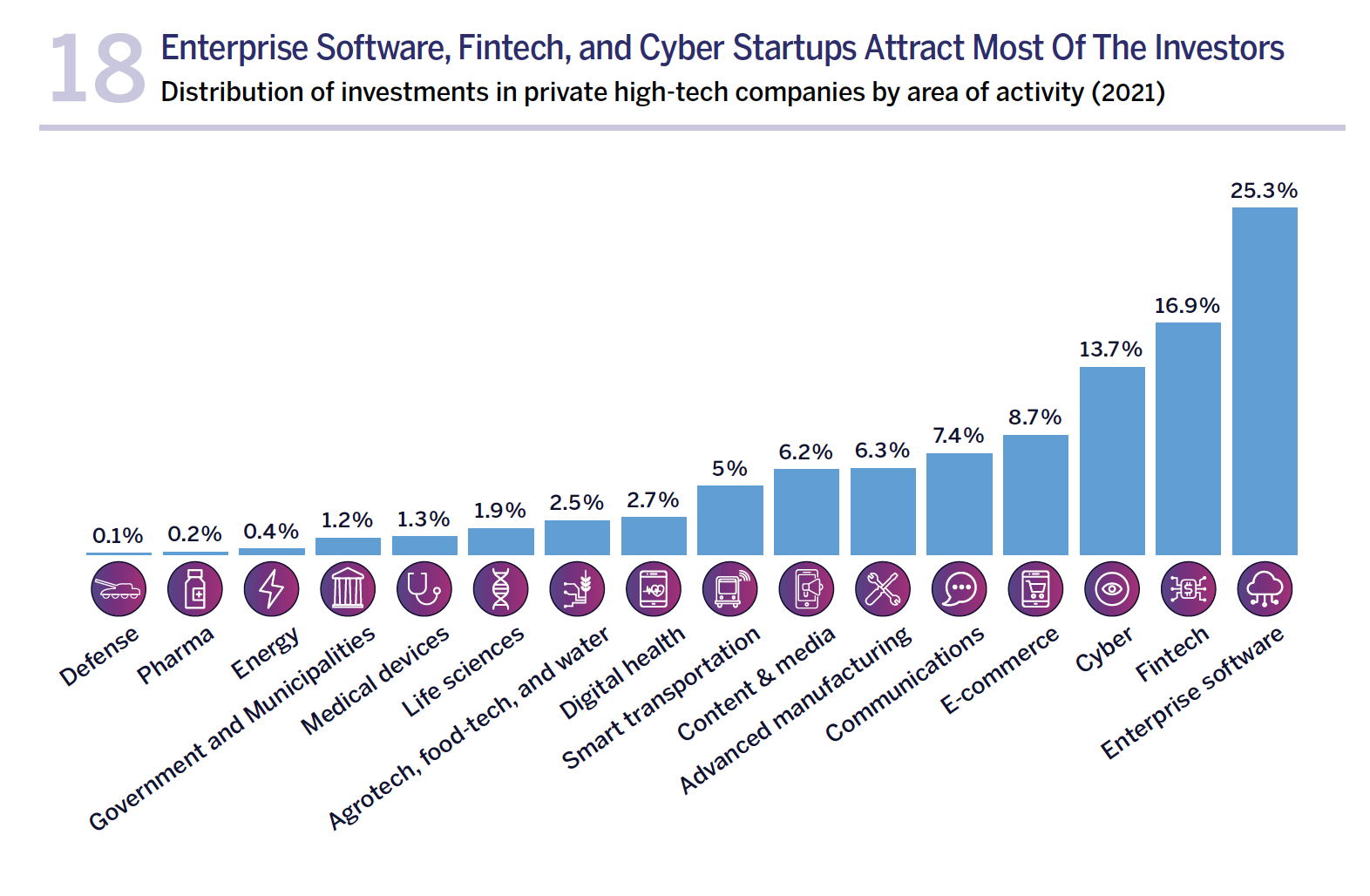

Regarding the areas of activity of the companies that raised capital during 2021, the leading field was enterprise software that attracted 27% of the capital raised. Two other fields that continued to concentrate investors’ attention were fintech and cyber that together constitute 38% of the capital raised by startups in Israel. In other words, over half the total capital attracted by Israeli high-tech in 2021 reached only three fields. This figure indicates a high concentration of investor interest. Fields that attracted less attention from investors were agriculture, energy, and life sciences that together attracted only 10% of the capital raised.

In recent years, private market investments in Israeli startups, primarily via venture capital funds, were focused mainly in software companies, and in companies from the high-tech services sector in general. The private market follows global trends in and demands for technologies in this field. The fact that most of the investments are concentrated in a limited number of fields that benefit from especially large funding rounds is also reflected in the current composition of the more mature companies that have grown in Israel. Moreover, these investments are expected to determine the composition of the large mature companies in Israel in the coming years.

The mirror image of the giant investments in software fields is the startups and companies in the fields of hardware and high-risk areas that are characterized by longer development processes and that enjoy almost none of the prosperity in the high-tech industry. In other words, the existing situation will affect the technological and industrial diversity in Israel in the years to come. There is therefore scope for reconsidering government investment in R&D, including increasing its ratio vis-à-vis GDP, in a way that also contributes to the diversity of high-tech in areas characterized by higher risk. Increasing government investment will contribute to the reduction of Israel’s high dependence on foreign capital in favor of investments in R&D and to the ramifications of the expected macro-economic changes as the result of global transition from the low interest rate environment.